Fintechs operate in fast changing markets across regions such as the UK, EU, and US. As onboarding speeds increase, new product features launch rapidly, and customer behaviours shift across markets, screening controls must remain both accurate and adaptable.

This page explains how modern screening approaches help fintechs reduce noise, improve accuracy, and meet regulatory expectations without slowing growth. It is written for compliance leads, MLROs, operations teams, and product stakeholders responsible for financial crime controls in high growth fintech environments.

Why Sanctions Screening Matters For Fintechs

Fintech screening environments evolve quickly as new products launch, onboarding channels diversify, and customer behaviours shift across markets. Unlike FX providers that operate within corridor driven flows, fintechs face variability created by mobile onboarding, partner integrations, embedded finance models, and high velocity account activity. These dynamics require screening engines that can keep pace with shifting risk patterns and inconsistent data inputs.

Fintechs often experience rapid onboarding cycles, diverse customer populations, and evolving business models. These conditions create unique AML risks, including inconsistent customer data quality, high alert volumes, and exposure to emerging financial crime typologies. Screening effectiveness can degrade when customer data structures vary between sign up flows or when new features such as virtual wallets introduce behaviour that legacy thresholds were not designed to manage.

Regulators increasingly expect fintechs to demonstrate controls that operate reliably at scale. Supervisors in the UK, EU, and US often test whether screening controls are aligned with local obligations such as FCA financial crime standards, EU AMLD requirements, or OFAC list management expectations. They often examine how firms justify threshold settings, how they document dismissals of partial matches, and how updates to lists and rules are tested before deployment. Screening must adapt as products change, customer segments expand, and transaction volumes grow. Firms that invest early in structured data, clear rule logic, and explainable screening models typically see the highest gains in both operational efficiency and risk mitigation. fintechs to demonstrate controls that operate reliably at scale. Screening must adapt as products change, customer segments expand, and transaction volumes grow. Firms that invest early in structured data, clear rule logic, and explainable screening models typically see the highest gains in both operational efficiency and risk mitigation.

Fintechs often experience rapid onboarding cycles, diverse customer populations, and evolving business models. These conditions create unique AML risks, including inconsistent customer data quality, high alert volumes, and exposure to emerging financial crime typologies.

Regulators increasingly expect fintechs to demonstrate controls that operate reliably at scale. Screening must adapt as products change, customer segments expand, and transaction volumes grow. Firms that invest early in structured data, clear rule logic, and explainable screening models typically see the highest gains in both operational efficiency and risk mitigation.

