AML Compliance

Adverse Media Screening: Why It’s Essential for Modern AML Compliance

Adverse Media Screening: Why It’s Essential for Modern AML Compliance

Adverse Media Screening: Why It’s Essential for Modern AML Compliance

Alex Rees

Alex Rees

Alex Rees

22 Oct 2025

22 Oct 2025

22 Oct 2025

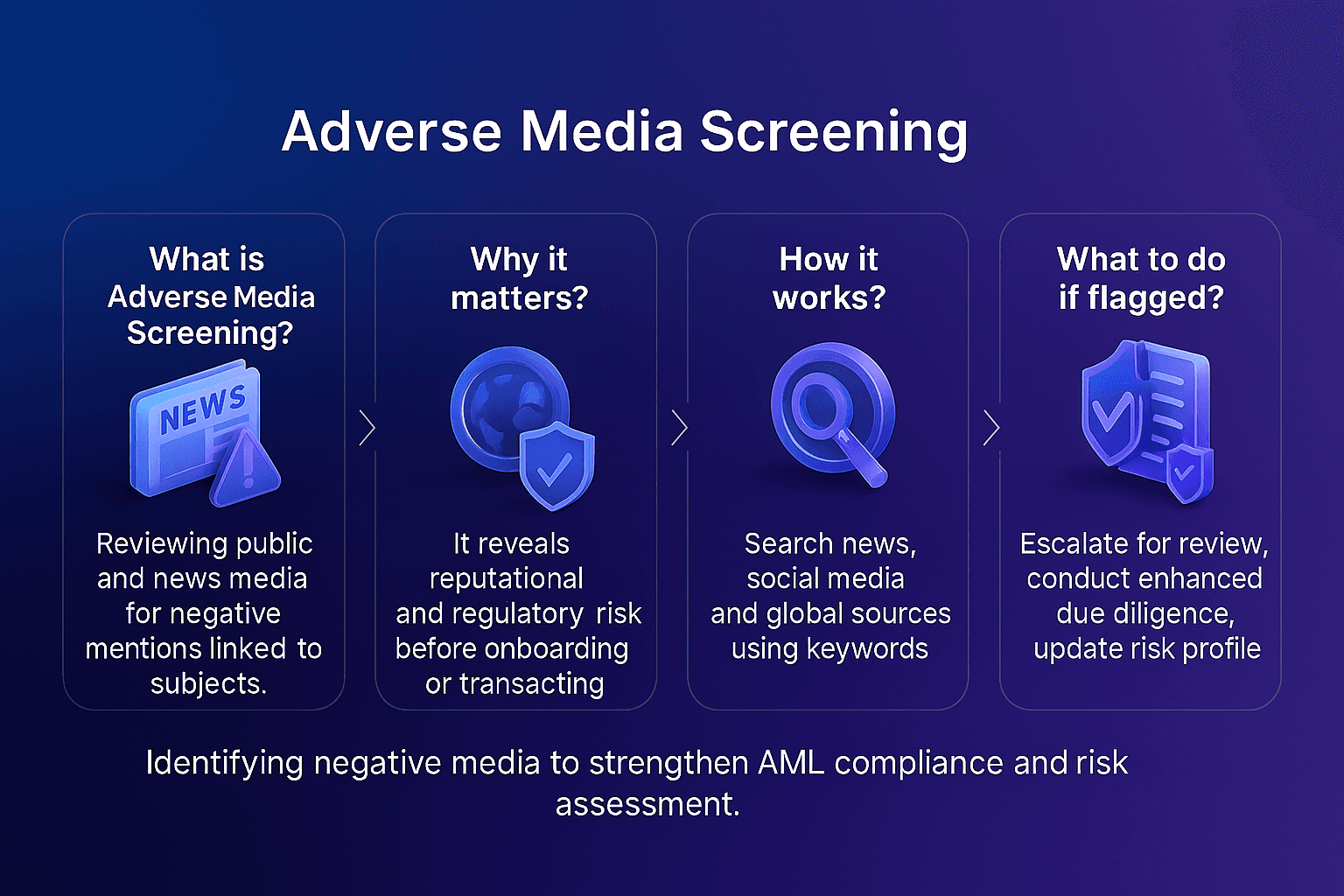

Adverse media screening has become a critical component of modern anti-money laundering (AML) frameworks. Regulators expect firms to go beyond sanctions and watchlist checks, capturing negative news and intelligence that could signal hidden risks.

This blog explains what adverse media screening is, why it matters, and how technology is helping financial institutions meet evolving compliance expectations.

What Is Adverse Media Screening?

Adverse media screening is the process of monitoring credible news, publications, and reports to identify potential risks associated with individuals or entities. Unlike sanctions or politically exposed persons (PEP) lists, adverse media sources often reveal risks before they are formally recognised by regulators.

