Customer screening and payment screening are two foundational AML controls that work at different stages of the compliance lifecycle. Both aim to detect sanctioned or high-risk entities but differ in timing, data inputs, and operational impact. Understanding their distinctions helps compliance teams design faster, more effective, and regulator-aligned screening frameworks.

Facctum Customer Screening (FacctView) and Facctum Payment Screening (FacctShield) are complementary compliance solutions designed for different points in the risk lifecycle. Together, they deliver a seamless, real-time compliance environment for both customer due diligence and payment-level control.

Why This Comparison Matters for Compliance Teams

Firms often deploy customer and payment screening within separate systems or business units. Without clarity, this can create redundant alerts or missed risks. A structured comparison helps teams identify where to optimize data flows, align thresholds, and improve efficiency while maintaining regulatory confidence.

Core Functions and Objectives

Customer screening focuses on identifying risks before a relationship begins or during ongoing due diligence. Payment screening operates in real time to stop prohibited transactions before settlement. The two functions complement each other, forming a comprehensive first and second line of defence.

What Is Customer Screening?

Customer screening, sometimes called name screening, involves checking individuals or entities against sanctions, politically exposed person (PEP), and adverse media lists. It’s used at onboarding and throughout the customer lifecycle to maintain compliance with evolving regulations. Explore the capability in detail on the customer screening page.

What Is Payment Screening?

Payment screening checks transactions against watchlists at the point of execution. It ensures payments are not sent to or received from sanctioned parties or jurisdictions. This process must run in real time, often within milliseconds, to avoid disrupting transaction speed. Facctum Payment Screening is API-native and supports sub-second screening for ISO 20022 and SWIFT MT/MX formats..

