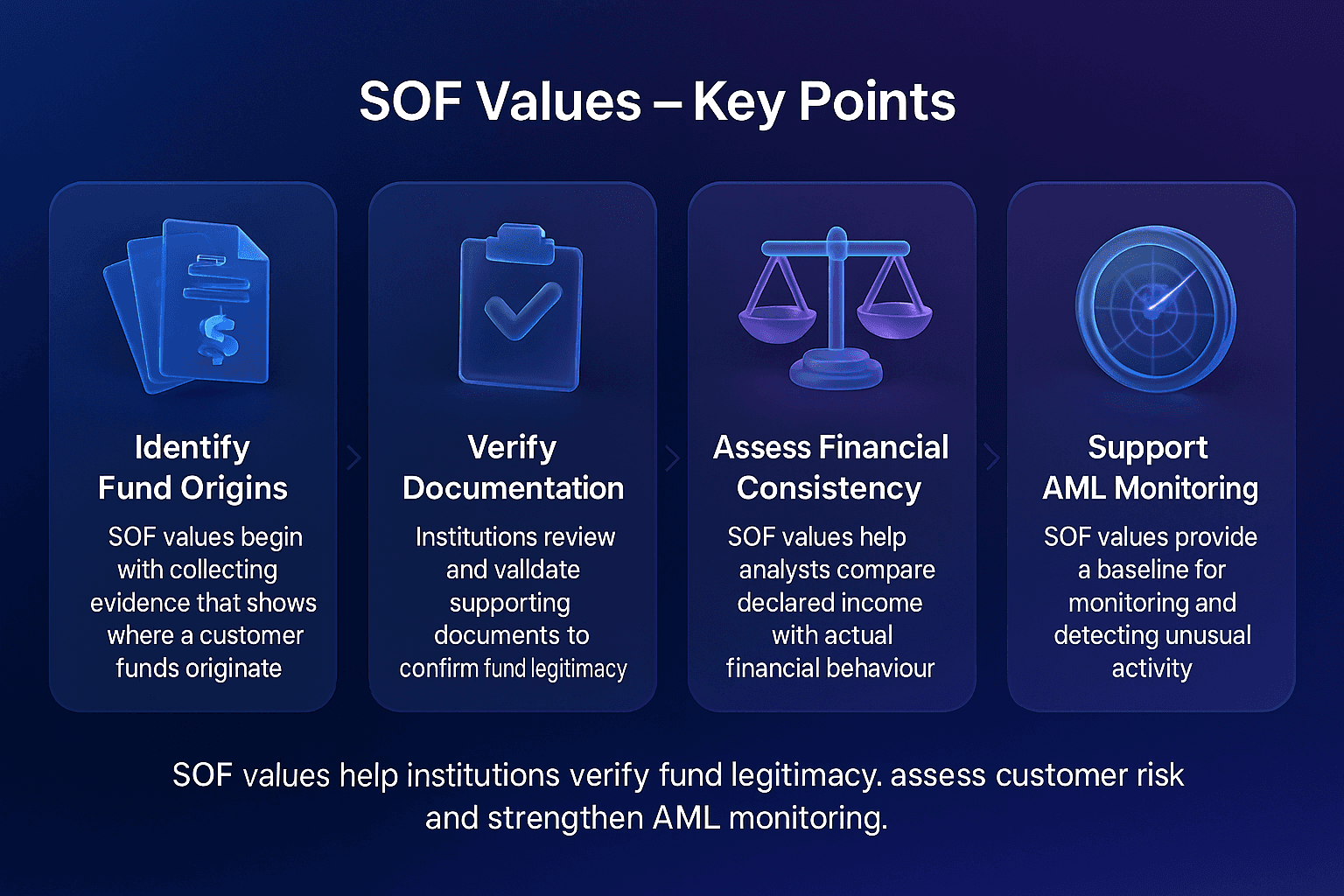

"SOF values" refers to the Source of Funds (SOF) information an organisation collects to understand where a customer’s money comes from. This information helps compliance teams confirm that a customer’s funds are legitimate and consistent with their declared profile.

SOF values form a core part of Know Your Customer (KYC) and broader AML frameworks. By documenting the origins of a customer’s funds, institutions can identify unusual activity, unexplained wealth or potential financial crime risks before they escalate.

Why SOF Values Matter In AML Compliance

SOF values strengthen customer understanding and help firms meet guidance provided by global bodies such as the Financial Action Task Force Recommendations. This information is central to applying a risk-based approach and demonstrating that a customer’s financial activity is credible and lawful.

Accurate SOF values help institutions:

Identify gaps between declared income and real financial behaviour.

Determine when enhanced due diligence is needed.

Detect early indicators of money laundering or fraud.

Maintain transparent records for audits and regulatory reviews.

Strengthen monitoring models with realistic customer baselines.

Key Components Of SOF Values

SOF values are collected by reviewing reliable, document-backed information related to:

Employment income - Salary or wages from verifiable lawful work.

Business revenue - Income from legitimate commercial activities.

Savings or accumulated wealth - Funds built up over time or from long-term asset ownership.

Investments - Dividends, interest or capital gains from regulated financial instruments.

Property transactions or inheritances - Evidence-supported transfers or windfalls.

Other lawful sources - Any additional income validated through trustworthy documentation.

Institutions align these checks with expectations outlined by the Financial Crimes Enforcement Network, which stresses the importance of clear and traceable financial activity.

How SOF Values Support Broader AML Controls

SOF values underpin multiple AML control areas. When documented correctly, they:

Improve customer risk scoring and onboarding decisions.

Provide context for sanctions screening and adverse media findings.

Guide transaction monitoring thresholds and scenario tuning.

Strengthen investigations by explaining the customer’s financial baseline.

Support escalations for unexplained activity or wealth.

This approach aligns with guidance from the World Bank Financial Market Integrity programme, which promotes transparency and financial crime risk mitigation.

How SOF Values Connect To Facctum Solutions

Facctum’s technology supports effective SOF value assessment by providing accurate data, real-time screening and structured investigation workflows:

FacctList, through the watchlist management solution, supports screening and verification during onboarding.

FacctView, delivered through the customer screening solution, enables real-time sanctions, PEP and adverse media checks.

Transaction monitoring capabilities help identify activity inconsistent with declared SOF values.

Alert adjudication workflows assist analysts in documenting and resolving discrepancies.

These tools support regulated industries including AML for Banks, AML for Fintechs and AML for Payment Service Providers.

Frequently Asked Questions About SOF Values

What Are SOF Values?

Why Do Institutions Need SOF Values?

What Documents Support SOF Values?

How Do SOF Values Affect Monitoring?

Are SOF Values Mandatory?