List management and name screening are often used interchangeably, yet they perform different functions within a compliance ecosystem. List management governs the creation and control of sanctions or PEP lists, while name screening applies those lists to customer data to identify risks. Understanding both is key to building efficient, defensible AML processes.

Quick Overview

Before comparing them in detail, it helps to see how they operate across the compliance lifecycle. Each plays a unique role but works best when seamlessly connected.

List Management handles data governance, version control, and distribution of watchlists across systems.

Name Screening uses those lists to match customer or counterparty names, generating alerts where potential risks are found.

Together, they ensure consistent, accurate, and real-time compliance coverage.

Defining Each Function

Understanding the difference begins with their purpose: one manages the data; the other applies it.

What Is List Management?

List management is the process of collecting, cleaning, and maintaining official or internal watchlists. It focuses on ensuring accuracy and auditability, preventing errors from duplicated or outdated records. Tools like watchlist management streamline these tasks through automated data governance and version control.

What Is Name Screening?

Name screening applies these curated lists to customer and transaction data to identify high-risk or sanctioned entities. It involves fuzzy matching, transliteration handling, and context analysis to reduce false positives. Platforms like customer screening deliver accurate results in real time, enabling faster onboarding and transaction decisions.

Key Differences

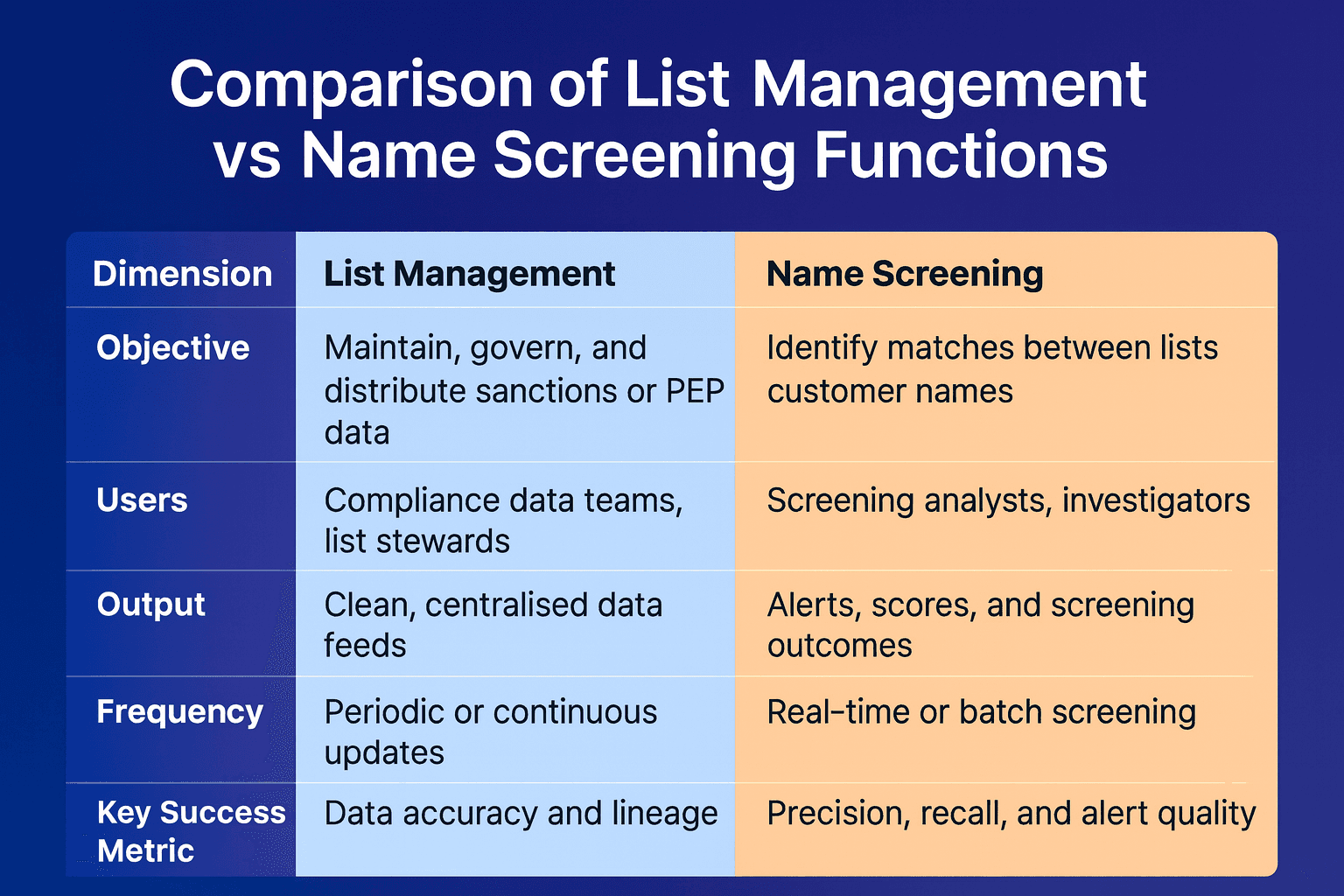

The table below outlines how the two processes differ in purpose, users, and outcomes while remaining closely connected within AML operations.

List management ensures the foundation is solid; name screening applies that foundation to practical detection tasks.

How They Interlink

These capabilities depend on one another to function effectively.

Data Integrity: Clean, versioned lists make screening faster and more accurate.

Feedback Loops: Resolved screening alerts can highlight data quality issues, helping improve list governance.

Transparency: Together they support traceable, audit-ready compliance operations, a growing expectation under global frameworks like the FATF Recommendations.

Benefits of Connecting Both

When integrated properly, list management and name screening create measurable business and regulatory advantages.

Reduced Alert Volume: High-quality data lowers false positives, saving analyst time.

Faster Decisions: Real-time updates ensure screening reflects current risk exposure.

Regulatory Confidence: Clear data lineage and explainability improve audit outcomes and strengthen trust with regulators like the Financial Conduct Authority (FCA).

These combined benefits not only strengthen operational resilience but also help align compliance programs with modern risk-based approaches.

Implementation Considerations

Practical deployment requires both technical and procedural alignment.

Data Control and Versioning

Ensure every update is logged, with clear metadata showing source, timestamp, and changes. Centralised list management systems provide the governance backbone that screening engines rely on.

Matching Accuracy and Explainability

Effective name screening requires transparent algorithms and contextual match scoring. This is often supported through fuzzy or AI-driven matching models that help reduce false negatives without overwhelming compliance teams.

The Role of Alert Adjudication

Even with clean data and strong screening, alerts still need resolution. This is where alert adjudication plays a critical role, providing structured workflows for investigation, documentation, and closure.

Good adjudication connects back to list management and name screening by:

Feeding false-positive patterns into rule tuning.

Highlighting recurring data or transliteration issues.

Ensuring every decision has a clear audit trail for supervisors.

External Standards and Guidance

Regulators and global bodies provide direction on both data governance and screening expectations. The IMF AML/CFT framework offers a global perspective on risk control, while the European Banking Authority defines specific operational standards for EU financial institutions.

What to Read Next?

To explore related solutions:

See how governance works in watchlist management.

Learn how screening precision improves through customer screening.

Discover how adjudication unites both with alert adjudication.

Or contact the team via contact for tailored advice on building an integrated compliance stack.