For example, allegations of corruption, fraud, or organised crime may appear in reputable media outlets long before enforcement action is taken. This makes adverse media a vital early-warning tool.

Why Adverse Media Screening Matters in Compliance

Global regulators emphasise the importance of monitoring customers and transactions for red flags, not just official listings. For example, FATF Recommendation 16 requires financial institutions to conduct ongoing due diligence and scrutiny of transactions to ensure they align with the known profile of the customer.

The UK Financial Conduct Authority (FCA) has criticised firms for failing to identify or act on adverse media signals, such as reports indicating potential illicit activity, which posed serious financial crime risks.

Benefits of Adverse Media Screening

Detects risks earlier than sanctions lists.

Helps firms meet regulatory expectations.

Protects institutions from reputational damage.

Common Challenges in Adverse Media Screening

While essential, adverse media screening comes with operational challenges.

High Volumes of Data

Millions of articles and sources must be filtered daily. Without automation, this is unmanageable.

False Positives

Name commonality can create irrelevant matches, overwhelming compliance teams.

Reliability of Sources

Not all media is equally credible. Institutions must distinguish between reputable journalism and unverified claims.

How Technology Improves Adverse Media Screening

Advances in automation, natural language processing, and fuzzy matching have transformed adverse media screening.

Smarter Matching and Filtering

Technology can apply relevance scoring and contextual analysis, reducing false positives and surfacing the most meaningful alerts.

Graph-Based Detection

Research shows that combining graph-based entity resolution with attribute similarity significantly improves the detection of hidden links in complex data.

Integrated Solutions

Tools like FacctList, Watchlist Management integrate adverse media into broader screening processes, ensuring coverage alongside PEPs, SIPs, RCAs, and sanctions.

Best Practices for Effective Adverse Media Screening

To meet regulatory expectations, firms should align adverse media processes with AML frameworks.

Use reputable, diverse data sources to capture risks early.

Apply automation and filtering to reduce false positives.

Integrate adverse media with customer and transaction monitoring via platforms like FacctView, Customer Screening and FacctShield, Payment Screening.

Keep a clear audit trail to demonstrate decisions to regulators.

Final Thoughts

Adverse media screening has evolved from a “nice-to-have” to a regulatory expectation. By capturing emerging risks before they appear in sanctions or PEP lists, it strengthens AML frameworks and protects financial institutions from exposure.

Take the Next Step in Strengthening Compliance

Managing adverse media effectively requires more than manual checks.

With FacctList, Watchlist Management, your institution can integrate adverse media data seamlessly into your screening engine of choice.

Complimenting this, FacctView, Customer Screening enables screening against adverse media data sets in real time, with powerful configurability options.

Contact Facctum today to see how FacctList and FacctView can enhance your screening framework.

Contact us

Explore Our Solutions

Contact us

Explore Our Solutions

What Is Financial Crime Compliance And Why Is It Essential For Institutions?

What Is Financial Crime Compliance And Why Is It Essential For Institutions?

What Is Financial Crime Compliance And Why Is It Essential For Institutions?

What Is Financial Crime Compliance And Why Is It Essential For Institutions?

How Does Real-Time Screening Help Detect And Prevent Financial Crime?

How Does Real-Time Screening Help Detect And Prevent Financial Crime?

How Does Real-Time Screening Help Detect And Prevent Financial Crime?

How Does Real-Time Screening Help Detect And Prevent Financial Crime?

What Are The Most Significant Challenges Facing AML Compliance Teams Today?

What Are The Most Significant Challenges Facing AML Compliance Teams Today?

What Are The Most Significant Challenges Facing AML Compliance Teams Today?

What Are The Most Significant Challenges Facing AML Compliance Teams Today?

How Does Artificial Intelligence Improve Accuracy And Reduce Errors In Compliance Screening?

How Does Artificial Intelligence Improve Accuracy And Reduce Errors In Compliance Screening?

How Does Artificial Intelligence Improve Accuracy And Reduce Errors In Compliance Screening?

How Does Artificial Intelligence Improve Accuracy And Reduce Errors In Compliance Screening?

Why Is Robust Data Management Critical To AML And Sanctions Screening?

Why Is Robust Data Management Critical To AML And Sanctions Screening?

Why Is Robust Data Management Critical To AML And Sanctions Screening?

Why Is Robust Data Management Critical To AML And Sanctions Screening?

How Do Financial Institutions Identify, Review, And Report Suspicious Activity?

How Do Financial Institutions Identify, Review, And Report Suspicious Activity?

How Do Financial Institutions Identify, Review, And Report Suspicious Activity?

How Do Financial Institutions Identify, Review, And Report Suspicious Activity?

How Does Data Quality Influence AML Screening Effectiveness?

