Watchlist Management

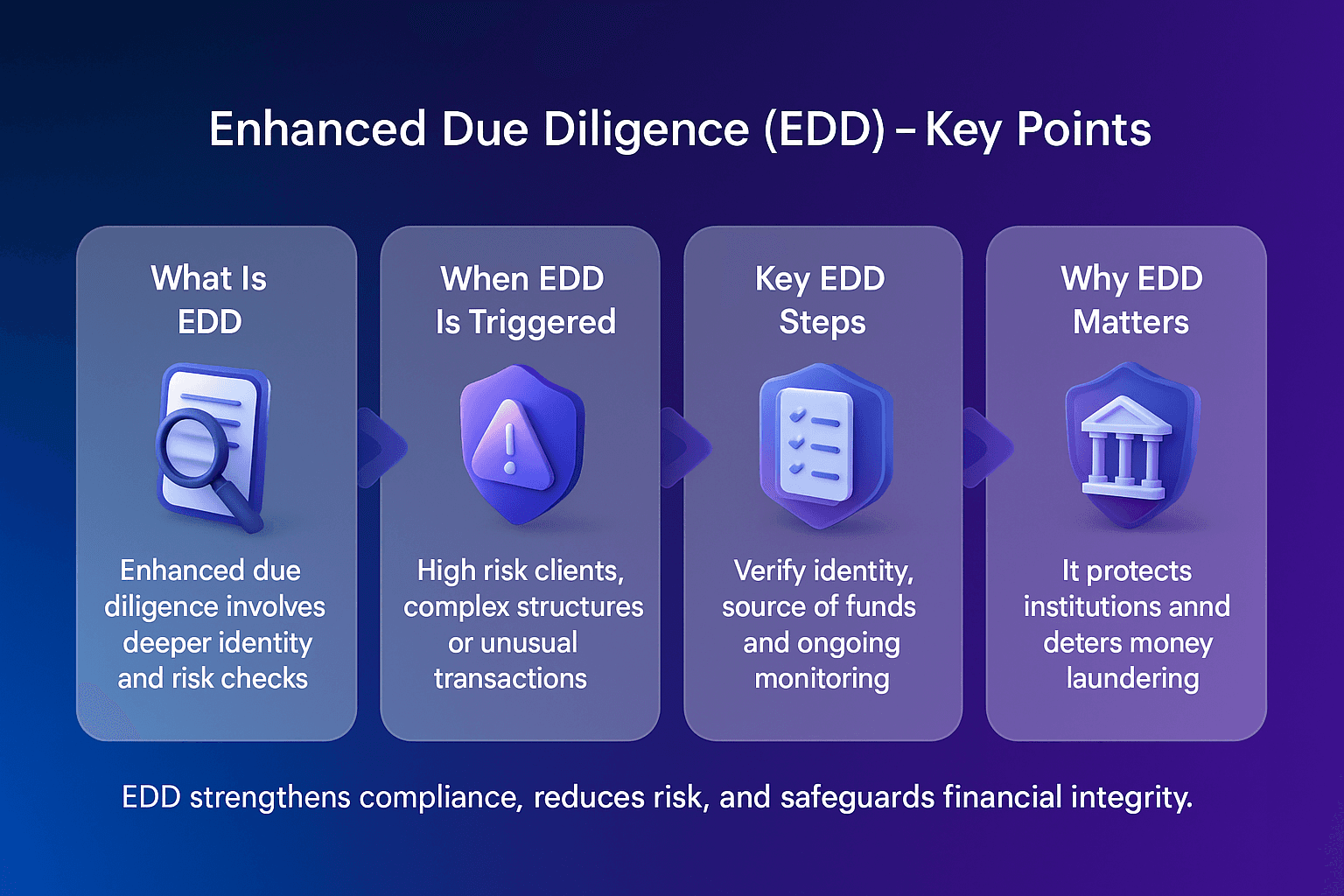

In an era of increasingly sophisticated financial crime, regulators and institutions alike are raising the bar for compliance. While Customer Due Diligence (CDD) forms the baseline for anti-money laundering (AML) processes, Enhanced Due Diligence (EDD) has become the go-to framework for higher-risk customers, jurisdictions, and transactions. But what exactly is Enhanced Due Diligence, and why is it so critical in today’s financial landscape?

This blog explores the fundamentals of EDD in AML, draws clear comparisons between CDD and EDD, examines practical applications in banking, outlines use cases, and offers best practice recommendations to help compliance teams stay ahead.

What Is Enhanced Due Diligence in AML?

Enhanced Due Diligence (EDD) is a more rigorous form of identity and risk assessment applied to customers or transactions that present a higher risk of money laundering or terrorist financing. It goes beyond basic verification to build a holistic picture of a customer's financial behaviour, business model, source of funds, and ultimate beneficial ownership.

In the UK, EDD is a regulatory requirement under the Money Laundering Regulations 2017. Financial institutions must apply EDD measures when dealing with politically exposed persons (PEPs), high-risk third countries, or unusual transactions without an obvious economic rationale. International frameworks such as the Financial Action Task Force (FATF) Recommendations reinforce this obligation globally.

But while EDD is a mandatory compliance step in certain scenarios, the real value lies in its preventive function—detecting and deterring illicit financial activity before it infiltrates the system.

Customer Due Diligence and Enhanced Due Diligence: What’s the Difference?

Many organisations still conflate CDD and EDD, leading to compliance gaps. So let’s clarify: the difference between CDD and EDD lies in the depth and scope of verification.

