AML Compliance

A new wave within artificial intelligence (AI) is gaining traction: AI agents. Designed for greater autonomy and context awareness, these systems can reason across steps, interact with external systems, and adapt their actions to meet specific goals. Interest in AI agents is growing alongside advances in generative AI and machine learning. At the same time, anti-money laundering (AML) compliance teams are under increasing strain: repetitive casework, alert backlogs, and mounting regulatory pressure.

AI is already transforming financial crime compliance, becoming a core part of the modern compliance toolkit. Now, AI agents help build on that foundation, complementing existing tools to support more complex, goal-oriented tasks.

How AI Agents Work

AI agents represent a major evolution in artificial intelligence, enabling systems to perform tasks that go beyond pattern recognition or scoring models. In the context of anti-money laundering, these agents can operate autonomously across multiple systems, interpret context, and make decisions that align with specific goals, such as escalating a case, requesting documents, or updating customer risk scores.

Unlike traditional automation tools, AI agents are designed for flexibility and autonomy. They combine large language models (LLMs), structured logic, and external data integration to perform continuous, adaptive actions across compliance environments. This makes them particularly valuable for AML teams managing complex, high-volume workflows, where rules-based systems often fall short. As the technology matures, financial institutions are exploring how these agents can be securely and effectively deployed within real-time AML operations.

What makes AI agents different

AI agents are goal-directed systems designed to operate with a degree of autonomy. They can process inputs, make decisions, and carry out multiple steps with minimal human involvement.

Many combine large language models (LLMs) with decision-making frameworks and the ability to interact with external systems, for example, retrieving real-time data or calling application programming interfaces (APIs). This allows them to perform more complex, context-aware actions across the AML workflow, such as initiating follow-up actions or streamlining investigations.

Unlike traditional AI tools, AI agents can sequence steps, assess when action is needed, and coordinate with external systems to achieve a defined objective. This makes them especially well-suited for decision-making, problem-solving, and acting on real-time context and predefined goals.

How AI agents build on existing AI in AML

AI is already embedded in financial services. A survey by the Bank of England found that 75% of firms are using AI, with another 10% planning to adopt it within three years.

AML programs already apply AI across core functions. Machine learning models trained on historical data surface complex patterns that manual reviews and rule-based systems often miss, helping teams identify anomalies and prioritise cases more effectively.

Natural language processing also supports adverse media screening. These tools process unstructured text such as news or court findings to find relevant mentions of individuals, entities, or potential financial crime.

AI agents now add a new layer to this landscape, linking insight with action and task execution across systems.

