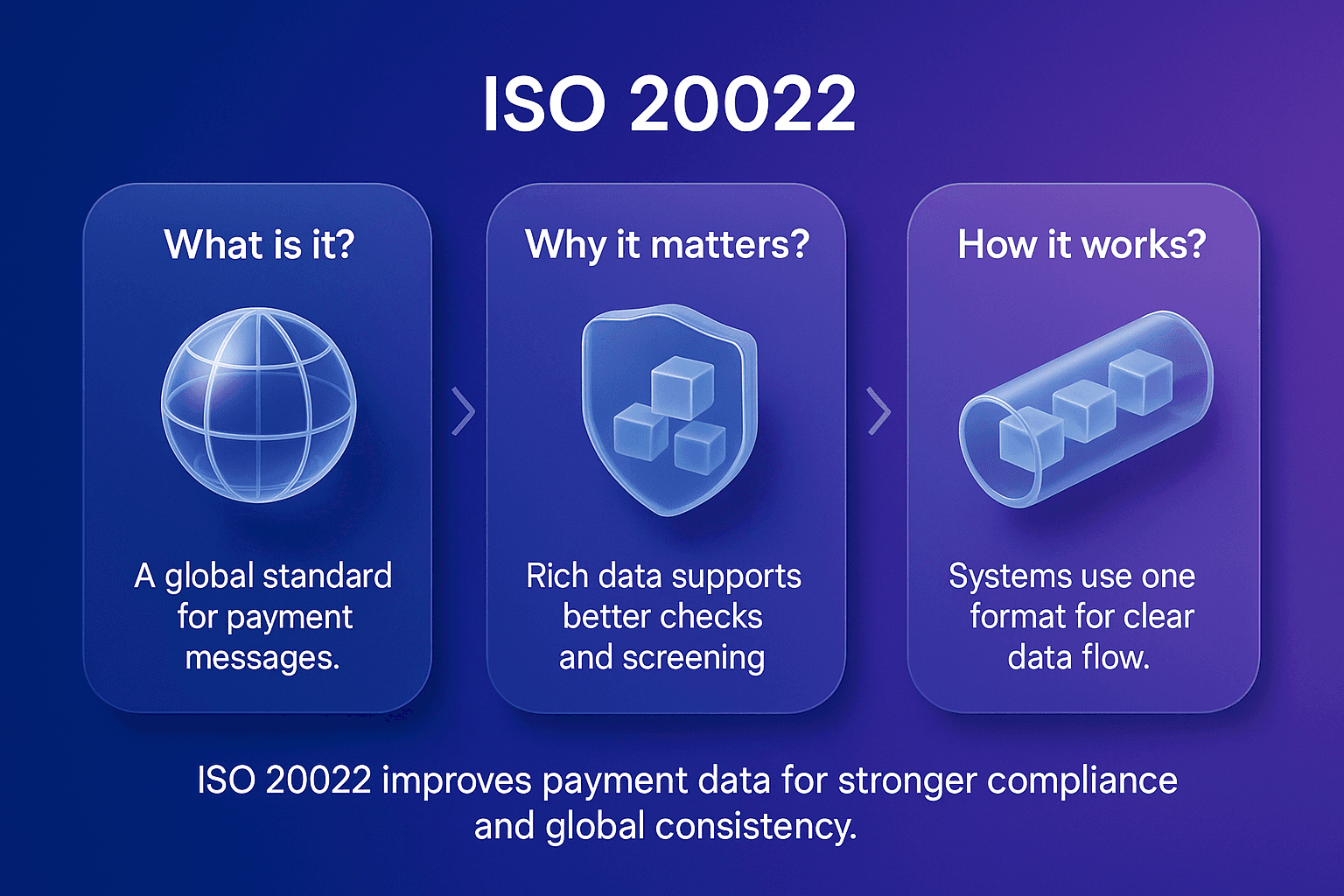

ISO 20022 is more than a messaging standard; it represents a transformative shift in how financial data is exchanged, interpreted, and used across global payment systems. By introducing a richer, structured data model, ISO 20022 enables better compliance monitoring, transparency, and operational efficiency for financial institutions and regulators alike.

Understanding ISO 20022 in the Context of Financial Compliance

ISO 20022 provides a universal financial messaging model that supports structured, machine-readable data. This standard is increasingly being adopted by central banks, payment infrastructures, and global financial institutions to harmonize payment and reporting formats.

The benefits of this harmonization extend beyond efficiency. It allows compliance teams to more effectively detect and prevent financial crime, aligning with key components of systems like Customer Screening and Payment Screening.

Why ISO 20022 Matters for Compliance Teams

For compliance professionals, ISO 20022 provides unprecedented granularity in transaction data, which improves accuracy in anti-money laundering (AML) and sanctions screening processes. It enhances how entities monitor, analyse, and report suspicious activities across borders.

Key benefits include:

Improved data transparency for risk assessment

Streamlined integration with Watchlist Management systems

Enhanced data lineage and audit trails for regulators

ISO 20022 and Data Standardization in Payments

Data standardization lies at the core of ISO 20022’s compliance advantage. It ensures that every participant in the payment chain, from originator to beneficiary, interprets information in the same way.

This shared understanding minimizes compliance gaps and reduces false positives in AML systems. By supporting structured data elements, ISO 20022 strengthens Transaction Monitoring and improves interoperability with reporting frameworks.

How ISO 20022 Supports Global Regulatory Alignment

The international nature of ISO 20022 helps regulators enforce consistent compliance expectations across jurisdictions. It aligns with the Financial Action Task Force (FATF) recommendations on transparency and cross-border cooperation, as reflected in the FATF Digital Transformation guidance.

Implementing ISO 20022 in Financial Institutions

Financial institutions must take a structured approach when implementing ISO 20022 to fully leverage its compliance benefits.

Before implementing ISO 20022, organizations should:

Conduct data mapping between legacy and ISO 20022 formats.

Ensure compatibility between screening, monitoring, and reporting tools.

Update systems to capture structured fields such as purpose codes and identifiers.

These steps enhance compliance accuracy and future-proof data management.

Challenges in ISO 20022 Adoption

While the advantages are clear, migration challenges persist. Institutions face hurdles such as data transformation complexity, integration costs, and maintaining interoperability with older systems.

To address these challenges effectively, organizations should:

Adopt a phased migration plan.

Collaborate with technology vendors to align data pipelines.

Train compliance teams on the new structured message formats.

How ISO 20022 Impacts Real-Time Payments

Real-time payments demand instant data validation and monitoring. ISO 20022 facilitates this by embedding detailed data elements that can trigger compliance rules within milliseconds.

This capability supports Real-Time Payment Screening and reduces friction in Instant Payments environments, balancing speed with accuracy.

The Future of Compliance and Data Interoperability

The shift toward ISO 20022 is a milestone in the digital transformation of compliance. Financial institutions that embrace its structured data model gain stronger risk visibility, better reporting accuracy, and improved collaboration with regulators.

As interoperability grows, ISO 20022 will serve as the backbone for cross-border compliance ecosystems.

Frequently Asked Questions