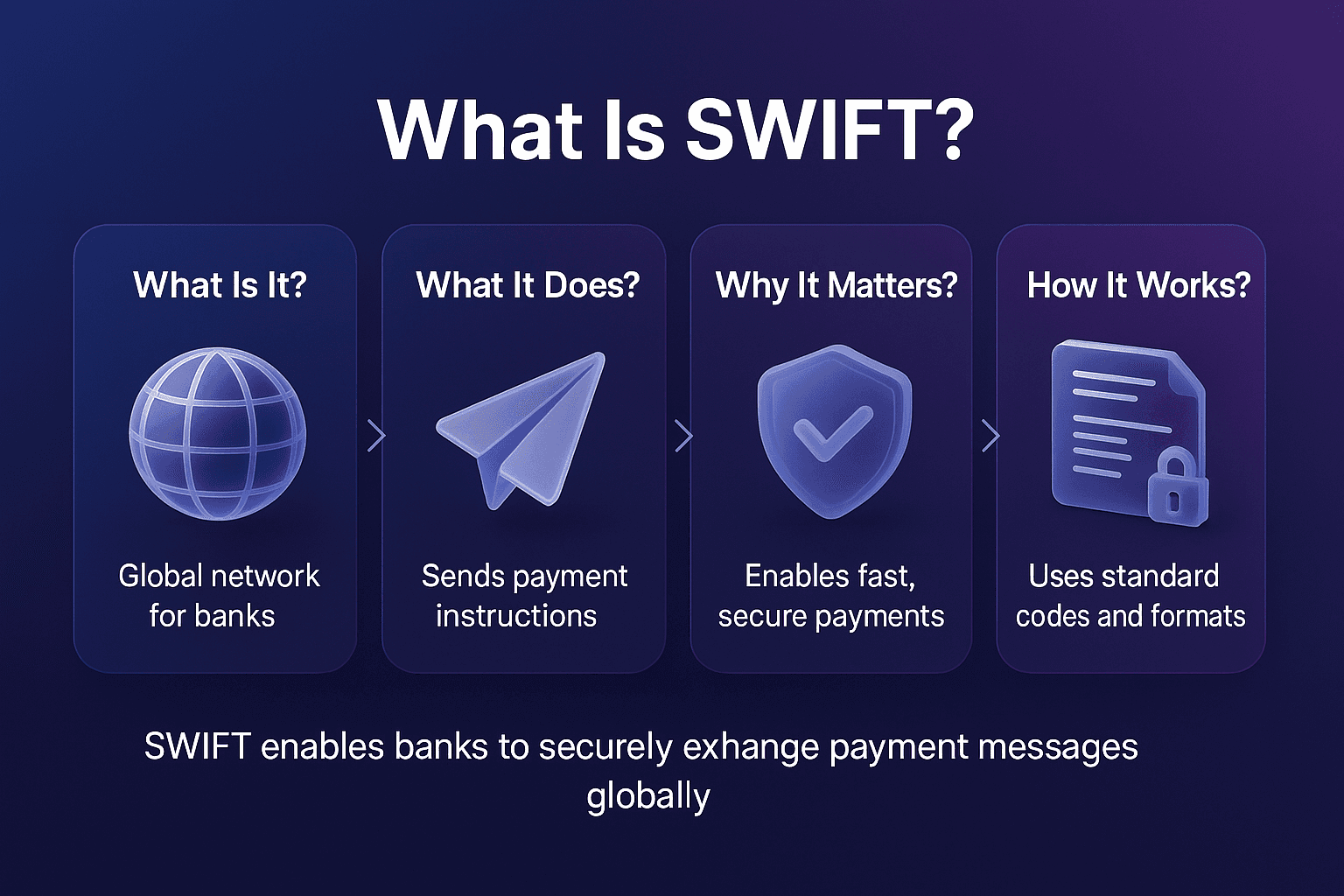

SWIFT (Society for Worldwide Interbank Financial Telecommunication) is a global messaging network used by banks and financial institutions to send secure payment instructions. Based in Belgium, SWIFT connects more than 11,000 institutions in over 200 countries, making it the backbone of international payments.

Although SWIFT does not move money itself, it provides the communication layer that enables banks to transfer funds reliably across borders. Because of this role, SWIFT is closely tied to sanctions compliance, transaction monitoring, and AML obligations.

The official SWIFT site and the European Central Bank provide oversight and updates on its role in financial stability.

Definition Of SWIFT

SWIFT (Society for Worldwide Interbank Financial Telecommunication) is a member-owned cooperative that provides a secure messaging standard for global financial transactions.

Its key functions include:

Messaging Standardisation: Secure, structured messages for payments, securities, FX, and trade.

Global Reach: Connecting over 11,000 institutions in 200+ countries.

Payment Reliability: Ensuring speed and accuracy of cross-border transfers.

AML Support: Enabling compliance by carrying structured payment data.

Why SWIFT Matters For AML And Sanctions Compliance

Because SWIFT underpins cross-border payments, it plays a critical role in financial crime prevention.

Sanctions Enforcement

SWIFT has been used as a sanctions tool, such as disconnecting Russian banks in 2022.

Richer Payment Data

Through ISO 20022 migration, SWIFT provides structured data for screening.

Transaction Monitoring

Cross-border transactions routed via SWIFT must be monitored for suspicious activity.

Regulatory Alignment

Global regulators expect firms to apply AML and CTF obligations on SWIFT-based payments.

Challenges Of SWIFT Compliance

Using SWIFT in compliance frameworks also raises challenges.

Cross-Border Complexity

Payments must align with multiple regulatory regimes simultaneously.

Data Gaps

Legacy SWIFT MT messages contained limited information compared to ISO 20022.

Sanctions Risks

Institutions must prevent sanctioned entities from accessing SWIFT.

High Volumes

Large banks process millions of SWIFT messages daily, creating monitoring challenges.

Best Practices For SWIFT Compliance

To stay compliant with SWIFT-based payments, institutions should:

Transition fully to ISO 20022 to capture richer data.

Apply real-time sanctions screening to all SWIFT transactions.

Monitor cross-border payments with behavioural and risk-based models.

Maintain accurate watchlist data for effective filtering.

Document all investigations and alert adjudication decisions.

The Future Of SWIFT And Compliance

SWIFT continues to evolve as the global standard for payments.

Key trends include:

ISO 20022 Migration: Richer structured data across all SWIFT transactions.

Integration With Instant Payments: Compatibility with FedNow and SEPA systems.

Cybersecurity Focus: Enhanced security measures to protect against threats.

Geopolitical Role: Continued use as a sanctions enforcement tool.

Strengthen SWIFT Payment Compliance With Real-Time Screening

SWIFT is essential for international payments, but it also carries major compliance responsibilities. Institutions must ensure every SWIFT transaction is subject to effective sanctions screening, monitoring, and alert management.

Facctum solutions; FacctShield, Payment Screening, FacctView, Customer Screening, FacctList, Watchlist Management, and Alert Adjudication help institutions manage compliance obligations for SWIFT transactions while reducing false positives.

Contact Us Today To Strengthen Your SWIFT Compliance