AML red flags are indicators that suggest a customer, transaction, or business activity may involve money laundering, terrorist financing, or other forms of financial crime. While not proof of wrongdoing on their own, red flags trigger further investigation and can lead to Suspicious Transaction Reports (STRs) or Suspicious Activity Reports (SARs).

Understanding and detecting AML red flags is a regulatory requirement for banks, payment providers, and other covered entities under global AML laws.

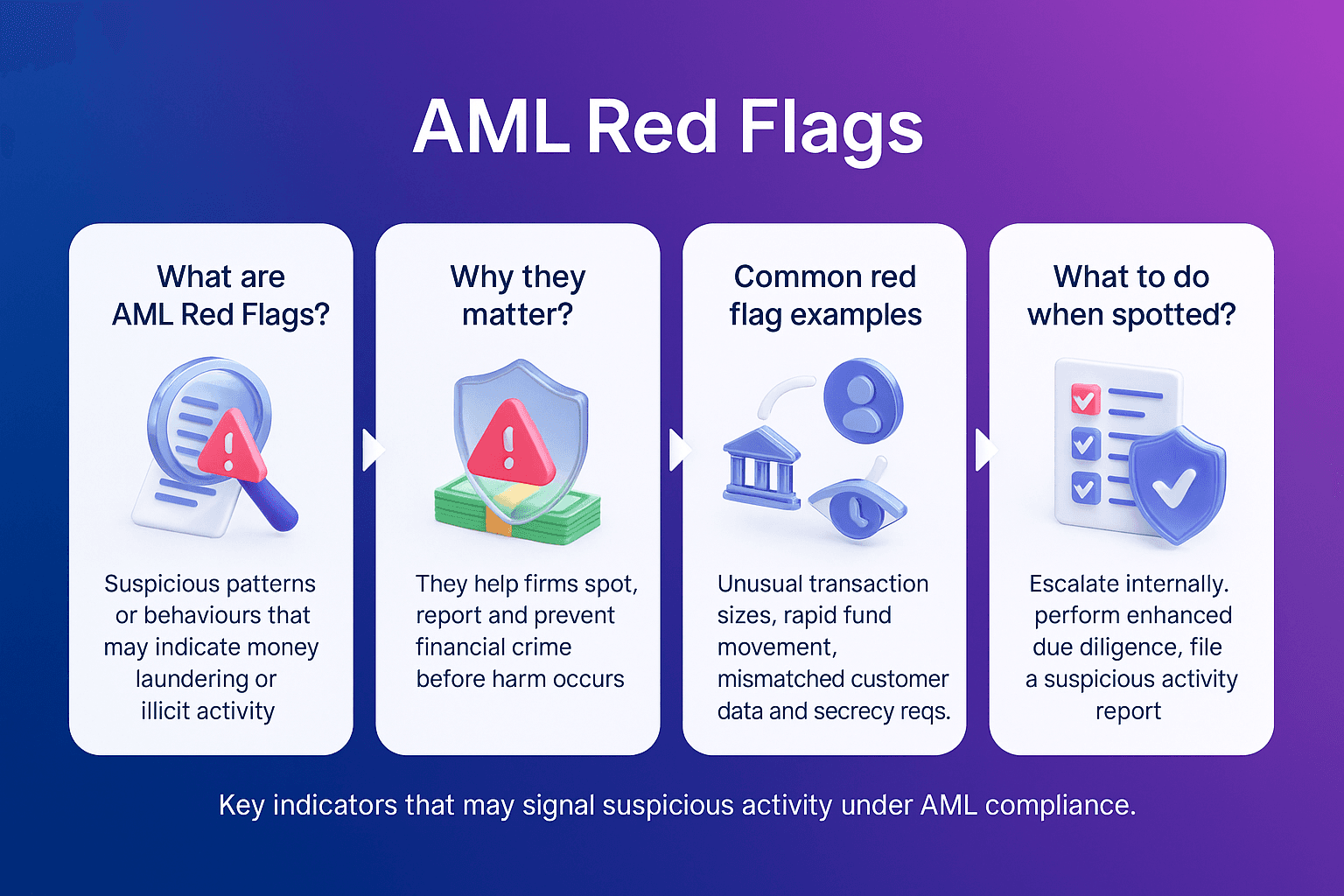

AML Red Flags

An AML red flag is any unusual activity, behaviour, or transaction pattern that raises concerns about potential financial crime.

Examples include:

Transactions inconsistent with a customer’s known profile.

Unexplained movement of large sums.

Use of complex or unnecessary intermediaries.

Involvement of high-risk jurisdictions or shell companies.

The Financial Crimes Enforcement Network (FinCEN) and the Financial Action Task Force (FATF) both publish red flag indicators to help institutions strengthen compliance programs.

Why AML Red Flags Matter For Compliance

Red flags are critical because they:

Trigger monitoring and reporting: Institutions must escalate suspicious activity for review.

Support regulatory compliance: Laws require financial institutions to maintain frameworks for identifying and investigating unusual activity.

Protect against penalties: Ignoring red flags can result in fines, enforcement actions, and reputational damage.

Enable proactive defence: Spotting issues early allows institutions to intervene before criminal networks fully exploit the system.

Common Types Of AML Red Flags

AML red flags are not all the same, they vary depending on the nature of the transaction, the customer’s behaviour, or the structure of the business relationship. Regulators publish these categories so compliance teams can design controls tailored to each risk type.

Transaction-Based Red Flags

Large or frequent cash deposits inconsistent with customer profile.

Wire transfers to or from high-risk jurisdictions.

Use of multiple accounts without clear business purpose.

Customer Behaviour Red Flags

Reluctance to provide identification documents.

Use of nominees, proxies, or third parties without justification.

Politically exposed persons (PEPs) attempting to conceal beneficial ownership.

Structural And Geographic Red Flags

Shell or offshore companies with no legitimate business operations.

Dealings with sanctioned individuals or entities.

Transactions routed through multiple countries without reason.

Detecting AML Red Flags

Institutions use a combination of regulatory frameworks and technology to detect red flags:

Transaction Monitoring to identify unusual transaction flows.

Customer Screening against sanctions, PEP, and watchlists.

Watchlist Management to ensure data accuracy.

Alert Adjudication to manage escalations efficiently.

Supervisors such as the European Banking Authority (EBA) highlight that red flag detection must be risk-based and proportionate to customer activity.

The Future Of AML Red Flag Detection

As financial crime becomes more complex, regulators and institutions are shifting toward:

AI-driven anomaly detection to uncover hidden patterns.

Cross-border data sharing for consistent detection of international risks.

Real-time monitoring to flag risks immediately, especially with instant payments.

Dynamic risk scoring to adjust alerts based on customer behaviour over time.

Strengthen Your AML Red Flag Detection Framework

Detecting AML red flags early is essential to compliance, protecting institutions from financial crime risks and regulatory penalties.

Facctum’s Transaction Monitoring and Alert Adjudication solutions give compliance teams the tools to identify, escalate, and resolve red flags efficiently, with real-time accuracy and audit-ready transparency.

Contact Us Today To Strengthen Your AML Compliance Framework