Ongoing monitoring is a core requirement of effective financial crime compliance. Regulators expect organisations to continuously assess customer risk, identify material changes, and respond proportionately throughout the customer lifecycle. In reality, many firms still rely on periodic reviews, manual checks, or broad re screening cycles that are costly, slow, and operationally fragile.

This use case explains how compliance teams monitor changes in customer risk in practice, how this differs from onboarding checks, and how ongoing monitoring can be implemented in a way that is accurate, explainable, and scalable.

The Operational Challenge With Ongoing Monitoring

Customer risk is not static. Changes in occupation, ownership, geography, transaction behaviour, or external exposure can materially alter risk profiles between formal reviews. The challenge for compliance teams is detecting meaningful change without re screening entire customer bases or overwhelming analysts with low value alerts.

Common challenges include:

Reliance on periodic reviews rather than continuous monitoring

Excessive alerts triggered by minor or irrelevant changes

Manual tracking of risk changes across systems

Limited visibility into why a customer’s risk profile changed

Regulatory Expectations For Ongoing Monitoring

Regulators consistently emphasise the need for ongoing monitoring as part of a risk based approach to customer due diligence. The Financial Action Task Force sets out clear expectations that firms must scrutinise transactions and keep customer information up to date throughout the business relationship.

In the UK, the Financial Conduct Authority highlights ongoing monitoring as a critical control for identifying changes in customer risk and ensuring that enhanced due diligence remains proportionate and timely.

These expectations mean that ongoing monitoring must be continuous, documented, and capable of demonstrating why action was or was not taken, including the requirement to conduct ongoing monitoring of a business relationship under Regulation 28 of the Money Laundering Regulations 2017.

