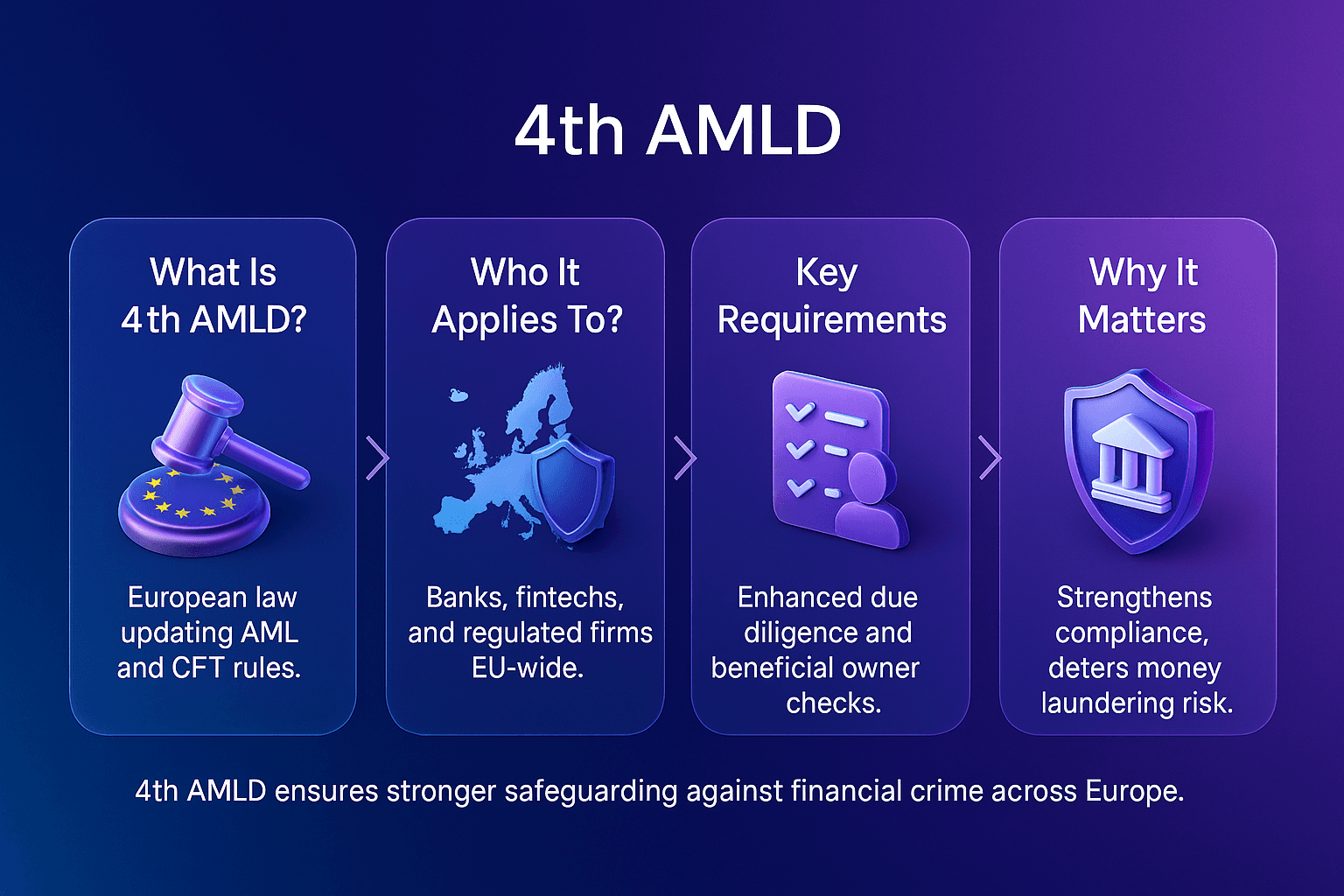

The 4th Anti-Money Laundering Directive (Directive (EU) 2015/849), adopted in May 2015, marked a major step in the European Union’s effort to modernise its anti-money laundering (AML) and counter-terrorist financing (CTF) framework. It replaced earlier directives by embedding a risk-based approach, increasing transparency around company ownership, and broadening the range of institutions and professions required to comply with AML laws.

