Watchlist Management

Key Weapon in the Fight Against Fraud: The Mobile Number Revocation List (MNRL)

Understanding and utilising the Mobile Number Revocation List (MNRL) is crucial for enhanced digital security. The Reserve Bank of India (RBI) is proactively tackling the rising threat of financial fraud in our increasingly digital world. Recognising the central role of mobile phones in modern transactions, the RBI has implemented a series of mandatory measures for banks and financial institutions.

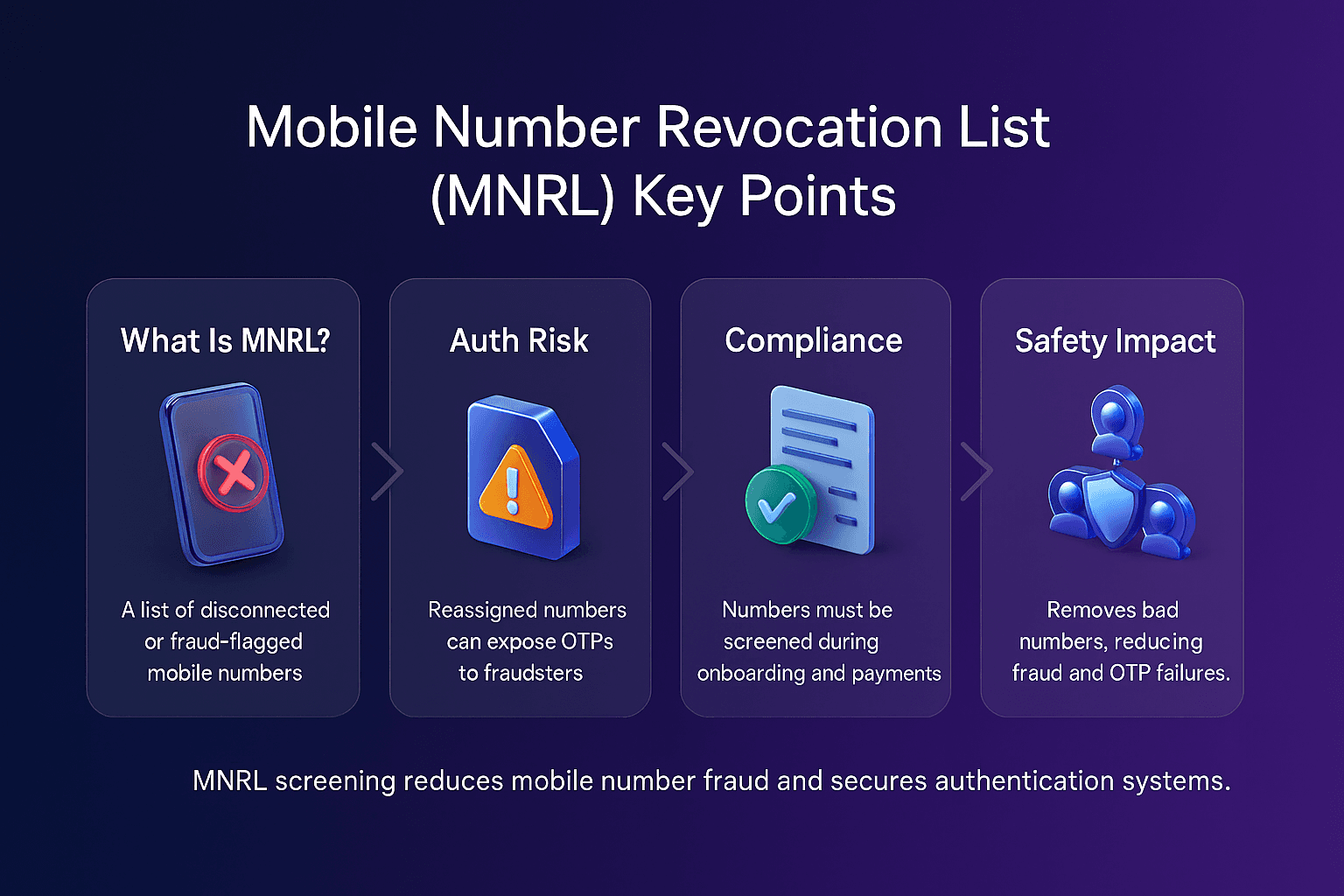

At the heart of this strategy is the Mobile Number Revocation List (MNRL), a powerful tool designed to enhance security and protect consumers. These measures must be in place by 31st March 2025.

