Sanctions Screening

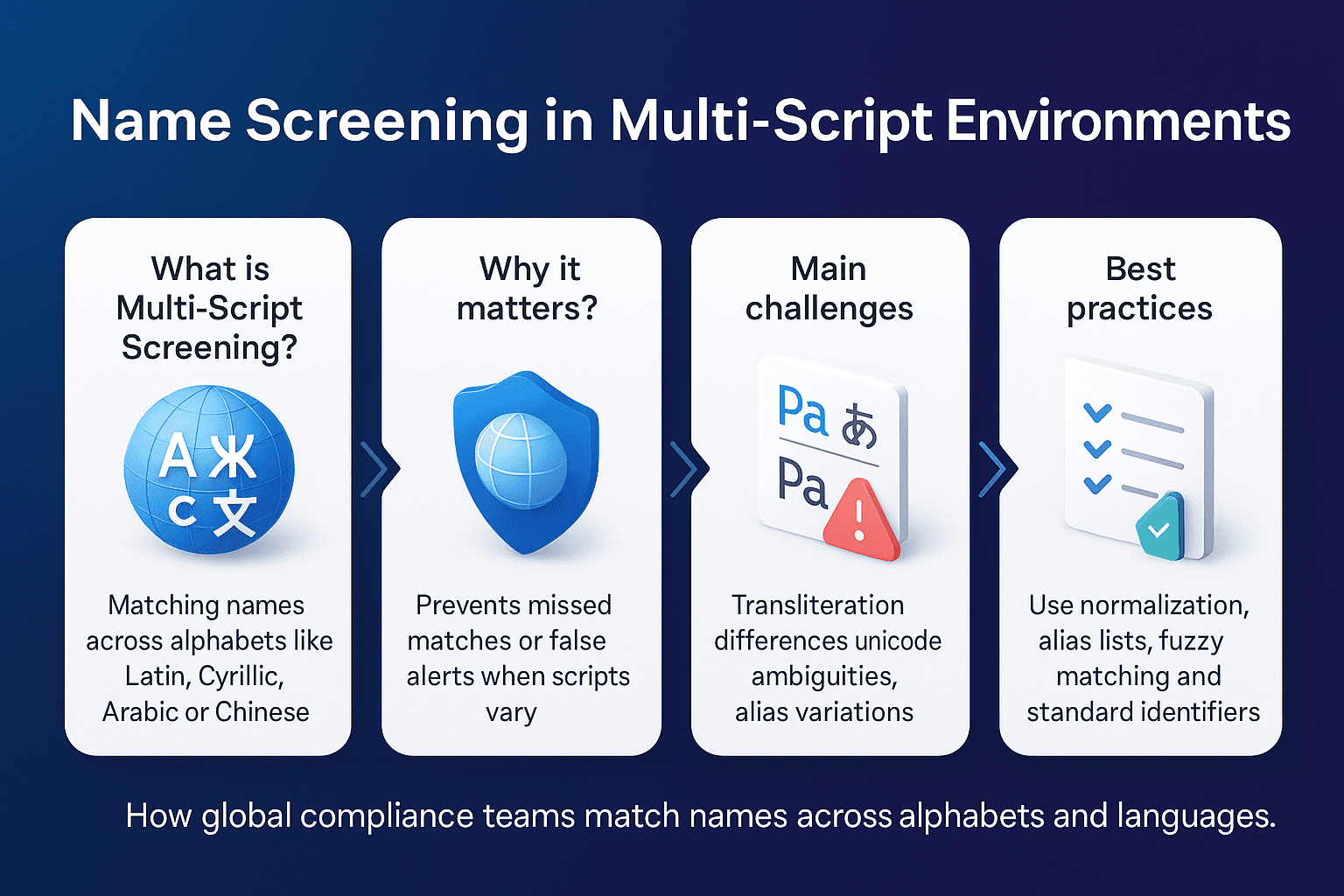

Name Screening in Multi-Script Environments: Challenges and Solutions for Compliance Teams

