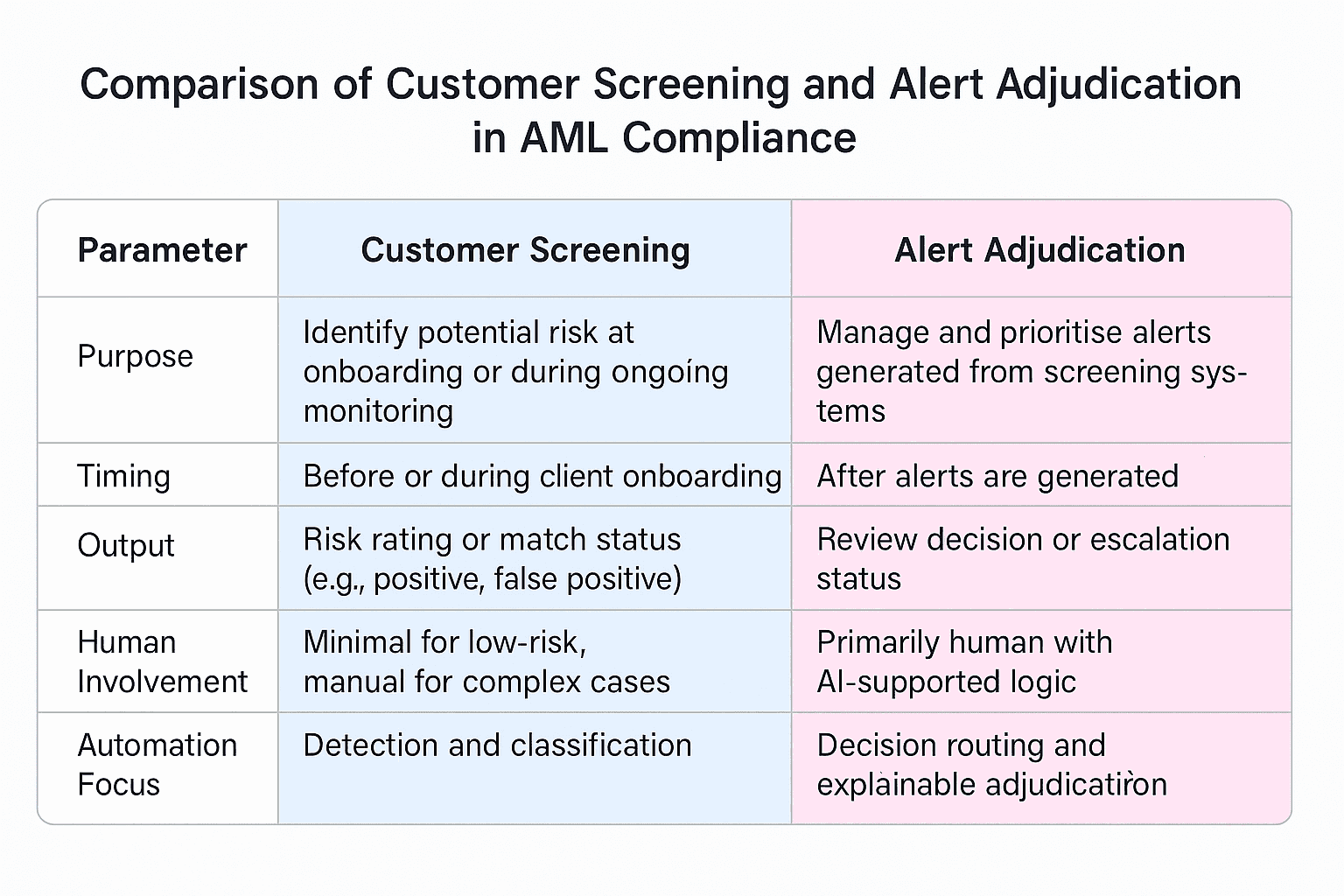

Customer screening and alert adjudication are two essential layers in a modern AML compliance framework. While both address risk detection, they serve different functions. Customer screening identifies potential risks during onboarding and monitoring, whereas alert adjudication determines how those risks are reviewed, prioritised, and escalated. Understanding how they differ, and integrate, helps financial institutions optimise operational efficiency and compliance accuracy.