How Does Data Quality Influence AML Screening Effectiveness?

How Does Data Quality Influence AML Screening Effectiveness?

How Does Data Quality Influence AML Screening Effectiveness?

How Can Automation Transform The Efficiency Of Compliance Operations?

How Can Automation Transform The Efficiency Of Compliance Operations?

How Can Automation Transform The Efficiency Of Compliance Operations?

How Can Automation Transform The Efficiency Of Compliance Operations?

Which Global Regulatory Bodies Define AML And Financial Crime Standards?

Which Global Regulatory Bodies Define AML And Financial Crime Standards?

Which Global Regulatory Bodies Define AML And Financial Crime Standards?

Which Global Regulatory Bodies Define AML And Financial Crime Standards?

How Do Modern RegTech Platforms Strengthen Financial Crime Prevention?

How Do Modern RegTech Platforms Strengthen Financial Crime Prevention?

How Do Modern RegTech Platforms Strengthen Financial Crime Prevention?

How Do Modern RegTech Platforms Strengthen Financial Crime Prevention?

Explore our compliance solutions

Reach out to us for more information!

Request a Demo

Explore our compliance solutions

Reach out to us for more information!

Request a Demo

Explore our compliance solutions

Reach out to us for more information!

Request a Demo

Explore our compliance solutions

Reach out to us for more information!

Request a Demo

Explore our compliance solutions

Reach out to us for more information!

Request a Demo

Explore our compliance solutions

Reach out to us for more information!

Request a Demo

Explore Our Comprehensive Platform

Explore the powerful capabilities of the Facctum Compliance Platform

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Explore Our Comprehensive Platform

Explore the powerful capabilities of the Facctum Compliance Platform

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Explore Our Comprehensive Platform

Explore the powerful capabilities of the Facctum Compliance Platform

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Explore Our Comprehensive Platform

Explore the powerful capabilities of the Facctum Compliance Platform

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

How Facctum Solves the

Biggest Compliance and

Screening Challenges

Explore the powerful capabilities of the Facctum

Compliance Platform

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Explore Our Comprehensive Platform

Explore the powerful capabilities of the Facctum Compliance Platform

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Explore Our Comprehensive Platform

Explore the powerful capabilities of the Facctum Compliance Platform

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Explore Our Comprehensive Platform

Explore the powerful capabilities of the Facctum Compliance Platform

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Protect against compliance failings, and transact with confidence.

Book a demo to find out more.

Protect against compliance failings, and transact with confidence.

Book a demo to find out more.

Protect against compliance failings, and transact with confidence.

Book a demo to find out more.

Protect against compliance failings, and transact with confidence.

Book a demo to find out more.

Protect against compliance failings, and transact with confidence.

Book a demo to find out more.

Protect against compliance failings, and transact with confidence.

Book a demo to find out more.

Protect against compliance failings, and transact with confidence.

Book a demo to find out more.

Protect against compliance failings, and transact with confidence.

Book a demo to find out more.

Solutions

Industries

© Facctum 2025

Solutions

Industries

© Facctum 2025

Solutions

Industries

© Facctum 2025

Solutions

Industries

© Facctum 2025

Solutions

© Facctum 2025

Solutions

© Facctum 2025

Solutions

Industries

© Facctum 2025

Frequently Asked Questions (FAQs)

What Is Financial Crime Compliance And Why Is It Essential For Institutions?

What Is Financial Crime Compliance And Why Is It Essential For Institutions?

How Does Real-Time Screening Help Detect And Prevent Financial Crime?

How Does Real-Time Screening Help Detect And Prevent Financial Crime?

What Are The Most Significant Challenges Facing AML Compliance Teams Today?

What Are The Most Significant Challenges Facing AML Compliance Teams Today?

How Does Artificial Intelligence Improve Accuracy And Reduce Errors In Compliance Screening?

How Does Artificial Intelligence Improve Accuracy And Reduce Errors In Compliance Screening?

Why Is Robust Data Management Critical To AML And Sanctions Screening?

Why Is Robust Data Management Critical To AML And Sanctions Screening?

How Do Financial Institutions Identify, Review, And Report Suspicious Activity?

How Do Financial Institutions Identify, Review, And Report Suspicious Activity?

How Does Data Quality Influence AML Screening Effectiveness?

How Does Data Quality Influence AML Screening Effectiveness?

How Can Automation Transform The Efficiency Of Compliance Operations?

How Can Automation Transform The Efficiency Of Compliance Operations?

Which Global Regulatory Bodies Define AML And Financial Crime Standards?

Which Global Regulatory Bodies Define AML And Financial Crime Standards?

How Do Modern RegTech Platforms Strengthen Financial Crime Prevention?

How Do Modern RegTech Platforms Strengthen Financial Crime Prevention?