The Financial Action Task Force (FATF) 40 Recommendations are a globally recognized set of standards designed to combat money laundering, terrorist financing, and the proliferation of weapons of mass destruction. They serve as the foundation for anti-money laundering (AML) and counter-terrorist financing (CTF) frameworks adopted by countries and financial institutions worldwide.

First introduced in 1990 and periodically updated, the FATF 40 Recommendations outline key obligations for financial institutions, regulators, and governments. These obligations cover risk assessment, due diligence, sanctions compliance, and international cooperation, making them a cornerstone of the global fight against financial crime.

The Origins Of The FATF 40 Recommendations

The FATF was established by the G7 in 1989 to develop international standards against money laundering. Its first set of 40 Recommendations came in 1990, focusing primarily on preventing financial institutions from being misused for criminal activity.

Over time, the scope of the recommendations expanded to include terrorist financing (after 2001), proliferation financing, and technological risks. Today, they are updated regularly to reflect new threats, such as virtual assets and emerging technologies in the financial sector.

The FATF publishes updated details on its official site, including full texts and explanatory notes on the 40 Recommendations.

Key Principles Behind The FATF 40 Recommendations

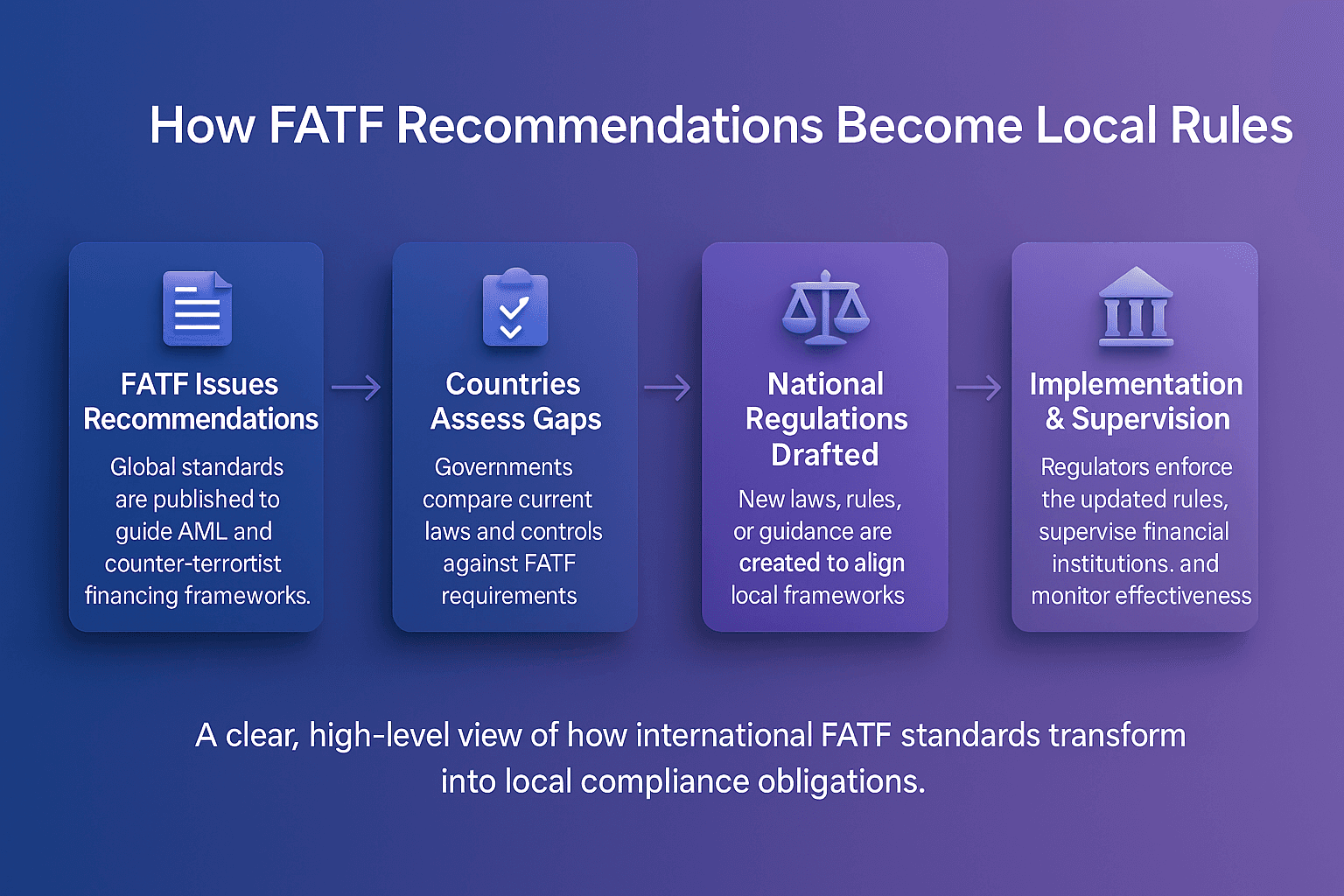

The recommendations are designed to create a consistent global framework for AML and CTF. While each country adapts them into local law, the underlying principles remain aligned with FATF’s global mission.

Some of the most critical principles include:

Risk-Based Approach: Financial institutions must assess and mitigate risks proportionally.

Customer Due Diligence: Institutions should verify customer identity and monitor ongoing relationships.

Sanctions Screening: Firms must ensure compliance with targeted financial sanctions.

International Cooperation: Countries are expected to work together to share information and strengthen oversight.

Solutions like FacctList for Watchlist Management and FacctView for Customer Screening directly support the implementation of these principles by providing reliable, real-time screening against sanctions and politically exposed persons (PEPs).

FATF Recommendations In Practice

When applied effectively, the FATF 40 Recommendations improve the resilience of financial systems against abuse. For example:

Transaction Monitoring: Institutions are required to detect unusual or suspicious activity.

Alert Adjudication: The recommendations call for timely reporting of suspicious transactions, supported by streamlined alert management systems.

Payment Screening: helps organizations comply with obligations to detect high-risk or sanctioned transactions.

According to the International Monetary Fund (IMF), applying FATF standards reduces systemic risks and improves financial transparency at both national and global levels;

"Effective anti-money laundering and combating the financing of terrorism (AML/CFT) policies and measures are key to the integrity and stability of the international financial system and member countries’ economies"

Common Challenges In Implementing The FATF 40 Recommendations

While widely adopted, the recommendations present challenges for financial institutions, including:

Resource Intensity: Building compliance frameworks often requires significant investment.

Complex Regulations: Different jurisdictions adapt FATF recommendations in varying ways.

Technological Gaps: Legacy systems struggle to keep pace with real-time compliance demands.

Data Management: Institutions must ensure data quality and accuracy to avoid compliance failures.

Research published on ResearchGate highlights that while adoption is global, effectiveness varies depending on national enforcement and institutional capabilities.

Strengthen Your FATF 40 Recommendations Compliance Framework

The FATF 40 Recommendations are central to building a resilient AML strategy. Implementing them effectively requires the right mix of policy, technology, and operational expertise.

Contact Us Today To Strengthen Your AML Compliance Framework