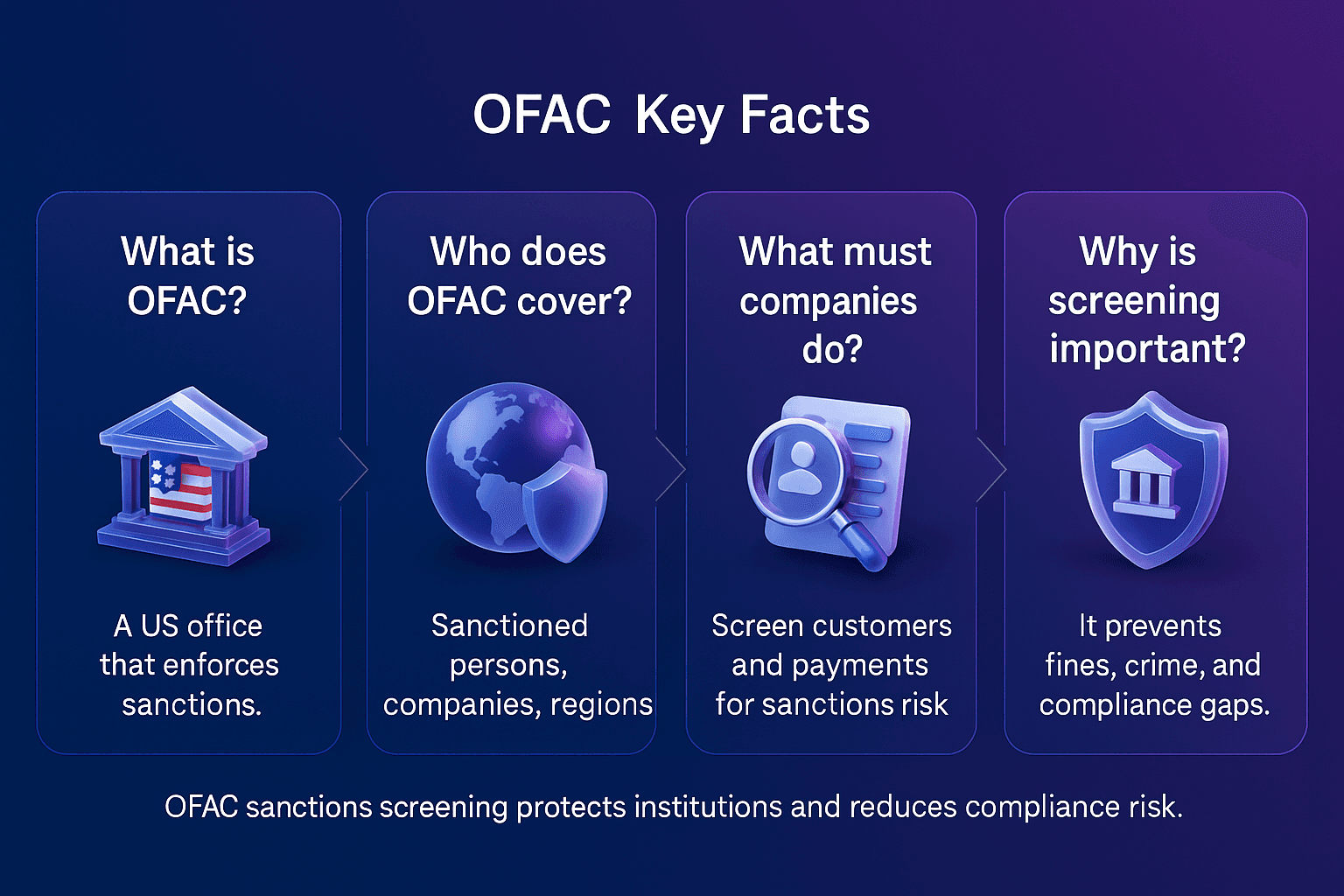

The Office of Foreign Assets Control (OFAC) is a division of the U.S. Department of the Treasury responsible for administering and enforcing economic and trade sanctions. These sanctions target specific foreign countries, regimes, individuals, and organizations linked to terrorism, money laundering, weapons proliferation, and other threats to U.S. national security.

For financial institutions, OFAC is central to anti-money laundering (AML) and counter-terrorist financing (CTF) compliance. Firms must screen transactions and customer records against OFAC sanctions lists, including the Specially Designated Nationals (SDN) list, to avoid processing prohibited payments.

The U.S. Department of the Treasury and FinCEN emphasise that compliance with OFAC sanctions is a legal requirement for all U.S. persons and entities, including banks, FinTech's, and payment service providers.

Definition Of OFAC

OFAC (Office of Foreign Assets Control) is the U.S. Treasury division that administers and enforces economic and trade sanctions based on U.S. foreign policy and national security objectives.

OFAC requires financial institutions and U.S. businesses to:

Block or reject transactions linked to sanctioned individuals, entities, or jurisdictions.

Screen customers and payments against the SDN and other sanctions lists.

Report blocked or rejected transactions to OFAC.

Maintain compliance programs that prevent sanctions breaches.

Why OFAC Compliance Is Critical For AML

OFAC sanctions are legally binding, and breaches can result in severe penalties, reputational damage, and loss of market access.

Sanctions Screening

Financial institutions must screen customer records, payments, and business partners against OFAC lists. Payment Screening automates real-time screening to prevent breaches.

Customer Due Diligence (CDD)

OFAC compliance overlaps with broader AML requirements, requiring firms to verify customer identities. Customer Screening helps ensure sanctioned parties cannot access financial services.

Watchlist Accuracy

Sanctions lists must be updated frequently to capture daily OFAC changes. Watchlist Management ensures lists are harmonised and accurate.

Alert Adjudication

OFAC screening often produces false positives. Alert Adjudication enables compliance teams to review alerts, document decisions, and maintain audit trails.

Challenges Of OFAC Compliance

Adhering to OFAC requirements presents several challenges for financial institutions.

High Penalties

OFAC violations can result in multi-million-dollar fines.

Complex Sanctions Programs

OFAC lists cover individuals, entities, vessels, aircraft, and entire jurisdictions.

False Positives

Name variations, misspellings, and fuzzy matches create unnecessary alerts.

Global Reach

Even non-U.S. firms with U.S. operations may be subject to OFAC jurisdiction.

Best Practices For OFAC Compliance

Financial institutions can strengthen compliance by:

Screening all payments, customers, and counterparties against OFAC lists.

Updating sanctions data daily.

Calibrating fuzzy matching to reduce false positives.

Integrating sanctions screening into real-time payment flows.

Maintaining audit-ready records of all blocked or rejected transactions.

The Future Of OFAC Compliance

As global sanctions become more complex, OFAC compliance is evolving in parallel. Key trends include:

Real-Time Screening: Required for instant payment systems like FedNow.

AI-Enhanced Detection: Machine learning to improve matching accuracy.

Cross-Border Alignment: Coordination between OFAC and global sanctions regimes such as EU and UN lists.

Integrated Risk Management: Linking OFAC screening with AML, fraud, and cybersecurity monitoring.

Strengthen Your OFAC Sanctions Compliance

OFAC compliance is a core requirement for financial institutions operating in or connected to the U.S. market. Real-time screening, accurate watchlist management, and efficient alert handling are essential to avoid costly penalties.

Facctum solutions; FacctShield, Payment Screening, FacctView, Customer Screening, FacctList, Watchlist Management, and Alert Adjudication - help firms manage OFAC compliance at scale.

Contact Us Today To Strengthen Your OFAC Compliance Program