Facctum’s technology ecosystem distinguishes between these two domains: customer screening detects potential risks, and alert adjudication orchestrates the review of those alerts with explainable logic and regulatory transparency.

Why This Comparison Matters

AML and sanctions screening programmes generate vast volumes of alerts. Without structured adjudication, analysts can be overwhelmed, leading to delays or inconsistent decisions. Comparing customer screening and alert adjudication clarifies how data, timing, and human oversight interact within the compliance workflow.

Purpose and Core Functions

Customer screening focuses on identifying who poses a risk. Alert adjudication focuses on deciding what to do with that risk once detected.

What Is Customer Screening?

Customer screening is the process of checking individuals or entities against sanctions, politically exposed person (PEP), and adverse media lists. It occurs at onboarding and continues through the customer lifecycle. Its goal is to ensure the institution does not engage with prohibited or high-risk clients. Learn more on the customer screening page.

What Is Alert Adjudication?

Alert adjudication is the structured process of analysing, prioritising, and managing alerts generated by compliance systems such as screening or monitoring tools. It applies defined decision logic, risk scoring, and review assignments to streamline alert handling. Explore how this function supports automation and transparency on the alert adjudication page.

Timing and Workflow Differences

Customer screening operates at the point of onboarding or periodic review, while alert adjudication functions after alerts are triggered. Both rely on consistent data sources and accurate watchlist information to ensure reliable outcomes.

Together, these two stages transform raw alerts into auditable, risk-based decisions. Screening identifies what may be risky; adjudication decides how to act on it.

Data and System Interoperability

Data consistency between customer screening and alert adjudication determines how effectively alerts are handled. When customer screening systems share structured data with adjudication platforms, decision-making becomes faster and more accurate.

This connection is strengthened by unified list management and watchlist management practices that maintain reliable source data. See how structured watchlist governance improves screening accuracy in watchlist management and related best practices from the blog on watchlist accuracy.

Regulatory Context

Regulators expect that AML processes not only detect risk but also demonstrate how decisions are made. The Financial Action Task Force (FATF) highlights the importance of transparent and auditable decision frameworks in its Forty Recommendations.

The UK Financial Conduct Authority (FCA) also outlines expectations for financial crime systems and controls, including the need for clear documentation of alert handling procedures.

In the United States, the Office of Foreign Assets Control (OFAC) provides compliance guidance on sanctions enforcement through its framework for compliance commitments, which underscores the role of consistent alert management in risk governance.

Common Challenges and Mitigation

Operating screening and adjudication systems separately can cause inefficiencies. Challenges include duplicated alerts, inconsistent escalation logic, and disconnected audit trails.

To mitigate these issues:

Align both systems under a unified data model.

Maintain consistent watchlist sources across tools.

Use transparent explainability features to justify decisions to regulators.

Learn more about improving alert workflows in the blog on smarter alert management.

Operational Integration Benefits

Integrating customer screening with alert adjudication improves both detection and decision-making quality.

Data interoperability ensures:

Fewer duplicate alerts through centralised list governance.

Faster risk assessments supported by machine learning.

Improved auditability and regulator confidence.

Together, they enable a risk-based approach aligned with global compliance standards and strengthen overall operational resilience.

Summary and Key Insights

Customer screening identifies risk; alert adjudication explains and manages it. The first step ensures no risky clients are onboarded, while the second ensures all alerts are reviewed consistently and documented transparently.

When connected through accurate data and governance, these systems help compliance teams achieve both speed and precision.

To explore how integrated screening and adjudication enhance compliance efficiency, connect with our team via the contact page.