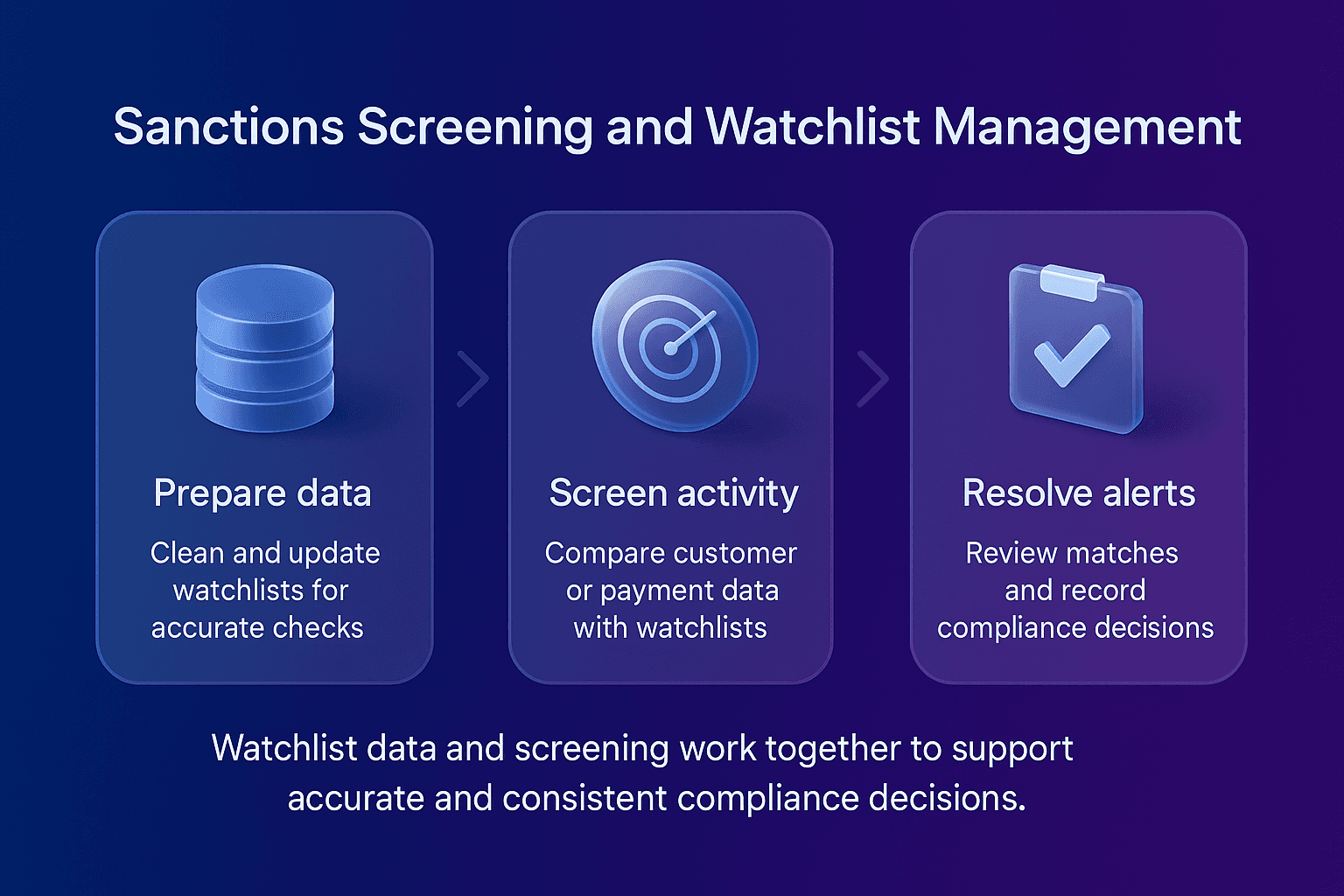

Sanctions screening and watchlist management are two core components of modern anti-money laundering (AML) compliance frameworks. While sanctions screening identifies potential matches against restricted entities, watchlist management ensures the lists driving those matches are accurate, complete, and up to date. Together, they form a closed feedback loop that enhances risk detection, reduces false positives, and maintains compliance integrity.

