Sanctions Screening

A Guide to Sanctions Screening and Sanctions Lists

A Guide to Sanctions Screening and Sanctions Lists

A Guide to Sanctions Screening and Sanctions Lists

Alex Rees

Alex Rees

Alex Rees

8 Oct 2025

8 Oct 2025

8 Oct 2025

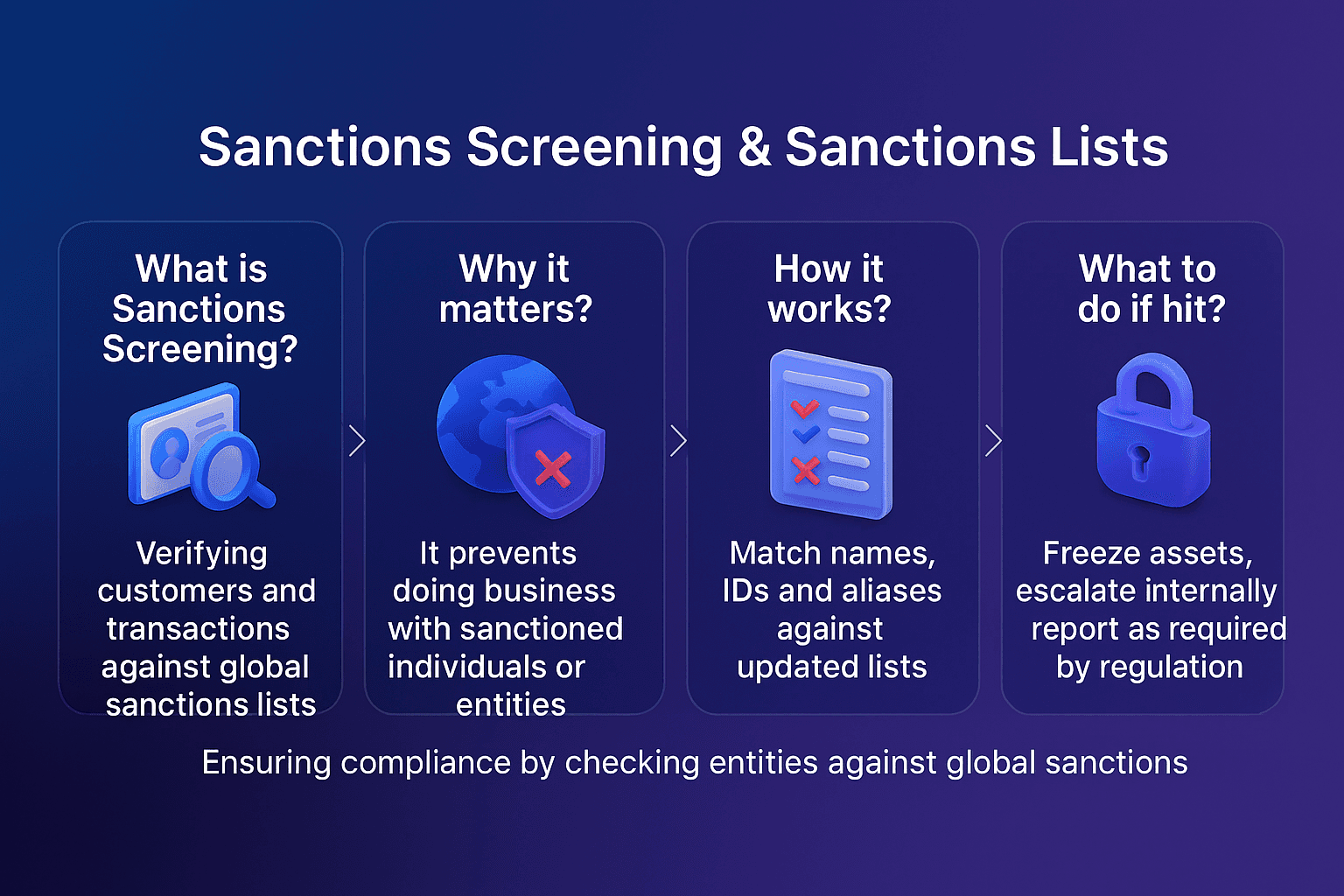

Sanctions screening is one of the most important controls in anti-money laundering (AML) compliance. Financial institutions are required to screen customers, payments, and transactions against global sanctions lists to prevent financial crime and ensure compliance with international regulations.

This guide explains how sanctions screening works, what sanctions lists include, and how technology helps organisations stay compliant.

What Is Sanctions Screening?

Sanctions screening is the process of comparing customer data, payments, and transactions against official sanctions lists. The objective is to identify individuals, entities, and countries restricted from financial activity due to involvement in crime, terrorism, or other high-risk activities.

Regulators such as the Financial Action Task Force (FATF) emphasise sanctions as a key pillar of financial crime prevention.