The RBI is committed to building a more secure and trustworthy digital financial landscape, and the MNRL is a crucial component of this commitment, providing banks and financial institutions with a vital resource in the ongoing fight against fraud. A cornerstone of the RBI's approach is the mandatory use of the MNRL.

This powerful tool, accessible via the Department of Telecommunications (DOT)' Digital Intelligence Platform (DIP), allows businesses to identify and monitor mobile numbers linked to fraudulent activity or that have been compromised. By leveraging the MNRL, banks can proactively cleanse their customer databases, preventing fraudsters from exploiting revoked numbers to access accounts or perpetrate illicit transactions. Let's delve into what the MNRL is, how it works, and how it fits into the RBI's broader strategy for safeguarding digital transactions.

Once the full name and MNRL is introduced in the first paragraph, do you refer to it as MNRL going forward? should we just reference banks here, or businesses?

What is the Mobile Number Revocation List (MNRL)?

The MNRL is a digitally signed list of permanently disconnected mobile numbers and active numbers that have been involved in fraudulent or financial crime related activities. Firms gain access to this list through a real-time feed which will soon be made available in the DIP portal of DOT.

The Significance of Mobile Numbers & The Problem They Present

In India, both public and private organisations depend heavily on mobile numbers for customer identification and authentication. These numbers are essential for authorising services, often through one-time passwords (OTPs). However, this reliance also creates a vulnerability. When a mobile number is surrendered or disconnected, it can be reassigned. Previous users often fail to update their contact details, creating an opportunity for fraudsters to potentially access accounts or sensitive information.

The Purpose of the MNRL: Bridging the Gap

The MNRL directly addresses this vulnerability. It provides a clear and efficient mechanism for organisations to update their databases, ensuring that sensitive information, such as OTPs, [CO1] are not sent to a reassigned number.

Benefits for Financial Institutions

The MNRL is invaluable for banks, non-banking financial institutions, and other regulated entities. It empowers them to proactively identify and flag customer accounts linked to disconnected phone numbers or numbers with fraudulent activity associated, enabling them to prompt customers to update their details, significantly reducing the risk of unauthorised access and fraud.

Responsibilities: Shared Accountability

User agencies are responsible for using the MNRL data responsibly and in compliance with all relevant regulations and guidelines. They are accountable for any issues arising from the use of disconnected numbers.

Key Considerations: Prudent Use is Essential

The MNRL is an indicative list provided by telephone service providers ( TSP[CO2] s). Some numbers may be reactivated. Therefore, user agencies must implement their own verification procedures before acting on MNRL data. The responsibility for its prudent use rests entirely with the user.

Boosting Customer Confidence and Transparency: Building Trust

Beyond the MNRL, the RBI is focused on increasing transparency and building customer trust. Financial institutions are now required to share their verified customer care numbers with the DIP, which will be published on the 'Sanchar Saathi' portal, making it easier for customers to access legitimate support channels and avoid scams.

Streamlining Communication and Preventing Misuse: Enhancing Security

To further strengthen security, the RBI has introduced specific numbering series for different types of communication. Transactional and service-related calls will use the '1600xx' series, while promotional calls will use the '140xx' series. This helps customers identify the nature of incoming calls.

Serious Consequences for Non-Compliance: Reinforcing Standards

The RBI has issued strong warnings about non-compliance. Financial institutions that fail to implement these measures or engage in fraudulent practices face severe penalties, including suspension of services, blacklisting, or legal action.

A Safer Digital Financial Landscape: A Collaborative Effort

Through these comprehensive measures, including the crucial MNRL initiative, the RBI is working to create a more secure and trustworthy environment for digital transactions in India. The emphasis on transparency, accountability, and customer protection underscores the RBI's commitment to safeguarding the integrity of the financial system and combating the evolving threat of fraud.

Looking to screen against the mobile revocation list?

Contact us today to see for yourself how our sanctions screening solutions can help you achieve this.