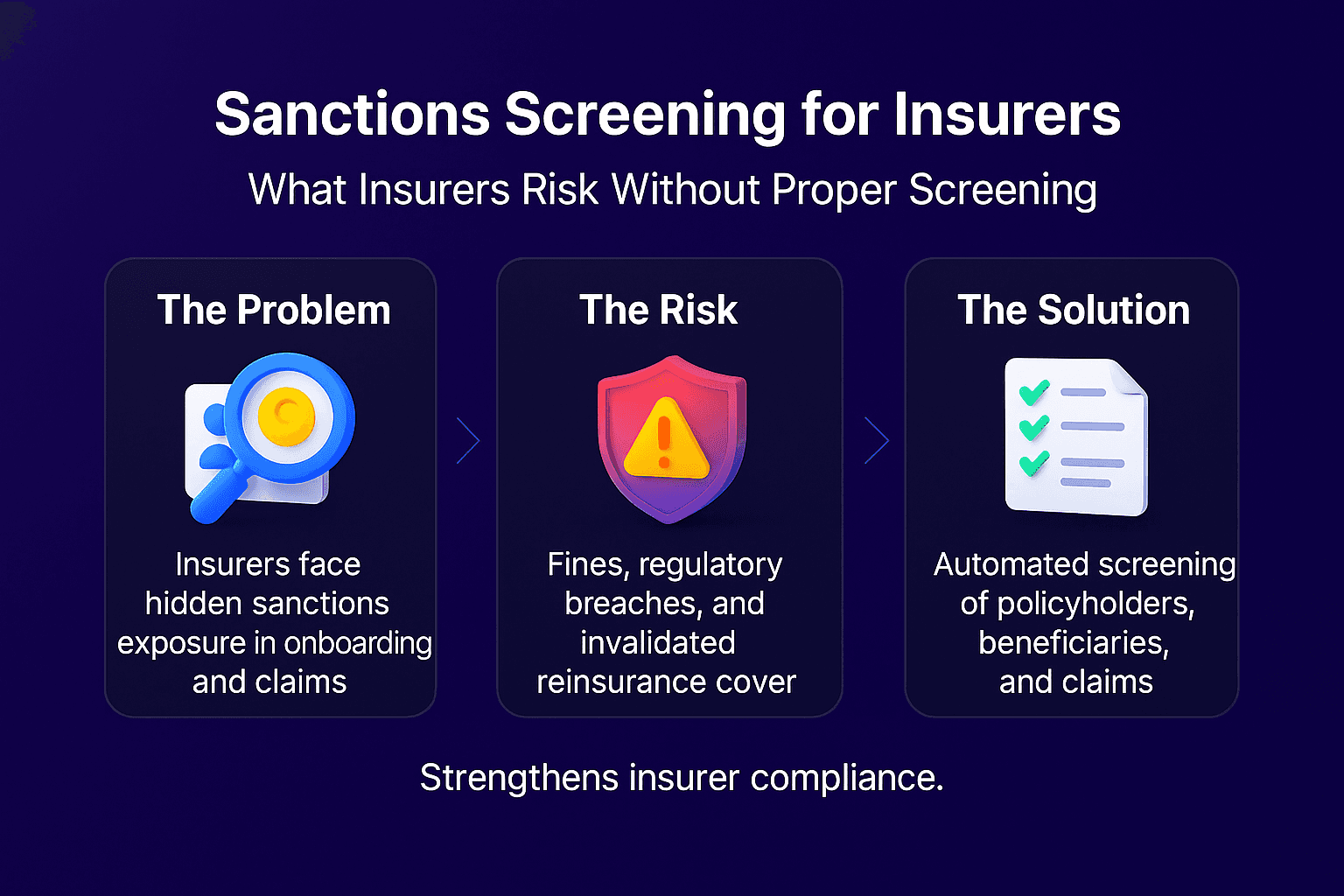

Sanctions screening has become a critical operational control for insurers as regulatory expectations rise across the UK, US and Europe, and as insurance portfolios span multiple jurisdictions. This includes the growing need for insurers to demonstrate strong insurance sanctions compliance practices that align with OFAC expectations in the US, OFSI requirements in the UK and EU sanctions frameworks. This page explains how sanctions screening functions within insurance underwriting and claims operations, why it matters, and how organisations can build reliable controls for OFAC screening for insurers, EU sanctions checks and UK regulatory oversight while supporting consistent decision making across complex distribution channels. It is designed for MLROs, compliance leaders and operational managers responsible for policy governance, delegated authority oversight and claims integrity.

