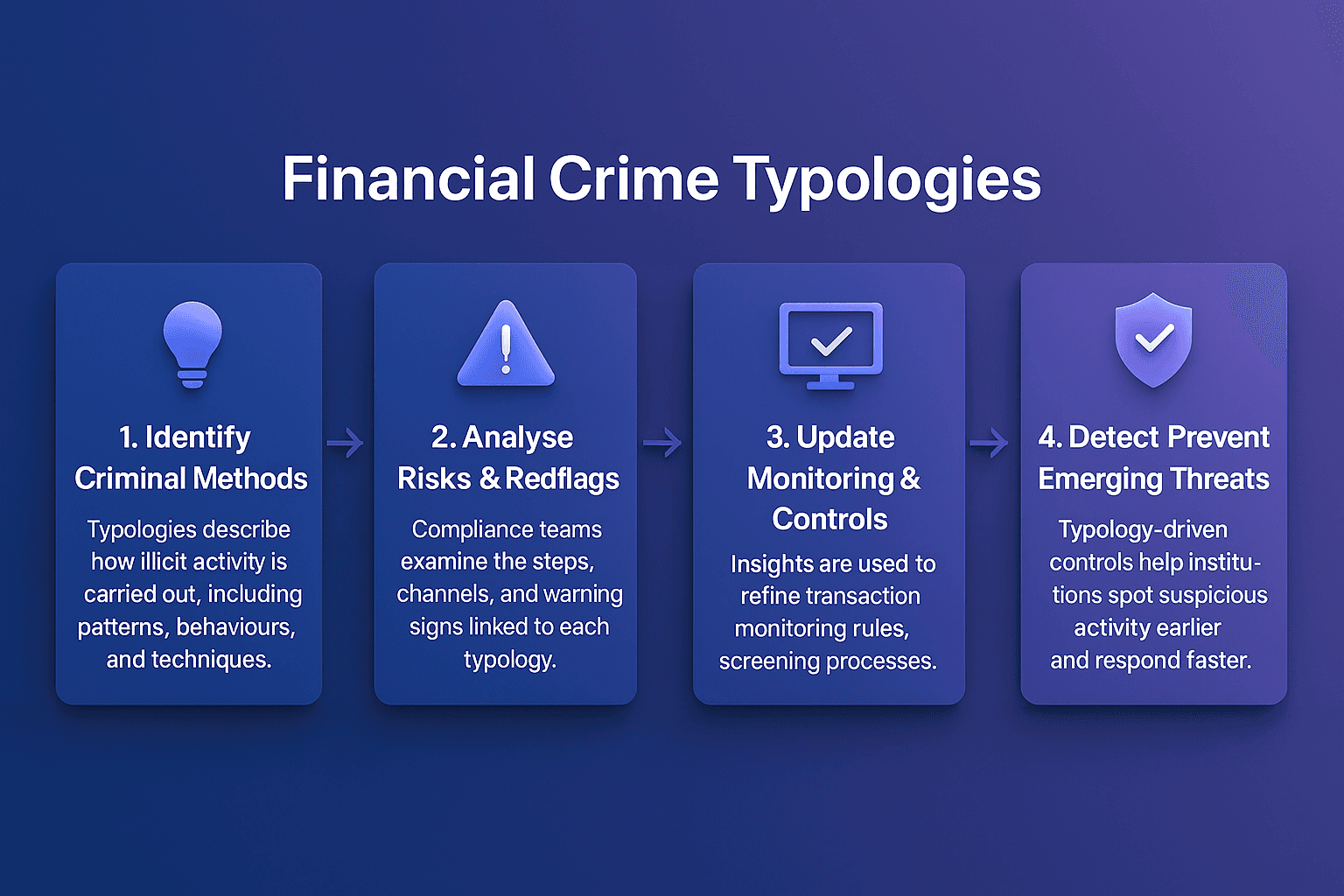

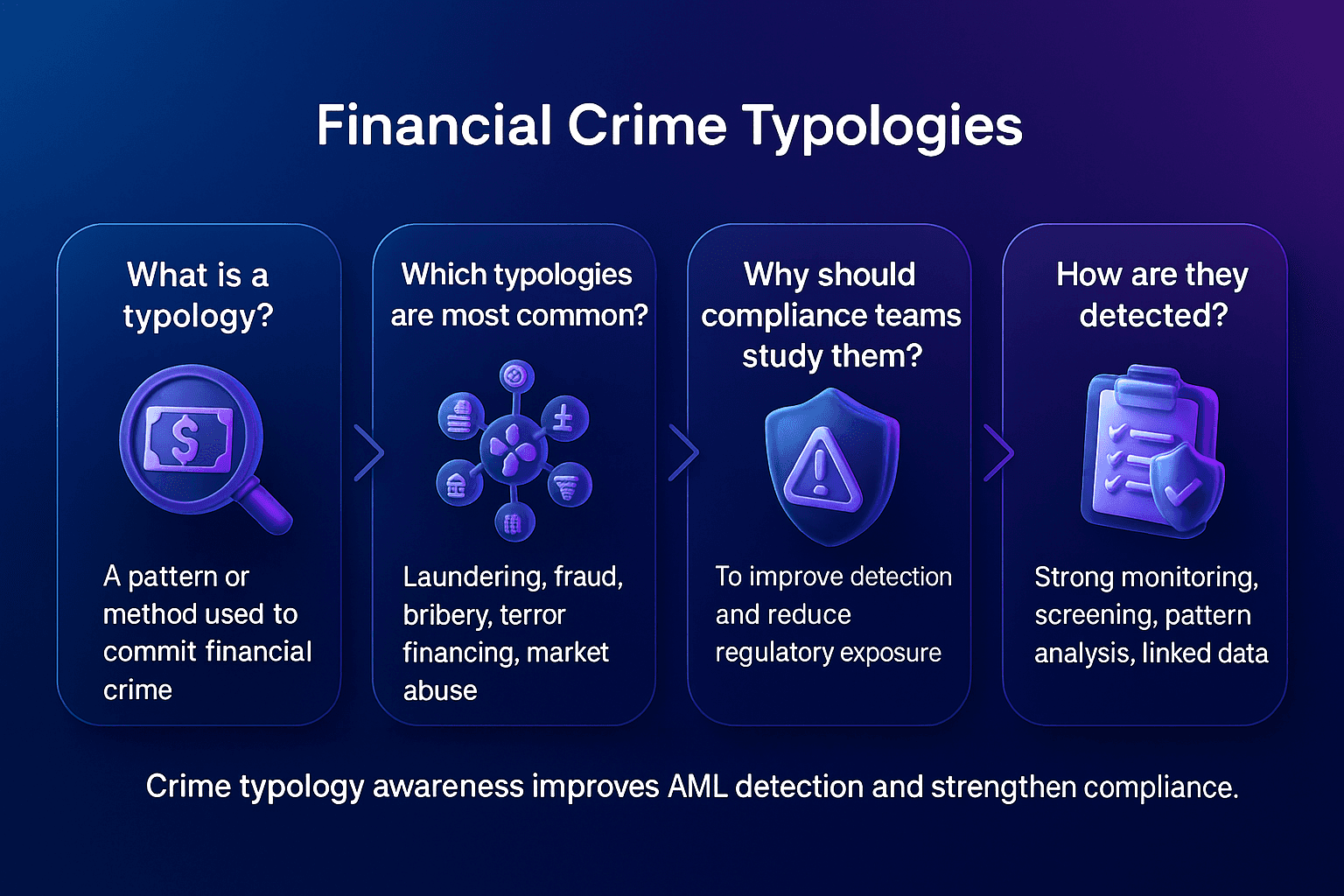

Financial crime typologies are patterns, methods, or techniques that criminals use to launder money, finance terrorism, or commit fraud. These typologies are studied and documented by regulators, financial institutions, and international organizations to help compliance teams detect and prevent illicit activities.

Financial Crime Typologies

A financial crime typology is a model that describes how money laundering or related crimes are carried out in practice. Typologies often include the steps criminals take, the sectors exploited, and the red flags that may indicate suspicious behavior.

International bodies such as the Financial Action Task Force (FATF) regularly publish “Methods & Trends” reports highlighting evolving money laundering and terrorist financing typologies. By studying these typologies, compliance teams can design more effective monitoring and reporting systems.

Why Financial Crime Typologies Matter In Compliance

Typologies help compliance officers anticipate risks rather than only reacting to alerts. By studying emerging crime patterns, institutions can strengthen transaction monitoring rules, adapt screening processes, and train staff more effectively.

For example, the FCA’s updated Financial Crime Guide stresses that firms must ensure their monitoring systems are tailored, tested, and responsive to new threats, otherwise they risk undetected gaps and regulatory consequences.

Common Examples Of Financial Crime Typologies

Financial crime typologies evolve constantly as criminals adjust their strategies. Some of the most significant examples include:

Trade-Based Money Laundering

Illicit actors manipulate invoices, customs documents, or trade values to disguise the movement of funds.

Structuring Or Smurfing

Large sums are broken into smaller transactions to avoid triggering reporting thresholds.

Use Of Shell Companies