Why Sanctions Screening Matters

Failure to comply with sanctions requirements can lead to heavy fines, reputational damage, and even restrictions on operating in certain markets. Global enforcement cases show how costly lapses in sanctions compliance can be.

Sanctions screening is not optional, it is a legal requirement for banks, payment service providers, and other regulated entities.

What Are Sanctions Lists?

Sanctions lists are official registers published by governments and international organisations. They identify individuals, groups, or entities restricted from conducting financial transactions.

Examples of Major Sanctions Lists

OFAC (U.S. Office of Foreign Assets Control): Manages the Specially Designated Nationals (SDN) List.

United Nations Sanctions List: Covers individuals and groups involved in terrorism and other violations.

EU and UK Lists: Administered under regional regulations, overseen in the UK by the FCA.

Challenges in Sanctions Screening

While essential, sanctions screening presents several operational challenges.

Data Quality Issues

Incomplete or inconsistent customer data makes it harder to identify true matches.

False Positives

Name commonality and spelling variations often trigger unnecessary alerts.

Evolving Sanctions Regimes

Sanctions lists are updated frequently, requiring real-time monitoring and updates to compliance systems.

How Technology Supports Sanctions Screening

Technology enables institutions to address sanctions screening challenges at scale.

Fuzzy Matching: Captures name variations to reduce false negatives.

Continuous Updates: Ensures screening systems reflect the latest sanctions lists.

Automation: Reduces manual workload and improves efficiency.

Solutions such as FacctShield, Payment Screening integrate sanctions data into payment workflows, while FacctList, Watchlist Management consolidates global sanctions sources into a single, reliable reference.

Best Practices for Effective Sanctions Screening

To meet regulatory expectations, firms should:

Screen against multiple global sanctions lists.

Apply fuzzy matching to account for name variations.

Continuously monitor payments and transactions.

Maintain an audit trail for all alerts and resolutions.

Final Thoughts

Sanctions screening is a legal and regulatory requirement that no financial institution can ignore. By combining accurate data, automation, and continuous monitoring, firms can reduce compliance risk and strengthen AML defenses.

Take the Next Step in Strengthening Compliance

Managing sanctions screening effectively requires technology that can handle frequent updates, complex name variations, and high transaction volumes.

With FacctShield, Payment Screening, your institution can integrate sanctions screening into real-time payment workflows, reduce false positives, and meet global regulatory expectations.

Contact Facctum today to see how FacctShield can enhance your sanctions compliance framework.

Contact us

Explore Our Solutions

Contact us

Explore Our Solutions

FAQs About Sanctions Screening

FAQs About Sanctions Screening

What Is Financial Crime Compliance And Why Is It Essential For Institutions?

What Is Financial Crime Compliance And Why Is It Essential For Institutions?

What Is Financial Crime Compliance And Why Is It Essential For Institutions?

What Is Financial Crime Compliance And Why Is It Essential For Institutions?

How Does Real-Time Screening Help Detect And Prevent Financial Crime?

How Does Real-Time Screening Help Detect And Prevent Financial Crime?

How Does Real-Time Screening Help Detect And Prevent Financial Crime?

How Does Real-Time Screening Help Detect And Prevent Financial Crime?

What Are The Most Significant Challenges Facing AML Compliance Teams Today?

What Are The Most Significant Challenges Facing AML Compliance Teams Today?

What Are The Most Significant Challenges Facing AML Compliance Teams Today?

What Are The Most Significant Challenges Facing AML Compliance Teams Today?

How Does Artificial Intelligence Improve Accuracy And Reduce Errors In Compliance Screening?

How Does Artificial Intelligence Improve Accuracy And Reduce Errors In Compliance Screening?

How Does Artificial Intelligence Improve Accuracy And Reduce Errors In Compliance Screening?

How Does Artificial Intelligence Improve Accuracy And Reduce Errors In Compliance Screening?

Why Is Robust Data Management Critical To AML And Sanctions Screening?

Why Is Robust Data Management Critical To AML And Sanctions Screening?

Why Is Robust Data Management Critical To AML And Sanctions Screening?

Why Is Robust Data Management Critical To AML And Sanctions Screening?

How Do Financial Institutions Identify, Review, And Report Suspicious Activity?

How Do Financial Institutions Identify, Review, And Report Suspicious Activity?

How Do Financial Institutions Identify, Review, And Report Suspicious Activity?

How Do Financial Institutions Identify, Review, And Report Suspicious Activity?

How Does Data Quality Influence AML Screening Effectiveness?

How Does Data Quality Influence AML Screening Effectiveness?

How Does Data Quality Influence AML Screening Effectiveness?

How Does Data Quality Influence AML Screening Effectiveness?

How Can Automation Transform The Efficiency Of Compliance Operations?

How Can Automation Transform The Efficiency Of Compliance Operations?

How Can Automation Transform The Efficiency Of Compliance Operations?

How Can Automation Transform The Efficiency Of Compliance Operations?