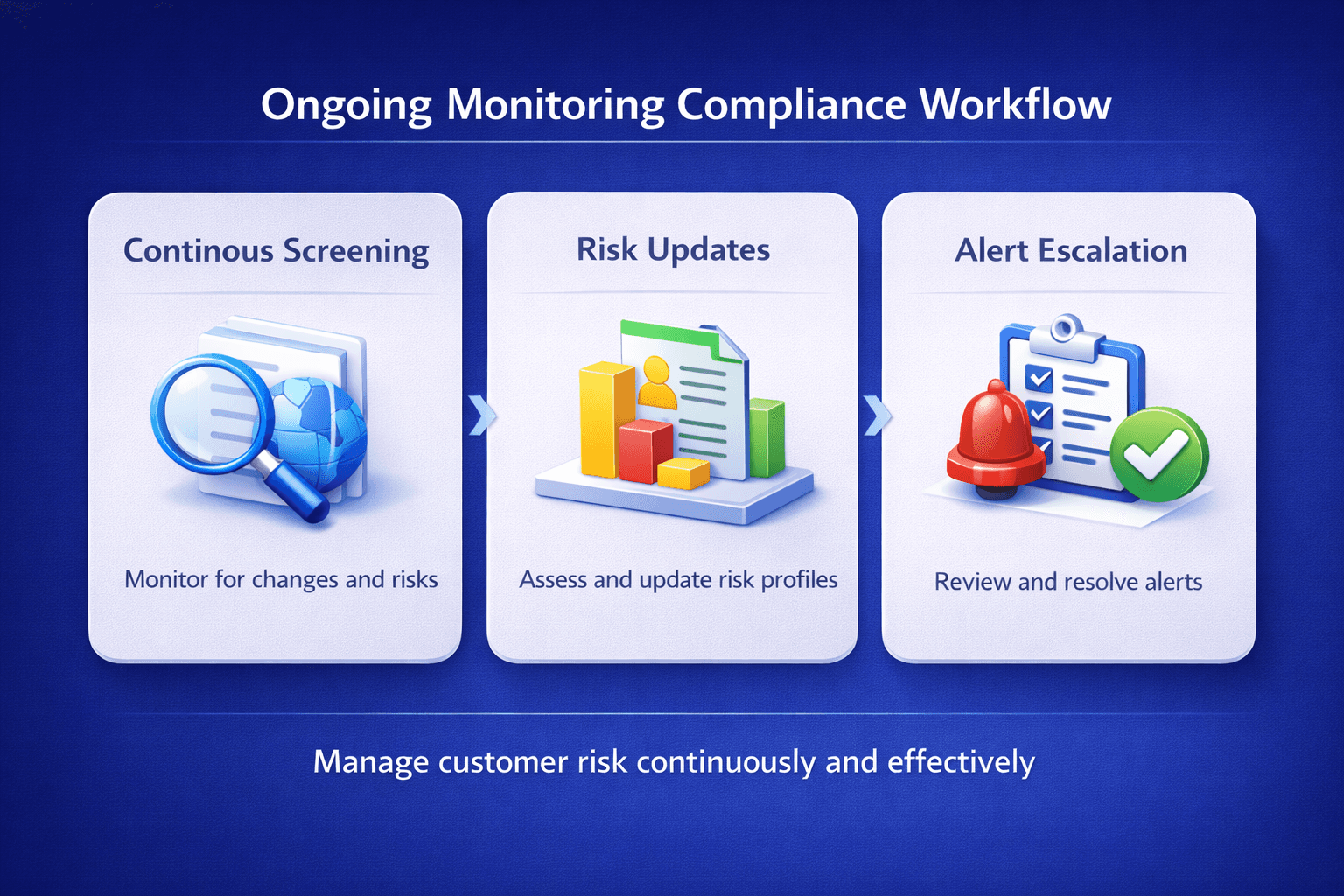

How Ongoing Monitoring Works In Practice

An effective ongoing monitoring workflow is event driven rather than calendar driven. It focuses on detecting meaningful change and responding with proportionate controls.

Continuous Screening And Change Detection

Customer data is continuously compared against updated sanctions, PEP, and adverse media sources. Rather than re screening entire datasets, changes are detected as they occur.

Risk Context And Materiality Assessment

Detected changes are enriched with contextual data to determine whether they materially impact customer risk. This prevents low impact changes from triggering unnecessary escalation.

Alert Escalation And Review

Where thresholds are met, alerts are generated and routed to analysts for review. Decisions are documented with clear rationale to support audit and regulatory review.

Risk Profile Updates

Approved changes feed directly into the customer risk profile, ensuring that downstream controls such as transaction monitoring remain aligned with current risk.

How Facctum Supports Effective Ongoing Monitoring

Facctum enables continuous, event driven monitoring across the customer lifecycle without relying on periodic re screening.

Continuous customer updates are supported through Customer Screening, while underlying list accuracy and change control are maintained through Watchlist Management.

Where behavioural risk is involved, ongoing monitoring integrates with Transaction Monitoring to ensure that changes in customer risk are reflected in transaction level controls.

Alerts generated through ongoing monitoring can be reviewed and resolved within Alert Adjudication, providing consistent workflows, audit trails, and governance.

Business And Compliance Outcomes

Firms that implement effective ongoing monitoring typically achieve:

Earlier detection of material risk changes

Fewer unnecessary periodic reviews

Reduced analyst workload through better alert quality

Stronger evidence of compliance during regulatory examinations

Related Use Cases

Ongoing monitoring is closely linked to other operational workflows, including PEP Screening and Watchlist Delta Management, where changes in external data can directly affect customer risk.

See Ongoing Monitoring In Action

If you want to understand how ongoing monitoring can be implemented within your existing compliance framework, Facctum’s specialists can walk you through real workflows, configuration options, and regulatory considerations.

You can see how continuous screening, risk change detection, and alert adjudication work together in practice, and how these controls can be tailored to your organisation’s risk profile and operating model.

Speak To A Compliance Specialist to explore a live demonstration or discuss how ongoing monitoring can support your regulatory obligations.