The Evolving Sanctions Landscape For UK, US And European Insurers

Insurers operating in the UK, US and Europe face increasing regulatory pressure to maintain robust sanctions controls across underwriting, distribution and claims, especially as supervisors focus more heavily on sanctions exposure within cross border policies and claims. The sanctions regimes of OFSI, OFAC and the EU continue to evolve rapidly, which places greater emphasis on real time list updates, clear governance and transparent decisioning. These regions frequently issue new designations in response to geopolitical developments, and insurers must demonstrate they can identify prohibited individuals or entities regardless of where the policy was sold or where the claim arises.

EU insurers often navigate requirements driven by broader geopolitical sanctions packages, while US insurers must consider the extraterritorial reach of OFAC rules. UK insurers balance OFSI expectations alongside sector specific regulatory scrutiny. For global insurance groups, this means a single policy may be impacted by multiple sanctions regimes at once. Firms monitoring updates to the FATF guidance on high risk and other monitored jurisdictions gain valuable context that supports cross border decision making.

With portfolios spanning different markets, insurers increasingly require screening frameworks that can adapt to regional rules while keeping operational disruption to a minimum. This is why sanctions screening has become a foundational control within modern insurance compliance.

Core Components Of Sanctions Screening For Insurers

Each stage in the insurance lifecycle introduces unique risks. Strong programmes break controls into well defined components that match operational workflows.

Screening At Policy Inception

Policy inception is a key control moment. New customers, beneficiaries and sometimes intermediaries require verification to ensure no coverage is being granted to prohibited individuals or entities. Insurers often incorporate structured checks that align with the principles found in effective watchlist management, which helps ensure list accuracy and timely updates.

Clear data capture at this stage reduces downstream false positives and prevents onboarding bottlenecks.

Screening Throughout Policy Lifecycle Events

Policies evolve, so sanctions screening cannot be a single check. Beneficiaries may change, endorsements may add new named parties and renewals provide natural opportunities to re run controls. Insurers often set automated triggers that rescreen policy records after each sanctions list update.

Continuous monitoring reduces the risk that a sanctioned individual remains undetected during the years a policy remains active.

Screening Within Claims Handling

Claims present one of the highest areas of sanctions exposure because payments occur under time pressure. Screening typically happens twice. First when the claim is notified to ensure the claimant or service provider is not sanctioned. Second immediately before payment to account for new designations issued during the investigation period.

For insurers handling overseas medical, travel or commercial claims, real time payment screening capabilities are essential. Claims payments often flow through international payment networks using formats such as ISO 20022. Screening these messages allows insurers to detect risks linked to sanctioned financial institutions, restricted jurisdictions or prohibited counterparties.

Insurers with large travel or health portfolios often screen both the claimant and any supporting parties, such as hospitals, repair networks or logistics providers. This helps maintain transactional integrity and reduces exposure across diverse global supply chains.

How Screening Decisions And Workflows Operate

Sanctions screening in insurance is more than name matching. It functions as a foundational control that links underwriting, claims and oversight teams, and this makes the placement of internal educational resources particularly useful. In many firms, teams responsible for making decisions benefit from reviewing structured material such as the guidance available within the Facctum Knowledge Hub, which helps contextualise screening requirements and improve operational consistency. It requires structured decision making that blends policy information, operational context and regulatory interpretation.

A typical workflow includes:

Running an automated name match against relevant sanctions lists

Assessing the alert using policy documents, claimant data and broker inputs

Applying contextual checks such as jurisdiction, corporate ownership or beneficiary relevance

Escalating ambiguous matches to compliance for review

Recording the decision with clear rationale and evidence

These steps ensure consistency across underwriting and claims teams. Insurers often improve decision quality by drawing on the good practice found in structured customer screening approaches, which highlight the value of clean input data and standardised review criteria.

After these steps, case handlers usually document the final position so that future audit reviews can understand the operational reasoning behind each decision. This documentation also supports supervisory engagement and strengthens internal assurance.

Many insurers use informal self assessment exercises to judge whether their workflows remain aligned with emerging risks and regulatory expectations. These reviews often highlight practical improvements that can be implemented quickly.

