Crypto exchanges that support fiat onboarding operate within a regulatory environment that expects the same level of discipline applied in traditional financial services. When customers deposit or withdraw fiat funds, supervisors focus on the quality of sanctions controls, the consistency of decisions, and the evidence supporting those decisions. This page explains how exchanges can build screening processes that satisfy regulatory expectations while supporting fast onboarding and predictable payment flows. Each section is designed to give compliance leaders clear, actionable guidance they can apply immediately.

The aim is to provide a clear, practitioner focused view of what strong sanctions controls look like in a dynamic, high velocity environment.

Executive Summary

Fiat onboarding introduces regulatory obligations that require exchanges to demonstrate transparent decisions, disciplined list governance, and clear auditability. Strong screening foundations help exchanges maintain confidence in outcomes as customer volumes grow, reducing operational friction and strengthening the overall control framework. MLROs and compliance leaders can use this guidance to benchmark their screening environment against UK, EU, and US expectations.

Key Takeaways For MLROs

Senior compliance leaders can use these points to assess readiness:

Screening accuracy relies on structured data, transparent rule logic, and explainable match outcomes.

Thresholds must be supported with rationale grounded in recent behaviour and risk assessments.

Documentation and audit trails materially influence supervisory outcomes.

Adjudication layers help reduce noise at scale without weakening detection.

Why Sanctions Screening Matters For Crypto On-Ramps

Supervisors treat fiat deposits, withdrawals, and related payment activity as regulated financial activity. Exchanges must therefore apply sanctions controls that demonstrate consistent decision making and defensible governance. UK regulators emphasise evidence backed decisions.

EU authorities prioritise transparency and list governance. US regulators focus heavily on audit trails and dismissal justification.

Core Components Of Sanctions Screening For Crypto On-Ramps

An effective screening environment relies on accurate lists, transparent match logic, and structured workflows that make outcomes easy to trace and defend. Each component reinforces the others, creating a more stable and predictable control framework that remains effective under operational stress.

Watchlist Governance And List Integrity

Effective detection depends on current, structured lists with clear segmentation across customer onboarding and fiat flows. FacctList provides watchlist governance, ensuring consistent updates, normalisation routines, and alignment across systems.

Customer Screening During Fiat Onboarding

Exchanges must screen customer names and identifiers before enabling fiat access. FacctView offers configurable profiles, weighted scoring, and explainable match evidence to help analysts understand why an alert occurred.

