AML Compliance

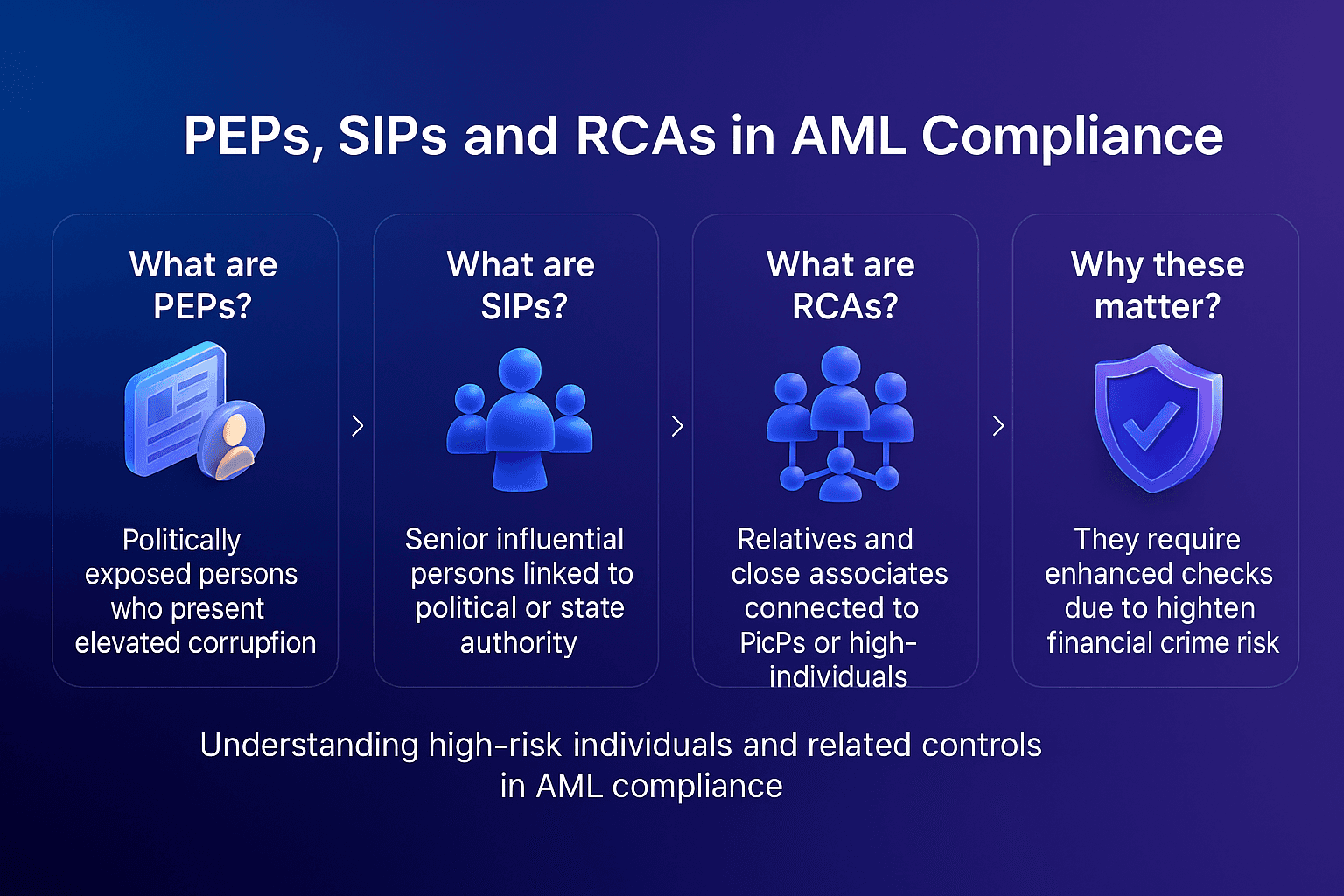

In anti-money laundering (AML) compliance, identifying and monitoring high-risk individuals is essential. Regulators expect financial institutions to detect and manage relationships with Politically Exposed Persons (PEPs), Special Interest Persons (SIPs), and Relatives and Close Associates (RCAs).

These categories carry unique risks for financial crime, corruption, and reputational damage. This article defines each of them, explains the regulatory guidelines, and explores how technology can help institutions manage their obligations effectively.

Politically Exposed Persons (PEPs)

A Politically Exposed Person (PEP) is an individual who holds or has previously held a prominent public function. This can include government ministers, ambassadors, members of parliament, or executives at state-owned enterprises.

Because of their political influence and access to resources, PEPs are considered high-risk clients. The FATF requires additional AML/CFT measures, such as enhanced customer due diligence and senior management approval, for business relationships with PEPs, but clarifies that these measures are preventive rather than implying criminal wrongdoing.