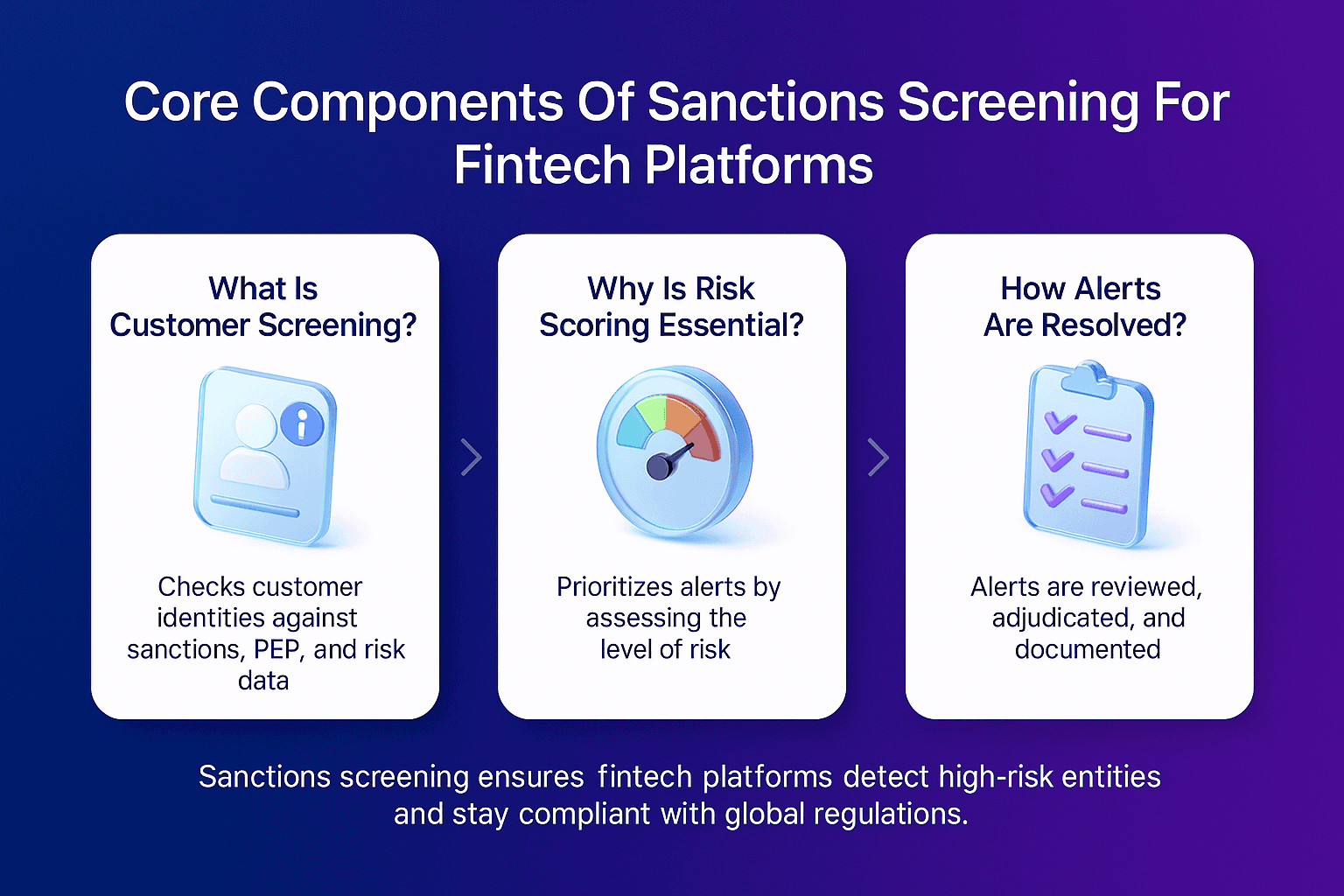

Core Components Of Sanctions Screening For Fintech Platforms

Fintech screening architectures must remain flexible, particularly for firms expanding into Western markets such as the UK, EU, and US, where expectations for control maturity and documentation standards tend to be higher. because product teams often introduce new features at pace. A change in user journeys, the launch of instant payout options, or new cross border capabilities can alter transaction patterns overnight. Screening controls must therefore support rapid iteration, structured testing, and clear traceability when thresholds or rules are adjusted.

Effective screening relies on multiple interconnected capabilities that strengthen risk detection across fast moving fintech ecosystems. on multiple interconnected capabilities that strengthen risk detection across fast moving fintech ecosystems.

Effective screening relies on multiple interconnected capabilities that strengthen risk detection across fast moving fintech ecosystems.

Watchlist Governance And List Integrity

Fintechs require well governed sanctions, PEP, and risk lists to ensure screening outputs remain reliable. This includes normalisation, enrichment, version management, and consistent updates from multiple international sources. Strong list governance prevents outdated or inconsistent data from undermining screening outcomes. Facctum’s modular platform supports this through FacctList for dedicated watchlist management, providing a centralised, governed repository that feeds downstream screening engines.

Customer Screening And Match Evaluation

Fintechs rely on structured data inputs and attribute based scoring to interpret customer names, identifiers, and demographic information. Weighted matching models help distinguish between genuine risk indicators and superficial similarities. These capabilities are essential in environments where customer naming patterns vary significantly by geography or onboarding channel.

Solutions built for this purpose, such as FacctView for customer screening, help fintechs maintain consistent detection quality as they scale by applying profile based thresholds, tailored list segments, and configurable screening profiles.

Payment Screening And Transaction Context

Fintechs handling payments, transfers, or account movements must screen events in real time. Structured transaction fields allow match engines to parse beneficiary details, counterparties, and jurisdictional information quickly and consistently. Screening must occur without introducing friction that disrupts customer experience. FacctShield, Facctum’s payment screening capability, applies flexible rules, supports multiple payment formats, and shares common list inputs and adjudication strategies with customer screening.

