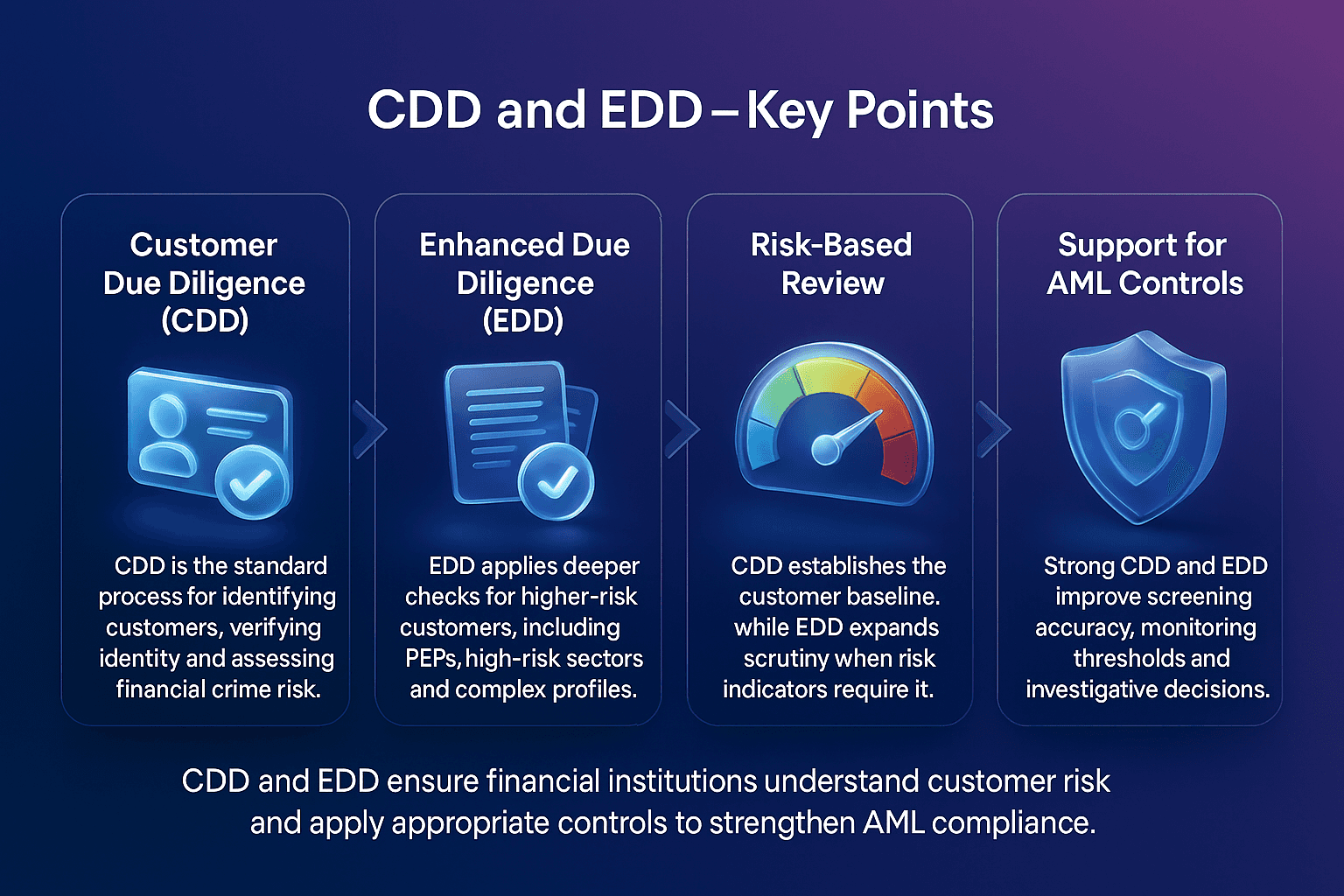

Customer Due Diligence (CDD) is the standard process financial institutions use to identify and verify customers, understand their activities and assess their level of financial crime risk. CDD applies to the majority of customers during onboarding and throughout the customer lifecycle.

