A challenger bank is a modern, digital-first bank designed to compete with traditional financial institutions by offering innovative services, streamlined customer experiences, and lower fees. These banks often operate without the overhead of physical branches and rely heavily on technology. While challenger banks disrupt traditional banking models, they face unique compliance challenges due to their rapid growth, digital infrastructure, and exposure to financial crime risks.

Challenger Bank

A challenger bank is a licensed financial institution that operates primarily online or through mobile apps. Unlike traditional banks, they usually lack a large branch network, instead focusing on delivering cost-effective services and agile digital products.

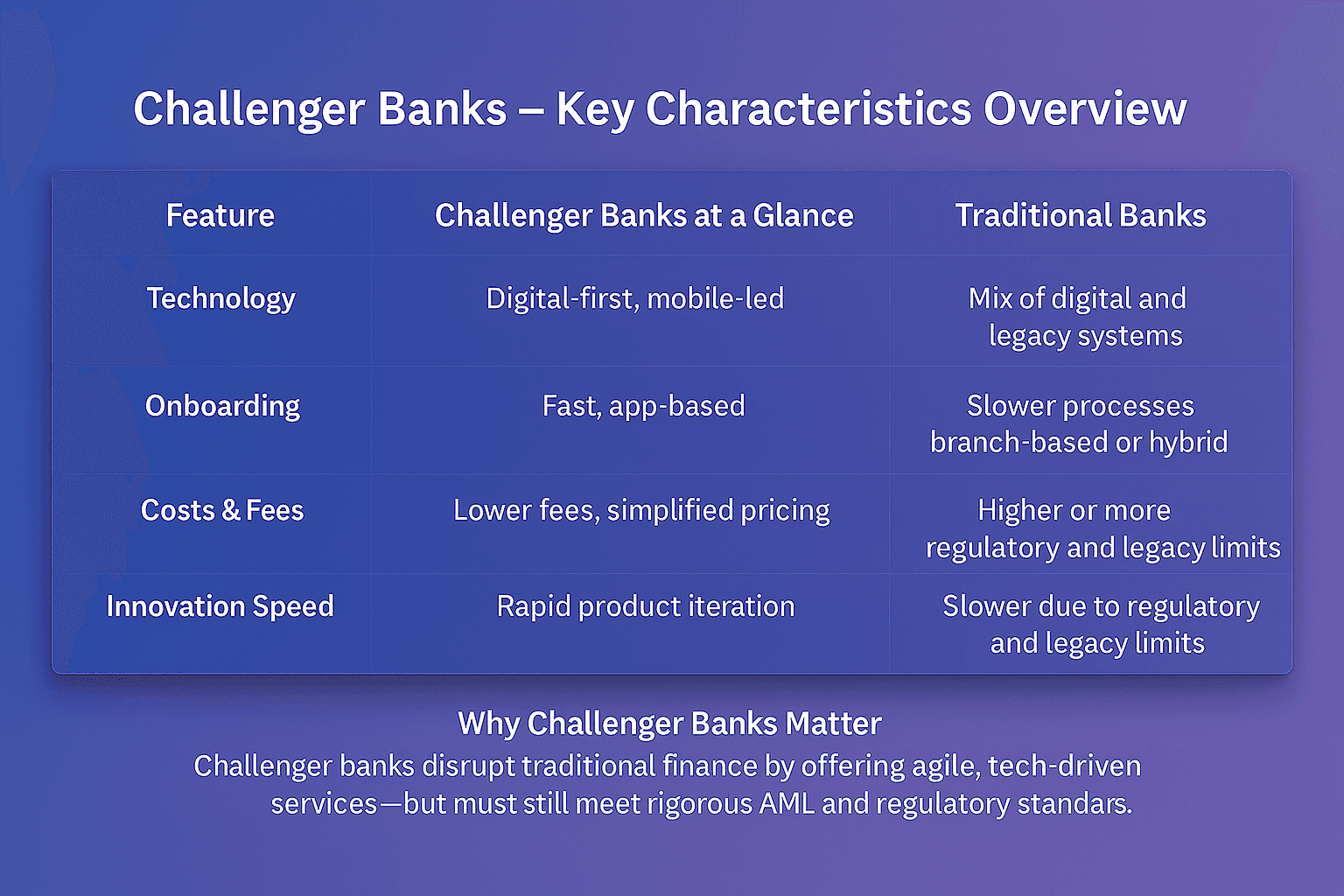

Key characteristics of challenger banks include:

Mobile-first platforms with user-friendly interfaces

Lower fees and competitive interest rates

Faster onboarding processes compared to legacy banks

Heavy reliance on digital innovation to attract customers

However, these strengths also expose challenger banks to compliance risks. Without robust systems for Customer Screening and Transaction Monitoring, they may become targets for money laundering, fraud, and other financial crimes.

Why Challenger Banks Matter In AML Compliance

Challenger banks are reshaping financial services, but their rapid digitalisation creates compliance complexity.

Regulators are paying close attention to these institutions to ensure they meet the same standards as established banks.

Regulatory expectations: Bodies like the Financial Conduct Authority (FCA) have stressed that challenger banks must adopt equally strong AML programs as traditional banks, applying a risk-based approach to anti-money laundering (AML) controls and also continuously make sure their financial crime controls remain fit for purpose as their business develops and grows

Increased risk exposure: Their fast growth, reliance on digital onboarding, and global customer base heighten risks of identity fraud and smurfing.

Compliance as a differentiator: Challenger banks that integrate advanced Alert Adjudication processes can turn compliance into a competitive advantage, reducing false positives and strengthening trust with regulators.

Core Features Of Challenger Banks

Challenger banks share common features that distinguish them from legacy institutions, but these features also shape how compliance must be managed.

Digital-First Banking

Challenger banks offer fully digital services, from account creation to international transfers. This convenience increases transaction speed but requires advanced compliance tools to monitor risks in real time.

Cost Efficiency

By avoiding branch networks and legacy infrastructure, challenger banks can offer lower fees and more competitive products. However, savings must be balanced with adequate investment in compliance technology and staffing.

Innovation And Agility

Challenger banks move quickly to launch new features like cryptocurrency integration or instant payments. This agility must be matched with strong oversight to ensure innovations don’t create compliance blind spots.

The Future Of Challenger Banks In Compliance

The future of challenger banks depends on their ability to balance innovation with regulatory compliance. As digital banking expands, regulators are intensifying scrutiny of how challenger banks manage AML, fraud prevention, and cybersecurity.

New technologies will play a central role. AI-driven monitoring systems, biometric identity verification, and advanced analytics will help challenger banks scale without sacrificing compliance standards. Additionally, global initiatives like those from the Bank for International Settlements (BIS) are shaping cross-border regulatory harmonisation, which will directly affect challenger banks operating in multiple jurisdictions.

In the coming years, compliance maturity will determine which challenger banks can sustain growth and compete internationally. Those that fail to invest in strong compliance frameworks risk fines, reputational damage, and even license restrictions.

Strengthen Your Challenger Bank Compliance Framework

Challenger banks thrive on innovation, but compliance is critical to sustainable growth. Investing in AML and financial crime prevention ensures that disruption does not come at the cost of regulatory risk.

Facctum’s Customer Screening solution helps challenger banks streamline onboarding while meeting strict compliance requirements.

Contact Us Today To Strengthen Your AML Compliance Framework