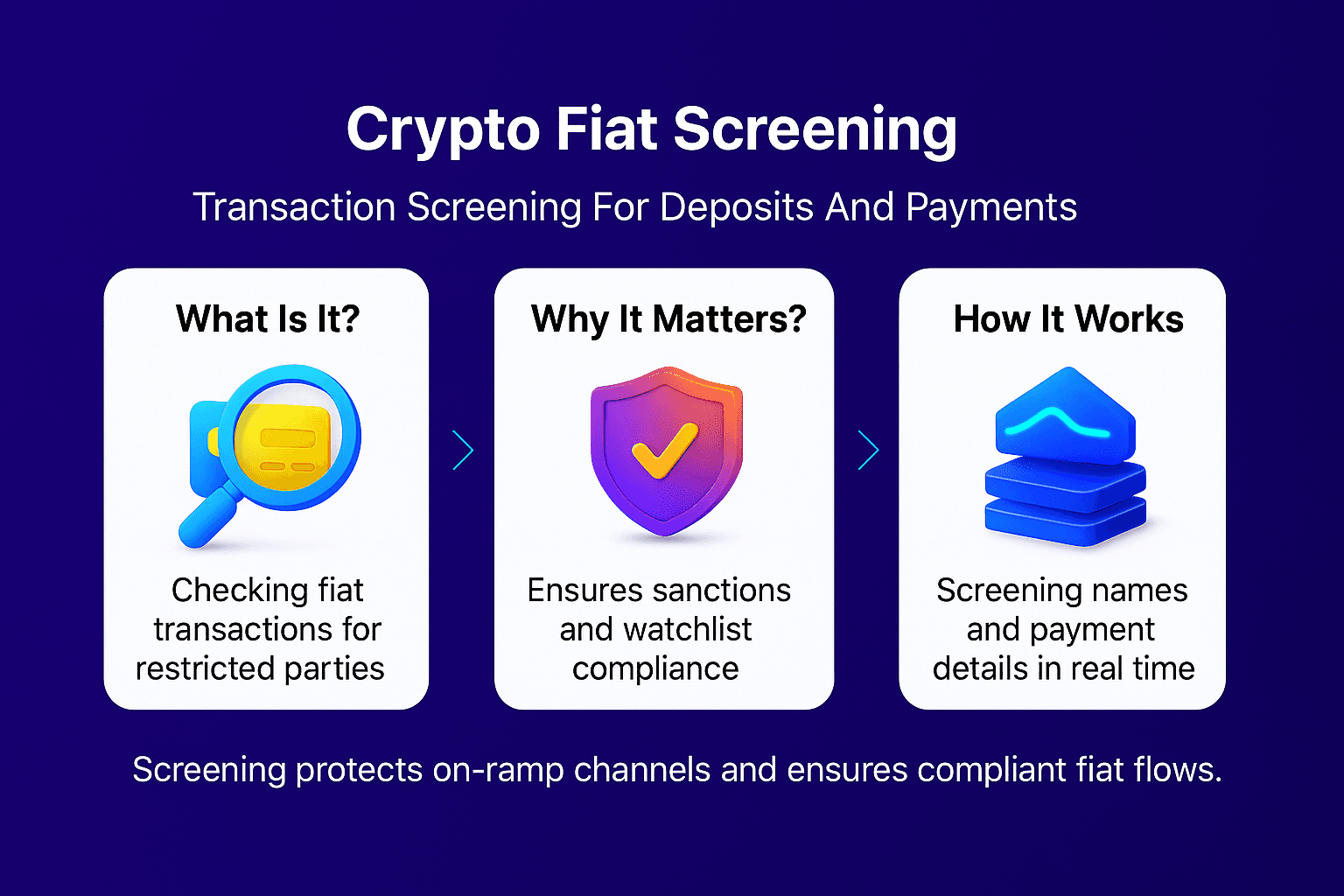

Payment Screening For Fiat Deposits And Withdrawals

Fiat movements require real time screening of transaction context and counterparties. FacctShield applies structured rule logic and list governance to deposits and withdrawals.

Adjudication To Improve Alert Quality

Automated adjudication enriches match evidence and estimates the likelihood of a true hit. This reduces noise and helps analysts prioritise meaningful alerts.

How Screening Decisions Are Made In Crypto Fiat Workflows

Screening performance depends on clear logic, thoughtful calibration, and disciplined review. Strong operational routines help maintain consistency across onboarding journeys, deposit behaviours, and diverse transaction types.

Evaluating Match Evidence

Weighted scoring highlights which attributes influenced a match, helping analysts assess its significance.

Analyst Review And Escalation

Analysts interpret evidence, apply internal policies, and document decisions in a traceable format aligned with supervisory expectations.

Documentation Expectations

Regulators expect clear justification for both true and dismissed alerts. Exchanges must show how decisions were reached and why certain rules or thresholds were applied.

Operational Challenges Crypto Exchanges Face In Fiat Screening

Customer behaviour and deposit patterns shift quickly, so screening controls must be able to adjust without creating instability. Adaptability in tuning and governance is essential for sustaining both accuracy and throughput without compromising customer experience.

High Onboarding Velocity

Fast sign up journeys create variability in data quality that can influence match outcomes.

Diverse Customer Profiles

Global user bases introduce naming conventions and formats that require flexible matching logic.

Instant Funding And Withdrawal Patterns

Real time deposits demand rules and adjudication models that maintain detection quality without slowing the customer experience.

What Good Looks Like In Crypto On-Ramp Sanctions Screening

Mature environments show strong governance, clear explainability, and consistent detection across all customer touchpoints. These characteristics give supervisors confidence that sanctions risks are being managed in a structured, transparent, and proportionate way.

Strong Governance And Clean Inputs

Reliable outcomes begin with accurate data, structured lists, and controlled update cycles.

Explainable Screening Logic

Clear rule behaviour and transparent evidence help supervisors understand why outcomes occurred.

Streamlined Alert Workflows

Adjudication layers reduce noise and improve analyst focus, especially during onboarding spikes.

