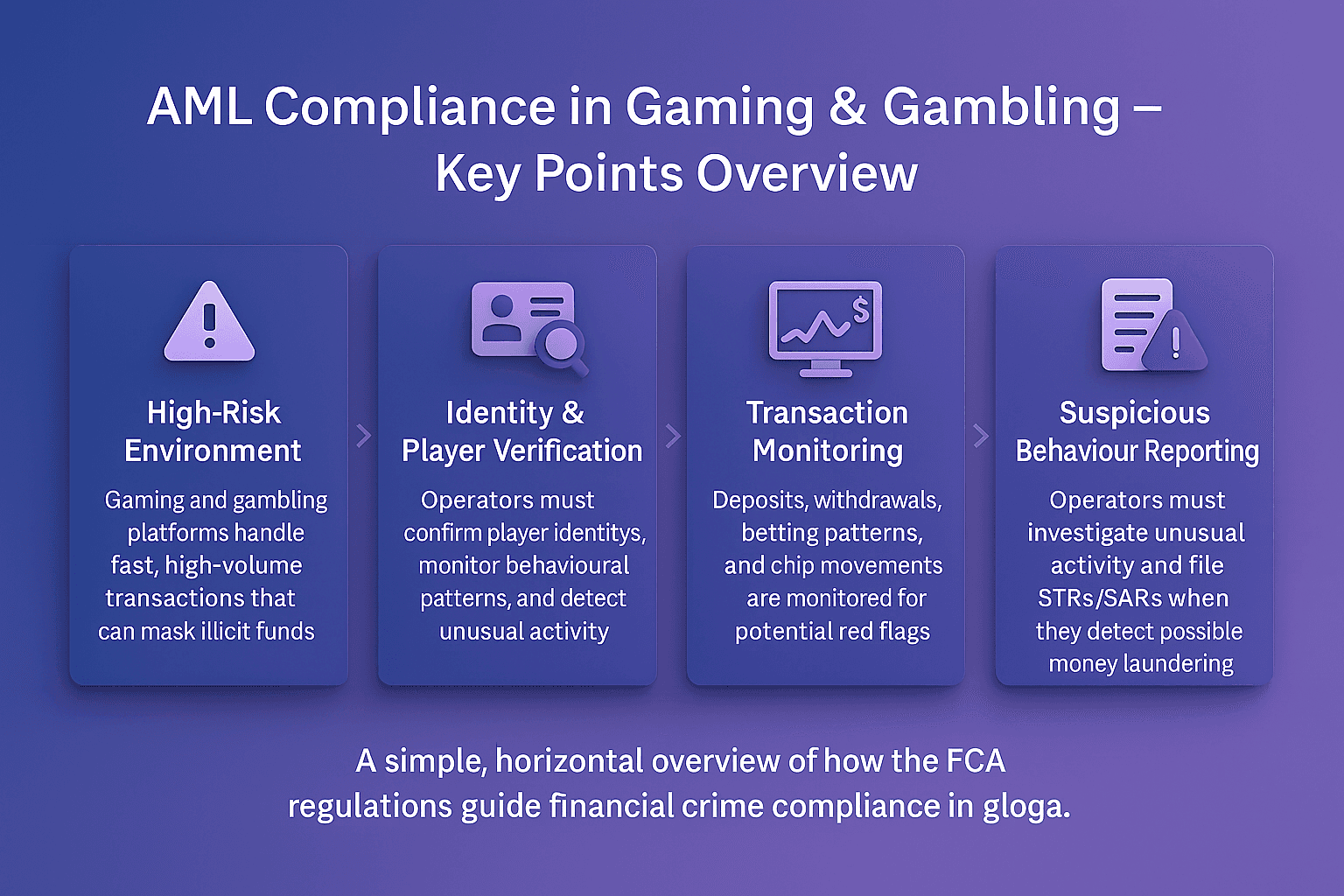

AML compliance in the gaming and gambling industry refers to the regulatory frameworks and controls that casinos, betting operators, and online gaming platforms must implement to prevent money laundering and terrorist financing.

The industry is considered high-risk because of its high transaction volumes, frequent use of cash, and potential for cross-border activity. Regulators worldwide require operators to implement strict customer due diligence, ongoing monitoring, and suspicious transaction reporting.

AML Compliance In Gaming And Gambling: Definition

AML compliance in gaming and gambling means applying anti-money laundering rules and controls to both land-based and online gambling operators.

Key elements include:

Know Your Customer (KYC) checks at account opening or entry points.

Customer due diligence (CDD) to verify identity and assess risk.

Transaction monitoring for suspicious betting or cash activity.

Suspicious Transaction Reports (STRs) filed with Financial Intelligence Units (FIUs).

Record keeping for auditability.

The Financial Action Task Force (FATF) explicitly lists casinos (including internet casinos) as “designated non-financial businesses and professions (DNFBPs)” subject to AML/CFT obligations.

Why The Gaming And Gambling Sector Is High-Risk

The sector is vulnerable to money laundering because of:

High cash usage: Land-based casinos often handle large volumes of cash, making it easier to introduce illicit funds.

Chip conversion and layering: Criminals can buy chips, gamble minimally, then cash out as “winnings.”

Cross-border exposure: Online gambling platforms can process payments across jurisdictions with varying levels of oversight.

Cryptocurrency adoption: Some platforms accept crypto, raising additional compliance challenges.

Customer anonymity: Without strict CDD, it is easier for criminals to hide identities or use proxies.

Regulatory Expectations For Gambling Operators

Authorities impose strict requirements on the gambling sector.

Customer Due Diligence

Operators must verify customer identity, apply Simplified Due Diligence for low-risk cases, and Enhanced Due Diligence for high-risk profiles, such as politically exposed persons (PEPs).

Ongoing Monitoring

Gaming platforms must track betting patterns and flag suspicious transactions for review, using Transaction Monitoring systems.

Suspicious Reporting

Operators are obliged to file Suspicious Transaction Reports (STRs) to national FIUs when they detect unusual or unexplained customer behaviour.

Regulatory Oversight

The European Commission and national regulators (e.g., the UK Gambling Commission, Malta Gaming Authority) enforce AML rules, often with significant penalties for non-compliance.

Key Challenges In AML Compliance For Gaming And Gambling

Operators face several hurdles when trying to maintain effective AML compliance:

False positives: Transaction monitoring can generate large volumes of alerts, overwhelming compliance teams.

Data quality: Inconsistent customer data across jurisdictions complicates screening.

Cross-border regulation: Varying national AML laws create compliance complexity.

Digital payments: Crypto and e-wallets add layers of risk.

Reputation risk: Failure to comply leads not only to fines but also loss of trust with regulators and players.

The Future Of AML In The Gaming Industry

The gambling industry is rapidly evolving, and so are its AML obligations:

Harmonisation: Regulators are pushing for common AML standards across Member States and online platforms.

Real-time monitoring: As instant payments and crypto become common, operators must adopt Real-Time Reporting and monitoring tools.

Technology adoption: AI and machine learning are increasingly used to detect suspicious betting patterns and reduce false positives.

Greater oversight: FATF and the EU Commission are pressing regulators to step up supervision of gaming operators to close compliance gaps.

Strengthen Your Gambling AML Compliance Framework

The gaming and gambling industry faces some of the toughest AML challenges, with regulators worldwide scrutinising operators closely. Staying compliant means adopting proactive, technology-driven frameworks that can keep pace with high-volume, high-risk transactions.

Facctum’s Customer Screening and Transaction Monitoring solutions give gambling operators the real-time capabilities needed to meet global AML requirements.

Contact Us Today To Strengthen Your AML Compliance Framework