Name screening is a foundational compliance control, but it is also one of the most error-prone. Variations in spelling, transliteration, aliases, and incomplete data can cause excessive false positives or, worse, missed risk.

This use case explains how compliance teams manage false positives and missed matches in name screening, why traditional approaches struggle, and how proportionate, defensible screening decisions can be applied at scale.

The Operational Challenge With Name Screening

Unlike exact matching, real-world screening must account for inconsistent data quality and linguistic variation. Names may appear differently across documents, jurisdictions, and data sources, creating challenges for automated screening systems.

Common issues include:

High false positive rates caused by loose matching thresholds

Missed matches due to spelling or transliteration differences

Manual review overload for compliance analysts

Inconsistent decisioning across similar alerts

Regulatory Expectations For Name Screening Accuracy

Regulators expect firms to implement screening controls that are effective, proportionate, and risk based. Screening systems must balance sensitivity with accuracy, ensuring that genuine risk is identified without overwhelming operations.

The Financial Action Task Force highlights the importance of reliable customer identification and appropriate controls as part of customer due diligence. In the UK, the Financial Conduct Authority has highlighted poor matching logic and excessive false positives as indicators of weak financial crime controls.

How Name Screening and Matching Are Applied in Compliance Workflows

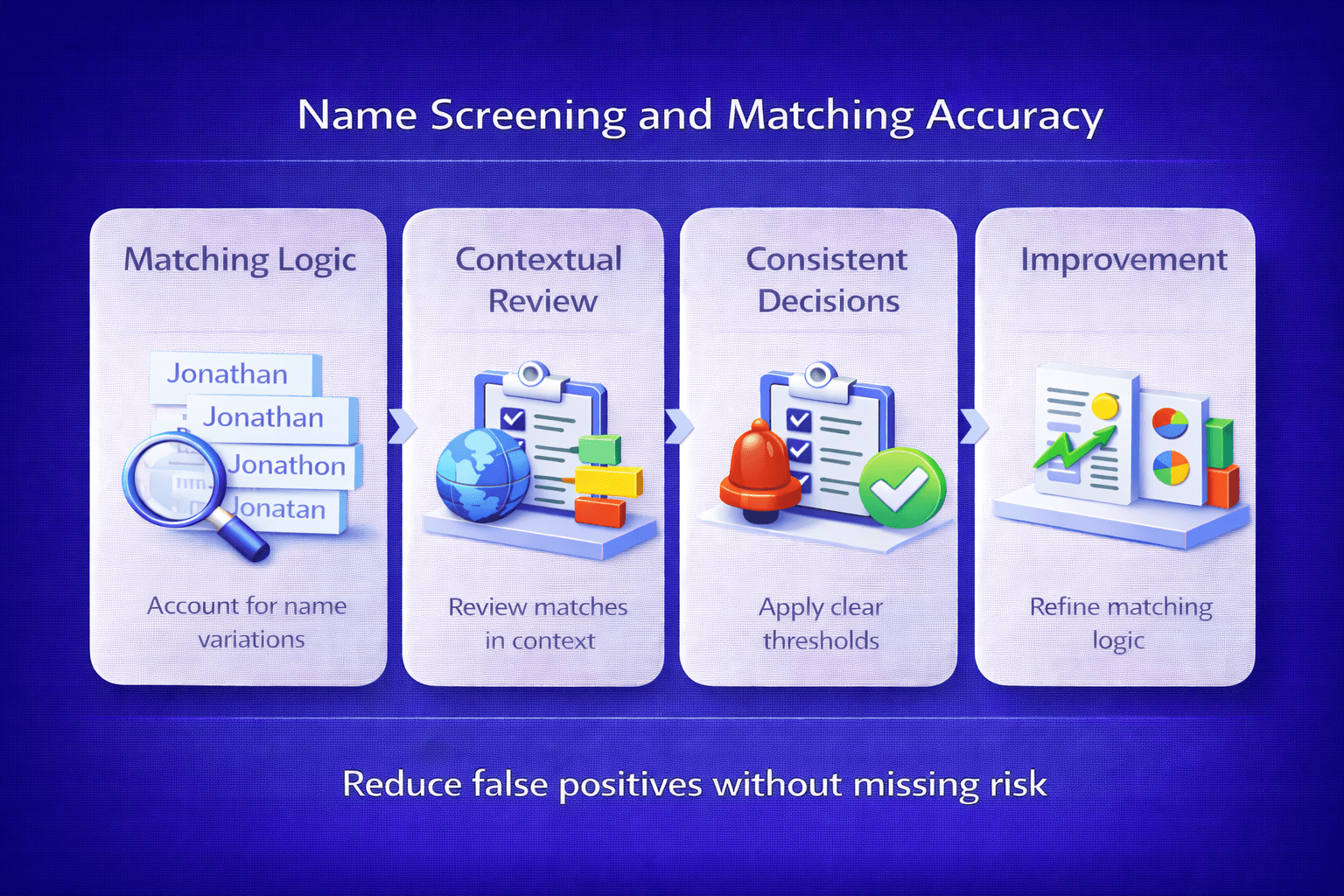

Effective name screening focuses on controlled matching logic and contextual decisioning rather than overly simplistic rules.

Matching Logic And Thresholds

Screening systems apply configurable matching rules to account for spelling variations, aliases, and transliterations while avoiding unnecessary noise.

Contextual Review

Potential matches are reviewed alongside customer attributes such as geography, date of birth, and known identifiers to determine relevance.

Consistent Decisioning

Clear thresholds and review guidance ensure that similar alerts are resolved consistently across teams and over time.

Continuous Improvement

Feedback from resolved alerts is used to refine matching logic and reduce recurring false positives.

How Facctum Supports Name Screening Accuracy

Facctum improves name screening accuracy by combining controlled matching logic with contextual review workflows through Customer Screening.

Screening inputs are managed through Watchlist Management, ensuring that list changes do not introduce unnecessary noise. Where alerts are generated, decisions can be reviewed and governed through Alert Adjudication.

Business And Compliance Outcomes

Organisations that improve name screening accuracy typically achieve:

Lower false positive volumes

Faster alert resolution times

More consistent and defensible decisions

Increased regulatory confidence in screening controls

Related Use Cases

Name screening accuracy supports broader workflows including PEP Screening and Adverse Media Screening, where matching quality directly impacts risk outcomes.

See Name Screening In Action

If you want to see how improved matching accuracy can reduce operational burden without increasing risk exposure, Facctum’s specialists can demonstrate real-world screening workflows.

Speak To A Compliance Specialist to request a demonstration or discuss your screening challenges.