Adjudication To Improve Alert Quality

Fintechs often struggle with high false positive rates as volumes increase. Adjudication layers evaluate match evidence, enrich profiles, and assign probabilities that help separate meaningful alerts from low relevance matches. Facctum’s alert adjudication capability supports both customer and payment screening by applying evaluate, conclusion, augment, and probability filters to score matches, enrich context, and estimate the likelihood of a true hit. This allows analysts to focus attention on cases with genuine sanctions or financial crime exposure.

How Screening Decisions Are Made In Fintech Workflows

Fintech screening decisions blend automated detection with analyst review. Match logic interprets customer or transaction attributes, adjudication models filter low value alerts, and analysts validate findings based on policy and risk context.

Many fintechs find that a structured review of match thresholds, list quality, and alert drivers reveals rapid opportunities to improve precision without compromising risk detection.

Evaluating Match Evidence

Weighted attribute scoring clarifies why a potential match appears and which elements contribute most to the alert. This transparency supports faster analyst decisions and reduces uncertainty.

Analyst Review And Escalation

Analysts examine enriched details, consider customer behaviour, and apply institution specific policies. Clear audit trails and explainable scoring support consistent decision making.

Documentation Expectations

Fintechs must maintain transparent, traceable documentation showing how alerts were generated, assessed, and resolved. This supports both internal governance and external supervisory review.

Operational Challenges Fintechs Face In Sanctions Screening

Fintechs face challenges that differ from both FX providers and traditional banks, especially when entering highly regulated Western markets where supervisors expect consistency in alert handling, list governance, and evidence capture. and traditional banks.

FX operations typically rely on structured payment messages, while fintech onboarding funnels capture varied customer data across multiple channels such as mobile apps, web portals, partner APIs, and referral flows. Each introduces data quality variations that can affect match outcomes.

Fintechs often encounter recurring challenges as they scale screening operations. recurring challenges as they scale screening operations. Fintechs often encounter recurring challenges as they scale screening operations.

High Customer Growth And Data Variation

Rapid onboarding can introduce inconsistent customer naming formats, incomplete fields, or transcription issues. Screening engines must adapt to these differences to maintain accuracy.

Emerging Product Risks

New fintech features such as instant transfers, multi currency wallets, and embedded finance partnerships introduce novel risk behaviours that screening models must accommodate.

Alert Volumes At Scale

As fintechs grow, alert volumes can rise sharply. Without adjudication or structured rules, analysts may become overwhelmed, slowing decision making and reducing control quality.

What Good Looks Like In Fintech Sanctions Screening

Effective fintech screening environments combine explainable rules, clean data, and adaptable adjudication logic.

Firms operating in the UK, EU, and US often adopt structured validation routines to meet supervisory expectations for transparency and model governance; clean data, and adaptable adjudication logic. Mature fintechs often maintain structured processes for threshold reviews, automated regression checks when rules change, and clear evidence capture for analyst decisions.

These practices help maintain control quality even when transaction patterns or customer segments evolve. High performing fintech screening frameworks share several characteristics.

Strong Governance And Clean Inputs

Fintechs with reliable detection typically maintain well governed watchlists, consistent data formatting, and controlled update cycles.

Transparent Rules And Explainable Models

Explainable scoring and clear rule logic help analysts understand why alerts occur and how decisions are made.

Streamlined Alert Workflows

Efficient workflows supported by adjudication layers keep analysts focused on genuinely material cases.

Common Gaps Observed Across Fintech Screening Programs

Fintechs frequently identify similar gaps when reviewing screening controls.

Inconsistent Data Quality

Rapid onboarding and varied customer inputs can lead to mismatched or unstructured fields that reduce detection accuracy.

Uniform Thresholds Across Diverse Customers

Applying identical match thresholds across multiple customer types often produces unnecessary alerts or missed detections.

Limited Use Of Adjudication Models

Teams may rely heavily on analysts for triage tasks that could be supported by structured adjudication logic.

How Fintechs Typically Strengthen Their Sanctions Screening Performance

Fintech improvement programmes often begin by analysing alert clusters to understand where noise originates. It is common to see that most false positives stem from a small number of attribute combinations or data quality inconsistencies. Once identified, these areas can be addressed through refined thresholds, improved list governance, or enhanced adjudication logic. Improvements often follow a predictable path.

