Watchlist Management

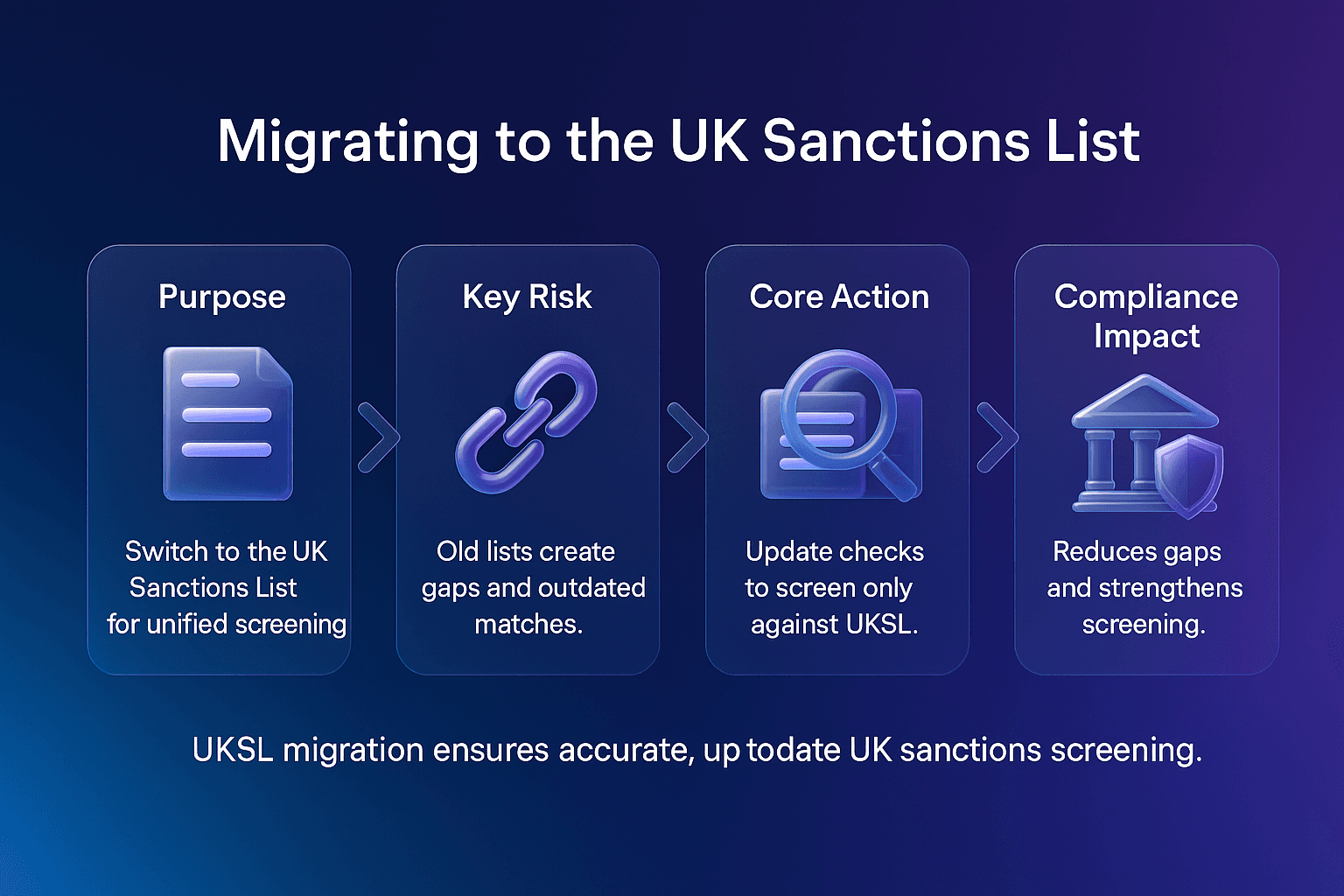

From 28 January 2026, the UK financial sector faces a significant regulatory shift. The OFSI Consolidated List, the database long used to identify sanctioned individuals and entities, will be retired and replaced by the UK Sanctions List (UKSL). According to the Office of Financial Sanctions Implementation (OFSI), this transition will change how banks, fintechs, and payment service providers (PSPs) manage sanctions screening and compliance operations.

This is not simply an update to an existing dataset. It is part of a national plan to streamline how the UK maintains and communicates sanctions information. As the UK Government guidance on moving to a single list explains, all UK sanctions designations will transition to the new UK Sanctions List from 28 January 2026, and the OFSI Consolidated List will no longer be updated from that date.

Why Is the UK Sanctions List Replacing the OFSI Consolidated List?

The UK Sanctions List (UKSL) is designed to consolidate and simplify how the UK presents its sanctions data. It will become the single authoritative source for all UK sanctions designations, combining the financial sanctions entries currently published by OFSI with other government listings.

Unlike the legacy OFSI Consolidated List, the UKSL introduces:

Unique UKSL IDs for all sanctioned individuals and entities

Enhanced data fields with consistent metadata

Improved version control and change tracking

A single access point on the UK Sanctions List publication page

As reported by Regulatory and Compliance, this move is intended to increase transparency, reduce duplication, and align the UK’s approach with international standards while maintaining domestic control after Brexit.

What Are the Risks of Not Migrating Before the Deadline?

Many institutions still depend on legacy feeds that draw from the existing OFSI Consolidated List. When that feed stops updating in January 2026, these systems will no longer reflect the latest sanctions data.

