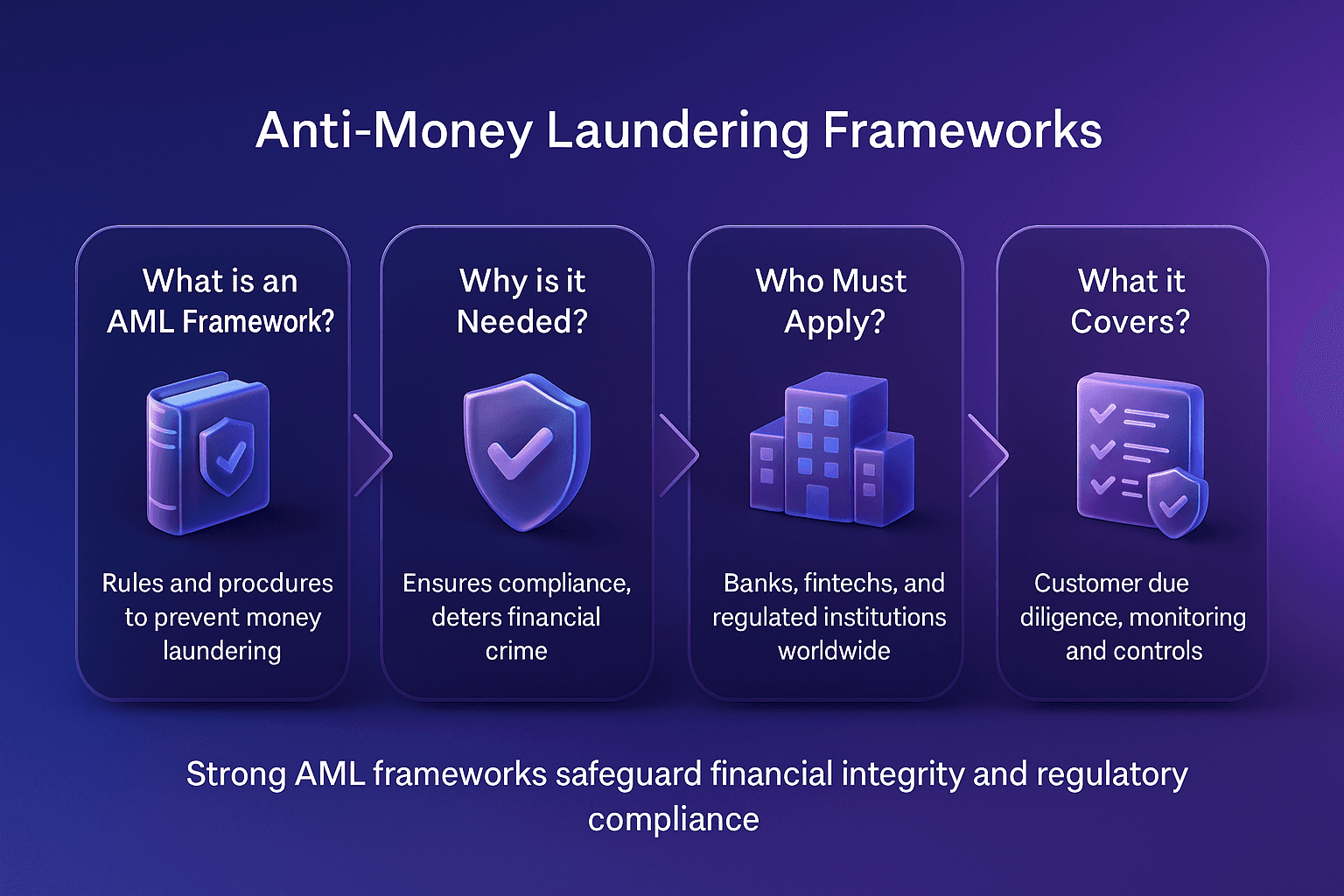

An anti-money laundering (AML) framework is the system of laws, regulations, policies, procedures, and technologies that financial institutions and regulated firms use to detect, prevent, and report money laundering and terrorist financing.

AML frameworks are the foundation of financial crime compliance. They are shaped by global standards, such as the FATF Recommendations, and adapted into national laws by regulators. For firms, an AML framework ensures that all compliance activities, from customer onboarding and sanctions screening to suspicious activity reporting, are aligned under a coherent, risk-based structure.

Strong AML frameworks protect not only financial institutions but also the wider financial system from abuse, instability, and reputational damage.

Definition Of An AML Framework

An AML framework is the structured set of legal, regulatory, and institutional measures that govern how firms identify, monitor, and mitigate the risks of money laundering and terrorist financing.

It covers:

Customer due diligence (CDD) and know your customer (KYC).

Sanctions screening and regulatory watchlists.

Transaction monitoring and suspicious activity reporting.

Governance and oversight by senior management.

Independent testing and audits.

Ongoing risk assessment and model validation.

The purpose of an AML framework is not only regulatory compliance but also proactive risk management and financial integrity.

Global Standards For AML Frameworks

AML frameworks are shaped by global standards and national enforcement.

