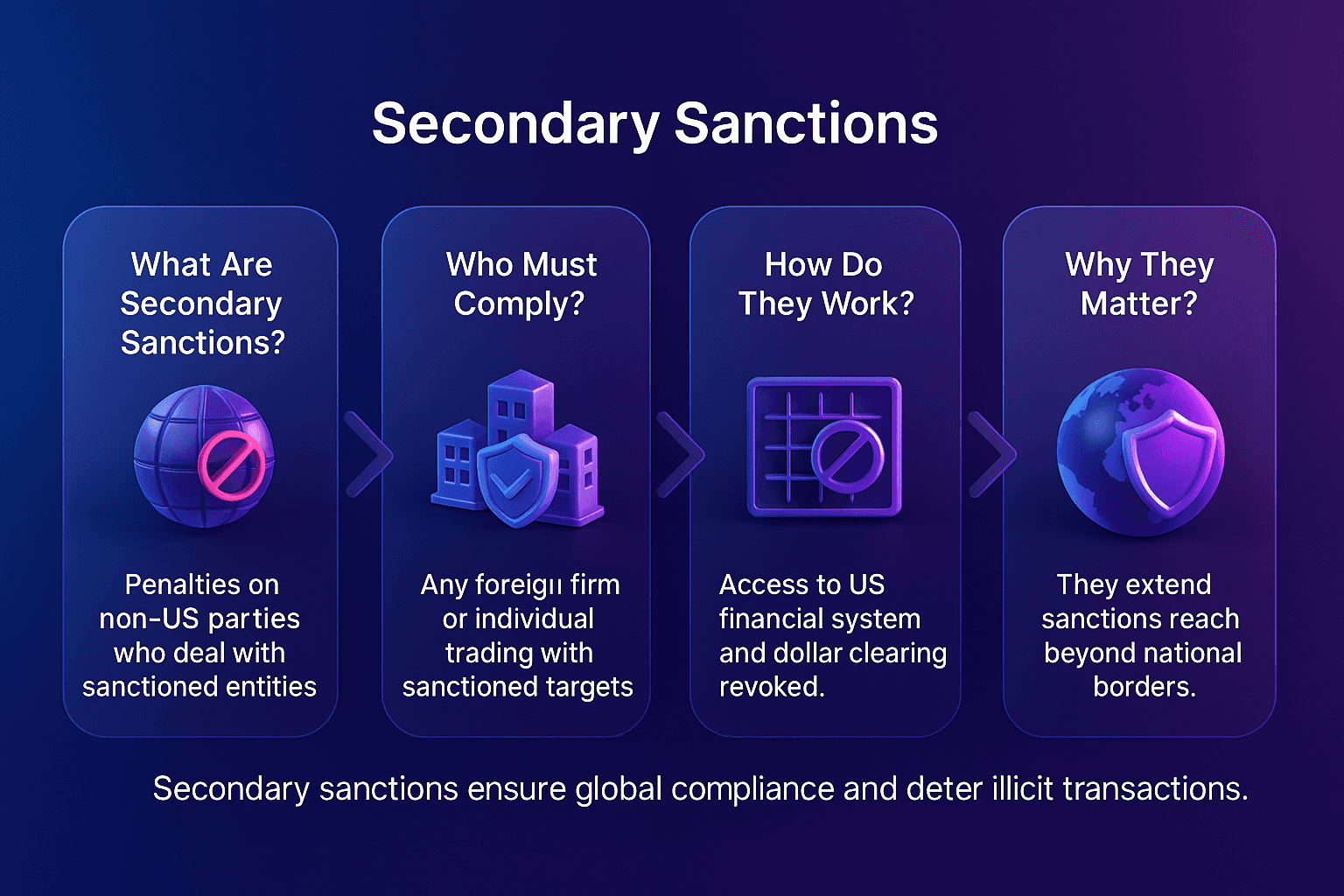

Secondary sanctions are penalties imposed by a government not only on its direct citizens or businesses (primary sanctions) but also on third parties that engage with sanctioned entities. They extend the reach of a sanctions regime beyond national borders, forcing global compliance.

For financial institutions, secondary sanctions create significant AML challenges because they must ensure they do not indirectly facilitate transactions with sanctioned parties. Ignoring these restrictions can result in loss of access to critical markets, particularly the U.S. financial system.

Secondary Sanctions

Secondary sanctions occur when a government penalizes foreign firms or individuals for doing business with sanctioned entities, even if those transactions occur outside its jurisdiction.

The United States has been the most active in applying secondary sanctions, often through the Office of Foreign Assets Control (OFAC). For example, non-U.S. banks engaging with sanctioned Iranian entities risk losing access to the U.S. financial system.

This extraterritorial reach makes secondary sanctions highly influential, effectively pressuring international businesses to comply with domestic policies of the sanctioning country.

Why Secondary Sanctions Matter In AML Compliance

Secondary sanctions significantly increase compliance complexity. Even if an institution does not operate in the country imposing the sanctions, it may still face severe penalties if it provides financial services to targeted entities.

The U.S. Treasury Department has stressed that foreign banks violating secondary sanctions could face exclusion from U.S. correspondent banking relationships, especially under rules that allow OFAC to impose blocking or correspondent account sanctions on foreign financial institutions even without a U.S. nexus. The European Union has publicly criticized these measures as infringing international norms, but many global banks nevertheless align with U.S. rules to avoid isolation from dollar-based financial systems and loss of access to U.S. markets

Institutions often integrate Payment Screening and Customer Screening solutions to ensure that their systems capture both direct and indirect exposure to sanctioned entities.

Key Risks Of Secondary Sanctions For Banks

Financial institutions face multiple risks if they do not manage secondary sanctions effectively:

Loss Of Market Access: Being cut off from the U.S. financial system can be devastating for global operations.

Reputational Risk: Association with sanctioned entities can damage credibility with regulators and clients.

Operational Risk: Complex compliance requirements increase costs and pressure on AML teams.

Legal Penalties: Fines, asset freezes, and criminal liability may follow violations.

These risks underscore the importance of embedding Watchlist Management and Transaction Monitoring into AML programs.

Regulatory Expectations For Secondary Sanctions

Regulators expect institutions to go beyond primary sanctions compliance and assess indirect exposure.

This means:

Screening counterparties, subsidiaries, and ownership structures for links to sanctioned entities.

Ensuring due diligence procedures extend to non-obvious connections.

Monitoring trade finance, correspondent banking, and cross-border transactions for indirect risks.

OFAC has made clear that secondary sanctions will be aggressively enforced where foreign institutions provide material support to targeted entities. Meanwhile, the FATF emphasizes that effective sanctions compliance frameworks must integrate ownership transparency and real-time monitoring.

The Future Of Secondary Sanctions

Secondary sanctions are becoming more common as governments seek to amplify the impact of their foreign policy. We are likely to see increased coordination among the U.S., EU, and other jurisdictions, but also growing tensions over extraterritorial enforcement.

For AML compliance, the future lies in greater reliance on advanced technologies such as graph analytics and dynamic ownership screening to detect hidden links to sanctioned entities. Financial institutions that fail to adapt risk exclusion from global markets.

Strengthen Your Secondary Sanctions Compliance Framework

Secondary sanctions present one of the toughest compliance challenges for global financial institutions. A proactive approach using advanced screening and monitoring systems is essential to avoid severe regulatory and operational consequences.

Contact Us Today To Strengthen Your AML Compliance Framework