Real-time payment screening is the operational control that prevents prohibited or high-risk payments from being processed, even when payments move in seconds. As instant payments grow across domestic and cross-border rails, compliance teams face a difficult trade-off: strengthen sanctions controls without adding latency, increasing false positives, or creating customer friction.

This use case explains how compliance teams screen payments in real time in practice, how this differs from customer screening, and how workflows can be designed to meet regulatory expectations while maintaining payment speed.

The Operational Challenge With Real-Time Payment Screening

Payment screening operates in the most time-sensitive part of the compliance lifecycle. Unlike onboarding checks, payment screening happens during transaction processing, where delays can cause failed payments, abandoned journeys, or scheme breaches.

Common operational issues include:

High false positives caused by low quality party data and overly broad matching

Screening systems that cannot keep up with instant payment latency requirements

Manual escalation paths that slow down payments or create inconsistent decisions

Limited auditability for why a payment was blocked, released, or investigated

Regulatory Expectations For Real-Time Payment Screening

Regulators expect firms to implement effective, up to date screening systems that are appropriate to the nature, size, and risk of their business, including screening payments and transaction counterparties as part of a broader sanctions control framework. The UK Financial Conduct Authority sets out specific guidance on screening customers, counterparties, and payments within the Financial Crime Guide.

At the global standard setting level, the Financial Action Task Force continues to update its standards for payment transparency and controls in modern payment systems, including expectations under Recommendation 16 for payment messages across evolving payment rails.

In the UK, sanctions compliance is further shaped by guidance from the Office of Financial Sanctions Implementation, which outlines the practical controls firms should have in place to prevent sanctions breaches.

How Real-Time Payment Screening Works In Practice

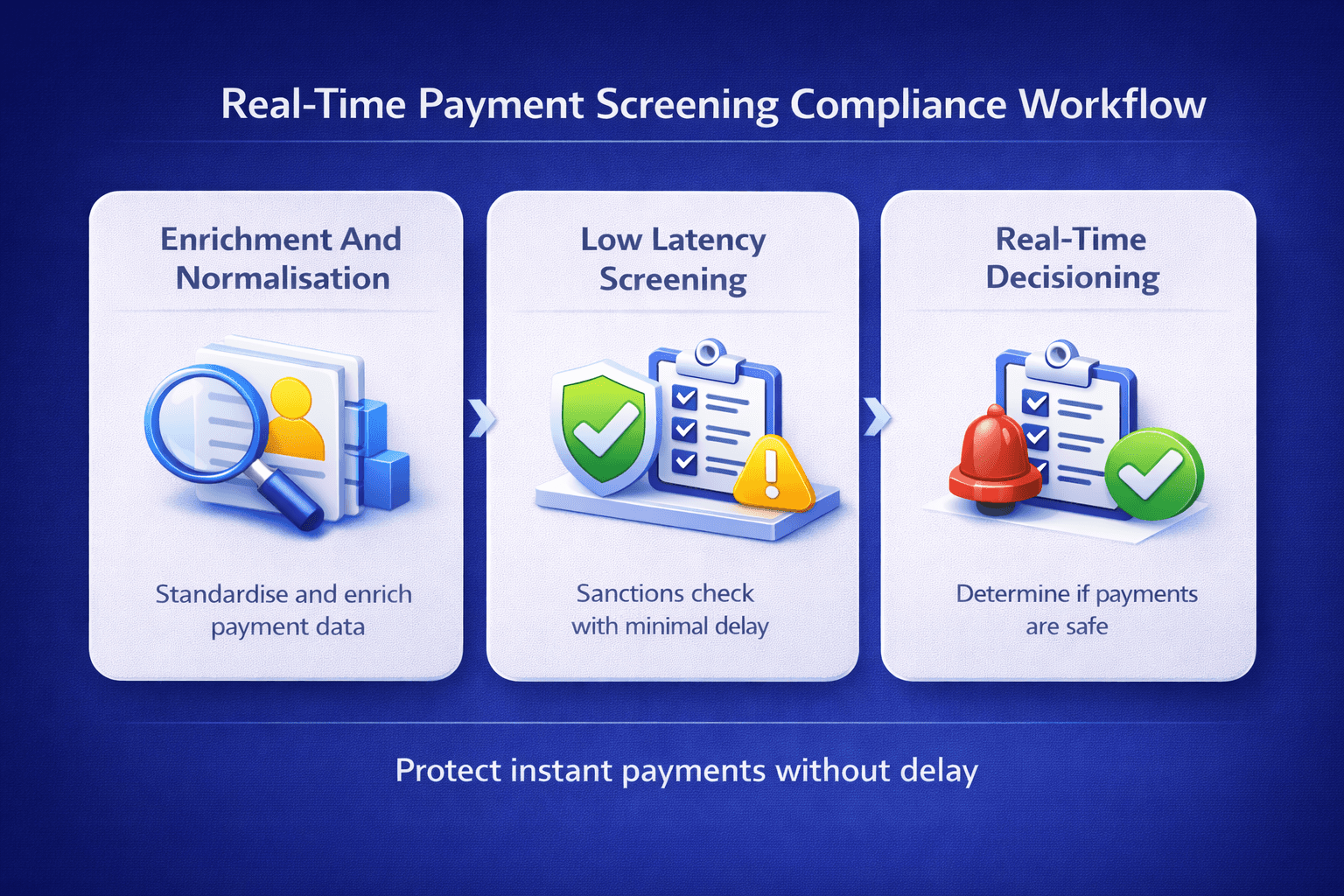

An effective real-time payment screening workflow is designed around speed, accuracy, and explainable decisioning.

Payment Data Normalisation And Enrichment

Incoming payment messages are normalised so that names, addresses, identifiers, and free text fields can be screened consistently. Where possible, data is enriched to improve match quality.

Low Latency Screening And Matching

Payment parties and key fields are screened against sanctions data with matching logic designed to capture aliases and variations without over-triggering. Scoring thresholds are calibrated to balance risk appetite with operational throughput and scheme latency requirements,

Real-Time Decisioning

If a match crosses defined thresholds, the payment is blocked or held while downstream escalation occurs. If not, the payment is released immediately, maintaining customer experience.

Alert Escalation And Case Resolution

High confidence or policy-defined alerts are routed to investigators for review. Decisions are documented with clear rationale so teams can demonstrate why action was taken.

How Facctum Supports Effective Real-Time Payment Screening

Facctum supports high-speed screening for modern payment environments through Payment Screening, enabling real-time transaction checks that can be configured to align with internal risk policy and scheme requirements.

Underlying list quality and controlled updates are maintained through Watchlist Management, helping teams apply changes safely without disrupting operational performance.

When payments are held or escalated, review workflows and auditable outcomes can be managed through Alert Adjudication, ensuring consistent decisioning and evidence for regulators.

Business And Compliance Outcomes

Firms that implement real-time payment screening effectively typically achieve:

Stronger sanctions controls without adding unnecessary latency

Reduced false positives through better data handling and calibrated matching

Faster investigations with consistent escalation and decisioning workflows

Clear audit trails for blocked or released payments

Related Use Cases

Real-time payment screening is closely linked to Sanctions Screening For Instant Payments and Watchlist Delta Management, where data changes and scheme-specific risk expectations can directly impact transaction controls.

See Real-Time Payment Screening In Action

If you want to understand how real-time payment screening can be implemented within your payment flows, Facctum’s specialists can walk you through live workflows, latency considerations, and policy configuration.

Speak To A Compliance Specialist to request a demonstration or discuss how real-time payment screening can support your sanctions compliance obligations.