Sanctions and screening systems may appear similar, but they handle different stages of compliance. Watchlist management governs data accuracy and distribution, while customer screening matches those lists against customers or counterparties. This comparison explains how they complement each other, when to prioritise one over the other, and what outcomes each drives.

Quick Summary

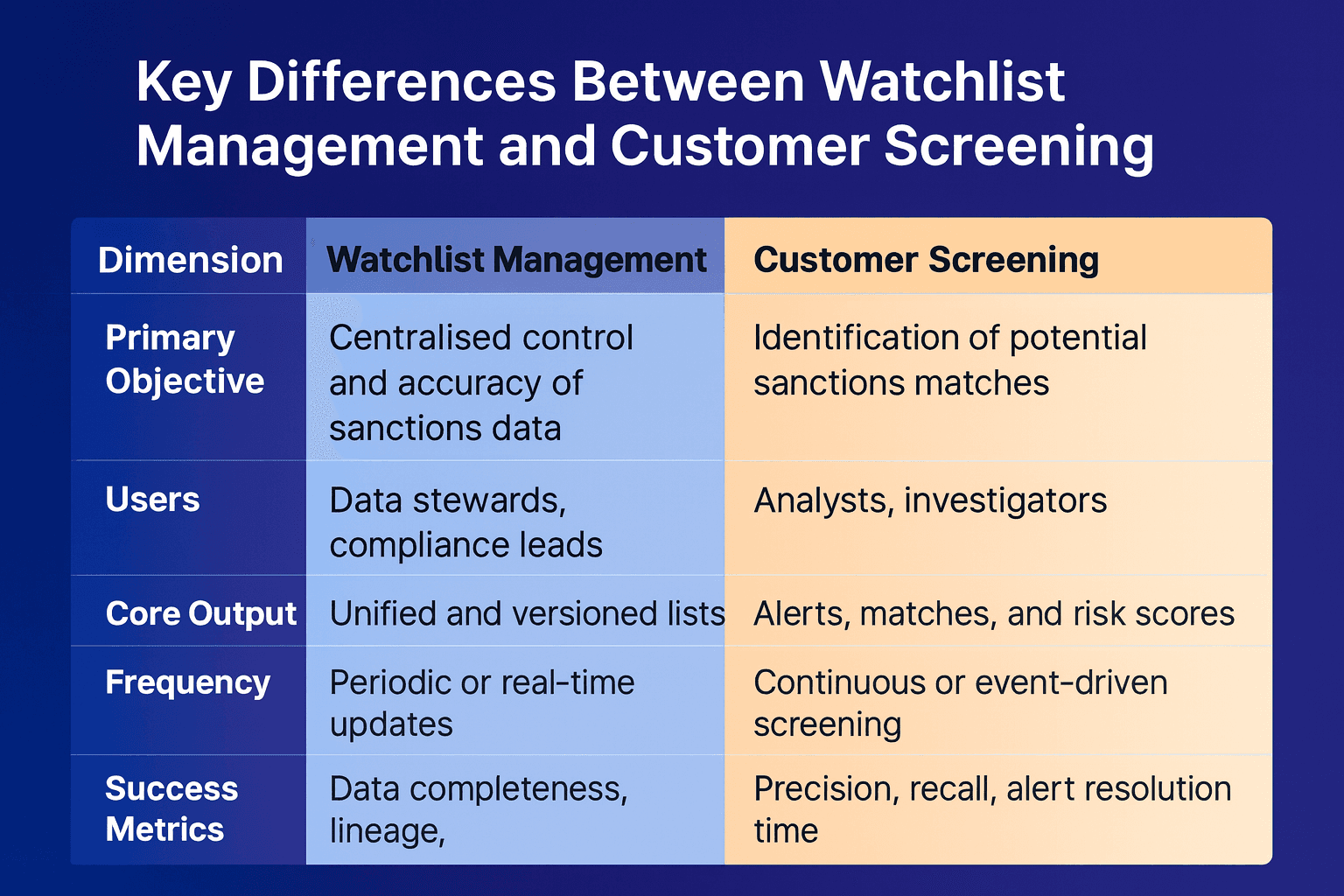

Here is the high-level view of roles and outcomes before we dive into detailed differences and implementation guidance.

Watchlist management curates, version-controls, and distributes official lists (e.g., OFAC, UN, EU) to ensure every system uses a single source of truth.

Customer screening applies those lists to customer data in real time or batch to identify sanctioned or high-risk individuals.

Together, they form the foundation of any sanctions compliance architecture.

Definitions and Scope

To compare these controls properly, it helps to define what each one owns, how teams interact with it, and where success is measured. The sections below set the boundary for responsibilities before we look at differences and handoffs.

What is Watchlist Management?

Watchlist management involves collecting, cleaning, deduplicating, and governing sanctions, PEP, and other regulatory lists. It focuses on data lineage, governance, version control, and auditability. Teams use platforms such as watchlist management to maintain accurate, unified data sources.

What is Customer Screening?

Customer screening compares customer records to official or internal lists using deterministic, fuzzy, or AI-driven matching. It aims for accuracy, low false positives, and explainability. Tools like customer screening enable real-time checks while meeting regulatory expectations.

How They Differ

Although both support sanctions compliance, they optimise for distinct outcomes: list governance pursues data quality and control, while screening prioritises precision, recall, and operational speed. The table summarises the core contrasts, comparing core objectives, users, outputs, and success measures for both capabilities.

As shown above, watchlist management focuses on maintaining the quality and integrity of sanctions data, while customer screening operationalises that data for daily compliance checks. Both are essential to effective sanctions control frameworks.

