A US Patriot Act Disclosure is a formal statement financial institutions must provide to customers, counterparties or partners explaining how customer information may be shared for the purpose of preventing money laundering and terrorist financing. These disclosures outline the institution’s obligations under Sections such as Section 314(a) and Section 326 of the USA PATRIOT Act, which require information sharing, identity verification and enhanced due diligence.

The disclosure ensures transparency while informing customers that their information may be used to comply with federal financial crime investigations.

Why US Patriot Act Disclosures Matter In Compliance

Patriot Act disclosures exist to support anti-money laundering controls, customer identification requirements and cooperation with law-enforcement bodies. They reinforce expectations outlined by the Financial Crimes Enforcement Network (Financial Crimes Enforcement Network) and support alignment with global standards such as the Financial Action Task Force Recommendations, which emphasise strong transparency and customer information management.

A well-written disclosure helps organisations:

Comply with mandatory US AML laws.

Maintain transparency with customers.

Support identity verification processes.

Strengthen trust and regulatory alignment.

Improve audit readiness.

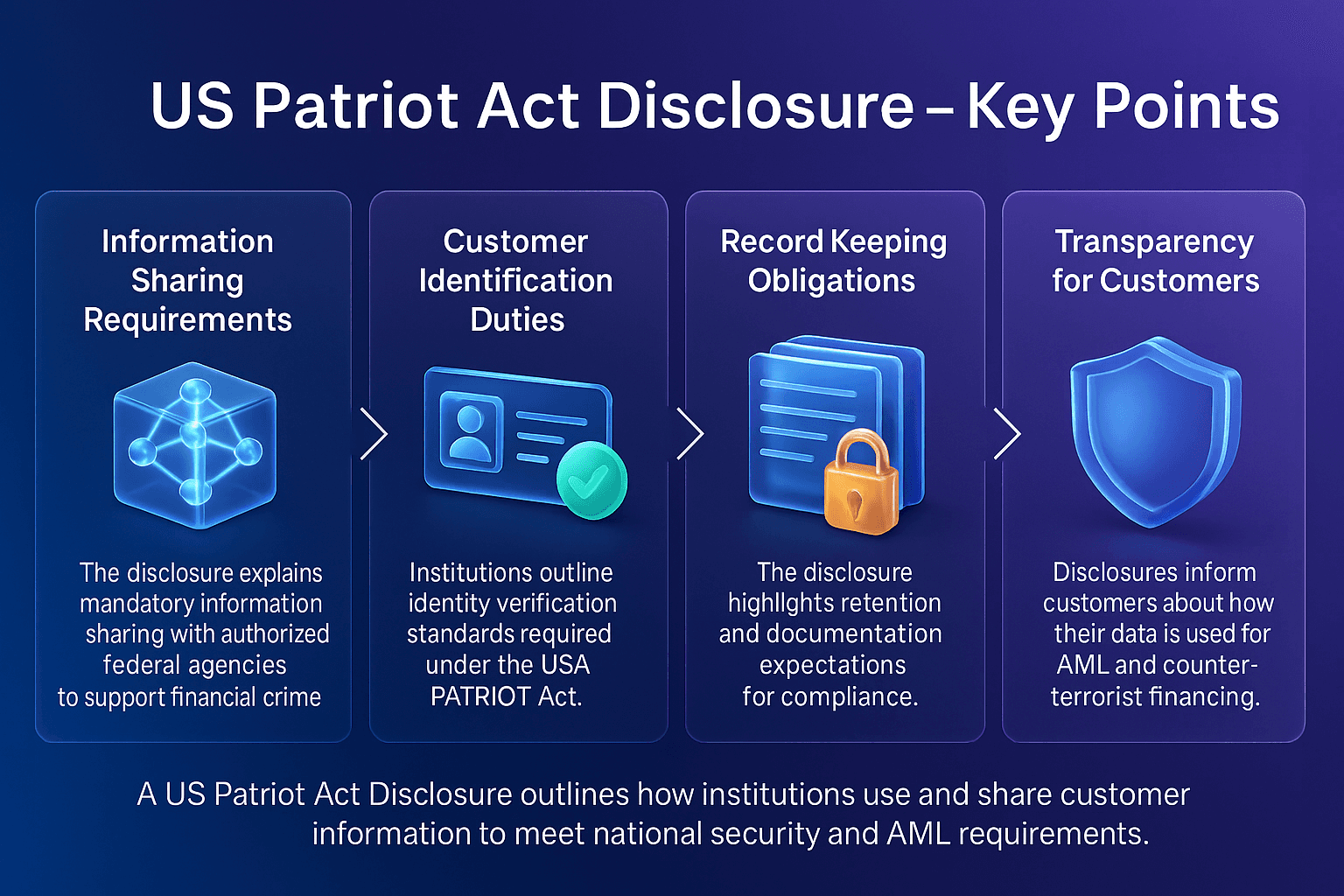

Key Components Of A US Patriot Act Disclosure

While disclosures vary slightly between institutions, they generally include:

Explanation of the USA PATRIOT Act requirements.

Statement of customer identification and verification responsibilities.

Notice of possible information sharing with federal agencies.

Description of record-keeping obligations.

High-level overview of AML and financial crime prevention controls.

Institutions often reference guidance from the Federal Deposit Insurance Corporation to maintain regulatory consistency.

How The US Patriot Act Disclosure Supports AML Controls

Disclosures help reinforce risk‑based controls by explaining how customer data is used to detect and prevent criminal activity. When combined with due diligence, sanctions screening and monitoring, they support broader AML frameworks outlined by organisations such as the World Bank Financial Market Integrity initiative.

These disclosures also help organisations in regulated sectors, including AML for Banks, AML for Fintechs and AML for Payment Service Providers, meet transparency and governance expectations.

How US Patriot Act Disclosures Connect To Facctum Solutions

Facctum solutions support the underlying processes referenced in Patriot Act disclosures:

FacctList, via the watchlist management solution, helps institutions maintain accurate lists used in verification and screening.

FacctView, delivered through the customer screening solution, supports real‑time checks across sanctions, PEPs and adverse media.

Transaction monitoring capabilities help detect unusual or suspicious activity.

Alert adjudication workflows strengthen transparency and documentation.

These systems help AML Officers and compliance teams fulfil the obligations described in US Patriot Act disclosures.

Frequently Asked Questions About US Patriot Act Disclosures

What Is A US Patriot Act Disclosure?

Who Must Provide A Patriot Act Disclosure?

What Information Does The Disclosure Include?

Why Do Institutions Need This Disclosure?

Does The Disclosure Affect Customer Privacy?