Compliance quality assurance and oversight ensure that screening, monitoring, and investigation decisions are applied consistently, proportionately, and in line with regulatory expectations. While frontline teams focus on resolving alerts, regulators increasingly assess how firms review decisions, identify weaknesses, and maintain effective governance across compliance operations.

This use case explains how compliance teams review and assure decision quality in practice, how firms monitor consistency, and how structured oversight processes support regulatory confidence.

The Operational Challenge With Compliance Oversight

As alert volumes grow and compliance teams scale, maintaining consistent decision quality becomes increasingly difficult. Without structured oversight, similar alerts may be resolved differently, weaknesses may go unnoticed, and management may lack visibility into systemic issues.

Common challenges include:

Inconsistent alert decisions across analysts or teams

Limited sampling or second-line review of resolved cases

Weak feedback loops between reviewers and frontline teams

Insufficient evidence of oversight for regulatory examinations

Regulatory Expectations For Quality Assurance And Governance

Regulators expect firms to maintain effective systems and controls, including oversight mechanisms that ensure compliance processes operate as intended. In the UK, the Financial Conduct Authority requires firms to establish robust systems and controls, clear accountability, and appropriate management oversight.

These expectations are reinforced under the UK Money Laundering Regulations, which require firms to implement internal controls, policies, and procedures that are proportionate to risk and subject to ongoing review, including independent oversight and second-line review where appropriate.

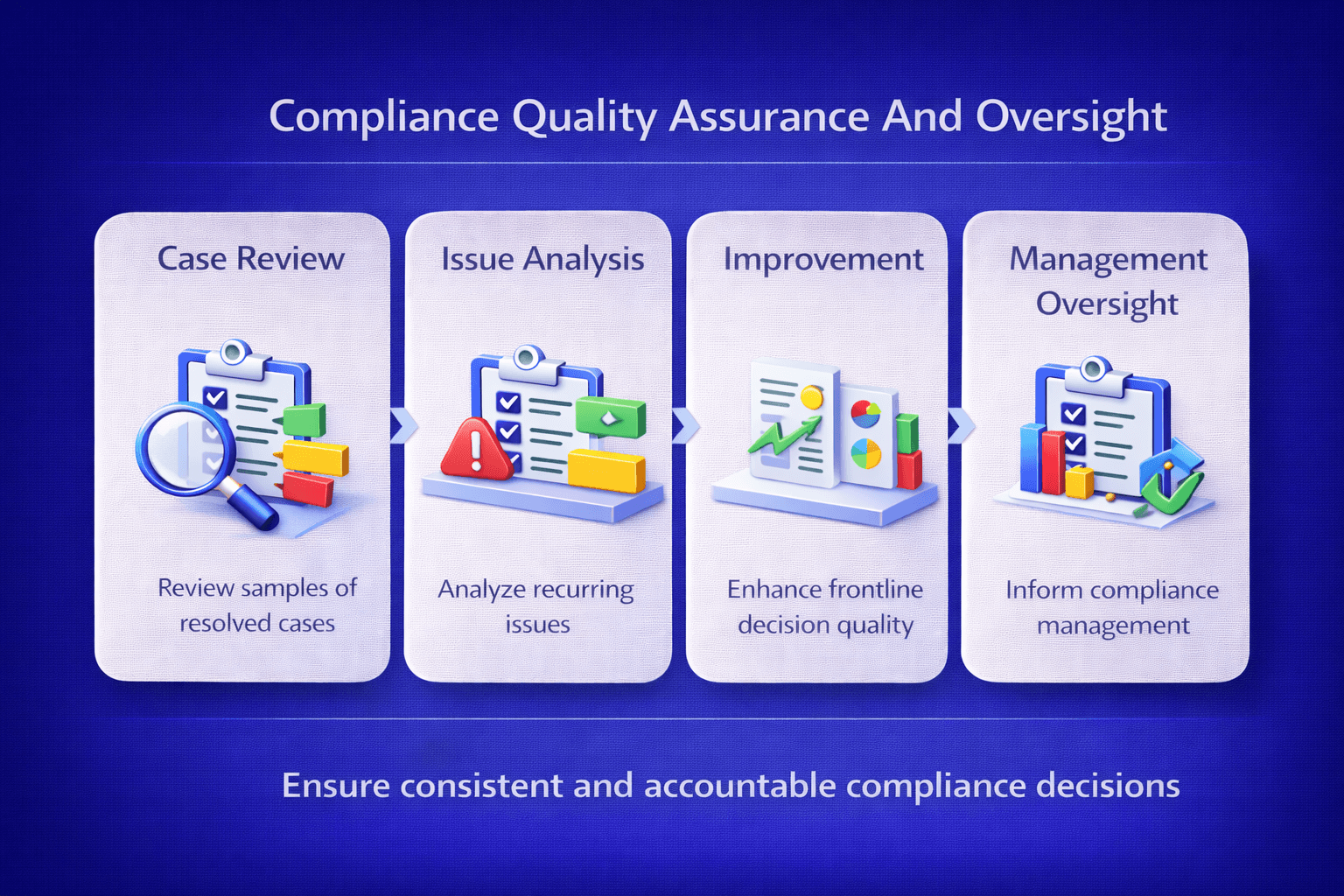

How Compliance Quality Assurance Works In Practice

Effective compliance oversight focuses on structured review, feedback, and governance rather than ad hoc checks.

Case Sampling And Review

A defined sample of resolved alerts and cases is reviewed to assess decision quality, consistency, and adherence to policy.

Issue Identification And Root Cause Analysis

Recurring issues such as false positives, unclear policies, or training gaps are identified through QA findings and analysed to determine root causes.

Feedback And Continuous Improvement

Findings are fed back into frontline teams through guidance, training updates, or policy refinement, helping improve future decision quality.

Management Reporting And Oversight

Aggregated QA results are reported to compliance management, supporting informed oversight, resource allocation, and regulatory engagement.

How Facctum Supports Compliance Quality Assurance

Facctum supports quality assurance and oversight by providing transparent, auditable decision workflows through Alert Adjudication.

Resolved alerts from Customer Screening, Payment Screening, and Ongoing Monitoring can be reviewed consistently within a single environment, enabling effective sampling and oversight.

Business And Compliance Outcomes

Organisations that implement structured compliance quality assurance typically achieve:

More consistent and defensible alert decisions

Earlier identification of systemic weaknesses

Stronger management oversight and governance

Improved outcomes during regulatory reviews

Related Use Cases

Compliance quality assurance underpins multiple operational workflows, including Alert Adjudication And Case Management and Watchlist Delta Management, where decision quality and control effectiveness are critical.

See Compliance Quality Assurance In Action

If you want to understand how quality assurance and oversight can be embedded into your compliance operations, Facctum’s specialists can demonstrate review workflows, governance dashboards, and reporting structures.

Speak To A Compliance Specialist to request a demonstration or discuss how compliance quality assurance can strengthen your control framework.