Understanding Politically Exposed Persons (PEPs)

PEPs fall into several categories, each carrying distinct compliance challenges. Firms must have processes in place to identify them at onboarding and throughout the customer relationship.

Types of PEPs

Domestic PEPs: Political figures within a home jurisdiction.

Foreign PEPs: Political figures abroad, often presenting higher risk.

International PEPs: Officials in global bodies such as the IMF or United Nations.

Screening PEPs in Compliance

Effective monitoring involves verifying sources of wealth, monitoring transactions, and flagging anomalies. FacctView, Customer Screening enables institutions to identify PEPs in real time and reduce false positives through intelligent matching.

Special Interest Persons (SIPs)

A Special Interest Person (SIP) is an individual identified as high-risk by regulators or intelligence agencies due to suspected links with criminal networks, terrorist financing, or sanctions exposure.

Unlike PEPs, SIPs are defined by evolving investigations and risk signals rather than political status. Since there is no single global definition, institutions must rely on regulatory guidance, adverse media checks, and intelligence databases to monitor SIPs effectively.

Special Interest Persons (SIPs) Explained

SIPs can shift risk categories rapidly. For instance, a person may move from being a subject of investigation to a sanctioned entity. Continuous monitoring is therefore crucial.

Regulatory Expectations for SIPs

While the term SIP may not have formal regulatory standing, UK regulators such as the FCA expect firms to include individuals flagged via credible adverse media or official intelligence within their AML frameworks. For example, FCA findings highlighted failures to act on adverse media that suggested possible illicit links. FacctList, Watchlist Management supports this process by consolidating official lists and media sources for screening.

Continuous Monitoring of SIPs

Because risks change quickly, monitoring cannot be static. FacctShield, Payment Screening provides ongoing transaction-level checks to prevent illicit flows from being processed.

Relatives and Close Associates (RCAs)

Relatives and Close Associates (RCAs) are individuals linked to PEPs or SIPs through family or personal ties. Examples include spouses, children, parents, siblings, or business partners.

Although RCAs may not hold influence themselves, they are often used as intermediaries to disguise financial activity. Regulators emphasize that ignoring RCAs creates blind spots in compliance controls.

Relatives and Close Associates (RCAs)

RCAs are difficult to detect because their relationships are often informal or hidden. Compliance teams must deploy advanced screening tools capable of uncovering indirect connections.

RCA Identification Challenges

Data on RCAs may be incomplete or poorly structured. Advanced matching, powered by FacctList, Watchlist Management, helps reveal hidden relationships by combining structured lists with media sources.

RCA Screening Best Practices

Collect relationship data during onboarding.

Screen against RCA-specific lists and databases.

Use link analysis to reveal indirect or informal ties.

Guidelines for Screening PEPs, SIPs, and RCAs

Financial institutions are expected to take a risk-based approach when screening these groups. This means applying enhanced scrutiny where risk is highest while maintaining coverage across all categories.

FATF and Regulatory Frameworks

The FATF Recommendations provide global standards, but implementation varies. For example, EU directives and UK rules require firms to continue monitoring PEPs for at least 12 months after leaving office, while other regions apply longer timelines.

Best Practice Screening Steps

Identify: Capture complete customer and relationship data.

Screen: Check against PEP, SIP, and RCA lists.

Assess: Apply enhanced due diligence to high-risk profiles.

Monitor: Continuously update profiles as risks change.

Document: Maintain records to demonstrate regulatory compliance.

Technology’s Role in Managing Risk

Manual screening cannot keep pace with regulatory expectations or the scale of global data. Automated systems that combine fuzzy matching, adverse media, and graph-based analytics are now essential.

Solutions such as FacctView, Customer Screening, FacctShield, Payment Screening, and FacctGuard, Transaction Monitoring allow compliance teams to manage risks more effectively. Research shows that combining graph‑based entity resolution methods with attribute similarity (like fuzzy matching) significantly improves detection of hidden links, such as those between PEPs, SIPs, and RCAs.

Final Thoughts

PEPs, SIPs, and RCAs form a critical triad of risk categories in AML compliance. By following a risk-based approach, guided by FATF recommendations and supported by advanced technology, firms can strengthen compliance frameworks and protect against financial crime.

Take the Next Step in Strengthening Compliance

Managing PEP, SIP, and RCA risks requires intelligent technology that goes beyond manual checks.

With FacctView, Customer Screening, your organisation can identify high-risk individuals in real time, reduce false positives, and meet regulatory expectations with confidence.

Contact Facctum today to see how FacctView can transform your compliance operations.