The Anti-Money Laundering Directives (AMLDs) are a series of legislative measures introduced by the European Union to prevent the use of the financial system for money laundering and terrorist financing. Each directive updates and strengthens the AML framework, ensuring that EU Member States apply robust, harmonised standards.

For financial institutions, AMLDs provide the legal foundation for customer due diligence, suspicious transaction reporting, and risk-based compliance. They also reflect the EU’s alignment with international standards set by the Financial Action Task Force (FATF).

Anti-Money Laundering Directives

Anti-Money Laundering Directives (AMLDs) are binding pieces of EU legislation that Member States must transpose into national law.

They set out requirements for financial institutions and designated non-financial businesses and professions (DNFBPs), covering:

Customer due diligence and beneficial ownership checks.

Record-keeping obligations.

Suspicious transaction reporting to Financial Intelligence Units (FIUs).

Risk-based compliance frameworks.

Cross-border supervisory cooperation.

By updating AMLDs over time, the EU adapts its AML/CFT regime to new risks and emerging technologies.

Evolution Of AMLDs

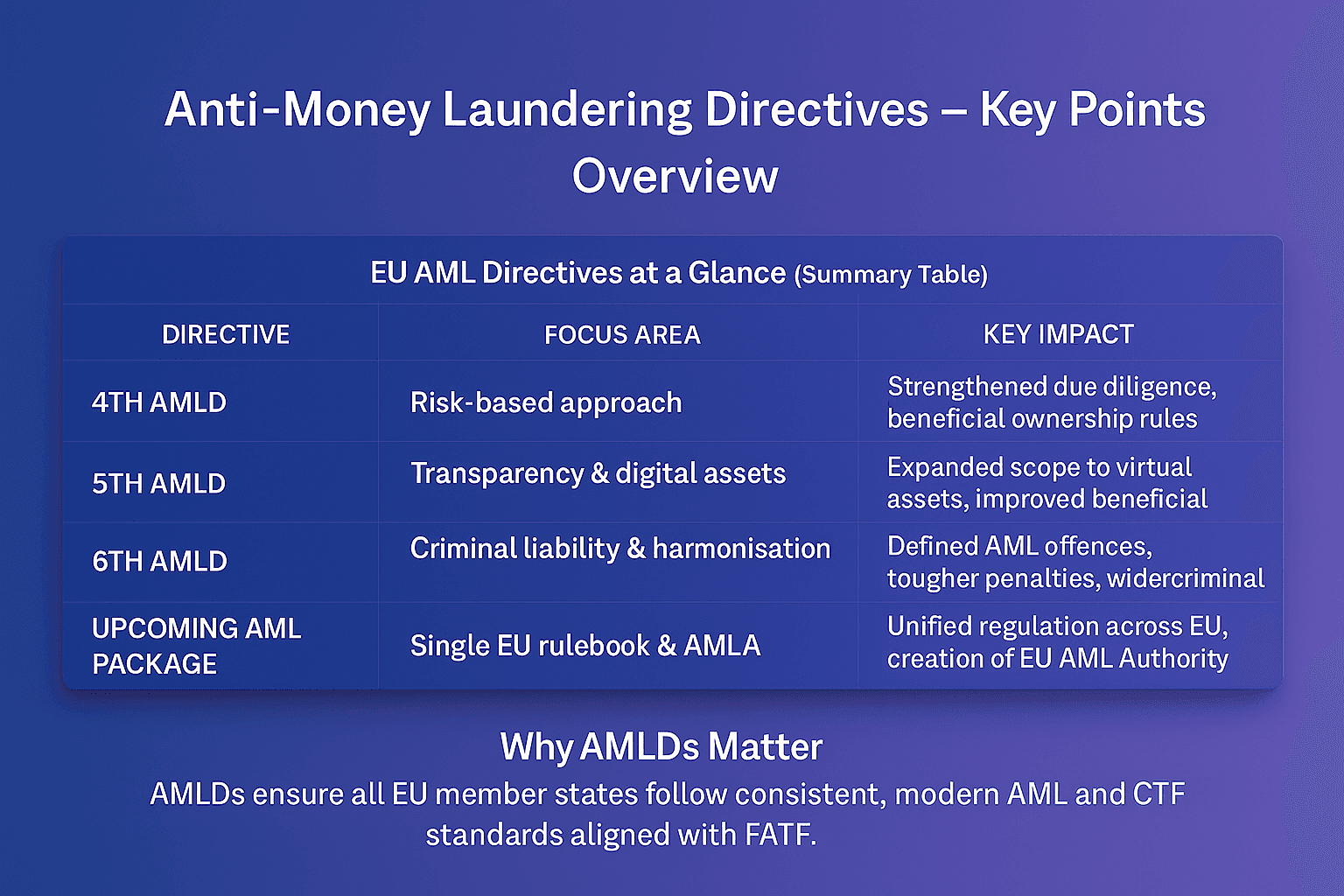

The AMLDs have evolved over several iterations, each strengthening the EU’s AML framework.

3rd AMLD (2005)

Introduced obligations for customer due diligence and suspicious transaction reporting across Member States.

4th AMLD (2015)

Adopted a risk-based approach to compliance, required centralised beneficial ownership registers, and aligned EU laws with FATF standards.

5th AMLD (2018)

Expanded scope to include virtual currencies, prepaid cards, and tighter rules on beneficial ownership transparency.

6th AMLD (2021)

Defined a harmonised list of predicate offences for money laundering, increased criminal liability for companies, and strengthened cross-border cooperation among FIUs and regulators.

Why AMLDs Matter In Compliance

The AMLDs matter because they provide the legal foundation for AML/CFT compliance across the EU.

Legal clarity: They harmonise rules, reducing fragmentation across Member States.

Stronger enforcement: The 6th AMLD increases penalties and extends liability to both individuals and companies.

Cross-border cooperation: AMLDs facilitate consistent reporting and monitoring across EU borders.

International alignment: The directives ensure EU rules remain consistent with FATF recommendations and global standards.

For firms, compliance with AMLDs is not optional. It is a legal requirement backed by strong enforcement.

The Future Of AMLDs

The EU is moving from directives to a Single Rulebook for AML, enforced by the new Anti-Money Laundering Authority (AMLA), expected to be fully operational by 2026.

Single Rulebook: Regulations will directly apply across all Member States without needing national transposition.

AMLA supervision: AMLA will directly oversee high-risk cross-border financial institutions.

Digitalisation: Future frameworks will address risks from instant payments, digital wallets, and crypto-assets.

This evolution builds on the foundation laid by AMLDs but shifts toward a more centralised, uniform framework.

Strengthen Your AMLD Compliance Framework

The AMLDs are the cornerstone of AML compliance in the EU. Financial institutions that anticipate and adapt to these evolving directives not only avoid penalties but also build more resilient compliance frameworks.

Facctum’s Watchlist Management, Customer Screening, and Transaction Monitoring solutions help institutions meet AMLD requirements with real-time, scalable compliance controls.

Contact Us Today To Strengthen Your AML Compliance Framework