"Connaissance client" is the French term for Know Your Customer (KYC). It refers to the process of identifying and verifying the identity of customers before establishing a business relationship. This includes collecting information on the customer’s identity, understanding the nature of their activities, assessing their risk profile and ensuring that the relationship aligns with anti-money laundering (AML) and counter-terrorist financing expectations.

The concept is a core requirement for regulators around the world and is central to preventing financial crime and maintaining trust in the financial system.

Why Connaissance Client Is Important In AML Compliance

Connaissance client requirements help institutions meet supervisory expectations set by regulators and global bodies such as the Financial Action Task Force Recommendations. Strong customer knowledge supports risk-based approaches, improves onboarding quality and strengthens monitoring.

Effective connaissance client processes help organisations:

Verify customer identity using reliable and independent information.

Detect and prevent fraud, money laundering and sanctions evasion.

Assess customer risk across industries including banking, fintech and payments.

Maintain compliance with national and international AML standards.

Provide transparent records for audits and regulatory reviews.

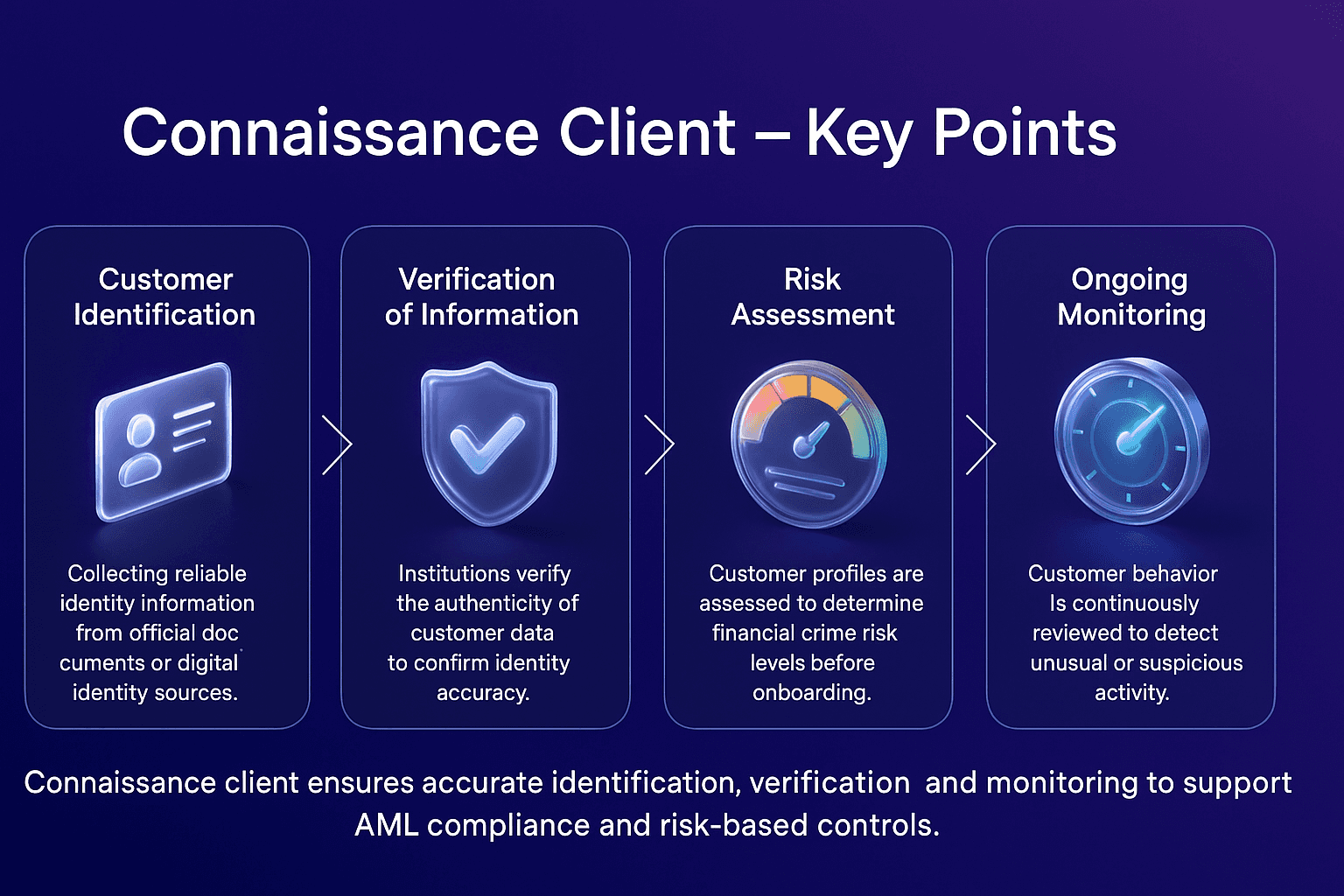

Key Components Of Connaissance Client

Connaissance client typically includes several core steps:

Identification - Collecting official documents or digital identity information.

Verification - Confirming the authenticity of identity data.

Understanding Customer Activity - Identifying occupation, expected account usage and transaction patterns.

Risk Assessment - Categorising customers by their level of financial crime risk.

Enhanced Due Diligence (EDD) - Applying additional checks for high-risk customers.

Ongoing Monitoring - Continuously reviewing customer behaviour and risk indicators.

These steps reflect best practices outlined by authorities such as the Financial Crimes Enforcement Network and global financial integrity programmes.

How Connaissance Client Supports Broader AML Controls

Strong connaissance client processes provide the foundation for sanctions screening, adverse media checks, transaction monitoring and ongoing customer reviews. They help institutions detect unusual behaviour and apply risk-based controls throughout the customer lifecycle.

This approach aligns with operational guidance provided by the World Bank Financial Market Integrity initiative and supports regulatory expectations in multiple jurisdictions.

How Connaissance Client Connects To Facctum Solutions

Facctum solutions support the full connaissance client lifecycle:

FacctList, available through the watchlist management solution, helps maintain accurate lists for sanctions and PEP screening.

FacctView, delivered through the customer screening solution, supports real-time sanctions, PEP and adverse media checks.

Transaction monitoring capabilities help institutions identify unusual or suspicious behaviour.

Alert adjudication workflows support investigations and resolution processes.

These tools help regulated industries including AML for Banks, AML for Fintechs and AML for Payment Service Providers maintain strong connaissance client practices.

Frequently Asked Questions About Connaissance Client

What Is Connaissance Client?

Why Is Connaissance Client Important?

What Does Connaissance Client Include?

Does Connaissance Client Apply To All Customers?

How Does Connaissance Client Relate To AML?