Name Screening in Multi-Script Environments: Challenges and Solutions for Compliance Teams

Name Screening in Multi-Script Environments: Challenges and Solutions for Compliance Teams

Alex Rees

Alex Rees

Alex Rees

10 Oct 2025

10 Oct 2025

10 Oct 2025

Financial institutions are required to screen customers and counterparties against sanctions and politically exposed persons (PEP) lists. In a global market, those names often appear in different scripts: Cyrillic, Arabic, Chinese characters, or Latin transliterations.

This creates unique compliance risks. Poor handling of script variation can either miss true matches (false negatives) or overwhelm teams with noise (false positives). Regulators expect firms to have clear strategies for handling this complexity.

Customer Screening: Definition

Customer screening is the process of checking individuals and entities against sanctions, PEP, and watchlists at onboarding and throughout the relationship lifecycle. The goal is to detect potential risks before transactions or relationships progress.

Effective customer screening involves:

Normalising names across different scripts and formats.

Matching against updated sanctions and PEP lists.

Reducing false positives with smart matching logic.

Documenting results for regulators and auditors.

Facctum’s Customer Screening solution focuses on achieving these outcomes in real time, ensuring compliance teams can act quickly and decisively.

Multi-Script Screening

Multi-script screening refers to the ability to process and match names written in different alphabets, such as:

Cyrillic (e.g., Russian, Ukrainian, Bulgarian).

Arabic (e.g., Middle Eastern and North African regions).

Chinese characters (Simplified and Traditional).

Latin transliterations of the above.

Without proper handling, the same person may appear differently across systems. For example, “Александр Иванов” (Cyrillic) might also be written as “Aleksandr Ivanov” or “Alexander Ivanoff.”

Compliance teams need screening systems that can account for these variations without introducing excessive false positives.

Why Multi-Script Screening Matters in 2025

Global sanctions regimes are publishing lists with more multilingual aliases. OFAC, the EU, and OFSI all include transliterations alongside native-script entries. FATF’s guidance on sanctions implementation highlights the importance of screening across scripts.

Without multi-script capability, firms risk:

False negatives by missing matches where only the native-script alias is present.

False positives by over-expanding matching rules across transliterations.

Audit gaps if they cannot show regulators how scripts were handled.

Supervisors in both Europe and the US increasingly ask how firms configure and test their screening engines for script handling.

Technical Challenges in Multi-Script Screening

Screening across scripts is not just about matching letters, it involves complex data and linguistic issues.

Unicode Issues

Different scripts contain visually similar characters, such as Latin “A” and Cyrillic “А.” These can create misleading matches unless normalised properly.

Transliteration Variability

Arabic and Cyrillic names may have multiple valid transliterations into Latin script. A single individual could appear with different spellings across documents and databases.

Phonetic Differences

Names transliterated phonetically can vary widely depending on the target language. For example, the Russian name “Юрий” can appear as “Yuri,” “Yury,” or “Juri.”

Script Switching in Records

Some databases mix scripts within the same record, especially in cross-border payments. Screening systems must detect and resolve these inconsistencies.

Reducing False Positives Without Missing True Matches

Firms can improve both accuracy and efficiency by applying targeted techniques:

Normalise input data into a common format before matching.

Use script-specific thresholds for fuzzy matching rather than global settings.

Leverage official identifiers (dates of birth, passport numbers) where available.

Document matching logic to provide clarity during regulatory exams.

See Facctum’s glossary on Algorithms and AML Screening for background on the detection methods that underpin multi-script screening.

Auditability and Regulator Expectations

Supervisors expect more than just results, they want evidence.

Regulators in the EU, US, and UK increasingly ask firms to:

Demonstrate how different scripts and aliases are processed.

Provide test cases showing successful detection of transliterations.