Fictitious or inactive companies are used to obscure beneficial ownership and move illicit funds.

Terrorist Financing Typologies

Funds are channelled through charities, informal value transfer systems, or small-scale transactions to evade detection.

Emerging Digital Typologies

The rise of virtual assets introduces typologies where cryptocurrencies are layered or mixed to conceal origins.

Benefits And Challenges Of Using Typologies

Typologies provide valuable intelligence for designing AML processes, training compliance staff, and updating monitoring rules. They also help regulators communicate evolving risks to financial institutions. However, challenges remain.

Typologies are often published after criminals have already exploited certain methods, creating a lag between emerging threats and institutional defenses.

A ResearchGate paper “From Rules to AI: Assessing Supervised Learning for AML Transaction Monitoring” explores how reliance on static rule-based typologies can limit effectiveness and argues for the adoption of adaptive models.

The Future Of Financial Crime Typologies

Future typologies will increasingly focus on digital finance, cryptocurrencies, and cross-border transactions. Hybrid compliance frameworks that combine typology-based insights with AI-driven monitoring will become the standard.

For example, arXiv research such as “Application of Deep Generative Models for Anomaly Detection in Complex Financial Transactions” shows how combining GANs and VAEs can detect abnormal behaviours in large payment flows, going beyond traditional typologies to reveal hidden risk patterns.

Strengthen Your AML Compliance With Typology Insights

Understanding financial crime typologies is critical to building adaptive AML frameworks. By combining typology-based insights with modern monitoring and screening solutions, institutions can stay ahead of emerging risks.

Contact Us Today To Strengthen Your AML Compliance Framework