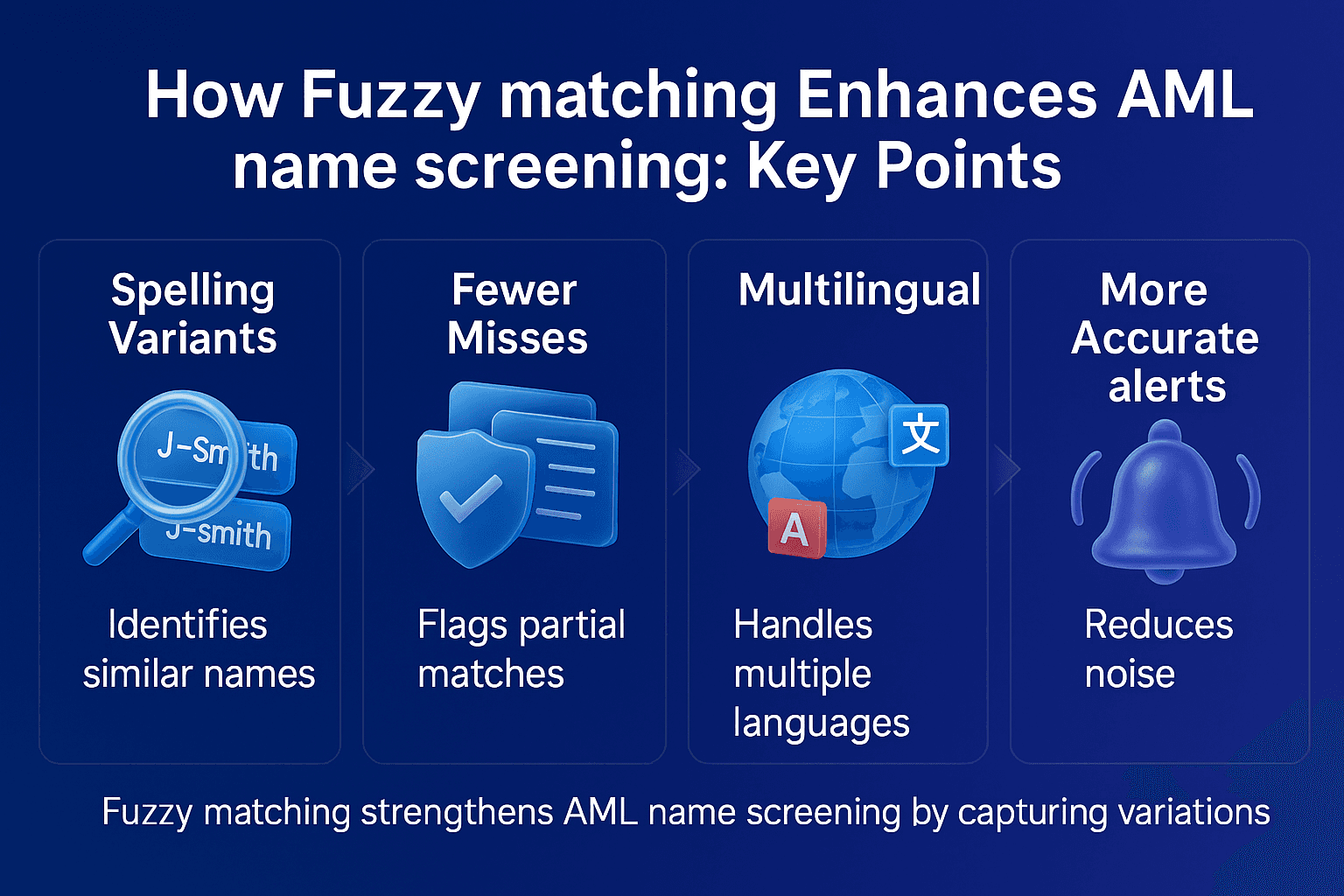

Fuzzy matching helps compliance teams find relevant matches even when names are misspelled, transliterated, or presented in multiple scripts. This explainer shows how fuzzy techniques work alongside deterministic rules to improve recall while controlling false positives, across onboarding and ongoing screening.

Why Fuzzy Matching Matters In Screening Workflows

Traditional exact/near-exact matching can miss risk due to naming variance (aliases, spacing, diacritics, nicknames). Fuzzy methods widen recall with controlled tolerance, then apply ranking and thresholds so investigators see the most likely candidates first.

How Fuzzy Techniques Work In Practice

Common approaches involve:

Tokenisation & Normalisation: Split and clean input fields (remove punctuation, standardise whitespace and diacritics).

String Similarity: Edit distance, Jaro–Winkler, token-based ratios, and phonetic encodings.

Multi‑Script Handling: Transliteration and script-aware comparison for Cyrillic, Arabic, and Asian scripts.

Ranking & Thresholds: Score candidates, then filter by calibrated cut‑offs per use case (real time vs. batch).

For practical context, see our blog on multi‑script challenges in screening and how fuzzy matching improves accuracy: Name Screening In Multi‑Script Environments and Fuzzy Matching In Compliance.

When To Use Fuzzy Matching, And When Not To

Use fuzzy matching when input quality is variable, transliteration is common, or list data contains aliases. Tighten thresholds or fall back to deterministic matching when regulatory policy requires exact hits for specific fields (e.g., identifiers) or when latency budgets are extremely tight.

Why Thresholds, Tuning, And Testing Drive Outcomes

Effectiveness hinges on calibration:

Segmented Thresholds: Distinct cut‑offs for onboarding vs. payment flows.

Weighted Fields: Prioritise surnames and critical attributes; de‑weight noisy fields.

Benchmarking: Measure precision/recall on labelled datasets and track False Positives over time.

Explainability: Provide feature‑level rationales auditors can follow.

See related concepts in our glossary: Fuzzy Matching and Name Screening.

How To Reduce False Positives Without Missing Risk

Combine fuzzy scores with:

Contextual Rules: Nationality/jurisdiction, date of birth windows, and list-type weighting.

Sanctions List Quality: Regular updates and hygiene via Watchlist Management.

Investigation Workflows: Route, bucket, and adjudicate efficiently with Alert Adjudication.

When To Combine Fuzzy Matching With Graph Or Entity Resolution

Network context (shared addresses, phones, or known associates) can help disambiguate common names and reduce manual review. For foundations, explore glossary terms Entity Resolution and Graph Analytics. Use network signals to prioritise reviews, while keeping screening decisions explainable and policy‑aligned.

Governance, Model Risk, And Explainability Expectations

Supervisors expect documented methodology, versioning, back‑testing, and human oversight. See FATF and national authorities for guidance on risk‑based controls. Maintain artefacts showing parameter choices, change logs, challenger tests, and reviewer outcomes.

Implementation Checklist For Compliance Teams

Define policy and tolerance per flow (onboarding, periodic, real‑time).

Standardise data: names, DoB, national ID formats, and character sets.

Choose algorithms fit for language/script realities.

Calibrate thresholds on labelled data; monitor drift.

Add investigator‑friendly rationales and MI dashboards.

Operationalise with resilient SLAs and audit trails via Customer Screening.

Ready To Improve Screening Accuracy?

Modernise name matching and reduce manual review with Facctum’s screening stack.

Explore Customer Screening (FacctView) for explainable fuzzy + rules orchestration, enhance list hygiene with Watchlist Management (FacctList), streamline investigations with Alert Adjudication, or Contact Our Team to discuss thresholds, SLAs, and integration.

FAQs About How Fuzzy Matching Improves AML Name Screening Accuracy