Step 1: Review Alert Drivers And Data Inputs

Understanding how alerts cluster and which inputs drive them helps teams identify the most impactful improvement areas.

Step 2: Strengthen List Governance And Formatting

Clean, structured list data improves accuracy across both customer and payment screening.

Step 3: Introduce Or Refine Adjudication Layers

Adjudication models refine match quality, reduce analyst burden, and improve clarity.

Professional Insight And Operational Confidence

Fintechs benefit from screening environments that combine robust technology, structured validation, and skilled analysts. As fintechs evolve, regulators increasingly expect firms to demonstrate how screening thresholds were set, how rule changes are tested, and how dismissals are justified. Clear documentation, transparent evidence, and consistent governance help fintechs meet supervisory expectations.

Practical Experience In This Sector

Fintech alert patterns often shift when new features launch. For example, introducing instant transfers or multicurrency accounts can produce unexpected alert spikes until match rules and adjudication settings are recalibrated. Systems that enrich customer information, highlight meaningful match evidence, and help analysts interpret attribute combinations support faster, more consistent decision making.

Technical And Regulatory Expertise

Supervisors frequently assess how screening engines handle structured fields, how match attributes are weighted, and whether audit trails capture the full decision path. They often request evidence showing how partial matches were dismissed, how nationality based conflicts were handled, and how list changes affected alert volumes.

Guidance from regulators such as the Financial Conduct Authority helps fintechs understand supervisory expectations for sanctions and financial crime controls. Topic specific guidance from bodies such as the Financial Action Task Force helps fintechs align screening to emerging global expectations. Industry commentary from the Bank for International Settlements also highlights how payment infrastructures evolve, shaping the way screening models must adapt.

Building Confidence In Controls And Decision Making

Regular model reviews, threshold tuning, and clear documentation help fintechs maintain strong and explainable screening controls that scale with business growth. Many fintechs establish pre production testing practices to ensure rule changes do not produce unexpected alerts. Others implement short validation cycles to ensure thresholds remain appropriate as customer demographics shift.

Regular model reviews, threshold tuning, and clear documentation help fintechs maintain strong and explainable screening controls that scale with business growth.

Our People First Approach To Compliance Content

This page is written to help fintech compliance teams understand screening challenges with clarity and practical relevance. The aim is to simplify complex topics while retaining the depth needed for informed decision making.

How Screening Expectations Differ Across The UK, EU, And US

Screening requirements vary by region, and fintechs expanding across markets often face different supervisory priorities.

In the UK, the FCA places strong emphasis on evidence backed decision making, proportionality in controls, and clear documentation of match disposition.

In the EU, AMLD and EBA guidelines shape expectations for model transparency, ongoing validation, and governance around list updates.

In the US, OFAC sanctions requirements and FinCEN expectations for BSA compliance drive a need for robust audit trails and clear criteria explaining why alerts were escalated or dismissed. Fintechs operating across regions benefit from harmonising global processes while accommodating local regulatory nuance.

Regulatory Expectations At A Glance

Fintech compliance teams often ask what regulators look for when assessing screening controls. While expectations differ by jurisdiction, several themes appear consistently across supervisory reviews:

Clear justification for threshold settings so examiners understand why specific match scores or rules were chosen.

Transparent evidence capture, including how analysts document alert outcomes and record contextual factors.

Testing and validation routines that show rule changes have been assessed before going live.

Strong list governance, ensuring sanctions, PEP, and risk lists are current, structured, and appropriately segmented.

Explainable screening logic, giving supervisors confidence that decision making can be traced and understood.

These themes help fintechs anticipate supervisory focus points and prepare control frameworks that withstand regulatory scrutiny.

Next Steps For Your Organisation

Fintechs looking to strengthen screening controls often begin by reviewing where noise originates, which rules drive unnecessary alerts, and how list governance affects match quality. Even modest improvements in adjudication logic or data quality can produce noticeable operational benefits.

If you would like to understand how your current screening thresholds perform, how adjudication models can reduce unnecessary alerts, or how structured governance supports regional regulatory expectations, we can help you explore these topics in more detail. For an initial discussion tailored to your operating model, you can reach out through our contact page.

Frequently Asked Questions