Sanctions Screening

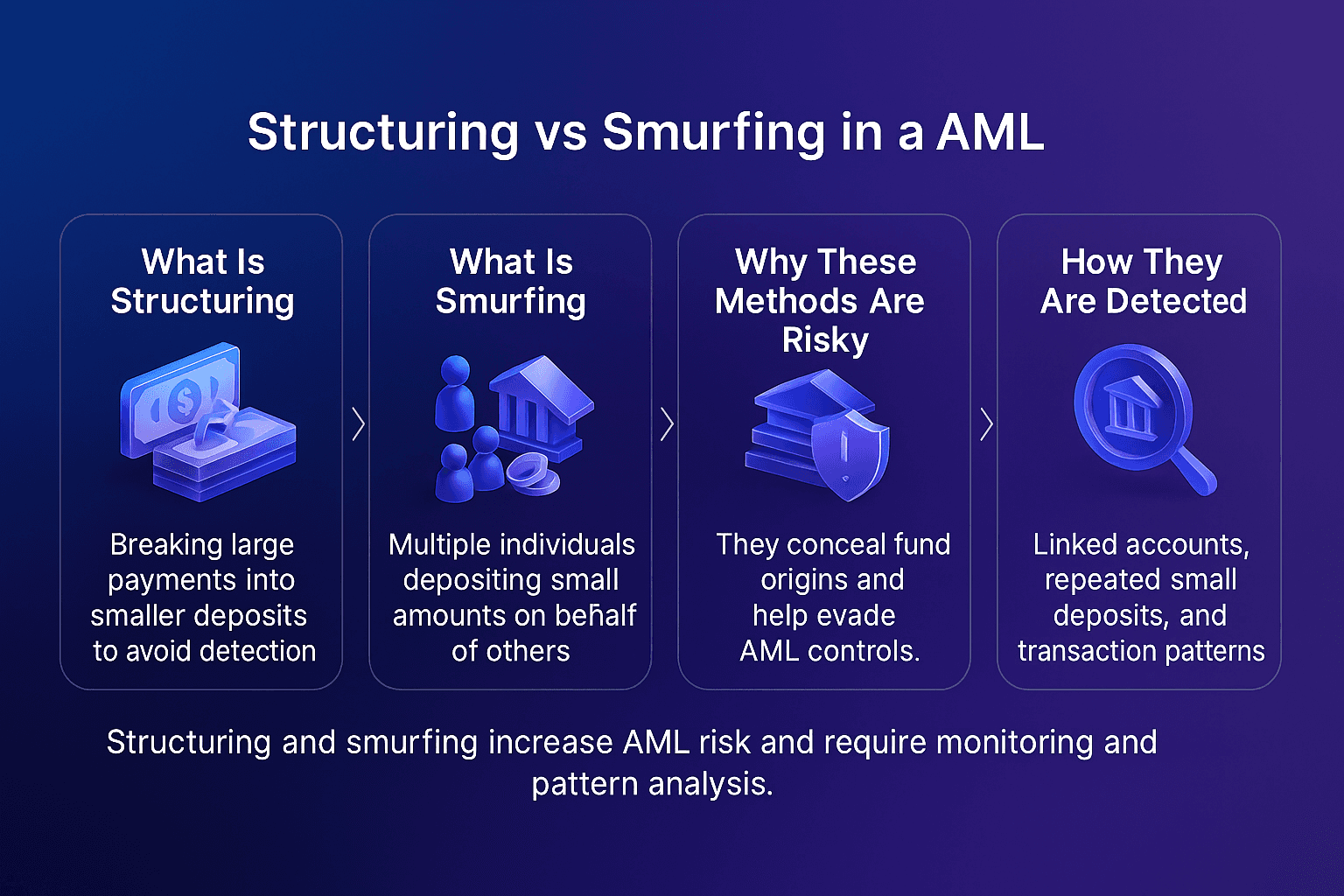

As financial criminals evolve, so too must the defences built to stop them. Structuring and smurfing are two such laundering techniques that increasingly challenge compliance teams worldwide. Although often used interchangeably, structuring and smurfing represent distinct tactics with different detection challenges.

This blog explains how they differ, highlights red flags, and outlines how modern compliance teams — particularly in fintechs, DNFBPs, and banks — can stay ahead.

What is Structuring in Money Laundering?

Structuring in money laundering — often called "AML structuring" or "structuring AML" — refers to the deliberate division of large transactions into smaller ones to avoid triggering reporting thresholds. These thresholds, imposed by regulators (such as those under the UK's Money Laundering Regulations), aim to flag suspicious activity.

For example, rather than depositing £24,000 at once, an individual might deposit £8,000 across three different branches on different days — a tactic known as "structuring deposits." The aim is to evade attention while moving illicit funds into the financial system.

This tactic exploits operational blind spots and patterns that traditional systems might overlook if not equipped with behavioural analysis tools.

