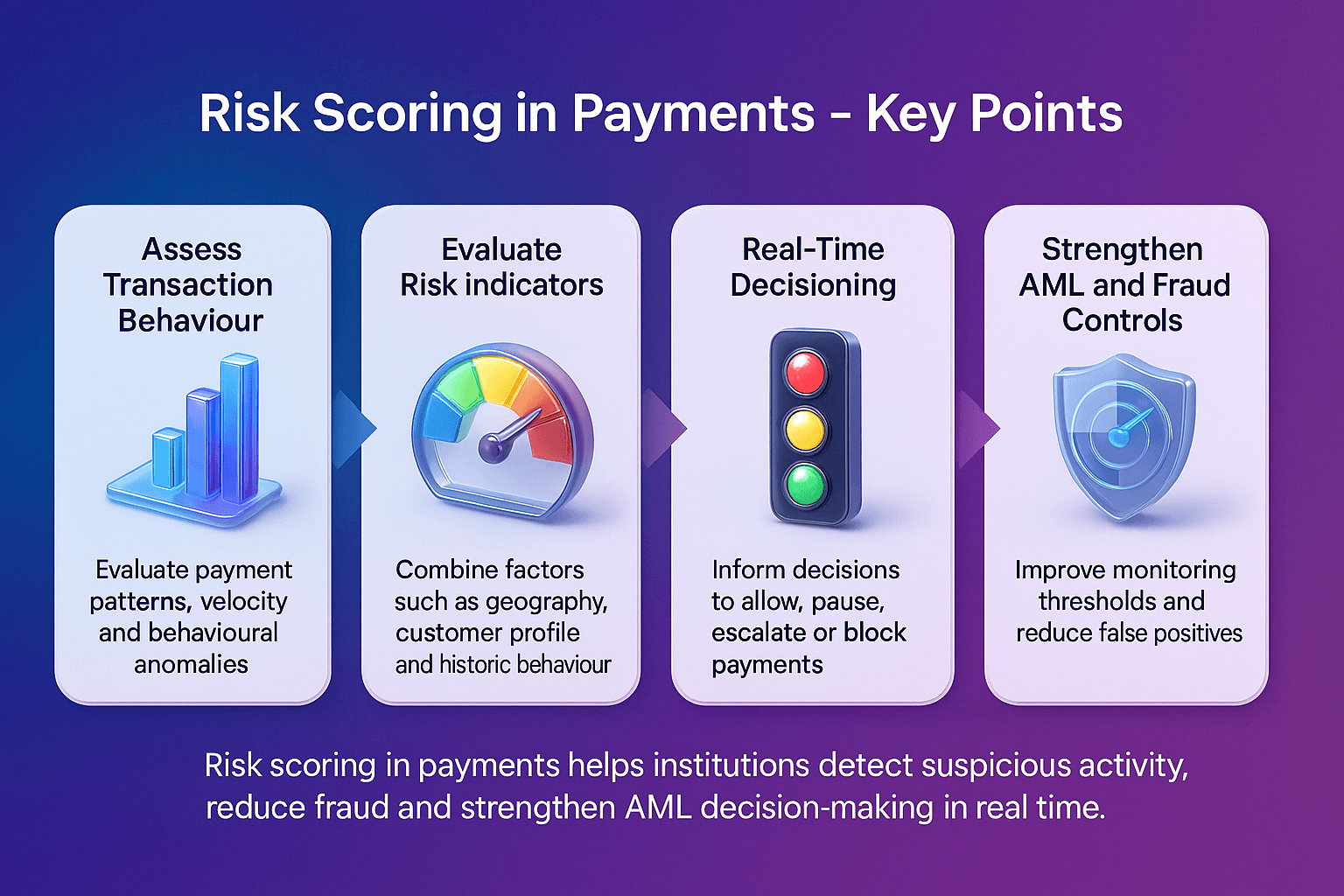

Risk scoring in payments is the process of evaluating transactions, customers or counterparties to determine their likelihood of being linked to fraud, money laundering, sanctions evasion or other financial crime.