Key Operational Challenges Facing UK, US And European Insurers

Insurers face several challenges when embedding robust sanctions controls across underwriting, policy administration and claims. These challenges often stem from legacy systems, inconsistent data, decentralised broker arrangements and cross border exposure that introduces multiple sanctions regimes.

One common issue is variable data quality. Poor input data reduces matching accuracy and increases false positives. Insurers also struggle with maintaining timely list updates, especially across OFAC, OFSI and EU regimes, which release designations at different intervals. Another difficulty emerges in claims handling, where payments may involve numerous third parties operating in high risk jurisdictions.

Firms operating across multiple markets must also reconcile regional expectations. US operations must consider the extraterritorial application of OFAC rules, while UK and EU insurers must follow OFSI and EU Council requirements respectively. Aligning these regulatory obligations while keeping operational workflows efficient is a persistent challenge.

Insurers face several challenges when embedding robust sanctions controls. Legacy systems can make it difficult to source consistent customer data. Distribution through brokers introduces variation in the information available at onboarding. Delegated authority models add complexity because third party partners may apply inconsistent standards.

Claims supply chains also create unpredictable risk points. A travel insurer, for example, may deal with hotels, hospitals or logistics providers in multiple jurisdictions. Screening each party reliably requires structured processes that feed accurate data into matching tools.

Insurers operating across multiple regions must also interpret different supervisory expectations. Some regulators apply stringent requirements for real time alerts while others focus on governance and oversight. Aligning these requirements while maintaining operational throughput is a common industry difficulty.

What Effective Sanctions Screening Looks Like For UK, US And European Insurers

Effective sanctions screening in the insurance sector requires both strong operational foundations and deeper technical capabilities that allow teams to make accurate and timely decisions. Modern screening environments combine structured workflows with advanced matching logic, enriched data, adjudication strategies and clear governance. These elements work together to reduce false positives, strengthen decision quality and support compliance across underwriting, policy servicing and claims.

Effective sanctions screening frameworks share a set of characteristics that help insurers manage risk with confidence.

Clear Allocation Of Responsibilities

Underwriting, claims and compliance teams each play distinct roles. Clear responsibilities reduce duplication and help ensure no part of the policy lifecycle is overlooked. Documents should explain who conducts screening, who approves exceptions and where decisions must be escalated.

High Quality Matching And Decisioning Practices

Accurate matching reduces unnecessary alerts and allows teams to focus on genuine risks. High performing insurers use matching engines that blend primary attributes, such as exact name elements, with secondary signals, such as nationality, geography or age indicators. This layered scoring improves accuracy and reduces noise.

Advanced adjudication models further strengthen accuracy. These models typically apply structured filters, such as evaluate filters that score how closely a name resembles a sanctioned entity and probability filters that estimate the likelihood of a true match based on multiple characteristics. Conclusion filters then combine these indicators to support a consistent final decision. These techniques help insurers reduce manual review, improve clarity and enhance overall risk assessments.

Some firms supplement this with data enrichment. Enriched policyholder or claimant data helps differentiate between similar names and provides context that improves match resolution. This approach is especially useful for large international books where customers or service providers may share common names.

Good documentation supports internal oversight and provides clarity during supervisory visits or external reviews. and provides clarity during supervisory visits or external reviews.

Common Gaps In Insurance Screening Frameworks

Many insurers find that gaps emerge during growth, system changes or portfolio expansion. Common issues include screening only the primary policyholder, outdated lists, inconsistent workflows across product lines or weak oversight of delegated authority partners. Claims teams sometimes focus solely on the claimant and overlook third party service providers.

Another frequent gap relates to governance. Firms may not define how quickly sanctions updates must be applied, which can create misalignment between operational needs and regulatory expectations. The FCA guidance on sanctions and asset freezes provides useful insight into supervisory focus areas and helps firms calibrate their own expectations.

These gaps tend to appear when control environments grow organically without structured review cycles.

How Insurers In The UK, US And Europe Typically Strengthen Their Sanctions Controls

Insurers generally follow a predictable path when strengthening sanctions controls, blending operational improvements with technical enhancements in matching, adjudication and governance.

Clarify responsibilities and stabilise workflows. Teams document where screening occurs and ensure consistent steps are followed across underwriting, distribution and claims.

Improve accuracy and reduce noise. Refining matching logic, adding enriched data, and implementing adjudication models helps insurers identify genuine alerts more efficiently.

Strengthen oversight and assurance mechanisms. Monitoring, sampling and reporting allow insurers to understand their control effectiveness and ensure screening aligns with OFAC, OFSI and EU expectations.