AMLD4 aligns EU law with the Financial Action Task Force (FATF) recommendations, ensuring that financial institutions, non-financial businesses, and professionals across Member States maintain robust procedures to prevent the misuse of the financial system for money laundering or terrorism financing. (

The Directive’s Core Principles

AMLD4 established a new compliance philosophy based on risk-sensitivity and proportionality. Institutions must evaluate the risks they face and calibrate their customer due diligence (CDD), monitoring, and reporting efforts accordingly. Instead of rigid, one-size-fits-all rules, AMLD4 encourages institutions to apply judgment and adapt controls to evolving threats.

This principle became the backbone of EU compliance frameworks, influencing both supervisory assessments and internal governance models within regulated entities.

Beneficial Ownership Transparency

While Facctum does not provide Ultimate Beneficial Ownership (UBO) reporting or registry solutions, AMLD4’s introduction of beneficial ownership transparency remains a cornerstone of global AML policy.

Under the Directive, EU Member States were required to create central registers of beneficial owners, databases identifying the natural persons who ultimately control or profit from legal entities. The goal was to expose opaque corporate structures that could conceal illicit activity.

Financial institutions and competent authorities were granted access to these registers to support due diligence and investigations. Although later directives (AMLD5 and AMLD6) refined and expanded these requirements, AMLD4 laid the foundation for ownership transparency across Europe.

Expansion Of Obliged Entities

AMLD4 significantly widened the definition of entities subject to AML obligations. Beyond banks and insurers, it encompassed gambling operators, real-estate intermediaries, tax advisers, auditors, and dealers in goods handling large cash payments above €10,000.

By expanding its scope, the Directive recognised that money laundering threats extend well beyond traditional finance. Professionals such as accountants, lawyers, and consultants who facilitate high-value transactions were also required to apply due diligence and reporting obligations.

For institutions, this expansion meant establishing cross-sector compliance frameworks, ensuring that all relevant subsidiaries and business lines applied consistent AML controls.

Strengthening Supervision And Enforcement

AMLD4 increased regulatory accountability by mandating that each EU Member State designate competent supervisory authorities to oversee compliance. These authorities, including financial regulators and professional bodies, were empowered to impose effective, proportionate, and dissuasive sanctions for non-compliance.

The Directive required that penalties be substantial enough to deter misconduct, such as fines of at least twice the amount of any illicit gain or a minimum of €1 million in severe cases. This enforcement culture shifted the EU’s AML regime from a procedural framework to a risk-outcome framework, where the effectiveness of compliance programs mattered as much as their existence.

The Role Of The Risk-Based Approach

AMLD4 was the first EU directive to embed the risk-based approach (RBA) formally into law. Institutions were required to assess the money-laundering and terrorist-financing risks posed by their clients, products, and geographic exposures, and to tailor their monitoring and reporting controls accordingly.

This approach is closely aligned with the methodologies used in advanced compliance systems such as Customer Screening and Transaction Monitoring, processes that detect unusual behaviour, screen customers against sanctions or watchlists, and flag activity for further review.

In practice, this principle encourages the use of dynamic technologies, such as real-time monitoring and data-driven alert systems, that allow institutions to allocate resources efficiently while maintaining compliance effectiveness.

Why AMLD4 Still Matters

Although it has since been updated by the 5th and 6th AML Directives and will eventually be replaced by the forthcoming EU AML Regulation (effective 2027), AMLD4 remains the foundation of modern European AML law. Its principles of proportionality, transparency, and cross-sector accountability underpin how regulators and institutions continue to approach AML compliance.

Its legacy endures in how compliance teams build their frameworks, from risk assessments and due diligence to automated transaction screening and real-time reporting.

The Future Of EU AML Regulation

The European Union is now consolidating its AML framework into a single, directly applicable AML Regulation and establishing the European Anti-Money Laundering Authority (AMLA). These reforms aim to eliminate inconsistencies between Member States and extend AML obligations to emerging sectors, including crypto-asset service providers.

Nonetheless, AMLD4’s emphasis on institutional responsibility, transparency, and data-driven supervision remains deeply influential. Compliance programs built on its foundations continue to meet, and often exceed, the expectations of modern regulators.

Strengthen Your AML Compliance Framework

The principles of AMLD4, particularly the emphasis on risk-based controls and transparency, remain vital to global AML programs. To ensure compliance readiness, institutions can strengthen their frameworks through modernised Customer Screening, Payment Screening, and Transaction Monitoring systems that detect risk in real time.

Contact Us Today To Strengthen Your AML Compliance Framework