The Office of Foreign Assets Control (OFAC), part of the U.S. Department of the Treasury, requires organizations operating in or connected to the U.S. financial system to establish a Sanctions Compliance Program (SCP).

The SCP outlines the essential components institutions should implement to identify, prevent, and respond to sanctions risks. Its purpose is to ensure businesses remain compliant with U.S. sanctions laws and avoid enforcement actions that could include heavy civil penalties or exclusion from U.S. markets.

OFAC Sanctions Compliance Program

The OFAC Sanctions Compliance Program (SCP) is a framework designed to help organizations structure their sanctions compliance practices. It was formally introduced in OFAC’s 2019 Framework for Compliance Commitments, which details how institutions can build effective programs tailored to their risk profile.

The framework identifies five essential elements of an SCP:

Management Commitment - senior management support and oversight of sanctions compliance.

Risk Assessment - ongoing evaluation of sanctions risks across customers, products, services, and geographies.

Internal Controls - policies, procedures, and technology to identify and prevent violations.

Testing and Auditing - independent reviews to assess program effectiveness.

Training - regular education for employees to ensure awareness of sanctions obligations.

OFAC stresses that the presence of these elements can reduce penalties if violations occur

Why The OFAC SCP Matters In AML Compliance

The SCP matters because it directly influences how regulators evaluate sanctions breaches. Companies with a documented, risk-based SCP may face reduced penalties in the event of violations, while those without one are likely to be penalized more harshly.

The U.S. Treasury highlights that sanctions compliance failures, even if unintentional, can lead to multimillion-dollar civil penalties. An effective SCP demonstrates proactive compliance, helping institutions reduce exposure to enforcement actions and reputational harm.

For AML teams, the SCP links closely with Watchlist Management, Customer Screening, and Transaction Monitoring to prevent prohibited dealings with sanctioned parties.

Key Risks Addressed By An OFAC SCP

An effective SCP helps institutions mitigate several high-risk areas, including:

Customer Onboarding Risks: Identifying sanctioned individuals or entities at account opening.

Transactional Risks: Screening real-time payments to prevent prohibited transfers.

Third-Party Risks: Managing exposure through correspondent banking and vendor relationships.

Geographic Risks: Monitoring activity linked to high-risk jurisdictions.

By aligning with SCP expectations, institutions strengthen their defenses against inadvertent sanctions breaches.

Regulatory Expectations For OFAC SCP

OFAC expects institutions to:

Integrate sanctions compliance into enterprise-wide risk management.

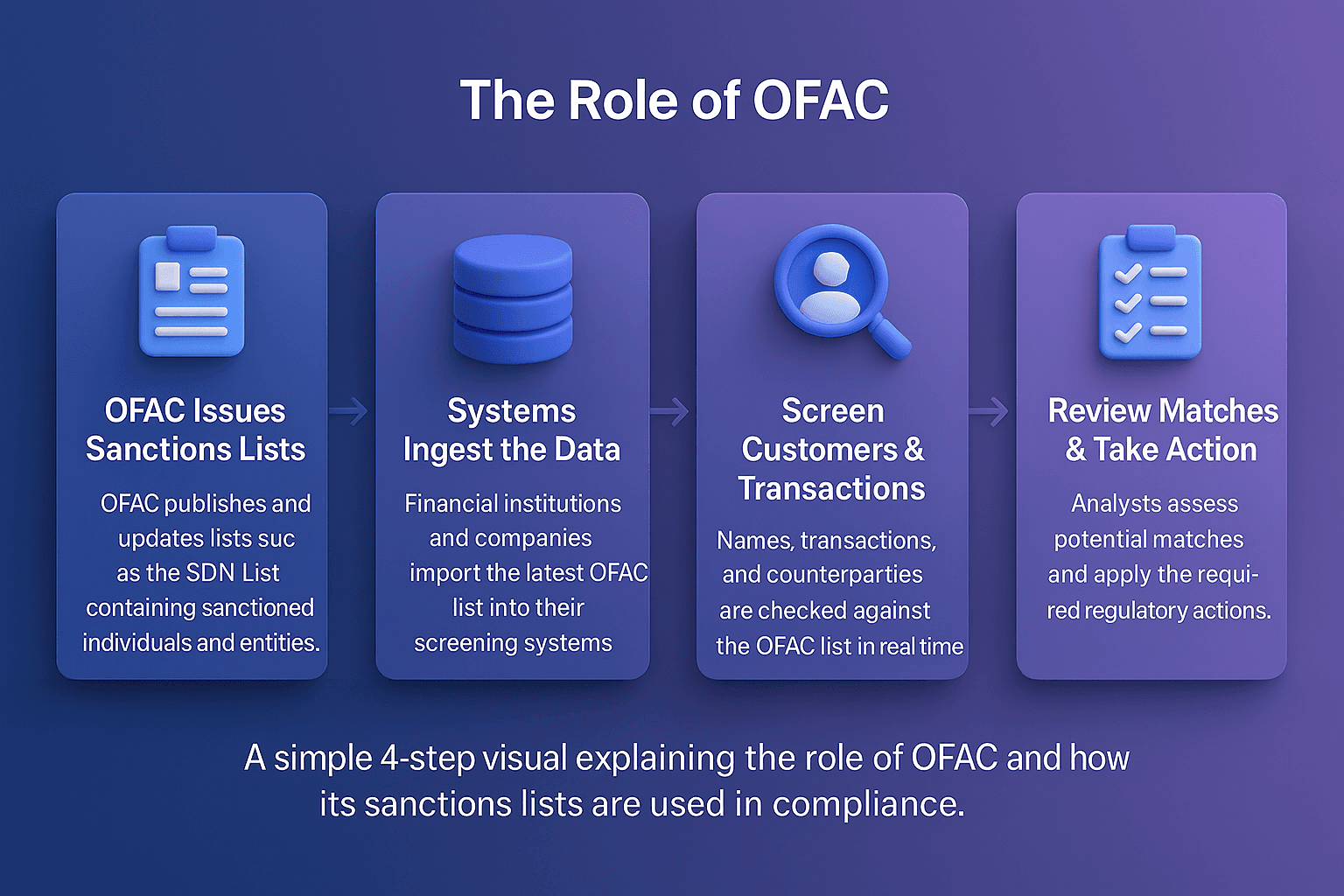

Keep screening tools updated with the Specially Designated Nationals (SDN) List and other OFAC lists (OFAC SDN List).

Apply controls across all subsidiaries, affiliates, and business units.

Ensure timely reporting of blocked or rejected transactions.

Failure to implement these controls can lead to significant enforcement actions, including civil penalties and reputational damage.

The Future Of The OFAC SCP

The OFAC SCP will continue to evolve alongside global sanctions regimes. With the rise of smart sanctions and sectoral sanctions, compliance programs must integrate advanced analytics, AI-driven detection, and Alert Adjudication tools to reduce false positives and strengthen monitoring.

Future SCPs are expected to place more emphasis on supply chain risks, fintech partnerships, and real-time screening across global payment systems.

Strengthen Your OFAC Sanctions Compliance Program

A strong SCP is essential for navigating today’s complex sanctions landscape. Financial institutions that invest in comprehensive screening, monitoring, and adjudication frameworks are better prepared to protect themselves from penalties and reputational harm.

Contact Us Today To Strengthen Your AML Compliance Framework