FCA Regulations are the rules and supervisory frameworks established by the UK’s Financial Conduct Authority (FCA) to ensure that financial institutions and regulated firms comply with anti-money laundering (AML), counter-terrorist financing (CTF), and financial crime obligations.

The FCA acts as one of the UK’s primary regulators, overseeing banks, investment firms, insurers, fintechs, and other financial institutions. Its regulations aim to protect consumers, safeguard market integrity, and ensure that the UK financial system is not exploited for criminal purposes.

For compliance professionals, FCA Regulations define the expectations for governance, due diligence, monitoring, and reporting. They also shape how firms must implement the Money Laundering Regulations (MLRs) and align with global standards such as the FATF Recommendations.

Definition Of FCA Regulations

FCA Regulations are the set of binding rules, supervisory expectations, and enforcement powers applied by the Financial Conduct Authority to ensure firms meet legal and regulatory requirements, including AML and CTF obligations.

These regulations encompass:

Customer due diligence (CDD) and enhanced due diligence (EDD).

Sanctions screening and transaction monitoring.

Suspicious activity reporting (SARs) to the National Crime Agency.

Governance and accountability frameworks for compliance functions.

Risk-based approaches to onboarding and ongoing monitoring.

While the Money Laundering Regulations provide the statutory legal framework, FCA Regulations operationalise them by clarifying supervisory expectations and enforcement priorities.