The Role of AI Agents in AML

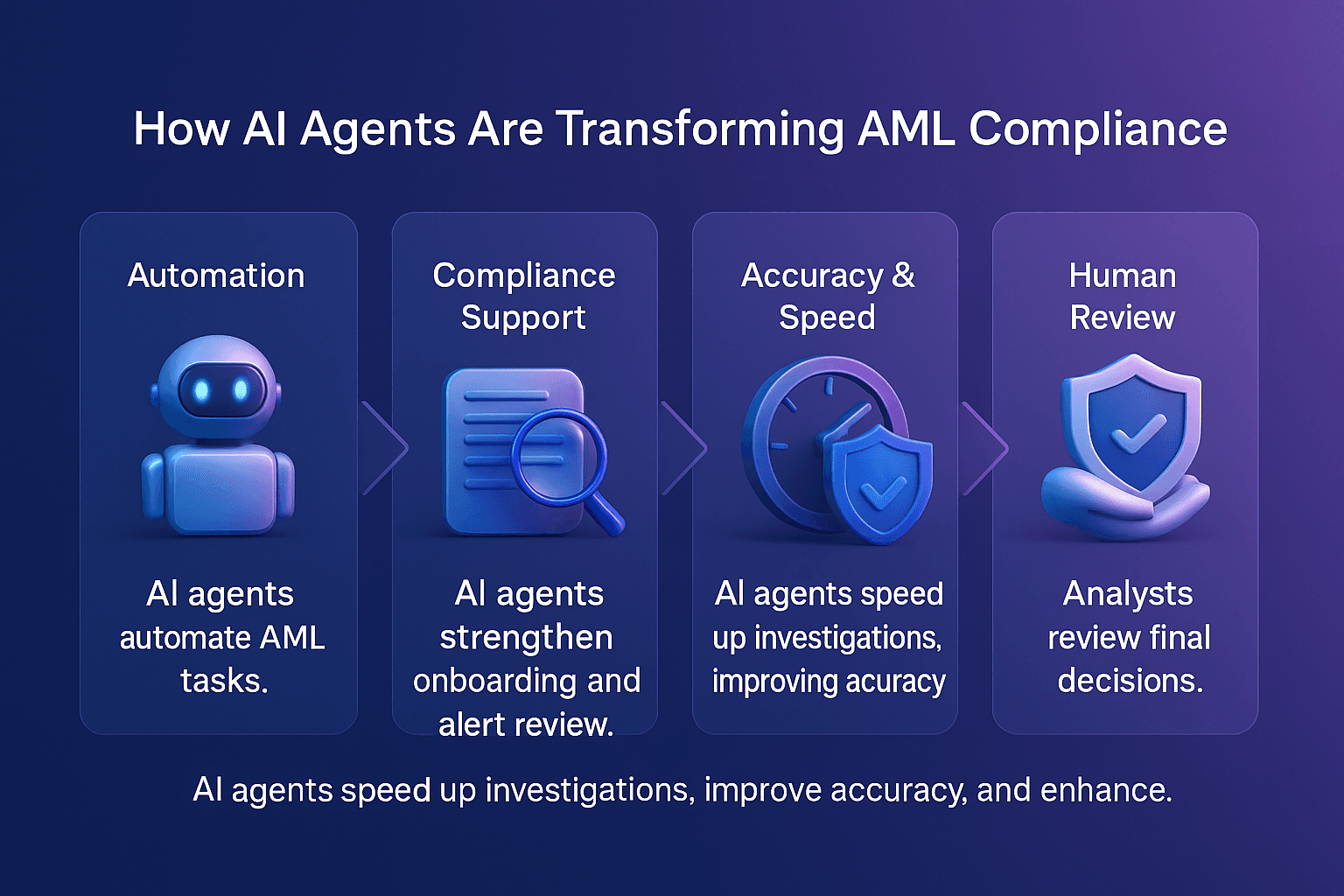

AI agents are reshaping the operational landscape of AML compliance by bridging the gap between analytics and execution. Their ability to reason across steps and adapt in real time makes them a valuable addition to financial crime teams already using machine learning, transaction monitoring, and name screening systems.

Instead of replacing current AML technologies, AI agents augment them, applying judgment, interpreting context, and taking action when certain risk thresholds or data conditions are met. From onboarding to investigations, their role is to automate repetitive tasks and enhance decision-making, enabling teams to respond to threats more efficiently. As money laundering tactics evolve, these intelligent systems help financial institutions stay proactive, agile, and compliant in the face of rising operational and regulatory demands.

Real use cases in AML workflows

AI agents support broader AML operations by automating routine, structured tasks across systems, tailoring their actions to the specifics of each workflow. They are particularly effective in high-volume, repetitive areas where steps are repeatable but context-dependent, such as preparing case summaries using information pulled from multiple systems, or initiating follow-up actions when risk factors or documentation gaps are present.

While AI tools already streamline tasks like alert scoring or name screening, AI agents can introduce greater autonomy. They reason across multiple steps, adjust based on case context, and coordinate actions across platforms, freeing analysts to focus on high-value, complex work.

For example, in financial crime investigations, AI agents can manage low-priority alerts from start to finish: gathering Know Your Customer (KYC) data and transaction history, reviewing recent alerts, and applying logic to determine whether to escalate or close the case for human review.

During onboarding, AI agents can validate KYC information against internal and external databases, identify missing documentation, and flag inconsistencies for analyst review, reducing delays.