Comparison of Key Parameters

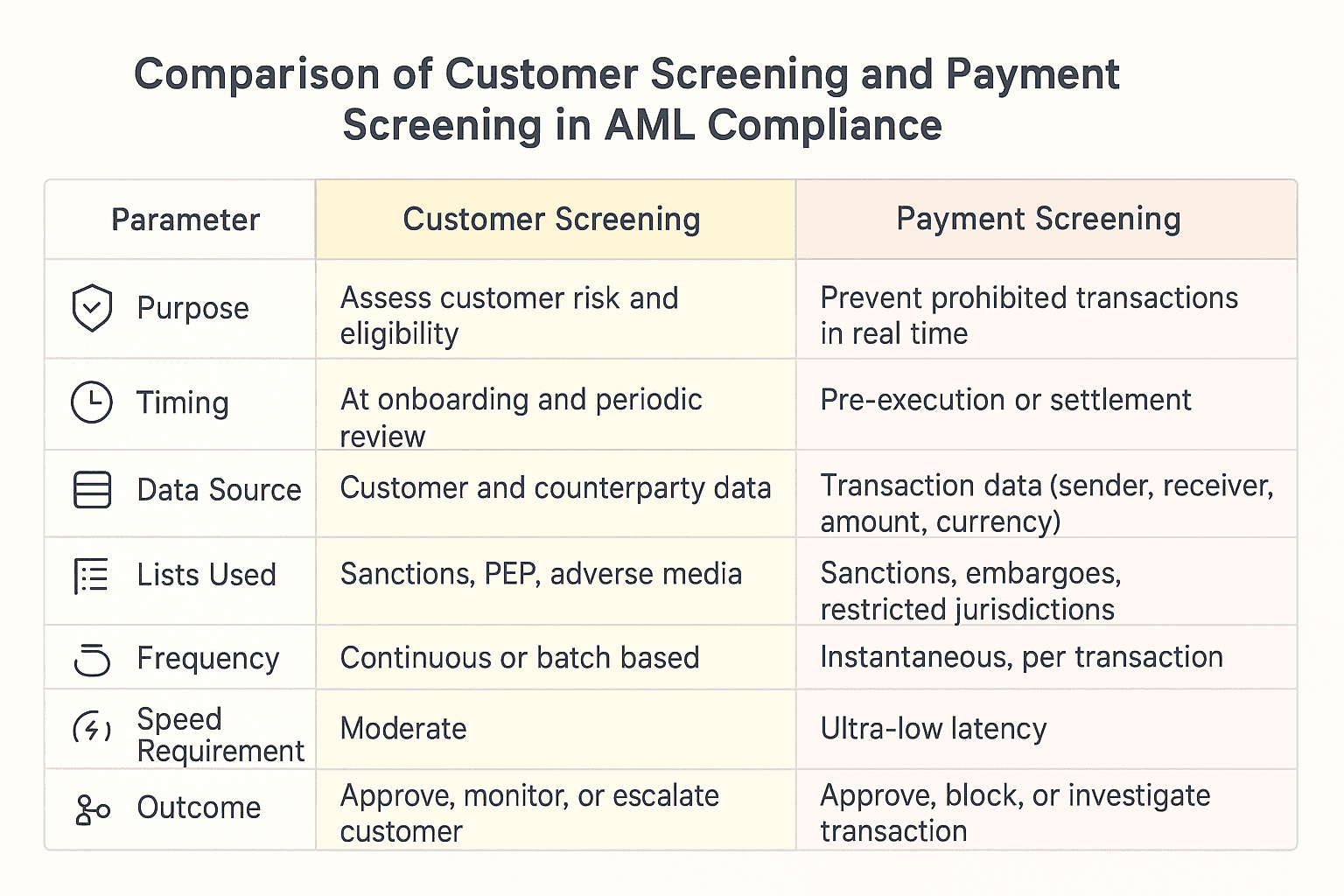

The table below summarizes how customer and payment screening differ in purpose, timing, and operational approach.

Both layers reinforce each other, customer screening establishes who you’re dealing with, while payment screening monitors how they transact. The combination enhances overall AML resilience.

Regulatory Expectations and Industry Standards

Global regulators require institutions to maintain screening controls that operate both at onboarding and at the point of transaction. Guidance from the Financial Action Task Force (FATF) through its Forty Recommendations, as well as the UK Financial Conduct Authority (FCA)’s guidance on financial crime systems and controls, outlines these obligations. The U.S. Treasury’s OFAC also maintains a live sanctions list resource for global compliance teams.

Integration and Data Interoperability

For optimal performance, customer screening and payment screening should share core reference data, especially from watchlist management and list management systems. Centralizing lists reduces duplication and improves accuracy. Learn how list governance supports compliance in our watchlist management resource and glossary entry on list management.

Data synchronization ensures consistent results between systems. Without this, false positives may rise due to mismatched list versions or scoring parameters. The blog on applying data management to sanctions screening provides deeper insights into improving list accuracy.

Performance and Operational Considerations

Each control has unique performance requirements:

Customer Screening: Accuracy is prioritized over speed. Analysts can review alerts manually, leveraging alert adjudication processes for decision quality.

Payment Screening: Speed is critical. Decisions must occur automatically to avoid delays in settlement or compliance breaches.

Both systems apply machine learning and configurable decision logic to reduce false positives and improve match precision. Connecting these controls through intelligent rules reduces duplication, strengthens efficiency, and improves regulator confidence.

Typical Workflow Integration

Customer and payment screening form part of a continuous compliance loop.

Onboarding: Customer is screened and risk-rated.

Monitoring: Continuous due diligence and automatic re-screening triggered by watchlist or data changes.

Transaction Stage: Payments screened in real time.

Alert Handling: If payment screening generates alerts, they can reference customer-level screening data for faster adjudication.

Integrating these stages ensures data flows seamlessly from initial due diligence through ongoing monitoring and real-time payment validation.

Common Challenges and Mitigation Strategies

Institutions face several challenges when operating both screening systems independently.

These include:

Duplicate alerts due to inconsistent watchlist sources.

Data latency between customer and payment systems.

Fragmented audit trails across multiple platforms.

Mitigating these challenges involves aligning data governance, centralizing list management, and defining escalation logic that feeds directly into alert adjudication workflows.

Summary and Next Steps

Customer screening and payment screening each play a vital role in AML defence. Customer screening ensures only compliant clients enter the system, while payment screening safeguards every transaction that follows. Integrating both functions enables end-to-end compliance visibility, reduced false positives, and faster regulatory response times.

Compliance teams seeking to strengthen their screening workflows can start by aligning customer and payment screening data, improving list quality, and exploring Facctum’s modular solutions through the contact page.