Sanctions Screening

The same controls that prevent financial crime can also disrupt the onboarding journey and push legitimate customers out of the funnel. According to one estimate, illicit flows are projected to reach $6 trillion by 2030, putting intense pressure on financial institutions to strengthen anti-money laundering (AML) compliance and improve the effectiveness of customer screening.

But when that pressure leads to overly sensitive thresholds, it creates friction, especially during onboarding, where delays or false positives are most likely to drive away the very people firms are trying to serve. While this may reduce the risk of missing a high-risk individual, it ultimately stalls growth, as legitimate users abandon the process before becoming customers.

Smarter, risk-based screening offers a better path, reducing attrition while supporting both compliance and growth.

The Cost of Screening Without Precision

Overly sensitive screening thresholds can create more problems than they solve, driving up false positives, slowing onboarding, and turning away legitimate customers.

When screening is poorly calibrated

During onboarding, checks help build trust and demonstrate a firm’s commitment to security. But when screening processes become overly complex or misaligned with risk, they trigger unnecessary alerts and manual reviews, frustrating users, increasing drop-off, and weakening conversion.

The risk of missing a prohibited or high-risk individual, such as a sanctioned party or politically exposed person (PEP), and the regulatory consequences that follow can lead firms to apply thresholds too conservatively. This can result in overly broad matching, for example, flagging names without contextual data, causing legitimate customers to be misidentified as high-risk. These false positives trigger manual Know Your Customer (KYC) reviews, slow digital onboarding, and increase pressure on compliance teams already stretched by rising caseloads.

Friction doesn’t end at onboarding. Once customers are active, transaction screening systems that aren’t properly calibrated to risk can still disrupt their experience, occasionally delaying or blocking legitimate transfers even when no true risk is present. Across the funnel and customer lifecycle, inefficient screening adds avoidable friction, creating cost and operational strain without proportionate improvement in risk outcomes.

The business impact of false positives

False positives introduce the wrong kind of friction, leading to onboarding delays, unnecessary escalations, and customer abandonment. A recent global study found that 67% of financial institutions have lost clients due to delays and inefficiencies during KYC and onboarding, an increase from the year before. Banks cite fragmented systems, process delays, and poor customer experience as key drivers of drop-off.