Failing to transition in time can lead to:

Screening against outdated or incomplete data

Missed designations due to mismatched identifiers

False positives and false negatives in transaction monitoring

Breaches of regulatory obligations and reputational damage

OFSI and HM Treasury have made it clear that regulated entities remain responsible for ensuring accurate and up-to-date sanctions screening, regardless of how the list is delivered. Early testing and migration will help demonstrate readiness and reduce the risk of enforcement action.

How Does Automated Watchlist Ingestion Support the UKSL Transition?

One of the most practical steps firms can take is adopting automated watchlist ingestion. Rather than relying on manual downloads or periodic file uploads, automation enables real-time integration with the new UKSL feed.

Automated watchlist ingestion ensures:

Continuous syncing with the latest UKSL IDs

Accurate mapping between old OFSI references and new UKSL entries

Fewer manual errors and reduced screening delays

Full audit trails for regulatory assurance

With automated systems in place, watchlist management software can instantly refresh sanctions data across customer onboarding, payment screening, and ongoing monitoring.

How Can Firms Prevent Mismatches and Screening Errors During Migration?

The new list introduces unique identifiers and changes in data structure, which can create mismatches if firms are not prepared. For example, a person previously listed under an OFSI code may now have a distinct UKSL ID, requiring systems to reconcile both.

Modern sanctions screening software can apply fuzzy matching, data normalization, and entity resolution to prevent false positives and ensure correct identification. When paired with real-time screening, these tools ensure continuous accuracy and transparency during the transition.

Integrating automated ingestion within customer screening and payment screening systems ensures all checks reflect current UKSL data without workflow disruption.

How Will the UKSL Transition Affect Banks, Fintechs, and PSPs?

Every financial institution regulated under UK law must adjust to the new sanctions framework.

Banks will need to update sanctions screening engines and reporting systems to recognize the new UKSL structure and data format.

Fintechs should review their third-party data providers to confirm that their PEP and sanctions screening solutions are UKSL-ready well before January 2026.

Payment service providers (PSPs) must align their transaction monitoring processes to ensure that real-time payments are screened against the most recent designations.

Each sector must also maintain clear documentation of its migration process to demonstrate compliance with evolving OFSI expectations.

What Practical Steps Should Firms Take to Prepare for the UK Sanctions List 2026?

Preparing for the UK Sanctions List (UKSL) migration is not just a technical task but a strategic compliance project. Financial institutions should approach the transition methodically, ensuring every data source, workflow, and third-party integration aligns with the new sanctions list. By conducting early testing and validation, firms can identify gaps before the January 2026 deadline and demonstrate to regulators that they are proactively managing risk.

To ensure a smooth transition, compliance teams should:

Map dependencies – Identify systems, feeds, and vendors that currently use OFSI’s Consolidated List.

Adopt automated ingestion – Connect to the UKSL feed to ensure real-time updates.

Test and validate data – Run parallel screening with both lists to confirm accuracy.

Reconcile identifiers – Cross-reference legacy OFSI IDs with new UKSL IDs.

Document migration – Keep detailed records for regulatory audits.

Train staff – Ensure compliance officers understand UKSL structures, fields, and audit expectations.

Taking these steps early reduces operational friction and ensures readiness for the 2026 compliance landscape.

Why Is Continuous Sanctions Screening Important After the Transition?

The transition to the UKSL should be seen as an opportunity to upgrade to continuous sanctions screening, an approach that ensures ongoing compliance through real-time updates and automated workflows.

This aligns with guidance from OFSI and the UK Government’s official sanctions list publication, which will become the central repository for all designations. Continuous screening allows firms to act immediately when new individuals or entities are sanctioned, avoiding retrospective compliance gaps.

For further insight into improving sanctions data quality, see our article on applying data management to sanctions screening.

How Can Firms Build a Future-Ready Sanctions Framework?

The migration to the UK Sanctions List is more than an administrative change. It is a chance for the financial sector to modernise its compliance infrastructure. Firms that embrace automation, real-time list ingestion, and continuous monitoring will strengthen their regulatory standing and operational resilience.

The new UKSL represents the future of UK sanctions governance, unified, transparent, and digitally accessible. For firms, adapting now means fewer false positives, stronger audit trails, and confidence that their sanctions screening programs meet the highest standards.

What Does the Future of Sanctions Data Governance Look Like?

The UK’s shift to the UK Sanctions List reflects a broader global trend toward structured, interoperable sanctions data. As regulatory environments evolve, compliance is no longer just about screening;

It is about data governance. Firms that treat sanctions data as a strategic asset can extract insights to improve decision-making, enhance risk visibility, and reduce operational bottlenecks.

Modern compliance teams should start to view sanctions screening as part of an integrated intelligence ecosystem, not an isolated control. By combining automation, machine learning, and better entity resolution, firms can transform reactive compliance into proactive risk management.

This transition also underscores the need for data standardisation across borders. As other jurisdictions explore unified sanctions frameworks, the UK’s example could shape how international regulators harmonise data in the years ahead. For technology providers and financial institutions alike, this is a moment to innovate, building screening architectures that are explainable, scalable, and continuously adaptive to regulatory change.

Key Takeaway

By 28 January 2026, the OFSI Consolidated List will be retired. Transitioning early to the UK Sanctions List, supported by automated watchlist ingestion, real-time screening, and data reconciliation, is essential to maintaining compliance and avoiding costly enforcement actions.