Customer Due Diligence (CDD) involves identifying and verifying a customer’s identity using reliable, independent sources—typically applied to most customers during onboarding. It may include name, date of birth, address, and document validation.

Enhanced Due Diligence (EDD), however, is a step up. It requires gathering additional data to assess risk—such as business activity, transaction patterns, source of wealth, geolocation risk, and relationship mapping. In some cases, ongoing monitoring and approval by senior management are also required.

In essence, while CDD answers the question “Who is this customer?”, EDD asks, “Can I trust this customer given the risks involved?”

What EDD in Banking Looks Like Today

The banking sector has long been under the microscope when it comes to AML compliance, and the role of Enhanced Due Diligence in banking has expanded accordingly. Faced with mounting regulatory pressure and billion-dollar fines, banks now take a more proactive approach to identifying and mitigating financial crime.

In practice, EDD in banking includes deeper scrutiny of accounts with cross-border activity, offshore structures, or links to high-risk jurisdictions. It often involves:

Reviewing corporate ownership structures to unearth beneficial owners.

Analysing source of funds and wealth with third-party documentation.

Applying adverse media screening to uncover reputational risks.

Conducting ongoing transaction monitoring using behavioural models.

A 2024 report from the UK’s Financial Conduct Authority (FCA) highlighted that banks failing to implement robust EDD procedures accounted for over 60% of AML compliance issues. This underlines the strategic importance of EDD in not just avoiding penalties but safeguarding institutional reputation.

Common EDD Use Cases Across Financial Services

Beyond traditional banking, EDD has become essential for fintechs, digital lenders, crypto exchanges, and DNFBPs (Designated Non-Financial Businesses and Professions). The following use cases demonstrate how EDD is being deployed in real-world scenarios:

High-risk customer onboarding: Fintechs onboarding foreign clients from high-risk countries use EDD to assess PEP status, screen watchlists, and verify legitimacy of business operations.

Monitoring UBOs in complex structures: In private banking, EDD tools help untangle layered ownership and flag connections to sanctioned entities.

Detecting smurfing or structuring: EDD supports pattern recognition and behavioural analytics to uncover deliberate fragmentation of large transactions.

Vendor and third-party risk: Regulated entities apply EDD to suppliers, agents, or payment processors that could pose indirect compliance risks.

Cryptocurrency platforms: Exchanges often rely on EDD to assess source of funds in high-value transactions and to ensure traceability of wallets.

Recent developments—such as the 2025 Europol report on shell company abuse in cryptocurrency laundering—have only intensified the need for consistent EDD frameworks across sectors.

Enhanced Due Diligence Requirements and Checklists

Building an effective EDD framework starts with understanding regulatory expectations and adapting them into internal processes. While specifics may vary across jurisdictions, a solid Enhanced Due Diligence checklist typically includes:

Verification of identity and address using government-issued documents.

Detailed risk assessment based on geography, industry, and transaction patterns.

Understanding the nature and purpose of the business relationship.

Source of funds and wealth documentation, including bank statements, tax records, or asset registers.

Beneficial ownership verification, especially in corporate structures.

Adverse media screening and continuous monitoring.

Senior management approval for onboarding high-risk clients.

In many cases, technology plays a central role. Automated platforms like Facctum’s RapidAML can significantly reduce manual errors, standardise assessments, and enable real-time decision-making—all while keeping costs low.

Best Practices for Implementing EDD

Applying Enhanced Due Diligence effectively requires more than ticking boxes. It involves embedding a culture of risk-awareness across onboarding, monitoring, and escalation processes. Here are some best practices to consider:

Risk-based approach: Tailor EDD intensity based on customer risk profile. Not all high-value clients require the same scrutiny.

Automate without losing judgement: Use AI-driven FCC tools to flag anomalies but ensure human oversight for complex cases.

Keep data fresh: Stale information leads to blind spots. Schedule regular reviews and integrate live data sources.

Train your teams: Even the best tech stack won’t help if staff can’t interpret red flags or follow escalation protocols.

Document everything: Regulators expect a clear audit trail—automated systems should generate logs for every step of the due diligence journey.

The Evolving Landscape: EDD and the Future of AML Compliance

The role of Enhanced Due Diligence will only grow in the years ahead. Emerging risks—from AI-generated identities to state-sponsored cybercrime—are expanding the boundaries of AML frameworks. The recent FATF review in 2025 warned of regulatory arbitrage in digital finance and urged global standardisation of EDD measures.

Institutions can no longer afford reactive compliance. Instead, they must shift towards proactive, data-driven EDD strategies that adapt to new typologies in real time. For banks and fintechs, this means investing in intelligent infrastructure, automating routine checks, and leveraging behavioural analytics to identify early warning signs.

At Facctum, we understand that Enhanced Due Diligence is not just a compliance requirement—it’s a business enabler. Our solutions combine speed, accuracy, and adaptability, allowing financial institutions to reduce friction while maintaining robust oversight.

Final Thoughts

Enhanced Due Diligence is no longer a niche process reserved for a few edge cases. It is now a cornerstone of modern AML strategy—whether you're onboarding a client in Mumbai or monitoring transactions in London. The difference between CDD and EDD lies not just in scale but in mindset. CDD helps you know your customer. EDD ensures you understand them—and the risk they bring.

By implementing the right technology, aligning to regulatory expectations, and adopting best practices, organisations can turn compliance into a competitive advantage. And in a world where trust and transparency define success, there’s no better time to start.

Stay ahead of financial crime risk—explore how Facctum’s can streamline your EDD workflows and ensure compliance with global regulations.