Adverse media screening helps organisations identify potential financial crime, reputational, or regulatory risk that may not yet appear on sanctions or watchlists. It plays an important role in early risk detection, but it is also one of the most operationally challenging controls due to data volume, subjectivity, and high false positive rates.

This use case explains how compliance teams identify emerging risk through adverse media in practice, how meaningful signals are separated from noise, and how alerts can be escalated and resolved in a consistent, defensible way.

The Operational Challenge With Adverse Media Screening

Unlike sanctions or PEP screening, adverse media relies on unstructured information such as news articles, public records, and online publications. This makes it difficult to determine relevance, severity, and materiality.

Common challenges include:

Large volumes of low-quality or duplicated alerts

Difficulty assessing the credibility and relevance of sources

Inconsistent escalation decisions between analysts

Poor auditability of why an alert was closed or escalated

Regulatory Expectations For Adverse Media Screening

Regulators expect firms to consider a broad range of information when assessing customer risk, including negative or adverse information from reliable sources. While adverse media is not always explicitly mandated, supervisory guidance consistently frames it as part of a risk based approach to customer due diligence and ongoing monitoring.

The Financial Action Task Force guidance on customer due diligence recognises the value of publicly available information, including adverse and reputational risk signals, in assessing customer risk.

In the UK, the Financial Conduct Authority’s good and poor practice guidance on financial crime controls highlights the need to conduct ongoing monitoring and keep due diligence up to date, reinforcing the expectation that firms consider adverse information as part of effective risk based controls.

How Adverse Media Screening Works In Practice

Effective adverse media screening focuses on signal detection and controlled escalation rather than exhaustive data collection.

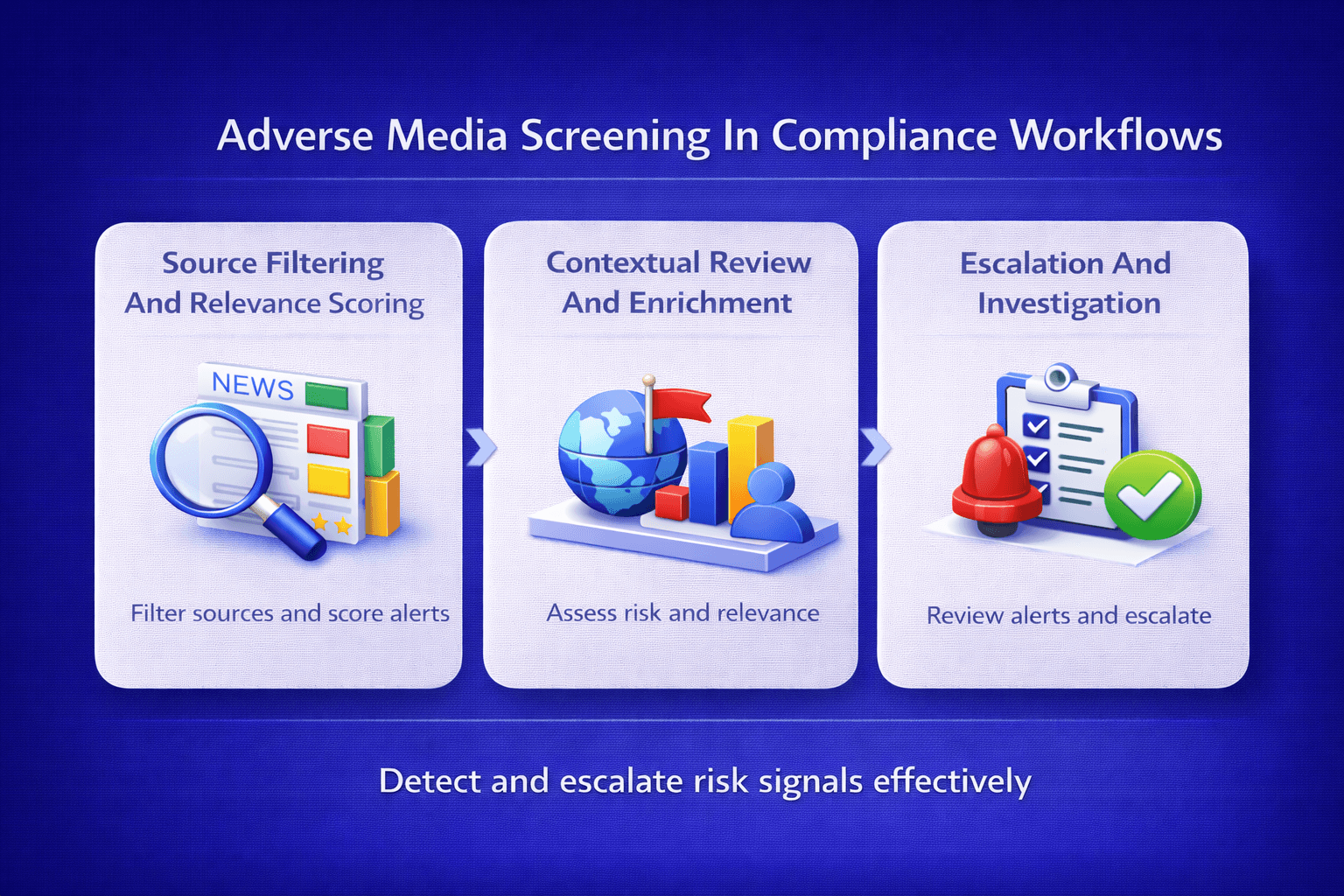

Source Filtering And Relevance Scoring

Media sources are filtered to prioritise credible publications and relevant risk categories. Alerts are scored based on factors such as severity, recency, and proximity to financial crime risk.

Contextual Review And Enrichment

Analysts review adverse media in context, considering customer profile, geography, and existing risk indicators. This helps prevent over escalation of minor or unrelated issues.

Escalation And Investigation

Where thresholds are met, alerts are escalated for investigation. Decisions are supported by documented rationale and supporting evidence.

Risk Profile Updates

Validated adverse media findings feed into the customer risk profile, supporting proportionate controls and ongoing monitoring.

How Facctum Supports Adverse Media Screening

Facctum supports adverse media screening by integrating negative news signals into broader screening and monitoring workflows rather than treating them in isolation.

Adverse media alerts can be assessed alongside Customer Screening and Ongoing Monitoring, providing analysts with full context.

When escalation is required, investigations can be handled through Alert Adjudication, ensuring consistent decisioning and clear audit trails.

Business And Compliance Outcomes

Organisations that implement effective adverse media screening typically achieve:

Earlier identification of emerging risk

Fewer false positives through relevance-based review

More consistent escalation decisions

Stronger evidence of risk based decisioning for regulators

Related Use Cases

Adverse media screening supports several wider compliance workflows, including PEP Screening and Ongoing Monitoring, where negative news can materially affect customer risk.

See Adverse Media Screening In Action

If you want to see how adverse media screening can be implemented without overwhelming your compliance team, Facctum’s specialists can walk you through practical workflows and escalation models.

Speak To A Compliance Specialist to request a demonstration or discuss how adverse media screening fits into your compliance framework.