Which Global Regulatory Bodies Define AML And Financial Crime Standards?

Which Global Regulatory Bodies Define AML And Financial Crime Standards?

Which Global Regulatory Bodies Define AML And Financial Crime Standards?

Which Global Regulatory Bodies Define AML And Financial Crime Standards?

How Do Modern RegTech Platforms Strengthen Financial Crime Prevention?

How Do Modern RegTech Platforms Strengthen Financial Crime Prevention?

How Do Modern RegTech Platforms Strengthen Financial Crime Prevention?

How Do Modern RegTech Platforms Strengthen Financial Crime Prevention?

Explore our compliance solutions

Reach out to us for more information!

Request a Demo

Explore our compliance solutions

Reach out to us for more information!

Request a Demo

Explore our compliance solutions

Reach out to us for more information!

Request a Demo

Explore our compliance solutions

Reach out to us for more information!

Request a Demo

Explore our compliance solutions

Reach out to us for more information!

Request a Demo

Explore our compliance solutions

Reach out to us for more information!

Request a Demo

Explore Our Comprehensive Platform

Explore the powerful capabilities of the Facctum Compliance Platform

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Explore Our Comprehensive Platform

Explore the powerful capabilities of the Facctum Compliance Platform

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Explore Our Comprehensive Platform

Explore the powerful capabilities of the Facctum Compliance Platform

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Explore Our Comprehensive Platform

Explore the powerful capabilities of the Facctum Compliance Platform

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

How Facctum Solves the

Biggest Compliance and

Screening Challenges

Explore the powerful capabilities of the Facctum

Compliance Platform

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Explore Our Comprehensive Platform

Explore the powerful capabilities of the Facctum Compliance Platform

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Explore Our Comprehensive Platform

Explore the powerful capabilities of the Facctum Compliance Platform

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Explore Our Comprehensive Platform

Explore the powerful capabilities of the Facctum Compliance Platform

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Alert Adjudication

Automate AML alert reviews to cut false positives, speed up investigations, and improve decision accuracy.

Learn more

Customer Screening

Achieve best in class results with configurability, scalability, and explainability in your process.

Learn more

Transaction Monitoring

Detect and mitigate suspicious activity in real-time with advanced analytics and configurable risk-based rules.

Learn more

Payment Screening

Screen transactions in real time for sanctions, AML, PEP, and fraud before processing.

Learn more

Watchlist Management

Ingest, combine, refine and deliver data from commercial, regulatory, and internal watchlists to downstream screening engines.

Learn more

Protect against compliance failings, and transact with confidence.

Book a demo to find out more.

Protect against compliance failings, and transact with confidence.

Book a demo to find out more.

Protect against compliance failings, and transact with confidence.

Book a demo to find out more.

Protect against compliance failings, and transact with confidence.

Book a demo to find out more.

Protect against compliance failings, and transact with confidence.

Book a demo to find out more.

Protect against compliance failings, and transact with confidence.

Book a demo to find out more.

Protect against compliance failings, and transact with confidence.

Book a demo to find out more.

Protect against compliance failings, and transact with confidence.

Book a demo to find out more.

Solutions

Industries

© Facctum 2025

Solutions

Industries

© Facctum 2025

Solutions

Industries

© Facctum 2025

Solutions

Industries

© Facctum 2025

Solutions

© Facctum 2025

Solutions

© Facctum 2025

Solutions

Industries

© Facctum 2025

Frequently Asked Questions (FAQs)

What Is Financial Crime Compliance And Why Is It Essential For Institutions?

What Is Financial Crime Compliance And Why Is It Essential For Institutions?

How Does Real-Time Screening Help Detect And Prevent Financial Crime?

How Does Real-Time Screening Help Detect And Prevent Financial Crime?

What Are The Most Significant Challenges Facing AML Compliance Teams Today?

What Are The Most Significant Challenges Facing AML Compliance Teams Today?

How Does Artificial Intelligence Improve Accuracy And Reduce Errors In Compliance Screening?

How Does Artificial Intelligence Improve Accuracy And Reduce Errors In Compliance Screening?

Why Is Robust Data Management Critical To AML And Sanctions Screening?

Why Is Robust Data Management Critical To AML And Sanctions Screening?

How Do Financial Institutions Identify, Review, And Report Suspicious Activity?

How Do Financial Institutions Identify, Review, And Report Suspicious Activity?

How Does Data Quality Influence AML Screening Effectiveness?

How Does Data Quality Influence AML Screening Effectiveness?

How Can Automation Transform The Efficiency Of Compliance Operations?

How Can Automation Transform The Efficiency Of Compliance Operations?

Which Global Regulatory Bodies Define AML And Financial Crime Standards?

Which Global Regulatory Bodies Define AML And Financial Crime Standards?

How Do Modern RegTech Platforms Strengthen Financial Crime Prevention?

How Do Modern RegTech Platforms Strengthen Financial Crime Prevention?