Reducing manual burden and enhancing efficiency

Manual processes continue to slow down AML operations and drive up costs. In KYC reviews, for example, low-risk customers can take up to 100 minutes per case, much of it spent on repetitive, manual steps.

AI tools ease this burden by automating key tasks, increasing both speed and accuracy. AI agents take this further by coordinating actions across systems, sequencing steps based on context, and minimising the need for manual handoffs.

This added efficiency matters as operational pressures grow. The rise of instant payments has shortened the window for identifying and responding to suspicious activity, increasing strain on compliance teams. Money laundering is also widespread, with the United Nations (UN) estimating that between 2% and 5% of global GDP is laundered each year. In this environment, faster and more scalable controls are critical.

Reducing manual workload benefits has long-term benefits internally and for employee well-being. Automating low-value tasks frees analysts to focus on higher-skilled work, such as investigations or escalations. Over time, this helps reduce burnout and supports more rewarding, engaging roles within AML operations.

Using AI Agents in a Holistic AML Environment

For AI agents to deliver real value in anti-money laundering, they must be part of a broader, well-integrated compliance ecosystem. This means aligning their use with governance standards, auditability, and existing AML tools such as transaction monitoring, customer due diligence (CDD), and sanctions screening.

Rather than acting as standalone applications, AI agents work best when embedded within a unified, end-to-end AML environment. In this setup, they can coordinate workflows, reduce silos, and ensure decisions are traceable and explainable, key requirements for meeting regulatory scrutiny. As adoption increases, compliance leaders must ensure these tools are not only technically effective but also aligned with principles of fairness, transparency, and ethical AI use.

Where AI agents belong

The real value of AI agents is realised within a broader anti-financial crime strategy — one that prioritises governance, transparency, and human oversight. In a well-designed technology environment, AI agents work alongside tools and models, drawing from high-quality inputs and contributing to explainable, defensible outcomes.

AI agents don’t replace core systems but can extend them, combining reasoning with tactical execution across workflows. Their strength is in connecting task-level tools into more continuous, end-to-end processes.

As AI adoption grows in compliance, financial institutions must ensure agent-based tools operate within clear guardrails. That includes meeting expectations for explainability, accountability, and avoiding black box systems that lack transparency or auditability.

What regulators expect

Regulators have long acknowledged the value of advanced technologies in AML. The Financial Action Task Force (FATF), the global watchdog on money laundering and terrorist financing, has emphasised their potential to improve the speed, quality, and efficiency of compliance.

As AI adoption grows, regulators are setting clearer expectations for how financial institutions manage associated risks. While AI agents are not yet the subject of specific regulatory guidance, their ability to operate with greater autonomy and less direct human oversight makes strong governance frameworks essential.

The Hong Kong Monetary Authority (HKMA) has recently acknowledged the emergence of agentic AI. While highlighting its potential, HKMA calls for a dual-track approach: encouraging innovation while managing risks such as cybersecurity and data privacy.

In the European Union, the AI Act has become the world’s first comprehensive AI regulation. It establishes a risk-based classification system, with stricter oversight, documentation, and transparency requirements for high-risk systems. The Monetary Authority of Singapore (MAS) has also advanced AI governance through detailed guidance, encouraging responsible adoption with a focus on fairness, ethics, accountability, and transparency.

Across jurisdictions, expectations around governance, explainability, and accountability are becoming more consistent. These principles apply broadly to AI technologies and will be increasingly important as agent-based systems take on a larger role in AML compliance.

Looking Ahead: AI and the Future of AML

AI agents offer exciting potential for AML. To deploy these tools effectively, firms need strong data foundations, reliable core systems, and well-defined governance structures.

The path forward starts with investing in modern, explainable AI systems across the AML workflow. Forward-thinking firms are building infrastructure that supports intelligent automation without compromising control, auditability, or trust.

Facctum’s all-in-one platform for AML screening, sanctions compliance, and watchlist management is designed with those principles in mind. Contact us to learn more.