These steps build organisational confidence and help insurers demonstrate control maturity in supervisory reviews.

Insurers generally follow a predictable path when strengthening sanctions controls.

Clarify responsibilities and stabilise workflows. Teams document where screening occurs and ensure consistent steps are followed.

Improve accuracy and reduce noise. Enhancing data quality, refining matching logic and improving alert review guidance often reduces false positives.

Strengthen oversight and assurance mechanisms. Monitoring, sampling and formal reporting help organisations understand their control effectiveness and identify further improvements.

These steps build organisational confidence and create a control environment that adapts more easily to regulatory and geopolitical developments.

Professional Insight And Strengthening Operational Confidence Across Regions

Industry experience shows that sanctions screening becomes more effective when insurers blend operational clarity with technical depth. Screening is most reliable when underwriting and claims teams understand how controls work and when decisions are supported by structured adjudication models and enriched data.

Practical Experience

Insurance operations involve multiple contributors, including brokers, claims partners and service networks. Practical experience shows that screening models work best when they are tailored to product lines and operational realities rather than applied uniformly across all portfolios.

Technical And Regulatory Expertise

Insurers benefit from understanding how sanctions regimes are implemented and enforced. Guidance such as OFAC’s sector advisories, OFSI enforcement insights and EU Council designation notices help firms interpret evolving expectations.

Building Confidence In Controls

Confidence increases when governance, workflow design and quality assurance reinforce one another. Structuring decisioning models with clear scoring, enrichment and escalation criteria helps insurers demonstrate control maturity, both internally and to regulators.

Practical Experience

Insurance operations involve multiple contributors, including brokers, claims partners and service networks. Practical experience shows that screening models work best when they are tailored to product lines and operational realities rather than imposed as rigid checklists.

Technical And Regulatory Expertise

Insurers benefit from understanding how sanctions regimes are implemented and enforced. Guidance such as the OFSI monetary penalties guidance gives organisations visibility into regulatory expectations and how breaches are assessed.

Building Confidence In Controls

Confidence increases when governance, workflow design and quality assurance reinforce one another. Controls become sustainable when they are integrated into daily underwriting and claims activity rather than treated as administrative add ons. Assurance teams can then verify that controls are functioning as intended.

Additional Regional Regulatory Context For Insurers

Insurers operating across the UK, US and Europe must account for the practical differences between OFAC, OFSI and EU Council sanctions regimes. OFAC rules can have extraterritorial impact where a US nexus exists, such as when payments are processed in US dollars or involve US financial institutions. UK insurers rely on OFSI designations and enforcement guidance, while EU insurers must follow the EU Council sanctions framework that frequently involves coordinated listings across member states. Understanding how these three regimes interact helps insurers develop screening models that adapt to cross border risk and changing designations.

Insurance Product Line Sanctions Risk Profiles

Different insurance products carry different levels of sanctions exposure. Retail motor and home policies generally carry lower risk due to limited cross border transactions. Travel insurance and health claims may involve overseas providers, which increases jurisdictional complexity. Commercial and specialty lines often present higher exposure, especially where insureds operate internationally or claim payments involve multiple parties. Mapping sanctions risk to product lines helps insurers calibrate screening expectations and resource allocation.

Who This Guidance Is For

This guidance is written for MLROs, sanctions officers, compliance leads, underwriting governance teams and claims managers who operate within UK, US or European insurance markets. These roles typically oversee controls that must balance regulatory expectations with operational realities.

People First Compliance Content

This content focuses on the lived operational reality of insurers and supports organisations seeking practical steps to enhance sanctions control maturity across the UK, US and European markets. It aims to provide practical clarity, support better decision making and help teams strengthen control environments in a way that fits their organisational structure and product risk profile.

Next Steps For Your Organisation

Insurers across the UK, US and Europe often begin strengthening sanctions screening by identifying one or two operational areas that can deliver immediate control improvements. This might include assessing escalation pathways, reviewing list update timing or validating how claims screening operates across service providers. Small refinements help build confidence and demonstrate measurable progress.

A practical next step is to map your current workflow against regulatory expectations and identify where clarity or consistency can be improved. This exercise helps underwriting, claims and compliance teams better understand their roles and reduces variations in decision making.

If your organisation is reviewing sanctions controls or planning enhancements to screening frameworks, you can start a conversation through the Facctum contact page.

Frequently Asked Questions