The FATF Recommendations

The Financial Action Task Force (FATF) establishes the global baseline for combating money laundering, terrorist financing, and proliferation. Its Forty Recommendations provide a comprehensive and consistent framework of legal, regulatory, and operational measures that countries must implement, tailored to their national circumstances, ensuring that AML/CFT systems are effective, not merely formal.

National Regulators

National authorities such as the Financial Conduct Authority (FCA) in the UK and FinCEN in the US adapt FATF standards into domestic regulations, requiring firms to align with local laws.

Supervisory Oversight

Regulators conduct inspections and can impose fines for weak frameworks. Some of the world’s largest penalties, often in the hundreds of millions, stem from deficiencies in AML frameworks.

International Bodies

Institutions such as the IMF leverage Financial Sector Assessment Programs (FSAPs) and capacity development to evaluate countries’ AML/CFT systems, providing both mutual evaluations and technical assistance. Similarly, the World Bank helps jurisdictions develop national risk assessments and enhance AML frameworks through advisory tools, risk‑assessment toolkits, and capacity-building efforts. These interventions frequently highlight enforcement gaps and areas requiring structural improvement.

Key Components Of An AML Framework

A robust AML framework combines policies, processes, and technology.

Customer Due Diligence (CDD) And KYC

The first step in preventing money laundering is identifying and verifying customers. Strong frameworks require firms to know their customer and apply enhanced due diligence (EDD) for higher-risk individuals, such as politically exposed persons (PEPs).

Sanctions And Watchlist Screening

Firms must screen against sanctions lists (OFAC, OFSI, EU, UN) and regulatory watchlists to avoid prohibited dealings.

Transaction Monitoring

Monitoring customer activity in real time or batch mode allows firms to detect suspicious behaviour. Solutions like FacctGuard (transaction monitoring) are central to this process.

Suspicious Activity Reports (SARs)

When suspicious behaviour is identified, firms must file SARs with national authorities, such as the UK’s NCA or the US FinCEN.

Governance And Training

Senior management must approve AML policies and ensure employees receive continuous training.

Independent Testing

Regular audits validate whether the framework is functioning effectively. Weak testing often leads to regulatory penalties.

Why AML Frameworks Are Essential

AML frameworks are critical because they:

Protect Financial Stability: Preventing illicit money flows reduces systemic risk.

Safeguard Reputation: Firms with weak AML controls face reputational harm and investor distrust.

Enable Regulatory Compliance: Frameworks ensure firms meet FATF-aligned laws.

Improve Operational Efficiency: Structured processes reduce wasted resources on false positives.

Support Risk-Based Decisions: Frameworks help firms allocate resources to the highest risks.

The IMF highlights that anti-money laundering and counter‑terrorist financing (AML/CFT) systems only become effective when jurisdictions implement them robustly, supported by proper supervision and enforcement.

Their 2023 review of the IMF’s AML/CFT strategy underscores that supervisors must ensure banks adopt and maintain effective, risk-based AML controls, while recognising that many countries still face gaps in enforcement capacity and execution.

Challenges In Building Effective AML Frameworks

Despite their importance, AML frameworks face multiple challenges.

Evolving Financial Crime Risks

Criminals continuously adapt, exploiting new technologies such as crypto and decentralised finance (DeFi).

High False Positives

Poorly calibrated systems generate excessive alerts, consuming compliance resources.

Data Fragmentation

Inconsistent customer data across business lines undermines screening and monitoring.

Regulatory Divergence

Different jurisdictions interpret FATF standards differently, creating complexity for global firms.

Cost Of Compliance

Building and maintaining AML frameworks is resource-intensive, particularly for smaller firms.

The FCA, in its review of firms’ responses to sanctions following Russia’s invasion of Ukraine, found that some screening systems were poorly calibrated, with overly sensitive settings producing excessive false positives that made alert reviews inefficient and error-prone.

Best Practices For AML Frameworks

Firms can strengthen their AML frameworks by adopting best practices.

Adopt A Risk-Based Approach (RBA): Calibrate monitoring to customer and product risk.

Automate Screening And Monitoring: Use tools like FacctList, watchlist management, and FacctShield, payment screening.

Invest In AI And Machine Learning: Reduce false positives and adapt detection models.

Enhance Data Governance: Improve data quality for more accurate monitoring.

Integrate Adverse Media Screening: Capture reputational risk from negative news.

Embed Governance And Training: Ensure senior oversight and continuous staff education.

The EBA’s guidelines on internal governance explicitly clarify that AML/CFT measures must form an integral part of firms’ governance arrangements, emphasising that compliance obligations should be embedded into institutional policies, procedures, and controls rather than treated as stand-alone functions

The Future Of AML Frameworks

AML frameworks are shifting toward more intelligent, integrated, and adaptive systems.

Explainable AI (XAI): Regulators demand transparent models in compliance monitoring.

Real-Time Compliance: Continuous monitoring will replace batch processes.

Cross-Border Harmonisation: Efforts will grow to align international AML standards.

Digital Asset Integration: Frameworks will adapt to cover crypto and DeFi.

Operational Resilience: AML controls will be embedded in resilience frameworks to manage systemic risks.

Firms that modernise their AML frameworks with advanced analytics and governance will be better positioned to meet regulatory expectations.