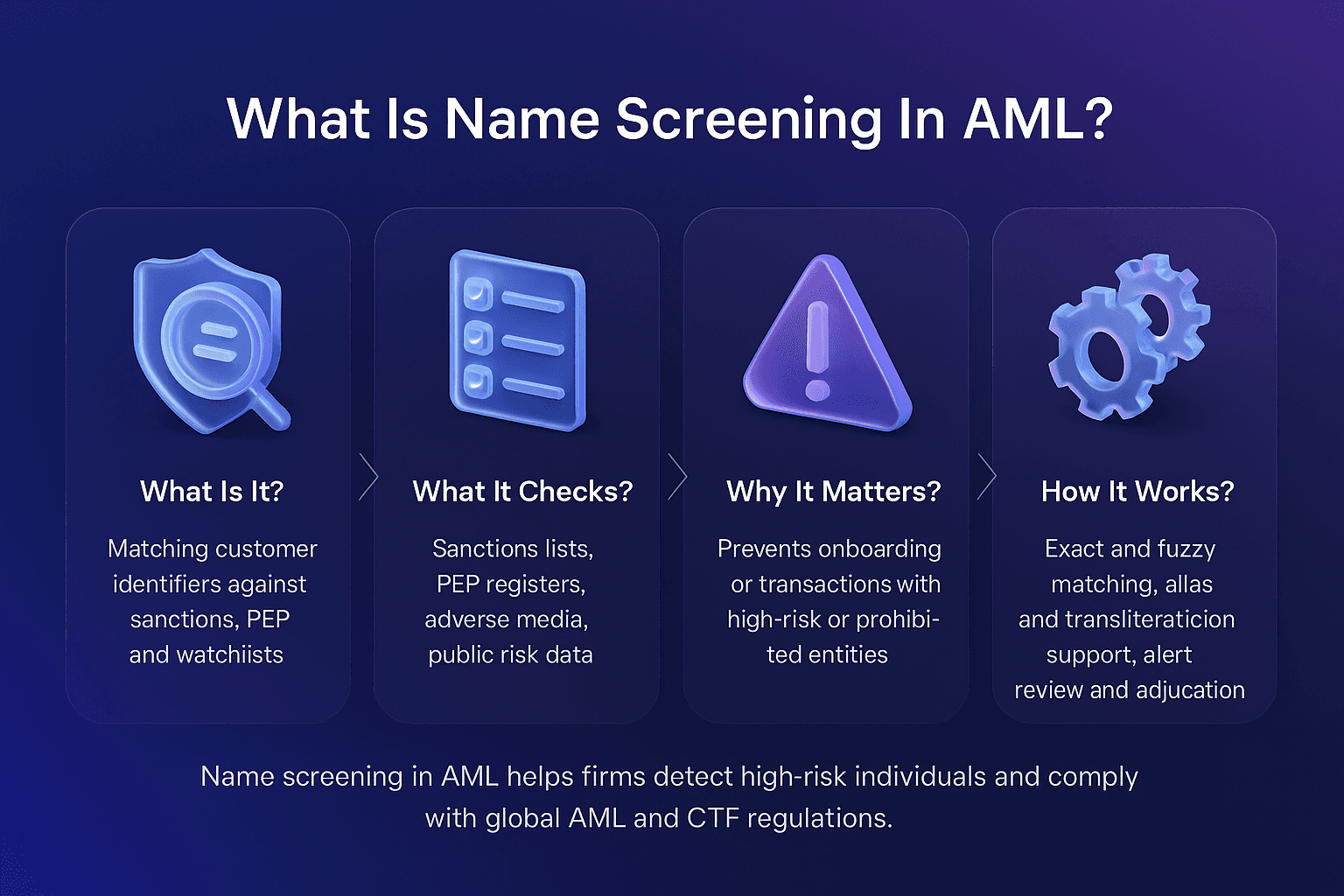

Name screening in anti-money laundering (AML) is the process of comparing customer and counterparty names against sanctions, politically exposed persons (PEPs), and adverse media lists. It enables financial institutions to detect high-risk or prohibited individuals, comply with global AML regulations, and prevent financial crime.

Without name screening, firms risk fines, reputational damage, and heightened exposure to money laundering and terrorist financing.

Definition Of Name Screening In AML

Name screening in AML refers to the systematic process of matching customer identifiers, including names, dates of birth, and addresses, against regulatory and risk-related datasets. It helps firms avoid engaging with prohibited entities and supports stronger compliance frameworks.

Facctum enables this capability through Customer Screening, which draws on enriched data from Watchlist Management and integrates with Payment Screening to provide complete AML protection.

Key Steps In Name Screening In AML

Name screening in AML involves several critical steps to ensure effective risk detection.

Key steps include:

Collecting and validating data such as customer names and identifiers.

Sanctions screening against global regulators including OFAC, UN, and EU.

PEP checks to identify politically exposed persons and their associates.

Adverse media monitoring to identify reputational risks.

Fuzzy and AI-driven matching to capture aliases, spelling variations, and transliterations.

Alert review and adjudication to ensure consistent decision-making and auditability.

Why Name Screening In AML Is Important For Compliance

Name screening is a mandatory part of AML compliance. It ensures firms can identify sanctioned or high-risk individuals before onboarding or processing transactions, reducing exposure to regulatory and reputational risks.

The FATF Recommendations require strong measures to detect and disrupt illicit financial flows. Similarly, the FCA’s SYSC 3.2 rules mandate that firms maintain proportionate systems and controls, subject to ongoing review and oversight.

Challenges In Name Screening In AML

While essential, name screening in AML presents a number of challenges.

Key challenges include:

High false positives from common names or limited data quality.

False negatives when strict thresholds miss genuine risks.

Multilingual data and transliteration complexities across jurisdictions.

Integration challenges with legacy systems.

Increased regulatory pressure requiring transparent governance and reporting.

How Facctum Addresses Challenges In Name Screening In AML

Facctum’s solutions are designed to improve the effectiveness and efficiency of name screening in AML.

Key ways Facctum addresses these challenges include:

High-Quality Data: Watchlist Management provides enriched and accurate sanctions, PEP, and adverse media lists.

Advanced Screening: Customer Screening applies fuzzy and AI-driven matching techniques to improve accuracy and reduce false positives.

Transaction Monitoring Integration: Payment Screening ensures screening is extended across payments for holistic coverage.

Structured Alert Handling: Alert Adjudication delivers transparent workflows and audit trails.

Scalability: Facctum supports high-volume, real-time screening across global markets.

The Future Of Name Screening In AML

As compliance requirements evolve, name screening will increasingly use AI, natural language processing, and hybrid entity resolution to enhance detection precision and efficiency.

Recent research on Deep Entity Matching With Pre-Trained Language Models shows how transformer-based approaches improve match accuracy. Applied to AML name screening, these methods will reduce manual workloads and strengthen compliance frameworks.

Strengthen Your Name Screening In AML Compliance Framework

Name screening is a cornerstone of AML compliance. By combining Watchlist Management, Customer Screening, Payment Screening, and Alert Adjudication, institutions can improve detection accuracy, reduce false positives, and ensure regulatory confidence.

Contact us today to strengthen your AML compliance framework