Common Gaps Observed Across Crypto Fiat Screening Programs

Many exchanges encounter similar challenges as customer volumes and deposit activity scale, often revealing pain points that surface only when screening volumes increase or customer behaviour shifts suddenly.

Inconsistent Customer Data Quality

Incomplete or unstructured onboarding data undermines detection.

Overly Rigid Thresholds

Uniform thresholds generate excessive alerts across diverse profiles.

Limited Use Of Adjudication Layers

Manual triage alone cannot support high throughput environments.

How Crypto Exchanges Typically Strengthen Their Sanctions Screening Performance

Most improvement cycles begin with targeted analysis, followed by rule tuning and focused governance updates. Over time, these incremental adjustments create a more resilient and transparent control environment that can support sustained growth.

Step 1: Analyse Alert Drivers

Understanding which match attributes produce noise helps prioritise improvements.

Step 2: Improve List Governance

Structured list management enhances accuracy and reduces unnecessary alerts.

Step 3: Refine Thresholds And Adjudication

Calibrated rules and adjudication layers improve both detection and throughput.

Regional Screening Expectations Snapshot

Screening priorities vary across the UK, EU, and US.

United Kingdom: FCA Priorities

The FCA emphasises documented rationale for thresholds, evidence based decisions, and reliable validation cycles, as outlined in the FCA’s SYSC 6.3 financial crime guidance.

European Union: AMLD And EBA Guidance

EU authorities focus on transparent rule logic, structured list governance, and alignment with risk factor guidelines, consistent with the EBA ML/TF risk factor guidance.

United States: OFAC And FinCEN Expectations

US regulators require strict list governance, clear justification for dismissals, and auditable decision trails, as reflected in OFAC’s sanctions compliance guidance.

Sanctions Screening Maturity Model For Crypto Fiat On-Ramps

This maturity model shows how exchanges advance their controls.

Level 1: Basic Controls

Manual list updates.

Limited documentation.

One size fits all thresholds.

Level 2: Emerging Structure

Governance routines begin.

Partial adjudication.

Some decision rationale recorded.

Level 3: Established Screening Framework

Transparent rule behaviour.

Evidence based calibration.

Clear documentation.

Level 4: Advanced, Defensible Controls

Consistent governance.

Data driven tuning.

Explainable outcomes.

Capability Map For Effective Fiat On-Ramp Screening

An effective sanctions control framework relies on a set of well defined capabilities that reinforce one another. Gaps in any capability often create downstream inefficiencies, inconsistent decisions, or unclear audit trails.

List Governance Capability

FacctList supports segmentation, normalisation, and consistent list management, as described in our watchlist management page..

Customer Name Screening Capability

FacctView provides configurable matching and explainable evidence, reflecting the configuration principles used in our customer screening capability..

Payment Screening Capability

FacctShield applies structured logic to deposits and withdrawals.

Adjudication Capability

Automated adjudication estimates true hit likelihood and improves prioritisation.

Auditability And Documentation Capability

Traceable decisions support internal assurance and regulatory reviews.

Compliance Risk Scenarios Crypto Exchanges Should Prepare For

Supervisors often test whether exchanges can identify the risks most relevant to their business model and demonstrate how they are managed.

Scenario 1: Multiple Name Variations On Initial Deposit

Disparate naming formats require weighted scoring and adjudication to avoid missed detections.

Scenario 2: High Velocity Deposit Spikes

Scaling rules and adjudication helps screening keep pace with onboarding surges.

Scenario 3: Withdrawals To Higher Risk Jurisdictions

Geographic context must inform alerting thresholds and review processes.

Scenario 4: Partner Channels With Unfamiliar Profile Formats

List governance and structured scoring reduce uncertainty when integrating external partners.

Next Steps For Your Organisation

Exchanges preparing for regulatory engagement often begin by reviewing match drivers, threshold behaviour, and the strength of their documentation. These insights help shape practical improvement plans that enhance accuracy, defensibility, and operational confidence. Even small improvements in governance or adjudication can deliver measurable benefits.

If you would like practical guidance on improving match outcomes or aligning your screening environment with FCA, EU, or US expectations, you can reach out through our contact page to discuss a focused review shaped around the needs of your operating model and the regulatory expectations governing your markets.

Frequently Asked Questions