Institutions assign a numerical or categorical score based on indicators such as behaviour, geography, channel usage, customer profile and transaction patterns.

Payment risk scoring operates in real time and informs decisions such as allowing, pausing, escalating or blocking a payment.

Why Risk Scoring Matters in Payments Compliance

Effective scoring helps organisations detect suspicious behaviour early and satisfy regulatory expectations set by bodies such as the Financial Action Task Force Recommendations. It supports consistent decision-making, reduces false positives and protects institutions from exposure to financial crime.

Strong risk scoring helps organisations:

Identify unusual or potentially suspicious transactions.

Prioritise investigative workflows.

Strengthen transaction monitoring thresholds.

Apply more accurate customer risk profiles.

Reduce fraud and sanctions risk in real time.

Key Components of Payment Risk Scoring

Payment risk scoring frameworks typically consider multiple categories of risk:

Customer behaviour: Spending patterns, frequency, transaction types and counterparties.

Geographic exposure: Links to high-risk jurisdictions identified by the Financial Crimes Enforcement Network.

Payment attributes: Size, frequency, channel, velocity and anomalies.

Historic activity: Past alerts, unusual deviations or previous suspicious activity.

External intelligence: Adverse media, sanctions lists and regulatory updates.

Institutions often combine these elements into weighted scoring models calibrated to their risk appetite.

How Risk Scoring Supports Broader AML and Fraud Controls

Risk scoring forms the backbone of modern AML and fraud strategies by providing clear risk indicators that feed into monitoring, escalation and investigations. Programmes such as the World Bank Financial Market Integrity initiative highlight the importance of risk-based approaches in identifying high-risk activity.

Effective scoring strengthens:

Transaction monitoring systems.

Sanctions and PEP screening.

Case management and alert workflows.

Fraud prevention and anomaly detection.

Ongoing reviews and periodic assessments.

Expert Insight

In practice, payment risk scoring only works when scoring models are updated regularly. Many institutions discover that outdated rules quickly become blind spots, allowing suspicious behaviour to slip through. Experienced analysts also review false positives to refine thresholds and improve accuracy over time.

Practical Example

A customer who usually sends small domestic transfers suddenly initiates a large international payment to a high-risk jurisdiction. A well-calibrated scoring model flags the payment instantly, prompting an analyst review before funds are released.

Regulatory Context

Regulators including the FCA and FinCEN emphasise that risk scoring must be proportionate, explainable and defensible during audits. Models should also demonstrate alignment with a risk-based approach.

Operational Tip

Teams often achieve better detection rates by combining rule-based scoring with behavioural analytics rather than relying solely on one method.

Related Concepts in Payment Risk Management

Risk scoring interacts with several facets of AML and fraud programs:

Transaction Monitoring to detect unusual behaviour and escalate suspicious payments.

Alert Adjudication to support consistent review and closure of flagged activity.

AML Compliance to maintain strong governance and defensible controls.

How Risk Scoring Connects to Facctum Solutions

Facctum solutions enhance real-time payment risk assessment through accurate data, screening and advanced workflow capabilities:

FacctShield, through the payment screening solution, applies dynamic controls including sanctions, PEP and fraud indicators.

FacctGuard, via the transaction monitoring solution, detects behavioural anomalies and high-risk payment activity.

Alert Adjudication, delivered through the alert adjudication solution, supports consistent decision-making and efficient routing of investigations.

These capabilities benefit regulated sectors including AML for Fintechs, AML for Banks and AML for Payment Service Providers.

Frequently Asked Questions About Risk Scoring in Payments

What Is Payment Risk Scoring?

What Factors Influence Risk Scores?

Why Is Risk Scoring Important?

Do Regulators Require Risk Scoring?

How Does Risk Scoring Improve Monitoring?