The sanctions screening and alert adjudication process is central to modern anti-money laundering (AML) and financial crime compliance. Together, they transform raw alerts into meaningful compliance decisions. Sanctions screening detects potential matches against regulatory lists, while alert adjudication enables analysts to review, validate, and determine whether those alerts represent genuine risks.

Understanding Sanctions Screening

Sanctions screening identifies individuals, organisations, or transactions that may be associated with prohibited entities. It compares customer and transactional data against official sanctions lists, including those issued by the Office of Foreign Assets Control (OFAC), the United Nations, and the European Union.

According to the Financial Action Task Force (FATF) recommendations, sanctions screening is a preventive control designed to detect risks early in the process. It typically operates in real time, flagging potential matches before transactions are processed.

What Alert Adjudication Involves

Alert adjudication is the structured review of screening alerts to determine whether a match is true or false. It is the critical link between detection and decision-making. During adjudication, compliance analysts assess contextual information, apply fuzzy matching logic, and use data enrichment to confirm or dismiss alerts.

A well-designed adjudication process not only improves compliance accuracy but also enhances operational efficiency by reducing repetitive reviews. Institutions often integrate adjudication tools with sanctions screening systems to streamline workflows and accelerate decision-making.

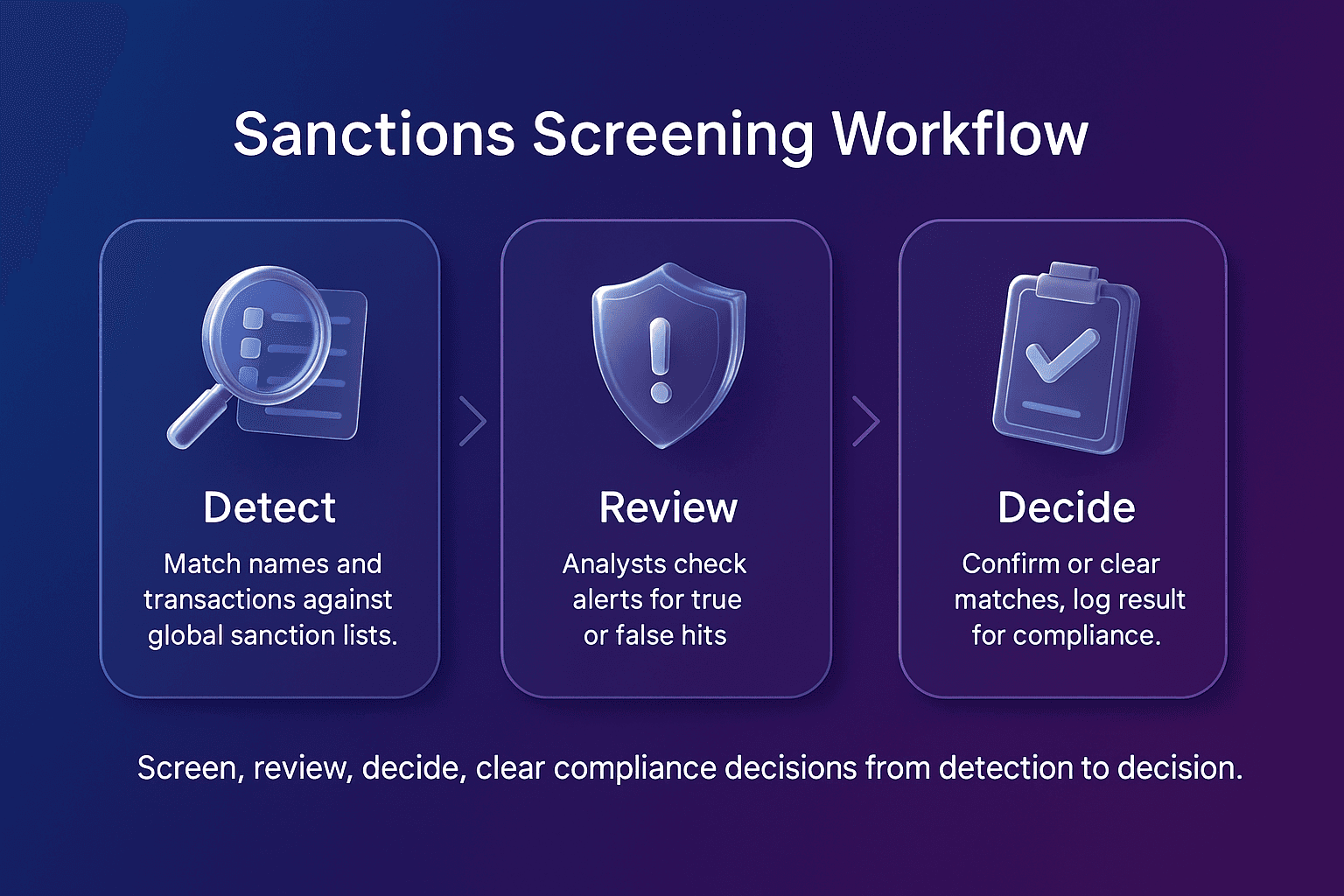

The Detection-To-Decision Workflow

Sanctions screening and alert adjudication work as sequential yet interconnected stages. Screening detects; adjudication decides. Together, they form a workflow that transforms potential matches into documented compliance actions.

The Workflow In Practice

Data Input: Customer and transaction data enter the sanctions screening engine.

Detection: The system compares data against global watchlists to generate alerts.

Alert Generation: Possible matches are flagged for compliance review.

Adjudication: Analysts evaluate alerts to confirm true positives or dismiss false matches.

Decision Output: Verified alerts are escalated for reporting or blocked transactions.

Table: Sanctions Screening vs Alert Adjudication - Functional Overview

Stage

| Sanctions Screening

| Alert Adjudication

|

Primary Goal

| Detect potential sanctions matches