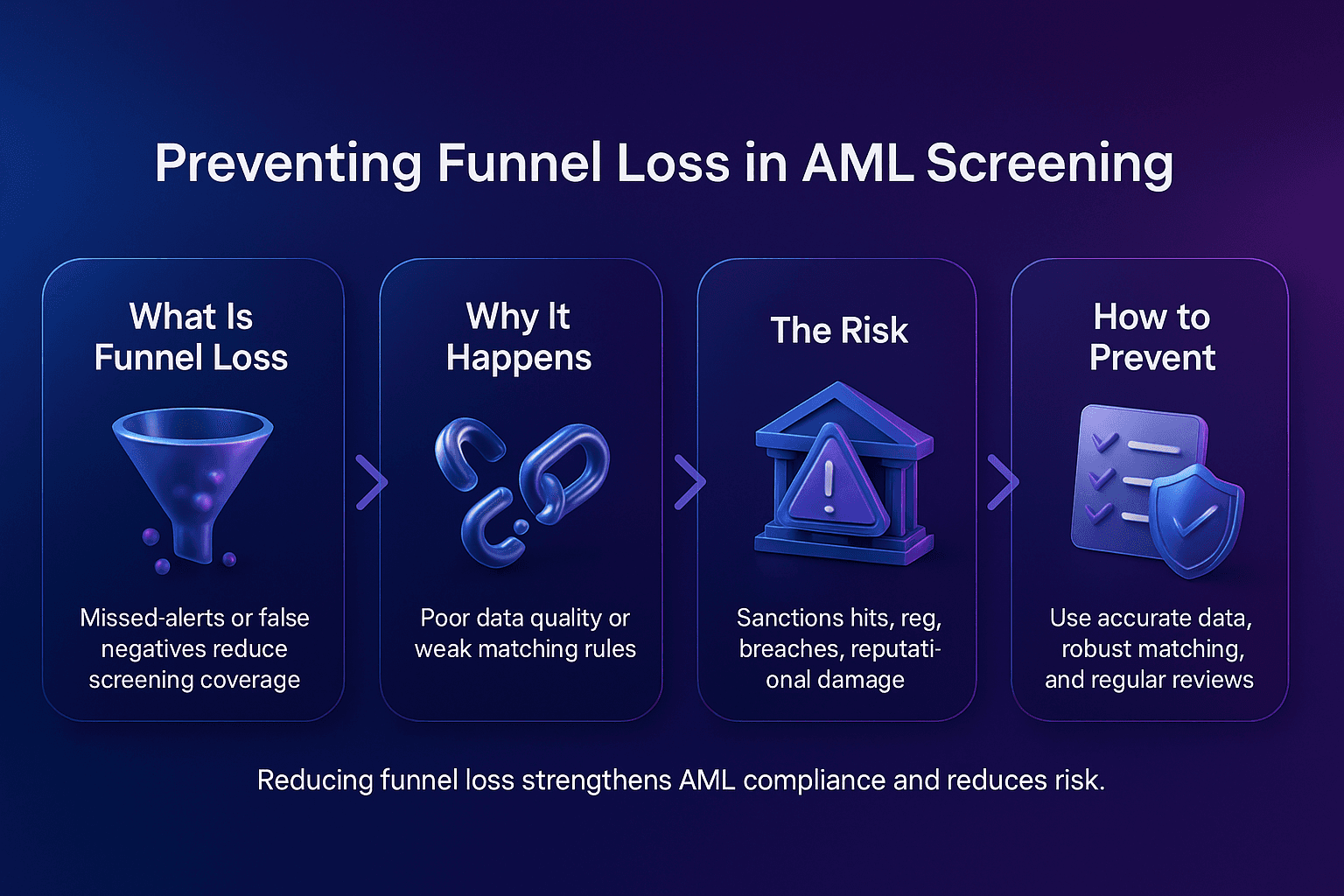

Funnel loss limits growth. When legitimate prospects are delayed or deterred, fewer accounts are opened, fewer products are adopted, and long-term revenue potential declines. It also increases operational overhead, as compliance teams spend time resolving unnecessary alerts instead of focusing on genuinely high-risk cases.

This inefficiency contributes to analyst fatigue and inconsistent decisions, risks that become harder to manage as case volumes grow. A slow or high-friction user experience can also damage trust and brand perception, particularly where accounts of negative experiences are shared and spread quickly. Reputation matters, especially among Millennials and Gen Z, where studies show that trust is the most important factor when choosing a long-term financial partner.

The Case for Risk-Based AML Screening

Regulators continue to reinforce the importance of proportionality in AML screening, expecting firms to calibrate controls to actual risk rather than rely on static thresholds.

Why risk-based screening matters

Effective compliance relies on thresholds that are configured to reflect real risk. International standard-setting bodies like the Financial Action Task Force (FATF) and the Wolfsberg Group have long emphasised proportionality over one-size-fits-all controls, as part of a risk-based approach.

In recent updates, the FATF has explicitly called for simplified measures in lower-risk scenarios, as part of an effort to promote proportionate controls that reduce blanket de-risking and improve financial inclusion for legitimate customers, including vulnerable segments.

A uniform approach may appear defensible to regulators, but it often misses the nuance required to distinguish real threats from low-risk activity. A risk-based approach allows firms to meet regulatory obligations without turning away legitimate customers, ultimately supporting both compliance and commercial growth.

Though compliance is often seen as business overhead, risk-based screening plays a more strategic role, helping firms reduce drop-off and keep legitimate customers moving through the funnel.

How teams calibrate in practice

Risk-based screening becomes effective when thresholds are regularly tuned to reflect actual customer risk. High-risk and low-risk customers shouldn't trigger the same level of scrutiny, for example, applying tighter thresholds in high-risk jurisdictions while proportionately streamlining checks in lower-risk contexts.

Fuzzy matching, used to detect name variants and near matches, plays a key role in screening precision. Modern systems layer phonetic, edit-distance, and increasingly, machine learning algorithms to improve accuracy. But even with those capabilities, effectiveness still depends on ongoing calibration: tuning similarity thresholds and reviewing match logic to reduce both false positives and false negatives.

Calibration is an iterative process. Compliance teams review case outcomes, analyst overrides, and operational bottlenecks to identify where thresholds need refinement. This feedback loop helps teams tighten review triggers where risk is higher and streamline onboarding where it isn’t, maintaining efficiency without compromising on real risk.

Customer Screening Solutions Tailored to Risk

Translating a risk-based approach into practice requires tools that adapt, not only to customer context, but also to changing regulatory and operational demands.

Tools that enable precision

Risk-based screening requires systems that can adjust in response to emerging patterns and changing conditions. Artificial intelligence (AI) and advanced analytics are increasingly central to that adaptability. Machine learning supports more targeted screening by learning from past case outcomes to recognise patterns among multiple identifiers, like names, aliases, and addresses, that influence match accuracy.

AI-driven auto-tuning and impact analysis further enhance precision, offering visibility into how threshold adjustments affect alert volumes, accuracy, and risk coverage. As these tools evolve, screening can remain better aligned with both risk and operational priorities, helping reduce false positives, accelerate onboarding, and minimise friction throughout the customer funnel.

Adapting to change

Effective screening relies on agility, the ability to respond as risks shift and regulatory expectations evolve. Recent developments are increasing regulatory complexity and operational pressure. The sanctions landscape is expanding and growing more complex with new measures targeting enablers and critical infrastructure.

Real-time payment systems such as the Single Euro Payments Area (SEPA) Instant Credit Transfer now demand near-instantaneous sanctions screening, heightening the need for both accuracy and speed.

Regulators continue to update guidance on how to assess and manage risk. For example, the United Kingdom’s Financial Conduct Authority (FCA) recently clarified that certain domestic public roles do not automatically require politically exposed person (PEP) classification, reducing unnecessary scrutiny in lower-risk contexts.

Screening systems must keep pace, updating thresholds in response to change, while preserving efficiency and customer experience.

How Facctum Can Help

Facctum helps financial institutions prevent funnel loss with FacctView, a customer screening platform built for scalable, risk-based AML compliance.

With configurable thresholds, scoring, and filters, FacctView allows teams to tailor screening profiles to actual risk. Built-in testing tools and AI-driven optimisation refine thresholds over time, which reduces false positives without compromising control.

More than 40 matching algorithms, including fuzzy and phonetic logic, improve accuracy and minimise unnecessary alerts. The platform integrates with case management systems, supports real-time and batch screening, and provides explainable results that speed up reviews.

In a landscape shaped by real-time payments, growing sanctions, and shifting regulations, Facctum enables screening that adapts helping firms meet compliance goals without turning away legitimate customers.

Ready to reduce funnel loss and modernise your screening strategy? Contact Facctum.