What is Smurfing in Money Laundering?

Smurfing in money laundering — or smurfing AML — builds on structuring by distributing transactions across multiple people ("smurfs") to mask their origin. These smurfs may be accomplices, family members, or even unwitting money mules.

Smurfing in AML presents greater complexity due to its decentralised nature. Unlike structuring, which involves a single actor, smurfing disperses risk and makes detection significantly harder. Criminal networks often rely on this tactic to avoid detection while moving large sums across digital wallets, cash deposits, and even crypto exchanges.

For instance, in the 2025 Victoria-Brito case, a smurfing network used accomplices across jurisdictions to route illicit funds. Similarly, in the J&K Bank Fraud Case (2022), officials facilitated deposits through proxy accounts, shielding the origin of stolen funds.

Key Differences Between Structuring and Smurfing

Structuring vs. Smurfing: A Side-by-Side Comparison

Feature | Structuring | Smurfing |

|---|---|---|

Definition | Breaking up a large transaction to avoid detection | Using multiple people to break up and move smaller transactions |

Actors Involved | Usually one person or a single account | Multiple individuals or accounts ("smurfs") |

Channels Used | Traditional banking, cash deposits | Cash, digital wallets, prepaid cards, crypto exchanges |

Risk Complexity | Medium risk complexity | High complexity due to distribution of actors and sources |

Red Flag Patterns | Sequential small deposits by the same party | Varied deposits from different locations and accounts |

Detection Challenge | Rule-based TMS and pattern monitoring | Requires AI, network analysis, and behavioural baselining |

Structuring and smurfing both aim to obscure illicit funds. However, smurfing in AML introduces higher complexity by involving multiple actors across various platforms. It’s more difficult to detect, particularly in digital ecosystems where transactions move rapidly across jurisdictions.

While structuring offences are traceable when backed by robust TMS, smurfing requires AI-powered network and behavioural analysis. Traditional monitoring methods often fail to detect these distributed patterns unless they use predictive models and anomaly detection.

Red Flags and Compliance Detection Methods

Strong AML controls start with recognising behaviour that deviates from expected norms. Early detection of structuring and smurfing hinges on system adaptability and real-time intelligence.

Common Red Flags:

Frequent deposits or withdrawals just below threshold limits

Similar transaction amounts across different branches

Use of multiple accounts showing identical deposit patterns

Cash-heavy businesses with inconsistent revenue reporting

Rapid fund transfers following deposits (a layering tactic)

Deposits made by third parties unaffiliated with the account holder

Detection and Prevention Techniques:

Transaction Monitoring Systems (TMS): These systems flag structured deposits by analysing transaction frequency, amount, and timing.

Risk Scoring Models: Dynamic models update customer profiles continuously to detect behaviour changes.

AI-Powered Pattern Recognition: Detects smurfing by analysing transaction flows across unrelated accounts.

Geolocation Analysis: Flags transactions from different locations in short timeframes.

Behavioural Profiling: Establishes customer baselines and identifies deviations.

Link and Network Analysis: Maps relationships between accounts and transaction pathways.

Together, these techniques allow compliance teams to move from static rule-based approaches to proactive, intelligence-led frameworks.

How Facctum Helps in Detecting Structuring and Smurfing

Facctum offers advanced compliance technology that helps institutions detect both structuring in money laundering and smurfing AML in real time.

Key Capabilities:

Real-Time Monitoring: Instantly flags structuring examples by detecting patterns of small, repetitive transactions.

Behavioural Analytics: Tracks normal user behaviour and spots irregularities.

Smurfing Detection Algorithms: Identifies transaction dispersion across seemingly unrelated accounts.

Scalable AI Architecture: Tailored for banks, fintechs, and DNFBPs across multiple jurisdictions.

Facctum transforms AML from passive monitoring into predictive intervention — empowering teams to prevent laundering before it scales.

Best Practices for AML Teams

Preventing laundering isn’t just about detection — it’s about preparation, awareness, and continuous adaptation.

Best Practices Include:

Maintain up-to-date KYC profiles and refresh risk ratings periodically

Adopt AI-based transaction monitoring tools for real-time detection

Run ongoing compliance training across teams and partners

Design tiered thresholds tailored to customer risk profiles

Participate in industry-wide intelligence networks (e.g., JMLIT, FinCEN exchanges)

Modern AML success depends on the synergy between people, processes, and technology. The faster teams adapt, the better they prevent.

Conclusion

Structuring and smurfing are distinct yet evolving tactics that challenge conventional AML defences. Understanding their distinctions is crucial, but so is investing in tools and strategies that adapt to criminal innovation. With advanced detection capabilities, AI-driven analytics, and real-time monitoring, Facctum equips organisations to detect, deter, and disrupt financial crime.

Facctum empowers financial institutions to move beyond compliance — into intelligent, adaptive risk management.