Instant payment schemes have fundamentally changed how money moves. Payments now settle in seconds, leaving no room for post-processing controls. This creates a significant compliance challenge: firms must prevent sanctions breaches in real time, without disrupting payment speed or customer experience.

This use case explains how compliance teams screen instant payments for sanctions risk in practice, how this differs from traditional batch or near-real-time controls, and how organisations can meet regulatory expectations while supporting high-volume, low-latency payment flows.

The Operational Challenge With Instant Payment Sanctions Screening

Unlike traditional payments, instant payments cannot be queued for manual review without breaking scheme rules or customer expectations. Screening must happen within milliseconds, often with limited or inconsistent payment data.

Common challenges include:

Extremely low latency tolerance for sanctions checks

Incomplete or unstructured payment message data

High false positive rates caused by conservative matching rules

Limited time to escalate or resolve potential sanctions matches

Regulatory Expectations For Sanctions Screening In Instant Payments

Regulators expect firms to have effective systems and controls to prevent sanctions breaches, regardless of payment speed. In the UK, the Financial Conduct Authority makes clear that sanctions screening should apply to customers, counterparties, and payments as part of an effective financial crime control framework.

Sanctions compliance is further governed by guidance from the UK Office of Financial Sanctions Implementation, which sets out expectations for preventing prohibited transactions and responding to potential matches.

At a global level, the Financial Action Task Force sets out expectations for the implementation of targeted financial sanctions under Recommendation 6, reinforcing the need for effective sanctions screening controls even within real-time payment environments.

How Sanctions Screening For Instant Payments Works In Practice

Effective sanctions screening for instant payments is designed around speed, accuracy, and explainable outcomes.

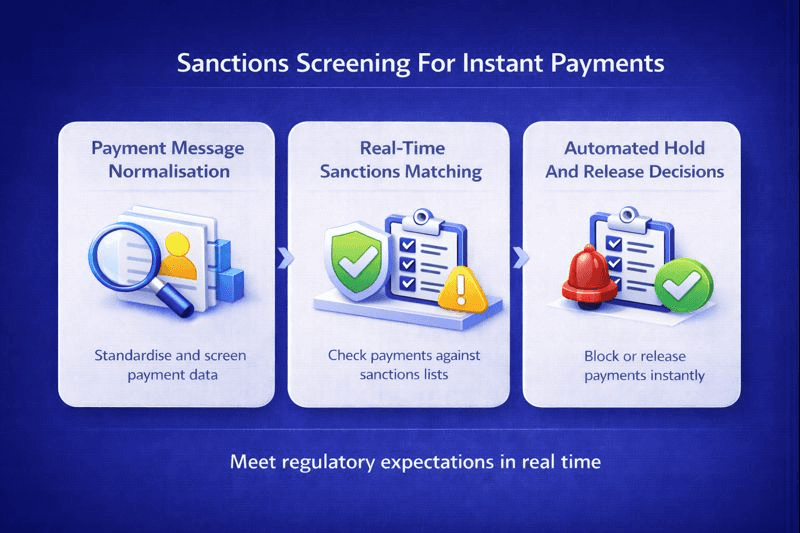

Payment Message Normalisation

Incoming payment messages are normalised so that key fields such as names, identifiers, and free text can be screened consistently, even when data quality varies across schemes.

Real-Time Sanctions Matching

Payment parties are screened against up-to-date sanctions data using matching logic calibrated for instant payments. Thresholds are tuned to capture genuine risk while minimising unnecessary payment blocks.

Automated Hold And Release Decisions

Where policy thresholds are met, payments are automatically held or rejected in line with scheme rules and sanctions obligations. Low-risk payments are released immediately to preserve customer experience.

Alert Escalation And Review

Sanctions alerts that require investigation are escalated for review, with clear documentation to support regulatory reporting and audit requirements.

How Facctum Supports Sanctions Screening For Instant Payments

Facctum enables sanctions screening within high-speed payment environments through Payment Screening, supporting real-time decisioning aligned with scheme and regulatory requirements.

Sanctions list accuracy and controlled updates are managed through Watchlist Management, allowing firms to apply changes safely without introducing operational risk.

Where sanctions alerts require investigation, cases can be reviewed and resolved through Alert Adjudication, ensuring consistent decisions and auditable outcomes.

Business And Compliance Outcomes

Firms that implement effective sanctions screening for instant payments typically achieve:

Reduced risk of sanctions breaches

Compliance controls that operate within scheme latency limits

Lower false positives through calibrated matching

Clear evidence of sanctions controls for regulators

Related Use Cases

Sanctions screening for instant payments closely intersects with Real-Time Payment Screening and Watchlist Delta Management, where list updates and data changes can directly affect payment decisions.

See Sanctions Screening For Instant Payments In Action

If you want to see how sanctions screening can be implemented within instant payment flows, Facctum’s specialists can demonstrate live workflows, latency considerations, and escalation logic.

Speak To A Compliance Specialist to explore a demonstration or discuss how sanctions screening can support your instant payment obligations.