Real-time and batch screening are two key models for sanctions and transaction compliance. While both ensure financial institutions meet global AML obligations, they differ in timing, infrastructure, and risk response. Understanding how they complement each other helps compliance teams balance efficiency and accuracy.

What Is Real-Time Screening?

Real-time screening checks customers and transactions against sanctions and PEP lists instantly, before a payment or onboarding event is completed. It allows organisations to stop high-risk or prohibited activity as it happens, improving protection against compliance breaches.

Financial institutions often use customer screening and payment screening systems to enable low-latency decisions across high-speed channels such as card payments and instant transfers.

What Is Batch Screening?

Batch screening runs large volumes of customer or transaction data against sanctions lists at scheduled intervals. It’s commonly used for overnight processing, periodic KYC refreshes, and retrospective compliance checks. This approach is less resource-intensive but offers slower feedback loops.

For insights into how screening data management improves accuracy and speed, read the watchlist data management blog.

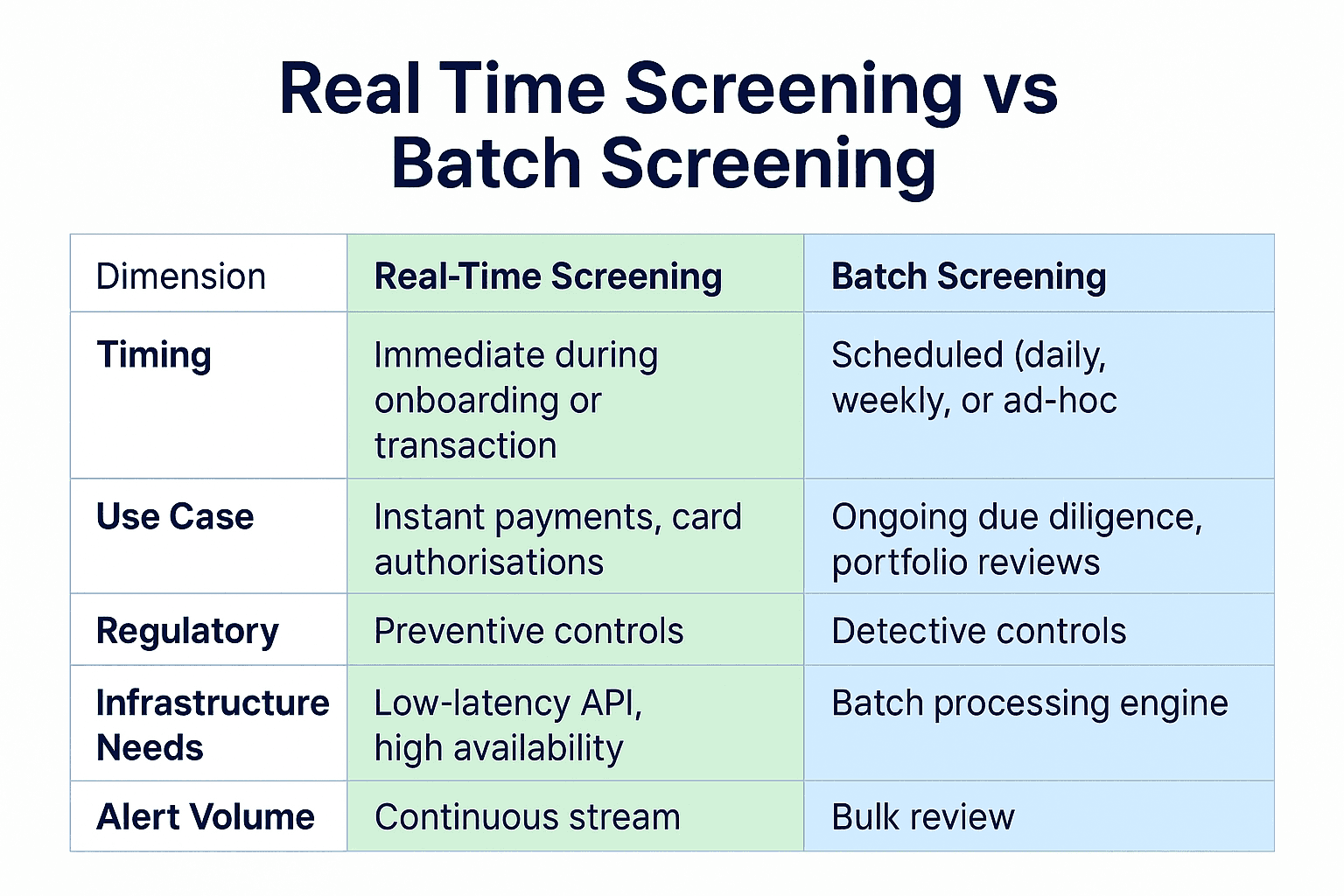

Key Differences Between Real-Time and Batch Screening

Below is a comparison table outlining their primary distinctions. Including a short summary before the table helps search engines understand context and users grasp relevance quickly.

Real-time screening emphasises speed, automation, and pre-transaction blocking, whereas batch screening focuses on periodic assurance and cost control. The table clarifies where each method fits best.

Benefits of Each Approach

Before selecting a screening model, organisations should consider their compliance maturity, system architecture, and risk appetite. Each approach offers unique operational and regulatory advantages.

Benefits of Real-Time Screening

Real-time screening allows immediate risk detection and blocking of sanctioned activity. This capability is critical in high-speed payment ecosystems such as SEPA Instant and FedNow.

It helps prevent reputational damage and regulatory fines.

Enables instant detection of sanctions matches before transaction settlement.

Reduces exposure to false negatives through dynamic, risk-based updates.

Meets expectations outlined in the FCA’s sanctions guidance for proactive controls.

Benefits of Batch Screening

Batch screening provides an efficient way to monitor large datasets while maintaining accuracy and compliance.

Optimises resource usage by processing during low-traffic periods.

Facilitates retrospective monitoring and KYC refreshes.

Supports audit trails and post-event investigations aligned with the FATF Recommendations.

How Real-Time and Batch Screening Work Together

In most compliance architectures, both screening types coexist. Real-time controls act as the first line of defence, while batch processes ensure continuous monitoring and data reconciliation.

Feedback Loops: Results from batch reviews improve threshold settings for real-time systems.

Data Synchronisation: A unified watchlist governance process ensures consistency across both workflows.

Alert Escalation: Unresolved or complex matches identified in either mode are passed to alert adjudication teams for case resolution and investigation.

Implementation Best Practices

To meet regulatory expectations and operational performance goals, both screening modes must align under a unified governance framework.

Data Governance and Integration

Establish a single source of truth for list management and integrate version-controlled data across both screening workflows. Consistency in data lineage supports explainability and compliance transparency.

Workflow Automation

Automated triage and escalation accelerate the resolution of alerts. As outlined in the IMF’s AML-CFT guidance, automation enhances efficiency without compromising regulatory accountability.

Summary

Real-time and batch screening serve distinct but complementary roles. Real-time screening prevents high-risk transactions before completion, while batch screening ensures ongoing compliance and data integrity. The most effective AML programmes use both models in tandem for full coverage.