Understanding Sanctions Screening

Sanctions screening involves comparing customers, counterparties, and transactions against official sanctions lists maintained by regulators such as the Office of Foreign Assets Control (OFAC), the European Union, and the United Nations Security Council. The goal is to identify prohibited entities and prevent restricted transactions.

According to the Financial Action Task Force (FATF) recommendations, sanctions screening is an essential safeguard that helps institutions avoid regulatory violations and reputational harm. It is typically integrated into both onboarding and ongoing monitoring processes.

The Role Of Watchlist Management

Watchlist management governs the sourcing, cleansing, and maintenance of sanctions and politically exposed persons (PEP) lists used for screening. It provides the foundation for reliable and accurate detection.

The European Banking Authority (EBA) AML/CFT compliance officer Guidelines highlight the importance of accurate data management in ensuring effective AML controls. Poorly maintained lists can lead to missed alerts or false positives, both of which create compliance and operational risks.

Within financial institutions, well-managed watchlists ensure that sanctions screening tools operate on a single, harmonised data source. This improves both detection accuracy and auditability.

How Sanctions Screening And Watchlist Management Interconnect

Sanctions screening and watchlist management operate in tandem. Screening tools depend on the accuracy of managed watchlists, while feedback from screening outcomes helps refine list quality. The two functions are therefore interdependent.

When integrated effectively, they create a continuous improvement cycle, where every alert reviewed contributes to better data and more efficient future screenings.

Table: How Sanctions Screening and Watchlist Management Support Each Other

Function

| Sanctions Screening

| Watchlist Management

|

Primary Purpose

| Detect potential matches

| Maintain accurate and current sanctions data

|

Input

| Customer, payment, or counterparty data

| Sanctions, PEP, and internal lists

|

Output

| Alerts for compliance review

| Cleaned and validated data for screening systems

|

Process Type

| Real-time or batch-based

| Scheduled updates and version control

|

Regulatory Drivers

| FATF, OFAC, EU, UN frameworks

| EBA, FCA, and internal governance standards

|

Interpreting The Findings

The table highlights the symbiotic relationship between the two processes. Sanctions screening cannot deliver reliable results without robust watchlist management, and effective list governance relies on feedback from screening outcomes to maintain accuracy. This integration forms the backbone of any scalable AML compliance system.

Benefits Of Integrating Sanctions Screening And Watchlist Management

Combining sanctions screening and watchlist management strengthens compliance performance in several key areas:

Improved Detection Accuracy: Clean data leads to fewer false positives and faster alert triage.

Operational Efficiency: Automated list updates ensure real-time alignment across global entities.

Regulatory Assurance: Integration supports audit trails and demonstrates compliance with FATF and EBA standards.

Data Consistency: A unified list source guarantees uniformity across all screening platforms.

Institutions leveraging integrated watchlist management and payment screening processes gain better visibility into evolving sanctions landscapes, ensuring proactive compliance rather than reactive response.

Common Challenges In Aligning Screening And List Management

Even with advanced systems, institutions often face challenges in aligning sanctions screening with list management:

Frequent updates to global sanctions lists.

Inconsistent data formats across sources.

Limited version control or list governance.

Fragmented ownership across departments.

To address these, regulators such as the Bank for International Settlements (BIS) provide principles for operational resilience and sound management of operational risk that encourage harmonised, auditable data processes.

Integrating sanctions screening with customer screening systems also helps maintain a holistic view of compliance risk, ensuring alerts are prioritised efficiently.

Summary And Key Takeaways

Sanctions screening and watchlist management are inseparable elements of an effective compliance programme. Screening identifies potential threats, but list management defines the integrity of the data driving those detections.

A unified approach ensures greater operational stability, audit readiness, and adherence to evolving global standards.

Frequently Asked Questions