Retain evidence of tuning decisions and thresholds.

OFAC, the EU, and OFSI issue regular updates with multi-script aliases. Compliance teams should log not just the update but also the validation that their systems captured it.

Integrating Multi-Script Screening Into Your Stack

Multi-script name handling works best when integrated across compliance tools:

Customer Screening: Applies multi-script logic in real time at onboarding and during monitoring.

Watchlist Management: Normalises lists and aliases across different scripts.

Alert Adjudication: Ensures investigators only receive alerts that are meaningful and de-duplicated across transliterations.

This layered approach provides accuracy, efficiency, and auditability.

Strengthening Compliance With Multi-Script Screening

Multi-script screening is no longer optional. It is a regulatory expectation and an operational necessity.

Firms that adopt robust controls benefit from:

Faster adoption of global sanctions updates.

Reduced operational strain from false positives.

Stronger evidence for regulators and auditors.

Better protection against financial crime risk.

Contact Facctum today to learn how our Customer Screening solution supports multi-script name screening at scale.

Contact us

Explore Our Solutions

Contact us

Explore Our Solutions

What Is Financial Crime Compliance And Why Is It Essential For Institutions?

What Is Financial Crime Compliance And Why Is It Essential For Institutions?

What Is Financial Crime Compliance And Why Is It Essential For Institutions?

What Is Financial Crime Compliance And Why Is It Essential For Institutions?

How Does Real-Time Screening Help Detect And Prevent Financial Crime?

How Does Real-Time Screening Help Detect And Prevent Financial Crime?

How Does Real-Time Screening Help Detect And Prevent Financial Crime?

How Does Real-Time Screening Help Detect And Prevent Financial Crime?

What Are The Most Significant Challenges Facing AML Compliance Teams Today?

What Are The Most Significant Challenges Facing AML Compliance Teams Today?

What Are The Most Significant Challenges Facing AML Compliance Teams Today?

What Are The Most Significant Challenges Facing AML Compliance Teams Today?

How Does Artificial Intelligence Improve Accuracy And Reduce Errors In Compliance Screening?

How Does Artificial Intelligence Improve Accuracy And Reduce Errors In Compliance Screening?

How Does Artificial Intelligence Improve Accuracy And Reduce Errors In Compliance Screening?

How Does Artificial Intelligence Improve Accuracy And Reduce Errors In Compliance Screening?

Why Is Robust Data Management Critical To AML And Sanctions Screening?

Why Is Robust Data Management Critical To AML And Sanctions Screening?

Why Is Robust Data Management Critical To AML And Sanctions Screening?

Why Is Robust Data Management Critical To AML And Sanctions Screening?

How Do Financial Institutions Identify, Review, And Report Suspicious Activity?

How Do Financial Institutions Identify, Review, And Report Suspicious Activity?

How Do Financial Institutions Identify, Review, And Report Suspicious Activity?

How Do Financial Institutions Identify, Review, And Report Suspicious Activity?

How Does Data Quality Influence AML Screening Effectiveness?

How Does Data Quality Influence AML Screening Effectiveness?

How Does Data Quality Influence AML Screening Effectiveness?

How Does Data Quality Influence AML Screening Effectiveness?

How Can Automation Transform The Efficiency Of Compliance Operations?

How Can Automation Transform The Efficiency Of Compliance Operations?

How Can Automation Transform The Efficiency Of Compliance Operations?

How Can Automation Transform The Efficiency Of Compliance Operations?

Which Global Regulatory Bodies Define AML And Financial Crime Standards?

Which Global Regulatory Bodies Define AML And Financial Crime Standards?

Which Global Regulatory Bodies Define AML And Financial Crime Standards?

Which Global Regulatory Bodies Define AML And Financial Crime Standards?

How Do Modern RegTech Platforms Strengthen Financial Crime Prevention?

How Do Modern RegTech Platforms Strengthen Financial Crime Prevention?