Where They Overlap and Hand Off

The two capabilities reinforce each other. Governed lists raise screening accuracy, while alert outcomes feed back into list improvements and thresholds.

Data Quality Loop: Clean lists reduce false positives; resolved alerts highlight list or data gaps.

Explainability: Versioned lists plus transparent matching rules support defensible outcomes in audits and regulatory exams. Building in transparency with explainable AI and well-governed rules-based systems helps analysts justify decisions.

Real-time Operations: For instant payments and 24/7 channels, both list updates and screening must support low-latency distribution and matching; many teams align this with their payment screening and real-time screening requirements.

Benefits and How They Interlink

When combined, watchlist management and customer screening create a resilient, high-performing compliance ecosystem. Each strengthens the other by improving both data quality and investigative outcomes.

Key Benefits

Reduced False Positives: Accurate lists feed cleaner screening outcomes, cutting analyst workload and improving turnaround times.

Audit and Regulatory Readiness: Governed list updates with transparent match logs simplify responses to regulator requests and board reporting.

Operational Efficiency: Shared data pipelines reduce duplication between teams managing lists and those running screening systems.

Real-time Assurance: Both systems working together improve detection speed and ensure sanctions controls keep up with fast payments environments.

How They Interlink

Watchlist management ensures every screening engine receives consistent and current list data.

Screening outcomes and alert data feed back into watchlist governance, highlighting gaps or new patterns.

Together they establish a continuous feedback loop between data governance and operational risk detection, reinforcing the overall compliance architecture.

Role of Alert Adjudication

Effective sanctions management doesn’t end at generating alerts. The process of reviewing, resolving, and learning from them, known as alert adjudication, is where insight turns into action.

How It Connects

Closing the Loop: Alert outcomes inform both list quality and screening thresholds, creating a self-improving system.

Explainability: Decision logs and match rationales produced during adjudication provide traceability that supports regulatory reviews and audits.

Efficiency Gains: Centralised case management accelerates resolutions, reducing backlogs and improving analyst confidence.

According to the FATF’s guidance on risk-based approaches, firms must be able to justify the steps taken in their screening and resolution workflows, which makes strong adjudication controls a supervisory expectation.

When to Prioritise One vs the Other

Depending on programme maturity and pain points, you may invest first in list governance or in screening quality. Use the indicators below to decide sequencing.

Prioritise Watchlist Management when…

You need robust lineage, versioning, and MI for audit and board reporting; our guidance on watchlist data management shows how governance choices reduce downstream alert noise.

You’re integrating multiple list sources (OFAC, EU, UN, OFSI) and facing duplication or update delays.

You’re scaling to new jurisdictions that require distinct local lists or de-duplication rules.

Prioritise Customer Screening when…

Onboarding SLAs suffer due to alert fatigue and high false positives; addressing alert fatigue often starts with better thresholds and list quality.

You’re expanding into multi-script or higher-risk geographies and need better transliteration and fuzzy matching; this deep dive on name screening in multi-script environments explains the operational considerations.

Regulators expect stronger evidence of explainability in matching outcomes, which can be delivered through clear feature contributions and decision logs.

Implementation Considerations

Strong outcomes depend on reliable data pipelines and transparent decisioning. These considerations help teams deliver defensible controls at scale.

Data and List Governance

Maintain clear versioning and lineage for every list change.

Capture metadata for update frequency, origin, and ownership.

Integrate business rules for exclusions, exemptions, and alias logic.

Matching and Threshold Design

Combine exact, phonetic, transliteration, and fuzzy matching with thresholds tuned per risk appetite; techniques such as fuzzy logic improve recall without overwhelming analysts.

Build explainability into every match (features, scores, rule paths) to accelerate adjudication; strong audit trails simplify alert adjudication.

Integration and Deployment Notes

Deployment patterns should support both analyst productivity and high-volume automation, with safe promotion between environments.

UI and API Patterns

Facctum’s modular architecture allows both interfaces to share the same governed data foundation. That means list governance tools feed APIs used by screening engines, ensuring changes propagate instantly across ecosystems.

Real-time Channels

For instant and card-present flows, ensure near real-time list updates and ultra-low-latency screening so decisions keep pace with authorisations. Many teams validate this by aligning with SEPA instant and card scheme SLAs while running controlled tests in non-production. When transactions are in flight, well-tuned real-time payment screening prevents avoidable declines and delays.

Buyer Checklist

Use these questions during demos and RFPs to separate marketing claims from capabilities that reduce risk and cost in production.

If Watchlist Management is your priority…

How is list lineage captured, versioned, and reconciled?

Can distribution occur across multiple screening engines without delay?

Does the system support delta updates and rollbacks?

If Customer Screening is your priority…

What match algorithms and threshold controls are available?

How does it handle transliteration, nicknames, and fuzzy matches?

Are explanations of match decisions human-readable and logged?

External Standards and Guidance

Supervisors expect programmes to align list governance and screening with global standards and national regimes. The FATF Recommendations outline baseline obligations for sanctions controls, the OFAC SDN data formats clarify how U.S. designations are structured for machine use, and the UK OFSI consolidated list provides the authoritative UK designations. Broader context on financial crime standards can be found in the IMF’s AML-CFT framework, which explains how supervisory expectations and sanctions compliance fit within global risk governance.

What to Explore Next?

If you’re consolidating lists or improving name match quality, it helps to see how these controls fit with the rest of the stack.

Many teams start by hardening list governance on the dedicated watchlist management page and then refine match quality on the customer screening page, before streamlining investigations with alert adjudication.

You can also speak with the team on the contact page.