Enhanced Due Diligence (EDD) is a deeper, more comprehensive review conducted for customers who present higher risk. This includes politically exposed persons (PEPs), high‑risk industries, unusual profiles, complex ownership structures or customers from high‑risk jurisdictions.

CDD establishes the baseline; EDD strengthens oversight where greater scrutiny is needed.

Expert Insight

In practice, due diligence quality determines how effective downstream AML controls will be. Weak CDD frequently leads to inflated false positives in screening and monitoring, while strong EDD gives analysts a reliable baseline for identifying genuinely unusual activity. Senior compliance teams often emphasise that consistent documentation during CDD and EDD greatly reduces audit friction and strengthens defensibility during regulatory reviews.

Practical Example

A customer may declare a low‑risk occupation, but their account activity may show frequent international transfers. Standard CDD might not capture this discrepancy, but an EDD review of source‑of‑funds evidence typically reveals whether the behaviour aligns with legitimate income.

Regulatory Context

Supervisors such as FinCEN and the FCA repeatedly highlight that thorough due diligence is a cornerstone of effective financial crime prevention.

Operational Tip

Institutions often improve efficiency by defining a clear list of acceptable documents for verifying source of funds and source of wealth.

Why CDD and EDD Matter In AML Compliance

CDD and EDD help organisations meet supervisory expectations set by global bodies such as the Financial Action Task Force Recommendations. They ensure financial institutions understand who their customers are, the legitimacy of their activities and whether they pose elevated financial crime risk.

Strong due diligence processes support:

Reliable identification and verification.

Early detection of financial crime indicators.

Consistent risk scoring and customer classification.

Transparent audit trails and regulatory compliance.

Stronger monitoring and escalation workflows.

Key Components Of CDD and EDD

While CDD and EDD vary by jurisdiction, most programmes include:

Core CDD Components

Collection of official identity documentation.

Verification using reliable and independent sources.

Basic understanding of customer activity.

Initial risk scoring and onboarding checks.

Screening for sanctions, PEPs and adverse media.

Core EDD Components

Deeper review of customer profile, history and financial behaviour.

Verification of source of funds (SOF) and source of wealth (SOW).

Additional documents or evidence for higher‑risk relationships.

Enhanced monitoring thresholds or bespoke scenarios.

Senior management approval where required.

These steps align with expectations outlined by authorities such as the Financial Crimes Enforcement Network.

How CDD and EDD Support Broader AML Controls

CDD and EDD provide the foundation for effective AML frameworks. They ensure screening results are contextualised, monitoring thresholds reflect real customer behaviour and investigations consider verified background information.

This structure reflects best practices promoted by international programmes such as the World Bank Financial Market Integrity.

CDD and EDD directly influence controls such as:

Sanctions screening.

Adverse media checks.

Transaction monitoring.

Risk scoring and segmentation.

Alert adjudication.

Related Concepts In Customer Risk Assessment

CDD and EDD interact with several other key compliance functions that help institutions build a complete and risk-sensitive customer profile:

Alert Adjudication ensures that risks identified during screening or due diligence are reviewed, documented and resolved consistently.

Transaction Monitoring highlights activity that deviates from expected behaviour established during CDD and EDD.

SOF Values validate the legitimacy of customer funds during enhanced scrutiny.

How CDD and EDD Connect To Facctum Solutions

Facctum supports due diligence workflows by providing accurate data, real‑time screening and structured investigation tools:

FacctList, through the watchlist management solution, supports sanctions and PEP screening.

FacctView, delivered through the customer screening solution, provides real‑time checks across sanctions, PEPs and adverse media.

Transaction Monitoring identify behaviour inconsistent with customer risk profiles.

Alert Adjudication help analysts review, escalate and resolve due diligence concerns.

These capabilities support regulated sectors including AML for Banks, AML for Fintechs and AML for Payment Service Providers.