The Role Of The FCA In AML Compliance

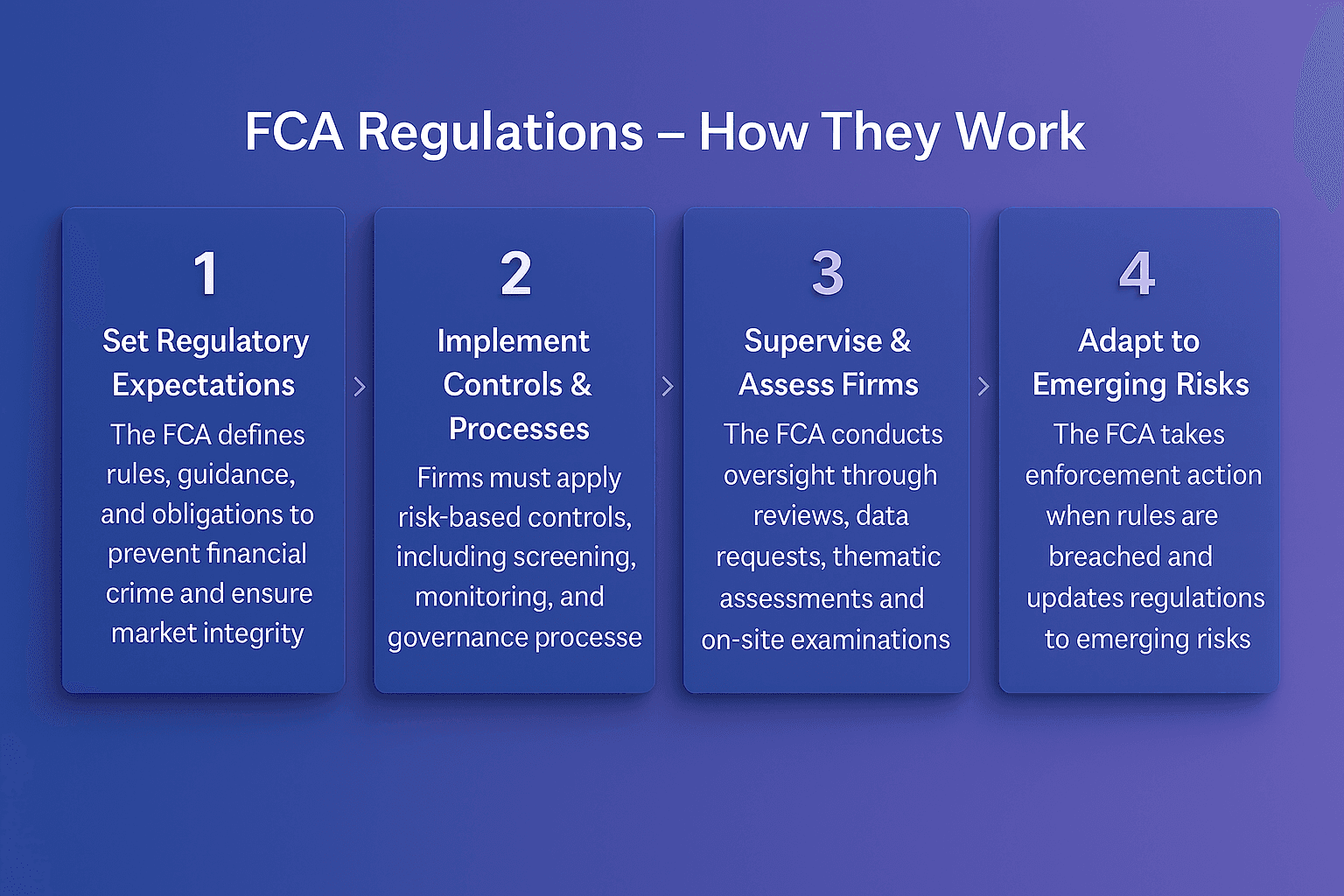

The FCA plays a dual role in AML compliance — setting regulatory expectations and enforcing them through supervision and penalties.

Supervisory Function

The FCA supervises regulated firms, ensuring they implement robust systems and controls to prevent financial crime. This includes audits, inspections, and thematic reviews.

Enforcement Function

When firms fail to comply, the FCA has the power to impose fines, restrict activities, or pursue criminal enforcement. Recent enforcement actions have seen UK banks fined millions for weaknesses in AML systems.

Alignment With FATF Standards

The FCA ensures the UK meets its commitments under international frameworks such as the FATF Recommendations, often emphasising risk-based approaches in its guidance.

Why FCA Regulations Are Important

FCA Regulations are a cornerstone of compliance in the UK financial sector.

Protecting Market Integrity

By enforcing AML/CTF measures, FCA Regulations protect the financial system from being used for illicit purposes.

Ensuring Consistency

The FCA provides guidance to ensure firms apply consistent AML standards across the UK, reducing regulatory arbitrage.

Driving Accountability

Senior management within firms are held accountable for compliance failings, ensuring responsibility is embedded at the top.

Supporting International Cooperation

FCA Regulations help the UK maintain credibility in global finance by aligning with international AML norms.

The FCA itself states that preventing financial crime is one of its core objectives, requiring firms to maintain effective systems and controls.

Key FCA Regulations For AML Compliance

While FCA oversight spans multiple areas, several regulations are particularly relevant to AML and financial crime compliance.

Customer Due Diligence (CDD)

Firms must identify and verify customers, beneficial owners, and risk profiles before establishing business relationships.

Enhanced Due Diligence (EDD)

EDD applies to higher-risk customers, such as politically exposed persons (PEPs), high-risk jurisdictions, and complex structures.

Ongoing Monitoring

Firms must continuously monitor customers and transactions to detect anomalies or suspicious activity.

Sanctions Compliance

The FCA requires robust screening processes to ensure firms comply with UK and international sanctions regimes.

Suspicious Activity Reporting

Regulated entities must submit SARs to the National Crime Agency (NCA) whenever suspicious transactions are identified.

Challenges In Meeting FCA Regulations

While necessary, FCA compliance presents operational challenges for many institutions.

Regulatory Complexity

Firms must align with multiple overlapping frameworks, the FCA Handbook, MLRs, FATF standards, creating complexity.

High Costs

Implementing robust AML systems, continuous monitoring, and staff training represents a significant cost for firms.

False Positives

Screening and monitoring often generate large numbers of false alerts. Tools such as FacctList, for watchlist management and FacctGuard, for transaction monitoring help reduce inefficiencies.

Technology Integration

Legacy systems often struggle to meet FCA expectations for speed, accuracy, and auditability in AML processes.

Best Practices For Meeting FCA Regulations

Firms can strengthen compliance with FCA regulations by adopting best practices that align with supervisory expectations.

Adopt A Risk-Based Approach: Focus compliance resources on the highest-risk customers, products, and jurisdictions.

Leverage Technology: Solutions such as FacctView (for customer screening) and FacctShield (for payment screening) provide real-time monitoring aligned with FCA standards.

Ensure Governance And Accountability: Senior management must own compliance outcomes, supported by board-level reporting.

Maintain Comprehensive Audit Trails: Document all compliance processes for inspection and supervision.

Train Staff Continuously: Regular training ensures staff understand both regulations and internal procedures.

The UK government also stresses that firms must embed compliance into governance structures and apply robust financial crime controls.

The Future Of FCA Regulations

The FCA is expected to place greater emphasis on technology, data, and resilience in AML compliance. Trends include:

Stricter supervision of crypto-asset firms and virtual asset service providers (VASPs).

Greater scrutiny of AI and machine learning in compliance, particularly explainability.

Closer collaboration with other global regulators to address cross-border financial crime.

Enhanced focus on consumer duty, linking AML outcomes with customer protection.

The FCA has already signalled increased enforcement against firms that fail to implement effective AML systems, suggesting the regulatory bar will continue to rise.