| Validate and classify alerts accurately

|

Key Inputs

| Customer and payment data

| Screening alerts, contextual data

|

Main Users

| Automated compliance systems

| Human compliance analysts

|

Output

| Alerts requiring review

| Verified decisions and audit records

|

Process Frequency

| Real-time or batch

| Event-driven review

|

Interpreting The Workflow

The workflow illustrates how accurate detection relies on quality adjudication. If screening is too sensitive, adjudication teams become overwhelmed. If it is too narrow, true risks may go unnoticed. Balancing the two functions ensures high detection accuracy and manageable operational workload.

Benefits Of Connecting Screening And Adjudication

Integrating sanctions screening and alert adjudication creates tangible compliance and operational benefits:

Reduced False Positives: Adjudication feedback improves screening precision.

Faster Decision-Making: Automated routing and prioritisation reduce manual delays.

Regulatory Confidence: Documentation of adjudication steps supports audit readiness.

Continuous Improvement: Insights from adjudication feed back into screening models.

This cyclical relationship ensures compliance systems remain adaptive and transparent, aligning with best practices from the Bank for International Settlements (BIS) principles for operational resilience.

Common Challenges In The Detection-To-Decision Chain

Despite technological progress, several challenges persist in integrating sanctions screening with adjudication:

High alert volumes due to overly broad matching parameters.

Inconsistent data between list management and screening tools.

Lack of structured feedback loops from adjudication to detection.

Limited auditability or transparency in decision logs.

Adopting unified governance and consistent data standards across systems helps institutions mitigate these issues. Integrating with watchlist management platforms further improves data accuracy and traceability.

Summary And Key Takeaways

The detection-to-decision workflow defines the efficiency and reliability of modern sanctions compliance. Sanctions screening identifies risk, and alert adjudication confirms or clears it. Their coordination ensures faster, more accurate, and defensible compliance outcomes.

By maintaining tight alignment between these processes, institutions can reduce alert fatigue, increase productivity, and demonstrate a clear commitment to regulatory standards.

FAQs About Sanctions Screening And Alert Adjudication In The Detection To Decision Workflow