The Specially Designated Nationals (SDN) List is published by the U.S. Treasury’s Office of Foreign Assets Control (OFAC). It contains the names of individuals, companies, organizations, vessels, and aircraft that are subject to U.S. sanctions.

Financial institutions and businesses are prohibited from dealing with anyone on the SDN List. Assets belonging to listed parties must be blocked, and transactions involving them must be rejected. Non-compliance can result in severe regulatory penalties, reputational harm, and potential criminal liability.

The official OFAC SDN List is updated frequently and is a cornerstone of U.S. and global sanctions compliance.

Definition Of The SDN List

SDN List (Specially Designated Nationals and Blocked Persons List) is a sanctions list maintained by OFAC that includes individuals and entities tied to terrorism, weapons proliferation, narcotics trafficking, corruption, and other threats to U.S. national security.

The SDN List requires firms to:

Block any assets owned by listed individuals or entities.

Reject transactions linked to listed parties.

Report blocked and rejected transactions to OFAC.

Integrate list updates into compliance systems immediately.

Why The SDN List Matters For AML And Sanctions Compliance

The SDN List is one of the most critical tools for preventing financial crime and enforcing U.S. foreign policy.

Sanctions Screening

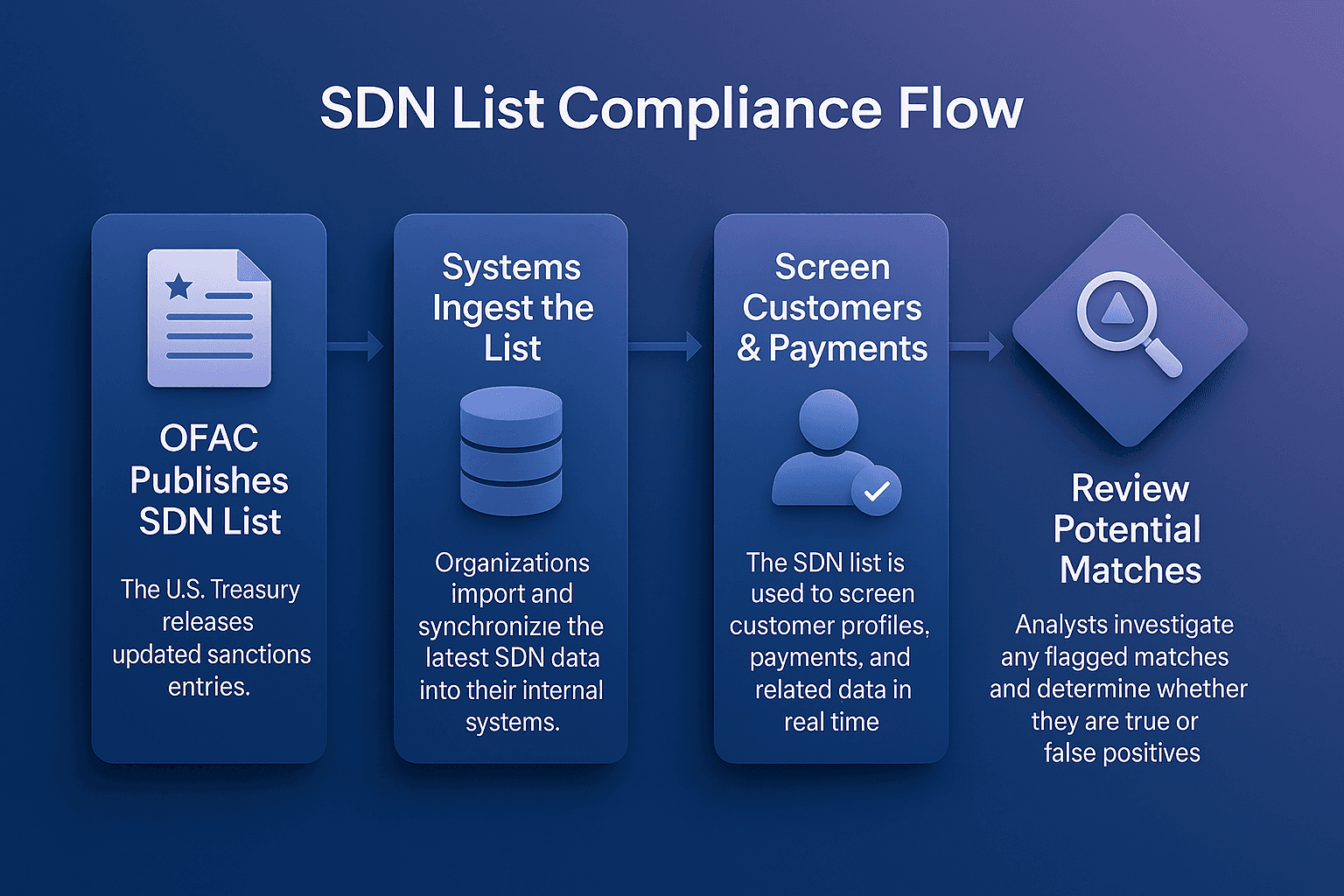

Financial institutions must screen all customers, payments, and business relationships against the SDN List. FacctShield, Payment Screening enables real-time filtering for transactions.

Customer Due Diligence

Firms must identify whether customers are linked to sanctioned individuals or entities. FacctView, Customer Screening supports risk-based checks.

Watchlist Management

The SDN List is updated regularly and must be harmonised with other sanctions lists. FacctList, Watchlist Management ensures clean and accurate data for screening.

Alert Adjudication

Screening against the SDN List often generates false positives. Alert Adjudication helps compliance teams review and document alerts efficiently.

Challenges Of SDN List Compliance

Working with the SDN List presents several operational difficulties.

Frequent Updates

OFAC updates the SDN List often, sometimes daily, requiring immediate integration.

Name Variations

Aliases, transliterations, and spelling variations make screening more complex.

High Volumes

Large institutions must screen millions of transactions daily, increasing the risk of false positives.

Global Reach

Even non-U.S. firms may be subject to SDN compliance if they conduct transactions in U.S. dollars.

Best Practices For SDN List Compliance

To comply with OFAC requirements, institutions should:

Automate sanctions screening across all transactions.

Keep sanctions lists updated daily.

Calibrate screening engines to reduce false positives.

Train staff on sanctions compliance and escalation procedures.

Maintain audit-ready documentation of all blocked and rejected transactions.

The Future Of SDN List Compliance

As geopolitical risks evolve, the SDN List will continue to expand and change rapidly.

Key trends include:

Real-Time Updates: Greater automation for integrating daily OFAC updates.

AI Matching: Machine learning to better detect aliases and reduce false positives.

Cross-Border Cooperation: Closer alignment between U.S. sanctions and EU/UN frameworks.

Integration With Fraud Controls: Combining sanctions checks with fraud prevention tools.

Strengthen Compliance With The SDN List

The SDN List is one of the most important tools in sanctions enforcement. Financial institutions must integrate OFAC screening into every customer and payment workflow to remain compliant.

Facctum solutions; FacctShield, Payment Screening, FacctView, Customer Screening, FacctList, Watchlist Management, and Alert Adjudication - provide real-time screening, accurate list management, and efficient alert handling for SDN compliance.

Contact Us Today To Strengthen Your SDN List Compliance