How Do Modern RegTech Platforms Strengthen Financial Crime Prevention?

How Do Modern RegTech Platforms Strengthen Financial Crime Prevention?

Explore our compliance solutions

Reach out to us for more information!

Request a Demo

Explore our compliance solutions

Reach out to us for more information!

Request a Demo

Explore our compliance solutions

Reach out to us for more information!

Request a Demo

Explore our compliance solutions

Reach out to us for more information!

Request a Demo

Explore our compliance solutions

Reach out to us for more information!

Request a Demo

Explore our compliance solutions

Reach out to us for more information!

Request a Demo

Explore Our Comprehensive Platform

Explore the powerful capabilities of the Facctum Compliance Platform

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Explore Our Comprehensive Platform

Explore the powerful capabilities of the Facctum Compliance Platform

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Explore Our Comprehensive Platform

Explore the powerful capabilities of the Facctum Compliance Platform

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Explore Our Comprehensive Platform

Explore the powerful capabilities of the Facctum Compliance Platform

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

How Facctum Solves the

Biggest Compliance and

Screening Challenges

Explore the powerful capabilities of the Facctum

Compliance Platform

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Explore Our Comprehensive Platform

Explore the powerful capabilities of the Facctum Compliance Platform

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Explore Our Comprehensive Platform

Explore the powerful capabilities of the Facctum Compliance Platform

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Explore Our Comprehensive Platform

Explore the powerful capabilities of the Facctum Compliance Platform

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Protect against compliance failings, and transact with confidence.

Book a demo to find out more.

Protect against compliance failings, and transact with confidence.

Book a demo to find out more.

Protect against compliance failings, and transact with confidence.

Book a demo to find out more.

Protect against compliance failings, and transact with confidence.

Book a demo to find out more.

Protect against compliance failings, and transact with confidence.

Book a demo to find out more.

Protect against compliance failings, and transact with confidence.

Book a demo to find out more.

Protect against compliance failings, and transact with confidence.

Book a demo to find out more.

Protect against compliance failings, and transact with confidence.

Book a demo to find out more.

Solutions

Industries

© Facctum 2025

Solutions

Industries

© Facctum 2025

Solutions

Industries

© Facctum 2025

Solutions

Industries

© Facctum 2025

Solutions

© Facctum 2025

Solutions

© Facctum 2025

Solutions

Industries

© Facctum 2025

Frequently Asked Questions (FAQs)

What Is Financial Crime Compliance And Why Is It Essential For Institutions?

What Is Financial Crime Compliance And Why Is It Essential For Institutions?

How Does Real-Time Screening Help Detect And Prevent Financial Crime?

How Does Real-Time Screening Help Detect And Prevent Financial Crime?

What Are The Most Significant Challenges Facing AML Compliance Teams Today?

What Are The Most Significant Challenges Facing AML Compliance Teams Today?

How Does Artificial Intelligence Improve Accuracy And Reduce Errors In Compliance Screening?

How Does Artificial Intelligence Improve Accuracy And Reduce Errors In Compliance Screening?

Why Is Robust Data Management Critical To AML And Sanctions Screening?

Why Is Robust Data Management Critical To AML And Sanctions Screening?

How Do Financial Institutions Identify, Review, And Report Suspicious Activity?

How Do Financial Institutions Identify, Review, And Report Suspicious Activity?

How Does Data Quality Influence AML Screening Effectiveness?

How Does Data Quality Influence AML Screening Effectiveness?

How Can Automation Transform The Efficiency Of Compliance Operations?

How Can Automation Transform The Efficiency Of Compliance Operations?

Which Global Regulatory Bodies Define AML And Financial Crime Standards?

Which Global Regulatory Bodies Define AML And Financial Crime Standards?

How Do Modern RegTech Platforms Strengthen Financial Crime Prevention?

How Do Modern RegTech Platforms Strengthen Financial Crime Prevention?