Politically Exposed Person (PEP) screening is one of the most sensitive and high‑risk compliance requirements for regulated financial institutions. Regulators expect firms to identify PEPs accurately, apply enhanced due diligence, and continuously assess risk as roles and relationships change. In practice, many organisations struggle with inconsistent data, excessive false positives, and unclear escalation processes.

This use case explains how compliance teams identify, assess, and monitor politically exposed persons in real operational environments, and how proportionate PEP controls can be implemented effectively at scale.

The Operational Challenge With PEP Screening

PEPs are not inherently prohibited customers, but they carry elevated corruption and bribery risk. The challenge is not simply identifying a name match. Compliance teams must determine relevance, understand the individual’s role, assess jurisdictional risk, and apply proportionate controls.

Common operational issues include:

Over‑classification of customers as PEPs due to poor matching logic

Manual research slowing onboarding and reviews

Inconsistent application of enhanced due diligence

Difficulty tracking when a customer’s PEP status changes

Regulatory Expectations For PEP Screening

Global regulators require firms to apply a risk‑based approach to PEPs. Guidance from the Financial Action Task Force makes clear that organisations must identify domestic and foreign PEPs, as well as their close associates and family members, and apply enhanced scrutiny where appropriate.

National regulators echo this expectation. For example, the UK Financial Conduct Authority outlines specific requirements for identifying PEPs, assessing risk, and documenting decisions throughout the customer lifecycle.

These expectations mean PEP screening cannot be a one‑time onboarding check. It must be accurate, explainable, and continuously maintained.

How PEP Screening Is Applied in Compliance Workflows

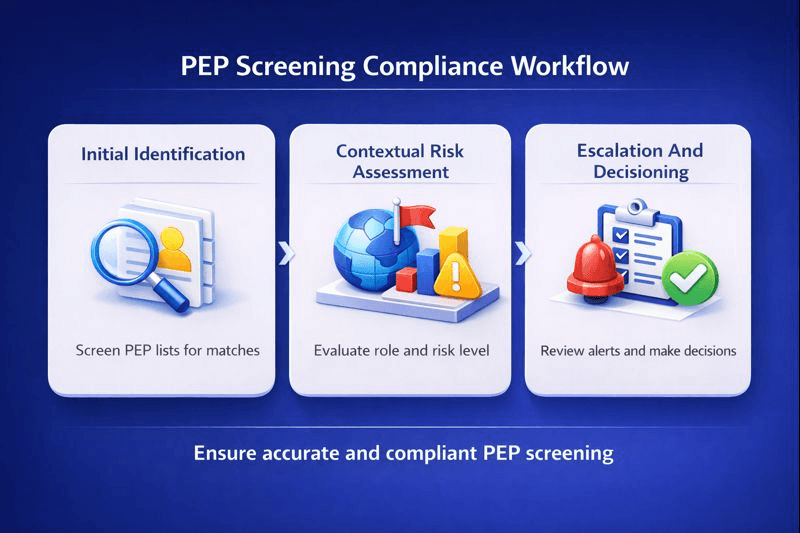

An effective PEP screening workflow typically involves several stages:

Initial Identification

Customer data is screened against structured PEP lists and profiles as part of onboarding or periodic review. Accurate matching is critical to avoid unnecessary escalation.

Contextual Risk Assessment

Potential PEP matches are enriched with contextual information such as role, seniority, geography, and tenure. This allows teams to distinguish between true PEP risk and low‑impact matches.

Escalation And Decisioning

Where enhanced due diligence is required, alerts are routed to compliance analysts for review. Decisions must be documented, consistent, and auditable.

Ongoing Monitoring

PEP status can change over time. Continuous monitoring ensures that newly appointed PEPs or changes in status are detected without re‑screening entire customer bases unnecessarily.

How Facctum Supports Effective PEP Screening

Facctum enables organisations to operationalise PEP screening using a combination of screening accuracy, workflow control, and auditability.

Customer identification and matching are handled through Customer Screening, which supports structured PEP data and configurable matching logic. Underlying list quality and change control are managed through Watchlist Management, ensuring updates are applied accurately without disrupting operations.

When potential PEPs require review, cases can be escalated into Alert Adjudication, allowing analysts to assess risk, document decisions, and demonstrate regulatory compliance.

Together, these capabilities allow teams to implement consistent PEP controls without slowing onboarding or overwhelming analysts.

Business And Compliance Outcomes

Organisations that implement PEP screening effectively typically achieve:

Faster onboarding for low‑risk customers

Reduced false positives and manual reviews

Consistent application of enhanced due diligence

Clear audit trails for regulators and internal governance

Related Use Cases

PEP screening often connects directly to broader compliance workflows, including Ongoing Monitoring and Watchlist Delta Management, where changes in roles, relationships, or list data can materially affect customer risk.

See PEP Screening In Action

If you want to understand how PEP screening can be implemented accurately and proportionately within your organisation, Facctum’s compliance specialists can walk you through real screening workflows, escalation logic, and ongoing monitoring scenarios.

You can see how politically exposed persons are identified, assessed, and monitored over time, how enhanced due diligence decisions are documented, and how audit trails are maintained to meet regulatory expectations without slowing onboarding or overwhelming analysts.

Speak To A Compliance Specialist to see a live demonstration or discuss how PEP screening can be tailored to your risk profile, jurisdictions, and compliance obligations.