In anti-money laundering (AML) programmes, watchlists and customer screening are often discussed together but serve distinct purposes. Watchlists are curated regulatory datasets, while customer screening is the process of comparing those datasets to customer or counterparty information. Understanding how they work together helps compliance teams build a stronger, more efficient risk detection framework.

Quick Summary

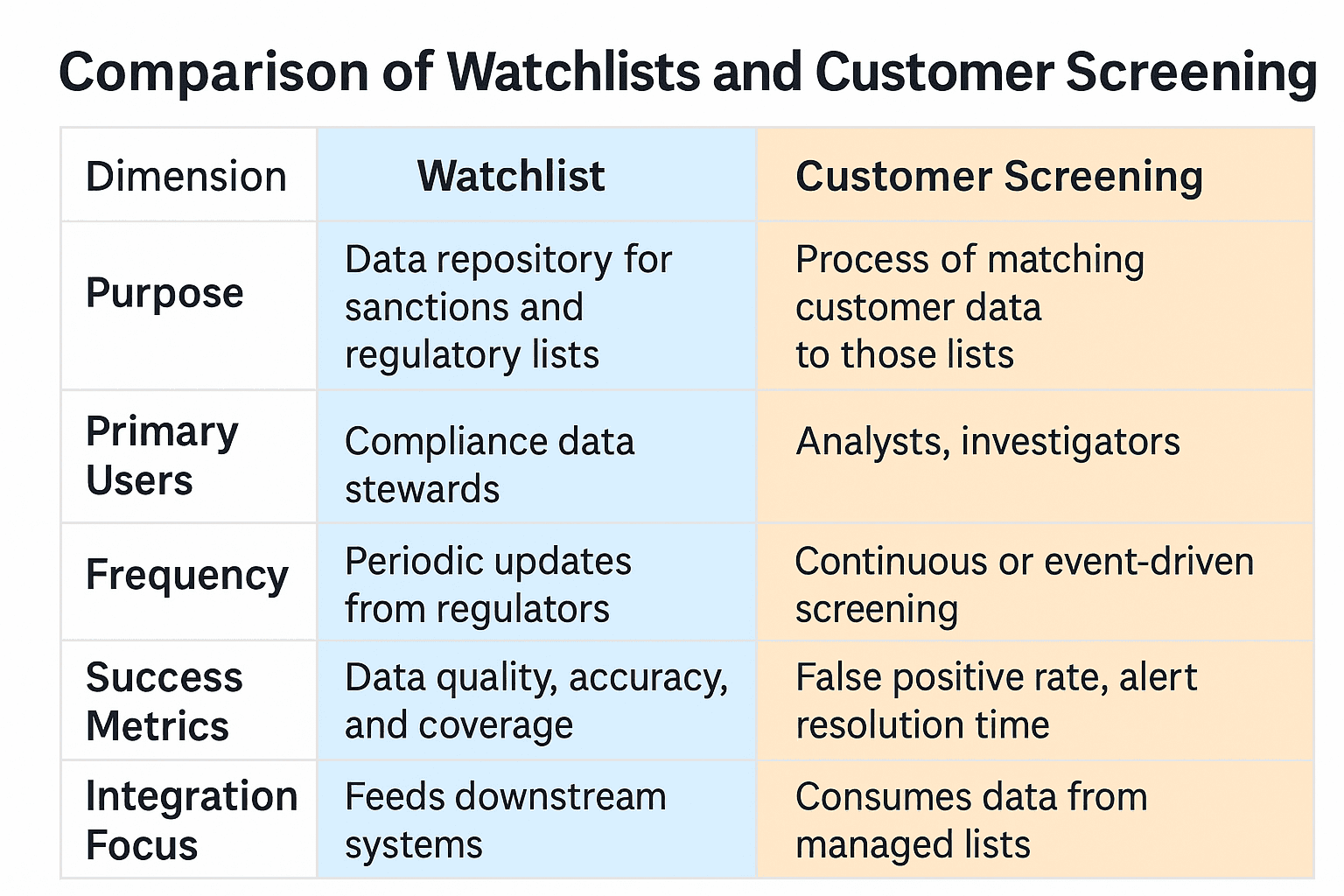

Before diving deeper, here’s how these two components differ and interact in the compliance process:

Watchlists are datasets from official bodies such as OFAC, the UN, and OFSI that identify sanctioned or high-risk entities.

Customer screening is the active process of matching these lists against customers, beneficial owners, and counterparties to detect potential risks.

Together, they underpin every AML and sanctions compliance workflow, ensuring accuracy, transparency, and regulatory alignment.

Watchlist Definition

Watchlists are authoritative collections of names and entities subject to sanctions, restrictions, or political exposure. These datasets include government-issued sanctions lists, politically exposed persons (PEPs), and other regulatory sources.

Institutions rely on structured watchlist management systems to curate, update, and distribute these lists in a consistent and auditable format. Strong data governance ensures every screening process references a single, up-to-date source of truth.

Customer Screening Definition

Customer screening is the process of comparing internal or external customer data against official and internal lists. It uses fuzzy matching, transliteration, and AI-driven logic to detect potential matches efficiently.

Solutions like customer screening allow institutions to perform these checks in real time or batch mode, maintaining both compliance and speed in onboarding and ongoing monitoring.

Key Differences

Although they’re part of the same compliance ecosystem, watchlists and customer screening solve different problems. The table below highlights the main distinctions and shared goals.

Both are essential for maintaining effective AML controls. Accurate watchlists enhance the precision of customer screening, while feedback from screening outcomes informs future list refinement.

Benefits of Watchlists

Maintaining accurate watchlists reduces compliance risk, increases data reliability, and strengthens audit readiness.

Benefits include:

Enhanced control over sanctions data lineage and provenance

Reliable and automated distribution across screening engines

Reduced false positives and missed matches through standardised updates

Effective watchlist management supports operational consistency and regulatory confidence across all screening environments.

Benefits of Customer Screening

Customer screening helps identify high-risk relationships, automate detection, and maintain compliance with international standards.

Key benefits include:

Faster onboarding and transaction approval cycles

Lower alert fatigue through precise matching thresholds

Real-time compliance with FATF and OFAC expectations

Well-calibrated screening workflows not only meet regulatory obligations but also protect institutional reputation and operational efficiency.

How They Work Together

When integrated, watchlists and customer screening form a continuous control cycle. Managed lists supply governed data to screening systems, while alerts generated from screening provide feedback that strengthens future list accuracy.

This feedback loop ensures ongoing optimisation across compliance operations. Teams that link both solutions, often alongside alert adjudication, gain improved transparency and faster case resolution. Real-time collaboration between data management and investigative teams ensures every control layer reinforces the other.

External Standards and Regulatory Context

Regulators expect both watchlist and screening controls to align with international frameworks such as the FATF Recommendations, OFSI Sanctions Lists, and the IMF AML-CFT Framework. These sources outline obligations around data accuracy, screening frequency, and governance reporting.

Aligning systems with these frameworks not only ensures compliance but also reduces exposure to operational and reputational risk.